Natural Food Colors And Flavors Market

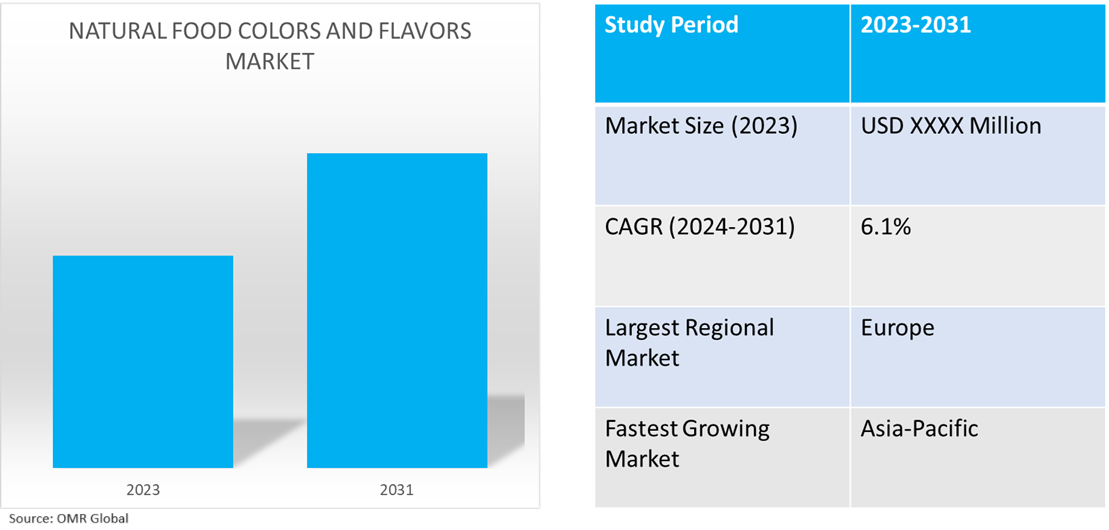

Natural Food Colors And Flavors Market Size, Share & Trends Analysis Report by Color Type (Caramel, Carmine, Carotenoids, Anthocyanin, Curcumin, Annatto, and Others), by Flavor Type (Natural Extracts, and Essential Oils), by Source (Animal, and Plant), and by Application (Processed Foods, and Beverages) Forecast Period (2024-2031)

Natural food colors and flavors market is anticipated to grow at a CAGR of 6.1% during the forecast period (2024-2031). Natural food color and flavor products are made from naturally sourced additives or ingredients. These ingredients are extracted from fruits, vegetables, spices, and other natural sources, providing an alternative to synthetic additives. The market growth is driven by rising consumer consciousness for sustainable products, shifting preference towards clean labels, a growing trend for natural or organic diets, and an expansion in product demand from emerging regions.

Market Dynamics

Increasing Consumer Consciousness

The overall consumer consciousness towards food ingredients and their impact is consistently increasing. Nowadays, consumers are seeking products with minimal synthetic additives and other ingredients that are innocuous to the environment and health. The trend is likely to gain more traction with support from government regulations and changes in dietary consumption, all of which are expected to strengthen demand for natural colors and flavors. According to a recent survey conducted by the International Food Information Council, 34.0% of Americans consider environmental sustainability to be a significant factor in their food and beverage purchasing decisions. This percentage is slightly lower than other factors examined. Additionally, 35.0% of respondents stated that the climate-friendliness of a product influences their buying choices. Millennials show the highest level of concern, with 46.0% expressing this sentiment compared to 39.0% of Gen Z, 38.0% of Gen X, and 22.0% of Boomers. When it comes to specific food categories, those who prioritize climate friendliness are most likely to consider the impact on their choices when it comes to meat and poultry (62.0%), fresh fruit and vegetables (55.0%), and dairy products (50.0%).

Supportive Regulation & Clean Labels

Developed regions, such as North America and Europe, are continuously striving to improve the standards of food safety and consumer information within their respective regions. These endeavors are primarily motivated by regulations, policies, and other relevant initiatives that aim to encourage well-informed consumer food labeling. The concept of clean labeling, which emphasizes the minimal use of ingredients in a product, including the absence of additives, preservatives, artificial colors, and flavors, is a notable example of such efforts. While food manufacturers are increasingly utilizing clean labels to promote natural products, this concept has yet to be officially acknowledged by regulatory authorities. Nevertheless, it is anticipated to stimulate demand among health-conscious consumers in the future. For instance, in December 2023, the Commission was pleased with the preliminary agreement achieved between the European Parliament and the Council regarding the Ecodesign for Sustainable Products Regulation. This agreement will contribute to establishing sustainable products as the standard in the EU, promoting longevity, energy and resource efficiency, ease of repair and recycling, reduced harmful substances, and increased recycled materials. Furthermore, it will enhance fair competition for sustainable products within the EU market and boost the international competitiveness of businesses that provide sustainable products.

