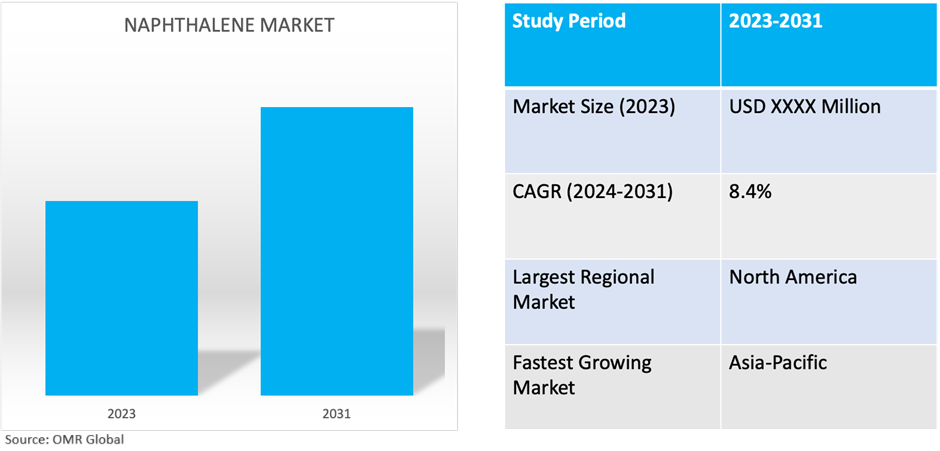

Naphthalene Market

Naphthalene Market Size, Share & Trends Analysis Report by Source (Coal Tar and Petroleum), and by Application (Phthalic Anhydride, Naphthalene Sulfonates, Low-Volatility Solvents, Moth Repellent, Pesticides and Others), Forecast Period (2024-2031).

Naphthalene market is anticipated to grow at a CAGR of 8.4% during the forecast period (2024-2031). Naphthalene is a white crystalline compound with a strong, distinctive odor. It is derived from coal tar or petroleum and is commonly used as a moth repellent and deodorizer. Major factors supporting the market growth are its versatile applications across various industries and market players expanding their capacity to support market demand.

Market Dynamics

Diverse Application of Naphthalene Across Various Industries

The demand for naphthalene is driven by its diverse applications across various industries. Industries such as chemicals, construction, agriculture, and consumer goods rely on naphthalene derivatives for a wide range of products. Factors such as population growth, urbanization, and industrialization contribute to the increasing demand for naphthalene-based products. Additionally, changing consumer preferences and lifestyle trends influence the demand for end-user products containing naphthalene, such as moth repellents and low-volatility solvents. As these industries continue to grow and evolve, the demand for naphthalene is expected to remain robust, driving market expansion.

Raw Material Dynamics is Shaping the Naphthalene Market Landscape

The availability and cost of raw materials, particularly coal tar, and petroleum, play a critical role in shaping the naphthalene market. Fluctuations in raw material prices, driven by factors such as supply-demand dynamics, geopolitical tensions, and regulatory changes, impact production costs and pricing strategies adopted by industry players. Access to reliable and cost-effective sources of raw materials is essential for maintaining competitiveness and profitability in the naphthalene market. Additionally, developments in alternative raw material sources and advancements in extraction technologies may influence raw material availability and market dynamics in the long term.

Market Segmentation

- Based on source, the market is segmented into coal tar and petroleum.

- Based on application, the market is segmented into phthalic anhydride, naphthalene sulfonates, low-volatility solvents, moth repellents, pesticides, and others.

Coal Tar is Projected to Emerge as the Largest Segment

The coal tar segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its abundant availability as a raw material. Coal tar, a byproduct of the coal carbonization process, serves as a primary source for naphthalene production due to its high naphthalene content. With extensive coal reserves globally and the continued use of coal in various industrial processes, there is a consistent and reliable supply of coal tar for naphthalene production.

Phthalic Anhydride Segment to Hold a Considerable Market Share

The phthalic anhydride segment commands a considerable market share in the global naphthalene market due to its versatile applications across industries such as plastics, coatings, dyes, and pharmaceuticals. With increasing demand for plastics and construction materials, as well as the expanding textile industry, the need for phthalic anhydride derived from naphthalene remains robust. Technological advancements have further improved the efficiency and cost-effectiveness of production processes, driving the segment's market share growth.

