Molecular Diagnostics Market

Global Molecular Diagnostics Market Size, Share & Trends Analysis Report by Technology(Polymerase Chain Reaction (PCR), In Situ Hybridization (ISH), DNA Microarray, Next-Generation Sequencing (NGS), Isothermal Nucleic Acid Amplification, and Other Technologies), By Product(Testing Equipment, Diagnostic Reagents & Kits, and Services & Software), By Applications (Infectious Diseases, Cancer, Cardiovascular Disease (CVD), Genetic Testing, Neurological Disease, and Other) Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global molecular diagnostics market is anticipated to grow at a significant CAGR of 9.9% during the forecast period. The molecular diagnostics involves the application of a large array of techniques, right from the molecular biology to conducting various tests for analyzing biological markers in the genome and proteomes. The molecular diagnostic is used to keep close track of infectious disease including COVID-19, and AIDS, its monitoring, risks involved, and among other purposes. The applicability of such diagnostic practice is in demand owing to the rising trend of personalized treatment and personalized medication. The major factor fueling the growth of the market includes the rise in the prevalence of infectious diseases and cancer across the globe. The demand for a cost-effective and accurate diagnostic solution is another factor propelling the growth of the market. However, the stringent laws and regulations related the molecular diagnostics are the major factor restraining the growth of the market. The lack of adequate infrastructure in emerging countries is one of the major hindrances in the growth of the market in emerging regions. The extended support of the government in terms of funding and technological advancement for the development of more precise and cost-effective diagnostic devices will propel the market in the future.

Impact of COVID-19 Pandemic on Global Molecular Diagnostics Market

The COVID-19 had shown a positive impact on the molecular diagnostics market. This industry is facing a downtrend earlier, however, the COVID-19 pandemic had brought the attention of governments across the globe towards the importance of this market. With the support of government initiatives and rapidly rising demand for COVID-19 diagnosis and its research had raised this market by manifold. However, this had sidelinedthe molecular diagnostics of other diseases, still, the COVID-19 alone is driving the market rapidly.

Segmental Outlook

The global molecular diagnostics market is segmented based on technology, product, and applications. Based on the technology, the market is segmented into PCR, ISH, DNA microarray, NSG, isothermal nucleic acid amplification, and other technologies. Based on the product, the market is segmented into testing equipment, diagnostic reagents & kits, and services & software. Apart from this, by applications, the market is segmented into infectious diseases, cancer, CVD, genetic testing, neurological disease, and other.

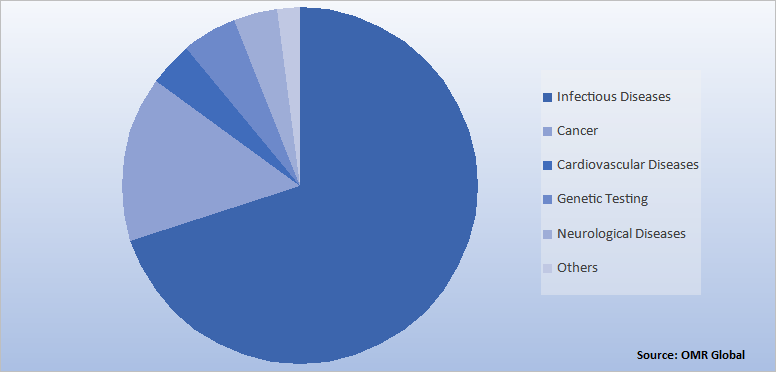

Global Molecular Diagnostics Market Share by Application, 2020 (%)

Infectious Diseases are Dominating the Global Molecular Diagnostics Market

The diagnostics of infectious diseases have taken a huge share in the molecular diagnostics market as these diseases tend to spread rapidly creating demand for their diagnosis. The spread COVID-19 in December 2019 is one of the best examples of infectious diseases. RT-PCR is guided to be the best testing method for its diagnosis. The diagnosis of other diseases aresidelined as per The Hindu news reports and the main focus of all the governments and market player across the globe is on the research and treatment of COVID-19.

