Molecular Cytogenetics Market

Molecular Cytogenetics Market Size, Share & Trends Analysis Report by Product (Consumables, Software & Services, and Instruments), by Application (Cancer, Genetic Disorders, and Personalized Medicine), and by Technique (Fluorescence in Situ Hybridization (FISH), Comparative Genomic Hybridization (CGH), and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Molecular cytogenetics market is estimated to grow at a CAGR of 8.5% during the forecast period. The major factors contributing to the growth of the market include a significant prevalence of Cancer and increasing demand for genetic testing tools. As per the World Health Organization (WHO), the global Cancer burden is estimated to have risen to 18.1 million new cases and 9.6 million mortality in 2018. 43.8 million persons were living with Cancer in 2018 and were diagnosed within the last 5 years. This rising prevalence of Cancer is attributed to the demand for molecular cytogenetic tools.

Fluorescence in-situ hybridization (FISH) study is a crucial tool for both diagnostics and clinical research, as well as diagnostics, in Cancer and Leukemia. FISH can be utilized to assess chromosomal abnormalities with fluorescent-labeled DNA probes that target specific DNA sequences. FISH-based tests and comparative genomic hybridization (CGH), and multicolor karyotyping, have been utilized in clinical applications. These tests allow the whole global scanning of genomic imbalances and the resolution of complex karyotypic aberrations. Cross-species array CGH analysis has been used in the identification of Cancer genes.

The clinical effect of FISH is crucial, primarily in the diagnosis, prognosis, and treatment decisions for hematological conditions, which facilitate the area of personalized medicine. Molecular cytogenetics enables to properly differentiate of Cancer-causing and normal cells, which in turn, is leading to its adoption in Cancer diagnostics. Further, the market has significant growth opportunities owing to the advent of next-generation sequencing (NGS) and increasing research on personalized medicines. However, certain factors restricting market growth include the high cost of instruments and unfavorable reimbursement policies for genomic tools.

Segmental Outlook

The global molecular cytogenetics market is segmented based on its product, application, and technique. Based on product, the market is segmented into consumables, software & services, and instruments. Based on application, the market is categorized into cancer, genetic disorders, and personalized medicine. Further, based on technique, the market is segmented into fluorescence in situ hybridization (FISH), comparative genomic hybridization (CGH), and others. Among the product segments, the consumables segment is expected to hold a prominent market share due to the recurring demand for consumables in diagnostic procedures.

Fluorescence in situ hybridization (FISH) is one of the major techniques in molecular cytogenetics testing.

Molecular cytogenetic techniques mainly rely on FISH, which is based on the principle of complementary hybridization of labeled DNA or RNA probes with normal or abnormal nucleic acid sequences on metaphase chromosomes, interphase cells, or tissue sections. FISH takes us to a colorful chromosome world, which involves a fluorescently labeled DNA probe hybridized to a specific genomic segment of interest. FISH can detect small chromosomal rearrangements that cannot be detected by conventional cytogenetic techniques. The use of the FISH technique enhanced the interpretation of the numerical and complex chromosomal rearrangements, bridging the gap between conventional cytogenetics and molecular biology. Therefore, it is being significantly adopted technique in genome research and cancer diagnostics. In genome research, FISH enables researchers to map and visualize the genetic material in an individual's cells, including portions of genes or specific genes. This technique may be applied to understand a range of chromosomal abnormalities and other genetic mutations.

Regional Outlooks

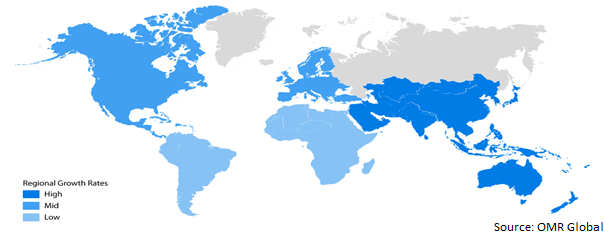

The global molecular cytogenetics market is further segmented based on geography, including North America, Europe, Asia-Pacific, and the Rest of the World. The market can be analyzed for a particular region or country level as per the requirement. The Asia-Pacific region is projected to experience considerable growth in the molecular cytogenetics market due to rising healthcare expenditure and increasing awareness about personalized medicine in the region.

Global Molecular Cytogenetics Market Growth, by Region 2023-2030

The North American Region is anticipated to Hold a Significant Share in the Global Molecular Cytogenetics Market

Among these, the North American region is anticipated to hold a significant market share owing to the significant prevalence of Cancer, increasing funding for genome research, and significant share in life science research in the region. In addition, the presence of major players, including Abbott Laboratories, Inc., Thermo Fisher Scientific Inc., and Illumina, Inc. are offering a potential opportunity for market growth in the region. These companies are focusing on introducing advanced molecular cytogenetics tools that will likely increase their market share.

