Molded Pulp Packaging Market

Global Molded Pulp Packaging Market Size, Share & Trends Analysis Report, By Source (Wood and Non-Wood), By Type (Thermoformed, Processed, Thick Wall, and Transfer), By End-Use (Food Packaging, Food Service, Electronics, Healthcare, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global molded pulp packaging market is estimated to grow at a CAGR of 4.6% during the forecast period. The major factors contributing to the market growth include the rising demand for sustainable packaging and increasing demand in the food packaging sector. A major trend towards sustainable packaging has been witnessed coupled with the stringent environmental regulations and consumer awareness regarding eco-friendly packaging. Molded pulp packaging is produced from a range of fibrous materials, including cardboard, recycled paper, or other natural fibers (wheat straw, bamboo, and sugarcane). These raw materials support to determine the surface texture, color, and strength of the packaging. It is designed with round corners and complex 3D shapes.

Egg cartons are a major instance that is manufactured using strong molded fibers in designs that protect from egg damage. With the improvement in manufacturing technology, it is becoming possible to get a more sophisticated look & feel and smoother surface. With the increased appearance, pulp packaging is now being utilized for a wide range of applications, along with traditional protective packaging (egg cartons, end caps). As per the International Molded Fiber Association (IMFA), renewable molded fiber packaging products are currently utilized in handling and packaging of thousands of manufactured products as it offers product protection in customer convenience, shipments, and other environmental benefits and economic packaging.

In the foodservice sector, compostable food packaging developed from the molded fiber is a suitable choice for insulating and rigid containers which makes it ideal for takeaway meal service. Huhtamaki OYJ uses breakthrough smooth-molding technologies to get effective quality and attractive finishing for food packaging products. The company’s range includes trays and food containers in several sizes and with and without compartments. Such products are suitable for home delivery and takeaway packaging of orders from several kinds of restaurants. Therefore, the increasing trend towards online food ordering is one of the vital factors contributing to the demand for molded pulp packaging products.

Market Segmentation

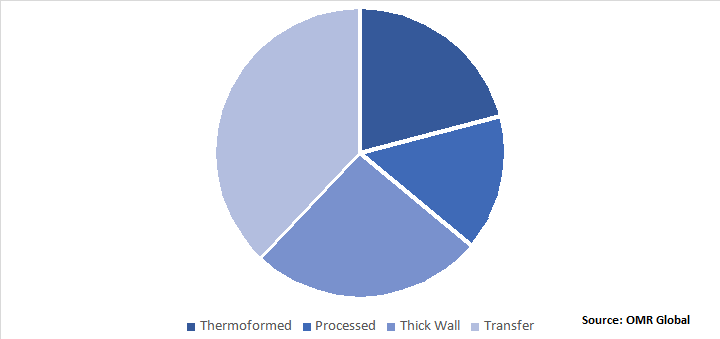

The global molded pulp packaging market is segmented based on source, type, and end-use. Based on the source, the market is classified into wood and non-wood. Based on type, the market is classified into thermoformed, processed, thick wall, and transfer. Based on end-use, the market is classified into food packaging, food service, electronics, healthcare, and others.

Transfer Molded to Witness Significant Adoption in the Type Segment

Transfer Molded products are also known as Thin-Wall. These molded fiber products normally have wall thicknesses of nearly 1/8 to 3/16 inches (3mm to 5mm). Surfaces of transfer molded products are relatively smooth on one side. Its most common applications are for trays and egg cartons. In electronics products, its new designs are utilized for the packaging of DVD players, cell phones, and others. Additionally, it is used for office equipment, hospital disposables, tableware, electrical appliances, and fruit and drink trays. Rising demand for eggs is primarily encouraging the demand for transfer molded packaging as it is highly utilized for massive transportation and packaging of eggs.

Global Molded Pulp Packaging Market Share by Type, 2019 (%)