Cancer is at second in the molecular diagnostics market. According to an estimation of the American Cancer Society, four new cases have been recorded every minute in the US with one death. The weakening of the immune system as an impact of increasing pollution is resulting in the severity of these diseases.

Genetic testing and research are emerging segments in this market. To get rid of genetic diseases this segment can play a major role in the future. Additionally, the extinguished species of plants and animals can also be revived through this technique. Revive&Restore organization is using it to bring Wooly Mammoth back into existence in Europe which was extinguished in the ice age.

Regional Outlooks

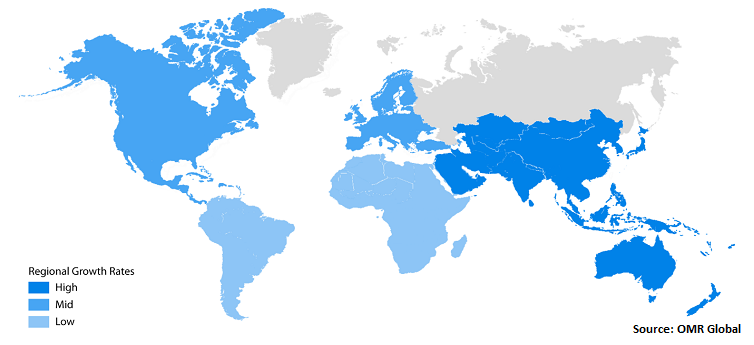

The global molecular diagnostics market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others, and the Rest of the World (the Middle East and Africa, and Latin America). The emerging countries such as India and China in the Asia-Pacific region are expected to grow significantly during the forecast attributed to the rapid development of the healthcare industry in such regions.

Global Molecular Diagnostics Market Growth, by Region 2021-2027

North America is Leading the Global Molecular Diagnostics Market

North America holds the major share in the molecular diagnostics market owing to the presence of a large number of companies both in the development and research of molecular diagnostic fields. The region also has the highest statistics related to cancer incidence. The European region follows North America in market share owing to the availability of well-established healthcare facilities and the increasing demand for personalized treatment. The Europe dominates in the testing kits segment of the market.

The increasing geriatric population in Latin America is driving the market in this region. Diabetes patients are increasing in this region due to the adoption of a changed lifestyle. The emerging economy and infrastructure in Africa are restraining the growth of the molecular diagnostics market in that region.

Market Players Outlook

The companies engaged in molecular diagnostics provide reagent kits and testing equipment for the molecular diagnostic test. The market players also provide molecular diagnostic services for the treatment and diagnosis of infectious diseases and cancer. The key players in the molecular diagnostics market include Becton Dickinson and Co., Abbott Laboratories, Inc., bioMérieux S.A., Bio-Rad Laboratories, Inc., Danaher Corporation, Nanopore Technologies, and others. To develop an effective treatment of COVID-19, the governments across the globe are also supporting these market players with incentives and subsidies that will enable them to expand organically in the market.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global molecular diagnostics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Molecular Diagnostics Market

• Recovery Scenario of Global Molecular Diagnostics Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Molecular Diagnostics Market by Technology

5.1.1. Polymerase Chain Reaction (PCR)

5.1.2. In Situ Hybridization (ISH)

5.1.3. DNA Microarray

5.1.4. Next-Generation Sequencing (NGS)

5.1.5. Isothermal Nucleic Acid Amplification

5.1.6. Other Technologies

5.2. Global Molecular Diagnostics Market by Product

5.2.1. Testing Instruments

5.2.2. Diagnostic Reagents and Kits

5.2.3. Services & Software

5.3. Global Molecular Diagnostics Market by Applications

5.3.1. Infectious Diseases (including COVID-19)

5.3.2. Cancer

5.3.3. Cardiovascular Disease (CVD)

5.3.4. Genetic Testing

5.3.5. Neurological Disease

5.3.6. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories, Inc.

7.2. Agilent Technologies, Inc.

7.3. AltheaDX, Inc.

7.4. AutoGenomics, Inc.

7.5. Beckman Coulter, Inc.

7.6. Becton Dickinson and Co.

7.7. Biocartis N.V.

7.8. bioMérieux S.A.

