Mono-Material Packaging Film Market

Mono-Material Packaging Film Market Size, Share & Trends Analysis Report by Material (Polyethylene, Polypropylene, PET, PLA, PBS and PVA), by Packaging Formats (Stand-Up Pouches, Flat Bottom Bags, Shrink Films, Flow Wraps, Trays & Containers and Labels & Inserts), and by End- Use (Food & Beverages, Pharmaceutical and Medical, Consumer Goods, Agriculture, Electronics and Automotive) Forecast Period (2024-2031)

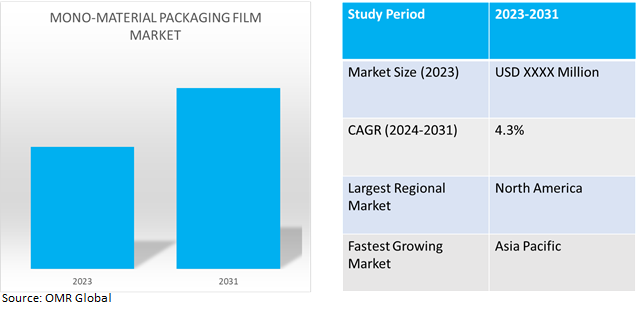

Mono-material packaging film market is anticipated to grow at a moderate CAGR of 4.3% during the forecast period (2024-2031). The mono material plastic packaging film can be recycled easily which gives advantage over multi-layered plastic packaging which is composed of various plastic polymer types which are challenging to separate and recycle. Its flexibility, light weight and exceptional barrier qualities makes it ideal for a variety of uses, including as personal care items, medical packaging, and food and beverage packaging.

Market Dynamics

Growing demand for Environmental Friendly Packaging Solutions

The rising environmental awareness among customers calls for more environment friendly and sustainable packaging options that effects conventional plastic packaging market. As mono-material packaging is composed of just one kind of plastic polymer and is readily recyclable, it is a desirable choice for businesses trying to lessen their negative environmental effect. Traditional multi-layer plastic films are being replaced by environmentally friendly films. Mono-material packaging films are becoming more and more popular among brands as they are recyclable and environmental friendly which makesit simpler to construct.

Rising demand for light weight and cost-effective packaging solutions in the market

Market demand for mono-material packaging film is rising as the requirement for affordable and lightweight packing materials are increasing. As it is flexible and light weight packaging material it is perfect for a variety of uses, such as packaging of personal care items, medical supplies, and food and beverages. Its cost effective nature makes its use crucial in markets where costs consideration is must. Therefore, the transition to mono-material solutions is highly encouraged by the potential cost advantages associated with increased recyclability, reduction of trash to landfills and landfill taxes.

Market Segmentation

Our in-depth analysis of the global mono-material packaging film market includes the following segments by material, packaging formats, and end-use:

- Based on material, the market is sub-segmented into polyethylene, polypropylene, PET, PLA, PBS, and PVA.

- Based on packaging formats, the market is sub-segmented into stand-up pouches, flat bottom bags, shrink films, flow wraps, trays & containers, labels & inserts.

- Based on end-use, the market is sub-segmented into food & beverages, pharmaceutical and medical, consumer goods, agriculture, electronics and automotive

Polyethylene is Projected to Emerge as the Largest Segment

The market growth is driven by the high adoption of polyethylene owing to its great strength, flexibility, affordability and higher resistance to chemicals and moisture. Polyethylene finds extensive application in industrial packaging, namely in the configuration of stretch wrap films.

Furthermore, advances in material science have made it possible to produce plastic films made of a single material that exhibit superior performance characteristics.The solid foundation for the continued growth of the mono-materials plastic market continues to be the focus on the well-established infrastructure of plastic film production and recycling.

Food & Beverage Sub-segment to Hold a Considerable Market Share

The market for mono-material plastic packaging film is dominated by the food and beverage category. The global market's largest application sector is that for food and beverage packaging. As plastic films are widely used to package a wide range of food and drink items, such as baked goods, snacks, frozen foods, and beverages. It can shield the contents from moisture, oxygen, other elements and helps in increasing its shelf life.