Market Players Outlook

The major players in the global molecular cytogenetics market include Abbott Laboratories, Inc., Thermo Fisher Scientific Inc., Illumina, Inc., Bio-Rad Laboratories Inc., and F. Hoffman La-Roche AG. Product launches and mergers and acquisitions are considered some key strategies adopted by the market players to increase market share and gain a competitive advantage. For instance, in January 2020, Oxford Gene Technology (OGT) introduced an NGS panel for constitutional cytogenetics research. The CytoSure Constitutional NGS Panel enables reliable and accurate detection of copy number variations (CNVs), insertion/deletions (indels), single nucleotide variations (SNVs), and loss of heterozygosity (LOH), such as in mosaic samples. It combines the advantages of NGS and microarrays in one cost-effective assay. This new launch will likely support those laboratories that are focusing on transitioning from arrays to NGS.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global molecular cytogenetics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bio-Rad Laboratories, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Illumina, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. F. Hoffmann La-Roche AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Thermo Fisher Scientific, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Molecular Cytogenetics Market by Product

4.1.1. Consumables

4.1.2. Software & Services

4.1.3. Instruments

4.2. Global Molecular Cytogenetics Market by Application

4.2.1. Cancer

4.2.2. Genetic Disorders

4.2.3. Personalized Medicine

4.3. Global Molecular Cytogenetics Market by Technique

4.3.1. Fluorescence in Situ Hybridization (FISH)

4.3.2. Comparative Genomic Hybridization (CGH)

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott Laboratories, Inc.

6.2. ADS Biotec Inc.

6.3. Agilent Technologies, Inc.

6.4. Applied Spectral Imaging

6.5. BioDot Inc.

6.6. Biological Industries Israel Beit Haemek Ltd.

6.7. Bio-Rad Laboratories, Inc.

6.8. Danaher Corp.

6.9. Euroclone S.p.A.

6.10. F. Hoffmann La-Roche AG

6.11. FUJIFILM Irvine Scientific

6.12. Illumina, Inc.

6.13. Laboratory Imaging s.r.o.

6.14. Leica Biosystems

6.15. MetaSystems Hard & Software GmbH

6.16. Nikon Corp.

6.17. Oxford Gene Technology Ltd.

6.18. PAN-Biotech GmbH

6.19. Perkinelmer, Inc.

6.20. Tecan Group Ltd.

6.21. Thermo Fisher Scientific Inc.

1. GLOBAL MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

2. GLOBAL MOLECULAR CYTOGENETICS CONSUMABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL MOLECULAR CYTOGENETICS SOFTWARE AND SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL MOLECULAR CYTOGENETICS INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL MOLECULAR CYTOGENETICS FOR CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL MOLECULAR CYTOGENETICS FOR GENETIC DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL MOLECULAR CYTOGENETICS FOR PERSONALIZED MEDICINE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2022-2030 ($ MILLION)

10. GLOBAL FISH FOR MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL CGH FOR MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL OTHER TECHNIQUES FOR MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2022-2030 ($ MILLION)

14. NORTH AMERICAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

16. NORTH AMERICAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2022-2030 ($ MILLION)

18. EUROPEAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

20. EUROPEAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. EUROPEAN MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

27. REST OF THE WORLD MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. REST OF THE WORLD MOLECULAR CYTOGENETICS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2022-2030 ($ MILLION)

1. GLOBAL MOLECULAR CYTOGENETICS MARKET SHARE BY PRODUCT, 2022 VS 2030 (%)

2. GLOBAL MOLECULAR CYTOGENETICS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

3. GLOBAL MOLECULAR CYTOGENETICS MARKET SHARE BY TECHNIQUE, 2022 VS 2030 (%)

4. GLOBAL MOLECULAR CYTOGENETICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL MOLECULAR CYTOGENETICS CONSUMABLES MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL MOLECULAR CYTOGENETICS SOFTWARE AND SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL MOLECULAR CYTOGENETICS INSTRUMENTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL MOLECULAR CYTOGENETICS FOR CANCER MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL MOLECULAR CYTOGENETICS FOR GENETIC DISORDERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL MOLECULAR CYTOGENETICS FOR PERSONALIZED MEDICINE MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL FISH FOR MOLECULAR CYTOGENETICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL CGH FOR MOLECULAR CYTOGENETICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL OTHER TECHNIQUES FOR MOLECULAR CYTOGENETICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. US MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

16. UK MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

21. ROE MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF ASIA-PACIFIC MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD MOLECULAR CYTOGENETICS MARKET SIZE, 2022-2030 ($ MILLION)