Myoglobin Market

Global Myoglobin Market Size, Share & Trends Analysis Report By Type (Human and Animal), and By End-User (Hospitals & Clinics, Research Institute, and laboratories) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global myoglobin market is anticipated to grow at a significant CAGR of 4.4% during the forecast period. The increased number of patients undergoing cardiac surgery, and growing knowledge of myoglobin's utility as an accurate indication of left ventricular wall thickening, drove demand for myoglobin reagents (LVWT) supporting the market. Myoglobin reagents are substances that are used to determine the amount of myoglobin in blood and urine samples. These tests are usually conducted on individuals who have recently had cardiac surgery or other injuries that resulted in internal bleeding that caused myoglobin to be released from muscle cells. As a result, there will be a greater emphasis on precise detection methods for left ventricular wall thickening using myoglobin techniques such as immunoturbidimetric assay which in turn is impacting the growth of the market.

Impact of COVID-19 Pandemic on Global Myoglobin Market

The COVID-19 Pandemic had impacted the global myoglobin market significantly owing to the effects of the COVID-19 on patients suffering from low levels of oxygen and myoglobin supply oxygen to cells in muscles, resulting in increased demand for myoglobin. The market for myoglobin counters negative impacts and focused on new chances generated by the pandemic situation.

Segmental Outlook

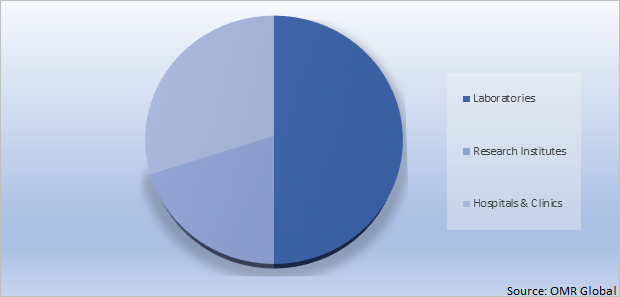

The global myoglobin market is segmented based on type and end-user. Based on the type, the market is sub-segmented into human and animal. Based on the end-user, the market is sub-segmented into hospitals & clinics, research institute, and laboratories.

Global Myoglobin Market Share by End-User, 2021 (%)

The Laboratories Segment Holds the Prominent Market Share in the Global Myoglobin Market

Myoglobin reagents are used to measure myoglobin levels in laboratories. Laboratories are diagnostic centers where a variety of diagnostic procedures are carried out. They usually have high-quality equipment, and the results that come out of these labs are accurate. Additionally, diagnostic laboratories have been discovered to be critical to the overall healthcare system, both in terms of quality of care and financial performance. The demand for diagnostics labs is growing as the patient population grows, and individuals prefer to go to diagnostics labs to get their disorders diagnosed. Furthermore, these labs can process large workloads more quickly. Thus, due to the increasing need for healthcare services, the diagnostic laboratories segment is expected to rise rapidly.

Regional Outlooks

The global myoglobin market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Myoglobin Market Growth, by Region 2022-2028

The North America Region Expected to Hold Considerable Share in the Global Myoglobin Market

The North American region holds the major share and is anticipated to grow fastest during the forecast period in the myoglobin market. According to the American Heart Association (AHA) in 2019, cardiovascular diseases cause around 8,36,546 deaths in the US each year, with almost 92.1 million Americans suffering from some type of cardiovascular disease. Moreover, according to the Centers for Disease Control and Prevention (CDC), in 2020, atrial fibrillation affects between 2.7 and 6.1 million persons in the United States. As a result of rising concerns about cardiovascular illnesses and increased investment in research and development of novel biomarkers, the market is likely to expand throughout the forecast period.

Market Players Outlook

The major companies serving the global myoglobin market include Bio-Rad Laboratories, Inc., Merck KGaA, OriGene Technologies, Inc., Scripps Labs, Thermo Fisher Scientific Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2021, Bio-Rad Laboratories, Inc., launched CFX Ops Dx Real-Time PCR detection systems. For diagnostic testing and research, the systems provide accurate and exact quantification to boost assay development and workflow efficiencies, and productivity.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global myoglobin market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Myoglobin Market

• Recovery Scenario of Global Myoglobin Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Bio-Rad Laboratories, Inc

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Merck KGaA

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. OriGene Technologies, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Scripps Labs

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Thermo Fisher Scientific Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Myoglobin Market by Type

4.1.1. Human

4.1.2. Animal

4.2. Global Myoglobin Market by End-User

4.2.1. Hospitals & Clinics

4.2.2. Research Institute

4.2.3. Laboratories

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott

6.2. Beckman Coulter, Inc.

6.3. BioMérieux SA

6.4. Boditech Med Inc.

6.5. Calzyme

6.6. F. Hoffmann-La Roche Ltd.

6.7. Labsystems Diagnostics

6.8. Lee BioSolutions

6.9. LSI Medience Corp.

6.10. Randox Laboratories Ltd.

6.11. RESPONSE BIOMEDICALAtum Charge

6.12. Siemens Healthcare GmbH

1. GLOBAL MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL HUMAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ANIMAL MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

5. GLOBAL HOSPITALS & CLINICS FOR MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL RESEARCH INSTITUTE FOR MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL LABORATORIES FOR MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

11. NORTH AMERICAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12. EUROPEAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. EUROPEAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

14. EUROPEAN MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

15. ASIA-PACIFIC MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. REST OF THE WORLD MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. REST OF THE WORLD MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. REST OF THE WORLD MYOGLOBIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MYOGLOBIN MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MYOGLOBIN MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL MYOGLOBIN MARKET, 2022-2028 (%)

4. GLOBAL MYOGLOBIN MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL HUMAN MYOGLOBIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL ANIMAL MYOGLOBIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL MYOGLOBIN MARKET SHARE BY END-USER, 2021 VS 2028 (%)

8. GLOBAL HOSPITALS & CLINICS FOR MYOGLOBIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL RESEARCH INSTITUE FOR MYOGLOBIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL LABORATORIES FOR MYOGLOBIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL MYOGLOBIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

14. UK MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD MYOGLOBIN MARKET SIZE, 2021-2028 ($ MILLION)