7.9. Bio-Rad Laboratories, Inc.

7.10. CareDX, Inc.

7.11. Danaher Corp.

7.12. ELITech Group

7.13. Exact Science Corp.

7.14. F. Hoffmann-La Roche, Ltd.

7.15. Genetic Technologies, Ltd.

7.16. GenMark Diagnostics, Inc.

7.17. Grifols, S.A.

7.18. Hologic, Inc.

7.19. HTG Molecular Diagnostics, Inc.

7.20. MDxHealth Group

7.21. Merck KGaA

7.22. Oxford Nanopore Technologies Ltd.

7.23. QIAGEN GmbH

7.24. Sequenom, Inc.

7.25. Siemens Healthcare Pvt. Ltd.

7.26. Source BioScience, Ltd.

7.27. Thermo Fisher Scientific, Inc.

7.28. Veracyte, Inc.

1. GLOBAL MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

2. GLOBAL PCR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ISH MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL DNA MICROARRAY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL NSG MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL ISOTHERMAL NUCLEIC ACID AMPLIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHER TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

9. GLOBAL TESTING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL DIAGNOSTIC REAGENTS AND KITS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SERVICES & SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

13. GLOBAL MOLECULAR DIAGNOSTICS FOR INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL MOLECULAR DIAGNOSTICS FOR CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL MOLECULAR DIAGNOSTIC FOR CVD MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL MOLECULAR DIAGNOSTICS FOR GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL MOLECULAR DIAGNOSTICS FOR NEUROLOGICAL DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL MOLECULAR DIAGNOSTICS For OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

20. NORTH AMERICAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. NORTH AMERICAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

22. NORTH AMERICAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

23. NORTH AMERICAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

24. EUROPEAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. EUROPEAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

26. EUROPEAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

27. EUROPEAN MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

30. ASIA-PACIFIC MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

32. REST OF THE WORLD MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

33. REST OF THE WORLD MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

34. REST OF THE WORLD MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

35. REST OF THE WORLD MOLECULAR DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MOLECULAR DIAGNOSTICS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MOLECULAR DIAGNOSTICS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL MOLECULAR DIAGNOSTICS MARKET, 2021-2027 (%)

4. GLOBAL MOLECULAR DIAGNOSTICS MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

5. GLOBAL PCR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL ISH MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL DNA MICROARRAY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL NSG MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL ISOTHERMAL NUCLEIC ACID AMPLIFICATION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL OTHER TECHNOLOGIES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL MOLECULAR DIAGNOSTICS MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

12. GLOBAL TESTING EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL DIAGNOSTIC REAGENTS AND KITS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL SERVICES & SOFTWARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL MOLECULAR DIAGNOSTICS MARKET SHARE BY APPLICATIONS, 2020 VS 2027 (%)

16. GLOBAL MOLECULAR DIAGNOSTICS FOR INFECTIOUS DISEASES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL MOLECULAR DIAGNOSTICS FOR CANCER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL MOLECULAR DIAGNOSTICS FOR CVD MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL MOLECULAR DIAGNOSTICS FOR GENETIC TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL MOLECULAR DIAGNOSTICS FOR NEUROLOGICAL DISEASES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL MOLECULAR DIAGNOSTICS FOR OTHER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. GLOBAL MOLECULAR DIAGNOSTICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

23. NORTH AMERICAN MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

24. UNITED STATES MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

25. CANADA MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

26. EUROPEAN MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

27. UK MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

28. GERMANY MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

29. SPAIN MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

30. FRANCE MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

31. ITALY MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

32. ROE MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

33. ASIA-PACIFIC MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

34. INDIA MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

35. CHINA MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

36. JAPAN MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

37. SOUTH KOREA MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

38. REST OF ASIA-PACIFIC MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)

39. REST OF THE WORLD MOLECULAR DIAGNOSTICS MARKET SIZE, 2017-2023 ($ MILLION)