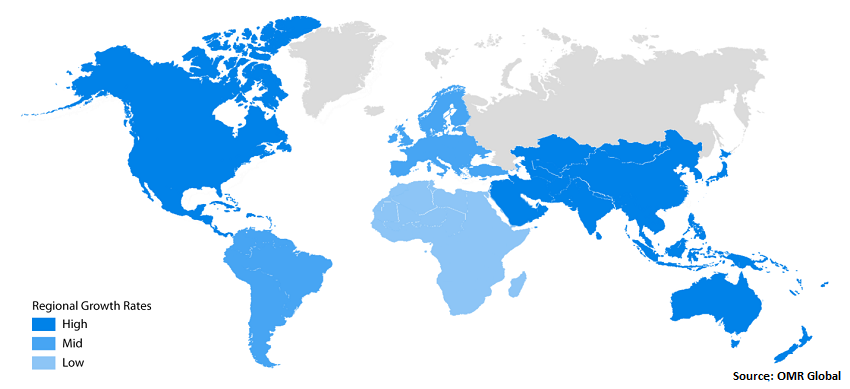

Regional Analysis

Geographically, Asia-Pacific is expected to witness potential share during the forecast period owing to the rising consumption of eggs, rising foodservice sector, and potential share in the electronics sector. Poultry is one of the emerging sectors in the Indian agricultural industry. India is the third-largest egg producer across the globe after China and the US. The production of eggs in India rose from nearly 83 billion nos. in 2015-16 to nearly 88 billion in 2016-17, which is showing a growth of nearly 6%. In addition, the per capita availability of egg rose from 61 in 2013-14 to 66 in 2015-16. During the period, 2016-17 it is 69. Rising consumption of eggs coupled with the growing per capita income and growing urban population, low cost of production of eggs, and growing export markets are some major growth drivers of leveraging egg production in India. This leads to an increasing demand for molded pulp egg trays which is a packaging tool utilized to hold eggs including poultry eggs and duck eggs. Its prime function is to absorb shocks and provide protection during transportation and carrying.

Global Molded Pulp Packaging Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Brødrene Hartmann A/S, Huhtamaki OYJ, UFP Technologies, Inc., Sonoco Products Co., and Novolex. Mergers and acquisitions and product launches are considered as some key strategies used by the market players to enhance their market share. For instance, in January 2020, Sonoco acquired Thermoform Engineered Quality, LLC, and Plastique Holdings, LTD, (together TEQ), a producer of thermoformed packaging that serves consumer, healthcare, and medical device markets, from ESCO Technologies, Inc.

In the US, TEQ operates three thermoforming and extrusion facilities in addition to molded-fiber and thermoforming production in Poland and a thermoforming operation in the UK. These facilities support the manufacturing of sterile, barrier packaging systems for medical devices and pharmaceuticals. Moreover, TEQ manufactures thermoformed plastic packaging and recyclable, molded-pulp-fiber packaging for several consumer products, especially in Europe. Thermoform Engineered Quality and Plastique rebranded to TEQ which will address the needs of their mutual customers.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global molded pulp packaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Brødrene Hartmann A/S

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Huhtamaki OYJ

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. UFP Technologies, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Sonoco Products Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Novolex

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Molded Pulp Packaging Market by Source

5.1.1. Wood

5.1.2. Non-Wood

5.2. Global Molded Pulp Packaging Market by Type

5.2.1. Thermoformed

5.2.2. Processed

5.2.3. Thick Wall

5.2.4. Transfer

5.3. Global Molded Pulp Packaging Market by End-User

5.3.1. Food Packaging

5.3.2. Food Service

5.3.3. Electronics

5.3.4. Healthcare

5.3.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AFP, Inc. (Sealed Air Corp.)

7.2. Atlantic Pulp

7.3. Brødrene Hartmann A/S

7.4. EnviroPAK Corp.

7.5. Fabri-Kal

7.6. FiberCel Packaging LLC

7.7. Genpak LLC

7.8. Henry Molded Products, Inc.

7.9. HIRSCH Servo AG

7.10. Huhtamaki OYJ

7.11. Keiding, Inc.

7.12. Molded Pulp Engineering

7.13. Molded Pulp Packaging

7.14. Novolex (Eco-Products, Inc.)

7.15. Pacific Pulp Molding, Inc.

7.16. Pro-Pac Packaging, Ltd.

7.17. Protopak Engineering Corp.

7.18. Pulp2pack

7.19. PulpWorks, Inc.

7.20. Sabert Corp

7.21. Sonoco Products Co.

7.22. UFP Technologies, Inc.

1. GLOBAL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

2. GLOBAL WOOD FIBER-BASED MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL NON-WOOD FIBER-BASED MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

5. GLOBAL THERMOFORMED MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PROCESSED MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL THICK WALL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL TRANSFER MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2019-2026 ($ MILLION)

10. GLOBAL MOLDED PULP PACKAGING IN FOOD PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL MOLDED PULP PACKAGING IN FOOD SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MOLDED PULP PACKAGING IN ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL MOLDED PULP PACKAGING IN HEALTHCARE RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL MOLDED PULP PACKAGING IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. GLOBAL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

18. NORTH AMERICAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. NORTH AMERICAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2019-2026 ($ MILLION)

20. EUROPEAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

22. EUROPEAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. EUROPEAN MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. ASIA-PACIFIC MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2019-2026 ($ MILLION)

28. REST OF THE WORLD MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

29. REST OF THE WORLD MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

30. REST OF THE WORLD MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2019-2026 ($ MILLION)

1. GLOBAL MOLDED PULP PACKAGING MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

2. GLOBAL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

3. GLOBAL MOLDED PULP PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2019-2026 ($ MILLION)

4. GLOBAL MOLDED PULP PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD MOLDED PULP PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)