Nanomaterials Market

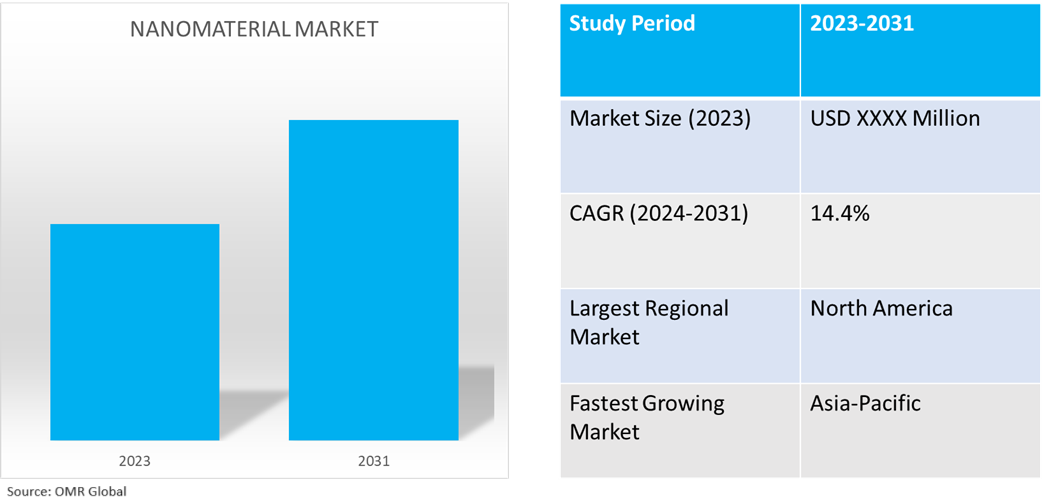

Nanomaterials Market Size, Share & Trends Analysis Report by Material Type (Carbon-Based, Metal Based, Dendrimers-Based, and Composite Segments), by End-User (Transportation, Electrical & Electronics, Healthcare, Construction & Coatings, Packaging, Consumer Goods, and Energy), Forecast Period (2024-2031)

Nanomaterials market is anticipated to grow at a CAGR of 14.4% during the forecast period (2024-2031). Nanomaterials are materials with a single unit size ranging from 1 to 100 nanometers, which may develop naturally, form as byproducts of combustion reactions, or be engineered to perform a specific function. The application of nanomaterials spans various industries including healthcare (nanomedicine), energy (thermoelectric), automotive (EV battery), and others. The market is expected to showcase significant growth in the future owing to the increasing use of nanotechnology, extensive application of nanomaterials in the healthcare and electronics industry, government initiatives to support nanomaterial R&D, and increasing consumption and development of lightweight products.

Market Dynamics

Growing Demand for EV Battery to Stimulate Nanomaterial Demand

The growth in the nanomaterials market is driven by rising demand for EV batteries, especially Li-ion batteries which comprise nanomaterials such as carbon black. From a battery application standpoint, the incentive for using a nanomaterial electrode as a Lithium-ion storage material is to gain considerable improvements in energy, power, cycle life, or some combination. Further, there are various nanomaterials in development to enhance battery capabilities and fulfill demand. For instance, as per the International Energy Agency (IEA), automotive lithium-ion (Li-ion) battery demand increased by about 65.0% to 550 GWh in 2022, from about 330 GWh in 2021, primarily as a result of growth in electric passenger car sales, with new registrations increasing by 55.0% in 2022 relative to 2021.

Increasing Application in the Healthcare Industry

Healthcare nanotechnology is one of the main applications of nanoscale materials and devices in the fields of medicine and healthcare. Materials in the nanoscale have unique and often enhanced capabilities that can be used for a variety of applications, including medication delivery, diagnostics, imaging, and tissue engineering. Nanotechnology enables the development of precise and focused medical interventions, with the promise of increased treatment efficacy, fewer side effects, and better patient outcomes. For instance, in medicine, the use of nanometric or nanostructured materials has resulted in nanomedicine, which takes advantage of the materials' specific features to better illness diagnosis and treatment. For instance, in January 2022, Pfizer announced an agreement with Acuitas Therapeutics for a lipid nanoparticle delivery system for mRNA vaccines and therapeutics. Under the development and option agreement, Pfizer will have the option to license, on a non-exclusive basis, Acuitas’ LNP technology for up to 10 targets for vaccine or therapeutic development.