Regional Outlook

The global naphthalene market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific is Growing Fastest in Naphthalene Market Growth

Asia-Pacific emerges as the fastest-growing market due to the region's burgeoning population and rapid industrialization driving significant demand for naphthalene across various sectors, including chemicals, construction, and agriculture, and also benefits from expanding infrastructural development, particularly in emerging economies such as China and India, which fuels the need for naphthalene-based products in construction materials and coatings. Additionally, the increasing adoption of naphthalene derivatives in the agriculture sector, particularly as pesticides and insecticides, contribute to market growth in the region.

Global Naphthalene Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant due to a well-established industrial sector, including chemical manufacturing that drives significant demand for naphthalene as a raw material in various processes and also benefits from advanced research and development capabilities, leading to continuous innovation in naphthalene-based products and applications. For instance, in February 2021, Bain Capital, a prominent private equity firm, executed strategic transactions involving its investment in Himadri Specialty Chemical. Bain Capital liquidated 8.36% of its stake in Himadri Specialty Chemical, reducing its ownership interest to 12.7%. Additionally, Bain Capital divested a 6.2% share in a bulk transaction, indicating adjustments in its investment portfolio.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global naphthalene market include Koppers Inc., Rain Industries Ltd., Himadri Speciality Chemical Ltd., EVRAZ plc, Exxon Mobil Corporation, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in December 2021 marked an important development as Exxon Mobil Corporation announced its acquisition of Materia Inc., a California-based company. This strategic move builds upon the companies' prior collaboration and aims to leverage Materia Inc.'s expertise in producing novel hydrocarbon-based materials. Through this acquisition, Exxon Mobil Corporation seeks to enhance its product offerings and strengthen its position in the market for innovative materials.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global naphthalene market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ExxonMobil Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Koppers Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rain Industries Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Naphthalene Market by Source

4.1.1. Coal Tar

4.1.2. Petroleum

4.2. Global Naphthalene Market by Application

4.2.1. Phthalic Anhydride

4.2.2. Naphthalene Sulfonates

4.2.3. Low-Volatility Solvents

4.2.4. Moth Repellent

4.2.5. Pesticides

4.2.6. Others (Concrete Admixtures, Dye Intermediates, Synthetic Resins, Tanning Agents, Lubricants, Disinfectants, Antiseptics, Emulsifying Agents, Wood Preservation Products and Specialty Chemicals)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. BASF SE

6.2. CARBOTECH

6.3. DEZA a. s.

6.4. Dong-Suh Chemical Ind. Co., Ltd

6.5. Epsilon Carbon Private Limited

6.6. EVRAZ plc

6.7. Gautam Zen International

6.8. Himadri Speciality Chemical Ltd.

6.9. Huanghua Xinnuo Lixing

6.10. JFE Chemical Corporation

6.11. Koppers Inc.

6.12. Merck KGaA

6.13. OCI Holdings Company Ltd.

6.14. PCC Rokita SA

6.15. Química del Nalón

6.16. Shandong Weijiao Group Co. Ltd.

6.17. TULSTAR PRODUCTS INC.

1. GLOBAL NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

2. GLOBAL COAL TAR NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PETROLEUM NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL NAPHTHALENE FOR PHTHALIC ANHYDRIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL NAPHTHALENE FOR NAPHTHALENE SULFONATES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NAPHTHALENE FOR LOW-VOLATILITY SOLVENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL NAPHTHALENE FOR MOTH REPELLENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL NAPHTHALENE FOR PESTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL NAPHTHALENE FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

17. EUROPEAN NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD NAPHTHALENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL NAPHTHALENE MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

2. GLOBAL COAL TAR NAPHTHALENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PETROLEUM NAPHTHALENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NAPHTHALENE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL NAPHTHALENE FOR PHTHALIC ANHYDRIDE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL NAPHTHALENE FOR NAPHTHALENE SULFONATES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL NAPHTHALENE FOR LOW-VOLATILITY SOLVENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL NAPHTHALENE FOR MOTH REPELLENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL NAPHTHALENE FOR PESTICIDES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL NAPHTHALENE FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL NAPHTHALENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

14. UK NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA NAPHTHALENE MARKET SIZE, 2023-2031 ($ MILLION)