Regional Outlook

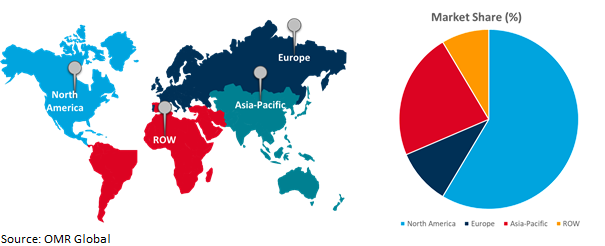

The global mono-material packaging film market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to Invest More in Sustainable Packaging

- The increasing awareness for sustainable packaging solutions is driving the demand for mono material plastic packaging film in Asia-Pacific.

- To promote the use of sustainable packaging solutions, the governments of several countries across Asia-Pacific has introduced policies and regulations which is expected to drive the growth of the market.

Global Mono-material Packaging Film Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds major share in the global mono material plastic packaging film market. In North America, the need for these films is being driven by a growing awareness of the need for sustainable packaging solutions. The landscape around the management of plastic trash is continuously changing, focusing more on the adoption of sustainable packaging solutions and the reduction of plastic waste. The food and beverage sector in North America is a significant consumer of these films owing to its exceptional barrier qualities, which shield goods from air, moisture, and other elements.

Furthermore, the development of high-performance materials with greater strength, durability, and barrier qualities as a result of technological improvements during the film's manufacture is propelling the market expansion.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global mono-material packaging film market include TOPPAN Holdings Inc., Polysack Flexible Packaging Ltd., Profol GmbH, Graphic Packaging International LLC, Mondi PLC and Novel Packaging,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2024, ProAmpac acquired Gelpac, from an investor group led by NAMAKOR Holdings, including Groupe W Investissements and CDPQ.Combining Gelpac and ProAmpac has allow the company toserve customers with better packaging solutions for food & beverage, agriculture, industrial and pharmaceutical end markets.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mono-material packaging film market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Polysack Flexible Packaging Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Profol GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. TOPPAN Holdings Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Mono-material Packaging Film Market by Material

4.1.1. Polyethylene

4.1.1.1.1. HDPE

4.1.1.1.2. LDPE

4.1.2. Polypropylene

4.1.3. PET

4.1.4. PLA

4.1.5. PBS

4.1.6. PVA

4.2. Global Mono-material Packaging Film Market by Packaging Formats

4.2.1. Stand-Up Pouches

4.2.2. Flat Bottom Bags

4.2.3. Shrink Films

4.2.4. Flow Wraps

4.2.5. Trays & Containers

4.2.6. Labels and Inserts

4.3. Global Mono-material Packaging Film Market by End-Use

4.3.1. Food & Beverages

4.3.2. Pharmaceutical and Medical

4.3.3. Consumer Goods

4.3.4. Agriculture

4.3.5. Electronics

4.3.6. Automotive

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Amcor Group GmbH

6.2. Berry Global Inc.

6.3. Bischof + Klein

6.4. Cosmo Films

6.5. Coveris

6.6. Flex Films

6.7. Graphic Packaging International, LLC

6.8. Innovia Films

6.9. Jindal Films

6.10. Mitsubishi Chemical Group Corp.

6.11. Mondi PLC

6.12. NOVA Chemical

6.13. Novel Packaging

6.14. Proampac

6.15. Reifenhauser

6.16. RKW SE

6.17. SABIC

6.18. Taghleef Industries

6.19. Teijin Ltd.

6.20. Toray Industries Inc.

6.21. Uflex Ltd.

6.22. Wipak Group

1. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL POLYETHYLENE FOR MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL POLYPROPYLENE FOR MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL PET FOR MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PLA FOR MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL PBS FOR MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL PVA FOR MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY PACKAGING FORMATS, 2023-2031 ($ MILLION)