Segmental Outlook

- Based on material type, the market is segmented into carbon-based, metal-based, dendrimers-based, and composite segments.

- Based on end-user industry, the market is segmented into transportation, electrical & electronics, healthcare, construction and coatings, packaging, consumer goods, and energy.

Carbon-Based Nanomaterial to Emerge as a Bigger Segment

Carbon nanomaterials are a diverse family of carbon allotropes that include 0-dimensional fullerenes and quantum dots, 1-dimensional carbon nanotubes (CNTs), 2-dimensional graphene, and 3-dimensional nanodiamonds and nanohorns. Carbon nanoparticles are used in a wide range of applications due to their unique physical and chemical properties including biomedicine, semiconductors, batteries, sensors, and others. However, carbon nanotubes are highly used in biological applications due to their diverse features. It has the most appealing possibilities for transporting anticancer medicines, DNA, and proteins for chemotherapy making it the most demanded nanomaterial in the healthcare industry.

Healthcare is the Prominent End-User Industry

Nanomaterials are critical in a variety of medical applications, including imaging, targeted medication administration, nanorobotic surgery, nano diagnostics, cell repair, and nano biosensors. The demand for nanomaterials is projected to continue high due to their application as T2 contrast agents in MRI scans, which capitalize on their superparamagnetic properties at room temperature. Furthermore, nanoparticles serve as gene carriers in gene therapy and play an important function in the body's detoxifying processes. Wherein, a rise in the nanomedicine industry is also expected to stimulate demand for nanomaterials.

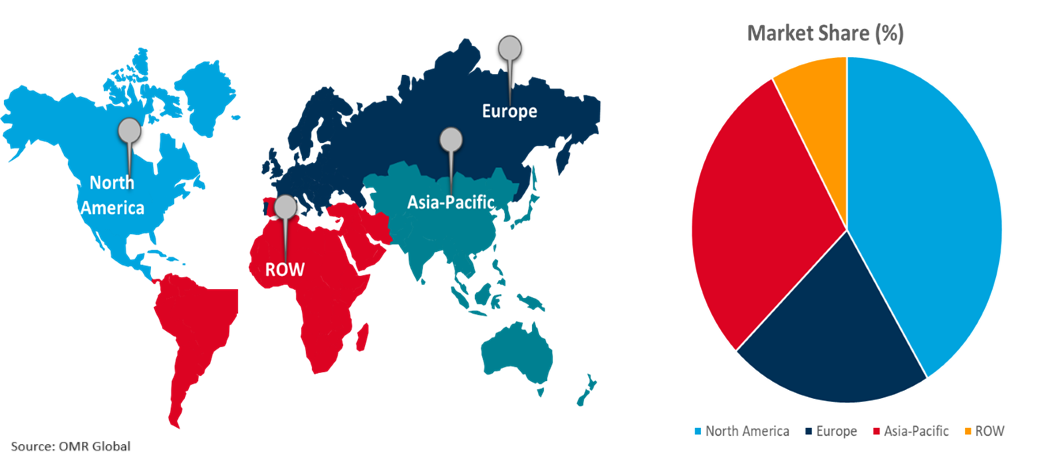

Regional Outlook

The global nanomaterials market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Dominate Global Nanomaterials Market

Asia-Pacific holds the highest and fastest-growing share of the global nanomaterials market. The key factors contributing to the growth are increasing investment in nanomaterial R&D, government support, growth of the healthcare sector in the region, demand for nanotechnology, high consumption of EVs, rising demand for specialty chemicals, and industrial growth in countries such as China and India. For instance, in 2023, according to the Chinese Ministry of Science and Technology, China's annual R&D investment exceeded $458.4 billion, an increase of 8.1% over the previous year. Whereas 950,000 new technology contracts were signed in China; and authorized invention patents reached 921,000, an increase of 15.3% from the previous year. Further, China made significant original contributions in quantum technology, integrated circuits, artificial intelligence, biomedicine, and new energy, including the official launch of the world's first fourth-generation nuclear power plant and the commercial operation of the C919 large aircraft.

