Motor Vehicle Insurance Market

Global Motor Vehicle Insurance Market Size, Share, and Trends Analysis Report by Vehicle Type (Personal Vehicle and Commercial Vehicle), and By Policy Type (Third-Party Vehicle Insurance, Fire & Theft Vehicle Insurance, and Comprehensive Vehicle Insurance), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global motor vehicle insurance market is anticipated to grow at a CAGR of 6.2% during the forecast period. Automotive vehicles are expensive products that a person purchases through their life-long earnings. Thus, any damage or loss of this vehicle does not create financial loss but also impacts the mental health of the vehicle owners. Due to this reason, vehicle owners around the globe purchases motor vehicle insurance to safeguard themselves from any type of financial loss due to vehicle theft or damage due to natural disaster and accidents. The rising disposable income is a major factor driving the growth of the motor vehicle insurance market. Moreover, stringent government regulations for motor vehicle insurance are also significantly supporting the growth of the market. For instance, the Motor Vehicles Act of 1988 of India mandates the insurance purchase with every vehicle driven in a public place.

Impact of COVID-19 Pandemic on the Global Motor Vehicle Insurance Market

The COVID-19 pandemic had suspended the manufacturing of automotive vehicles due to lockdowns and facility shutdowns. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of automotive vehicles in 2020 was down by 16% as compared to the previous year. Additionally, the buyers avoided spending on non-essential and expensive products, which drastically reduced the sales of automotive vehicles by 12% in 2020. The insurance companies had suffered great trouble during the pandemic, as they had faced huge numbers of bankruptcy during the pandemic period, as the majority of people were unable to pay their insurance premiums.

Segmental Outlook

The global motor vehicle insurance market is segmented based on the vehicle type and policy type. Based on the vehicle type, the market is segmented into personal vehicle and commercial vehicle. Among these vehicle types, the passenger vehicles segment holds the major share in the market. The rising per capita income of customers is the driving factor for this segment. The commercial vehicles segment is majorly driven by the increasing sales of cabs. COVID-19 had made lots of people unemployed, and most of these unemployed people are searching for different ways to earn a livelihood. By becoming a cab service provider, such people become self-employed. Thus, driving the growth of the commercial vehicle segment. Based on the policy type, the market is sub-segmented into third-party vehicle insurance, fire & theft vehicle insurance, and comprehensive vehicle insurance. The above-mentioned segments can also be customized as per the requirements.

Regional Outlooks

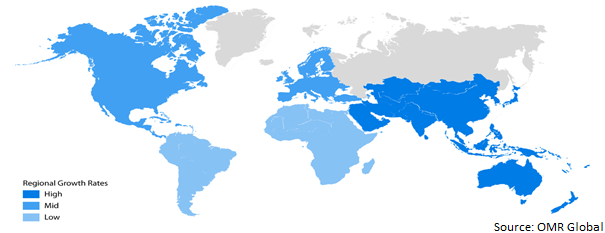

The global motor vehicle insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can also be analyzed for a particular region or country level as per the requirement.

Global Motor Vehicle Insurance Market Growth by Region, 2022-2028

The Asia-Pacific Region to Grow Significantly in the Global Motor Vehicle Insurance Market

The Asia-Pacific region is anticipated to grow significantly in the motor vehicle insurance market, as the region is the hub of automotive manufacturing. According to the OICA, around 44.3 million vehicles were produced in the Asia Pacific region in 2020, which is around 57% of global vehicle production. China, Japan, India, and South Korea are the major contributors to the regional market. The supportive government subsidies for the production as well as the purchase of automotive vehicles are the major driving factor for the growth of the motor vehicle insurance market in the region. Re-sale of used cars is also expected to drive the market in the region, due to its increasing demand.

Market Players Outlook

The major companies serving the global motor vehicle insurance market include State farm, All State, USAA, Allianz SE, Geico (Berkshire Hathaway Inc.), AXA SA, Zurich AG, Bajaj FinServ Ltd., PICC Property & Casualty Co. Ltd., IFFCO Tokio General Insurance, Royal Sundaram General Insurance, The Oriental Insurance Company Co., and HDFC ERGO General Insurance, among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, GEICO partnered with AI technology company Tractable in May 2021, to accelerate its auto claim and repair processes. Tractable is the developer of a proprietary computer vision technology that has been trained on millions of historical claims. The AI can assess vehicle damage based on photos, much like a human appraiser. GEICO is looking to utilize Tractable’s technology to accurately review estimates within seconds while reducing administrative overheads.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global motor vehicle insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Motor Vehicle Insurance Market

• Recovery Scenario of Global Motor Vehicle Insurance Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Motor Vehicle Insurance Market by Vehicle Type

4.1.1. Personal Vehicle

4.1.2. Commercial Vehicle

4.2. Global Motor Vehicle Insurance Market by Policy Type

4.2.1. Third-Party Vehicle Insurance

4.2.2. Fire & Theft Vehicle Insurance

4.2.3. Comprehensive Vehicle Insurance

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Allianz SE

6.2. Allstate

6.3. American Family Insurance

6.4. Assicurazioni Generali

6.5. AXA SA

6.6. Bajaj FinServ Ltd.

6.7. GEICO (Berkshire Hathaway Inc.)

6.8. HDFC ERGO General Insurance

6.9. IFFCO Tokio General Insurance

6.10. Liberty Mutual

6.11. National Insurance Co.

6.12. PICC Property & Casualty Co. Ltd.

6.13. Ping An Insurance

6.14. Progressive

6.15. Royal Sundaram General Insurance

6.16. State Farm

6.17. TATA AIG GIC, Ltd.

6.18. The Oriental Insurance Co.

6.19. United India Insurance Co. Ltd.

6.20. USAA

6.21. Zurich AG

1. GLOBAL MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

2. GLOBAL PASSENGER VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COMMERCIAL VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY POLICY TYPE, 2021-2028 ($ MILLION)

5. GLOBAL THIRD-PARTY VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL FIRE & THEFT VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL COMPREHENSIVE VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

11. NORTH AMERICAN MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY POLICY TYPE, 2021-2028 ($ MILLION)

12. EUROPEAN MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. EUROPEAN MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

14. EUROPEAN MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY POLICY TYPE, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY POLICY TYPE, 2021-2028 ($ MILLION)

18. REST OF THE WORLD MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. REST OF THE WORLD MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD MOTOR VEHICLE INSURANCE MARKET RESEARCH AND ANALYSIS BY POLICY TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MOTOR VEHICLE INSURANCE MARKET, 2021-2028 ($ MILLION)

2. GLOBAL MOTOR VEHICLE INSURANCE MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

3. GLOBAL PASSENGER VEHICLE INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL COMMERCIAL VEHICLE INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL MOTOR VEHICLE INSURANCE MARKET SHARE BY POLICY TYPE, 2021 VS 2028 (%)

6. GLOBAL THIRD-PARTY VEHICLE INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL FIRE & THEFT VEHICLE INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL COMPREHENSIVE VEHICLE INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL MOTOR VEHICLE INSURANCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. US MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

12. UK MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF ASIA-PACIFIC MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD MOTOR VEHICLE INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)