9. GLOBAL MONO-MATERIAL PACKAGING FILM FOR STAND-UP POUCHESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MONO-MATERIAL PACKAGING FILM FOR FLAT BOTTOM BAGSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MONO-MATERIAL PACKAGING FILM FOR SHRINK FILMSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MONO-MATERIAL PACKAGING FILM FOR FLOW WRAPSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MONO-MATERIAL PACKAGING FILM FOR TRAYS & CONTAINERSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MONO-MATERIAL PACKAGING FILM FOR LABELS AND INSERTSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

16. GLOBAL MONO-MATERIAL PACKAGING FILM FOR FOOD & BEVERAGESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL MONO-MATERIAL PACKAGING FILM FOR PHARMACEUTICAL AND MEDICALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL MONO-MATERIAL PACKAGING FILM FOR CONSUMER GOODSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL MONO-MATERIAL PACKAGING FILM FOR AGRICULTUREMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL MONO-MATERIAL PACKAGING FILM FOR ELECTRONICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL MONO-MATERIAL PACKAGING FILM FOR AUTOMOTIVEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. NORTH AMERICAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. NORTH AMERICAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

25. NORTH AMERICAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY PACKAGING FORMATS, 2023-2031 ($ MILLION)

26. NORTH AMERICAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY END-USE,2023-2031 ($ MILLION)

27. EUROPEAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. EUROPEAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

29. EUROPEAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY PACKAGING FORMATS, 2023-2031 ($ MILLION)

30. EUROPEAN MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFICMONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

33. ASIA-PACIFICMONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY PACKAGING FORMATS, 2023-2031 ($ MILLION)

34. ASIA-PACIFICMONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

37. REST OF THE WORLD MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY PACKAGING FORMATS, 2023-2031 ($ MILLION)

38. REST OF THE WORLD MONO-MATERIAL PACKAGING FILM MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL POLYETHYLENE MONO-MATERIAL PACKAGING FILM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL POLYPROPYLENE FOR MONO-MATERIAL PACKAGING FILM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL PET FOR MONO-MATERIAL PACKAGING FILM MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PLA FOR MONO-MATERIAL PACKAGING FILM MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL PBS FOR MONO-MATERIAL PACKAGING FILM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL PVA FOR MONO-MATERIAL PACKAGING FILM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET SHAREBY PACKAGING FORMATS, 2023 VS 2031 (%)

9. GLOBAL MONO-MATERIAL PACKAGING FILM FOR STAND-UP POUCHESMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MONO-MATERIAL PACKAGING FILM FOR FLAT BOTTOM BAGSMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MONO-MATERIAL PACKAGING FILM FOR SHRINK FILMSMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MONO-MATERIAL PACKAGING FILM FOR FLOW WRAPSMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MONO-MATERIAL PACKAGING FILM FOR TRAYS & CONTAINERSMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL MONO-MATERIAL PACKAGING FILM FOR LABELS AND INSERTSMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL MONO-MATERIAL PACKAGING FILM MARKET SHAREBY END-USE, 2023 VS 2031 (%)

16. GLOBAL IN MONO-MATERIAL PACKAGING FILM FOR FOOD & BEVERAGESMARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL MONO-MATERIAL PACKAGING FILM FOR PHARMACEUTICAL AND MEDICALMARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL MONO-MATERIAL PACKAGING FILM FOR CONSUMER GOODSMARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL MONO-MATERIAL PACKAGING FILM FOR AGRICULTUREMARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL MONO-MATERIAL PACKAGING FILM FOR ELECTRONICSMARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL MONO-MATERIAL PACKAGING FILM FOR AUTOMOTIVEMARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL MONO-MATERIAL PACKAGING FILMMARKET SHARE BY REGION, 2023 VS 2031 (%)

23. US MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

24. CANADA MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

25. UK MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

26. FRANCE MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

27. GERMANY MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

28. ITALY MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

29. SPAIN MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF EUROPE MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

31. INDIA MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

32. CHINA MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

33. JAPAN MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

34. SOUTH KOREA MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF ASIA-PACIFIC MONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

36. LATIN AMERICAMONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)

37. MIDDLE EAST AND AFRICAMONO-MATERIAL PACKAGING FILMMARKET SIZE, 2023-2031 ($ MILLION)