Global Nanomaterials Market Growth by Region 2024-2031

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global nanomaterials market include BASF SE, Merck KGaA, Evonik Industries AG, LANXESS Corp., and Arkema Group, among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in July 2021, NBRAIN Neuroelectronics, a startup at the crossroads of Medtech, DeepTech, and digital health dedicated to inventing the world's first graphene-based intelligent neuroelectronic system, announced a collaboration with Merck KGaA, a prominent research and technology firm. The agreement aims to co-develop the next generation of graphene bioelectronic vagus nerve therapeutics targeting severe chronic disorders in Merck's KGaA, Darmstadt, Germany therapeutic areas via INNERVIA Bioelectronics, a subsidiary of INBRAIN Neuroelectronics.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global nanomaterials market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Arkema Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BASF SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Evonik Industries AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. LANXESS Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Merck KGaA

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Nanomaterials Market by Material Type

4.1.1. Carbon-Based

4.1.2. Metal Based

4.1.3. Dendrimers-based

4.1.4. Composite Segments

4.2. Global Nanomaterials Market by End-User

4.2.1. Transportation

4.2.2. Electrical & Electronics

4.2.3. Healthcare

4.2.4. Construction and Coatings

4.2.5. Packaging

4.2.6. Consumer Goods

4.2.7. Energy

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Altair Nanotechnologies Inc.

6.2. Bayer AG

6.3. Cytodiagnostics, Inc.

6.4. Daikin Industries Ltd

6.5. DuPont de Nemours, Inc.

6.6. EMFUTUR Technologies

6.7. Frontier Carbon Corp.

6.8. LG Chem Ltd.

6.9. Nanoco Technologies Ltd.

6.10. Nanocomposix, Inc.

6.11. NANOCYL S.A.

6.12. Nanoshel LLC

6.13. SkySpring Nanomaterials Inc.

6.14. Strem Chemicals, Inc.

6.15. Umicore N.V.

6.16. US Research Nanomaterials, Inc.

6.17. Quantum Materials Corp.

1. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CARBON-BASED NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL METAL-BASED NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DENDRIMERS-BASED NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL COMPOSITE NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

7. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR TRANSPORTATION BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR ELECTRICAL & ELECTRONICS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR HEALTHCARE BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR CONSTRUCTION AND COATINGS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR PACKAGING BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR CONSUMER GOODS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS FOR ENERGY BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

18. EUROPEAN NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. REST OF THE WORLD NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD NANOMATERIALS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL NANOMATERIALS MARKET SHARE BY MATERIAL TYPE, 2023 VS 2031 (%)

2. GLOBAL CARBON-BASED NANOMATERIALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL METAL-BASED NANOMATERIALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DENDRIMERS-BASED NANOMATERIALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL COMPOSITE NANOMATERIALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL NANOMATERIALS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

7. GLOBAL NANOMATERIALS MARKET SHARE FOR TRANSPORTATION BY REGION, 2023 VS 2031 (%)

8. GLOBAL NANOMATERIALS MARKET SHARE FOR ELECTRICAL & ELECTRONICS BY REGION, 2023 VS 2031 (%)

9. GLOBAL NANOMATERIALS MARKET SHARE FOR HEALTHCARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL NANOMATERIALS MARKET SHARE FOR CONSTRUCTION AND COATINGS BY REGION, 2023 VS 2031 (%)

11. GLOBAL NANOMATERIALS MARKET SHARE FOR PACKAGING BY REGION, 2023 VS 2031 (%)

12. GLOBAL NANOMATERIALS MARKET SHARE FOR CONSUMER GOODS BY REGION, 2023 VS 2031 (%)

13. GLOBAL NANOMATERIALS MARKET SHARE FOR ENERGY BY REGION, 2023 VS 2031 (%)

14. GLOBAL NANOMATERIALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

17. UK NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)

29. THE MIDDLE EAST AND AFRICA NANOMATERIALS MARKET SIZE, 2023-2031 ($ MILLION)