Segmental Outlook

- Based on color type, the market is segmented into caramel, carmine, carotenoids, anthocyanin, curcumin, annatto, and others (betanin, spirulina, paprika).

- Based on flavor type, the market is segmented into natural extracts and essential oils.

- Based on the source, the market is segmented into animals and plants.

- Based on application, the market is segmented into processed foods and beverages.

Plants are the Major Source of Natural Food Colors and Flavors

Plants remain the primary source of natural food colors and flavors owing to their rich diversity of pigments and aromatic compounds. The segmental growth is driven by sustainable farming practices, which promote biodiversity and nutrient-rich soil, wide availability of natural sources, a growing trend for organic farming, and visual and taste-based features. For instance, in March 2024, Roquette expanded the boundaries of the plant protein market with the introduction of four versatile pea proteins aimed at enhancing flavor, consistency, and innovation in plant-based foods and high-protein nutritional items. Through the continued growth of its renowned NUTRALYS plant protein range, the prominent ingredient firm is presenting a variety of fresh and enhanced possibilities for food producers.

Processed Foods are the Preferred Natural food colors and flavors Application

Processed foods are the largest application for natural food colors and flavors, driven by consumer demand for healthier options and clean-label products, increasing consumption of processed and ultra-processed foods, regulatory requirements to reduce synthetic additives in processed foods, advancements in extraction methods, and the formulation of stable natural ingredients that enhance the appeal and nutritional value of processed foods.

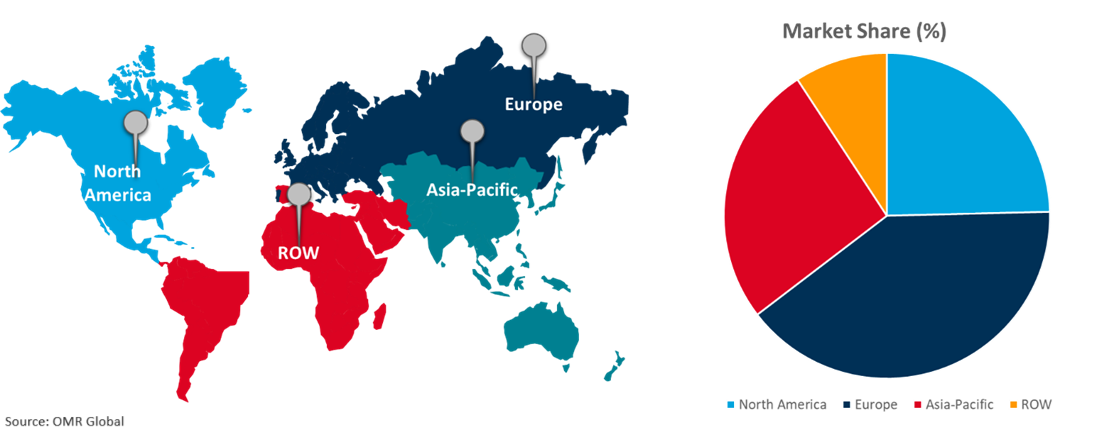

Regional Outlook

The global natural food colors and flavors industry is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe Dominates the Global Natural Food Colors and Flavors Market

Europe holds a major market share in the global market attributed to the ongoing efforts by regional governments to promote safe and natural food ingredients. A higher level of consumer consciousness in the region, increasing demand for naturally sourced products and ingredients, and the presence of major natural food color and flavor manufacturers such as Symrise AG and Otterra Group, among others are other contributors to the regional market share. For instance, in May 2024, the European Food Safety Authority (EFSA) and its partners in EU Member States introduced the 2024 Safe2Eat initiative. Previously recognized as #EUChooseSafeFood, the campaign comes back with a fresh identity and a renewed dedication to raising awareness about food safety among European residents. The initiative broadens its scope by enlisting the support of 17 countries to empower consumers to make well-informed decisions regarding their food selections. The nations taking part in the 2024 campaign are Romania, Czechia, Hungary, Greece, Estonia, Croatia, Italy, Latvia, Cyprus, Slovenia, Spain, Luxembourg, Slovakia, Austria, Poland, Portugal, and North Macedonia.

Global Natural Food Colors and Flavors Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Global Natural Food Colors and Flavors Market

- The Asia-Pacific region is projected to experience an upside demand for natural foods and colors owing to regulatory updates to policies promoting safe and naturally sourced food products.

- The region is also experiencing rapid growth in the processed food market, where manufacturers may use natural colors or flavors to align with the local preference for naturally sourced ingredients.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global natural food colors and flavors market include DuPont de Nemours, Inc. Ottera Group., and Symrise AG among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in July 2022, Oterra finalized the acquisition of Akay Group, a natural ingredients manufacturer located in India. The deal was officially sealed this month and is currently pending regulatory approval. This recent purchase marks Oterra’s fourth acquisition within 14 months, following the successful acquisition of Diana Foods and Secna Natural Ingredients. The acquisition is expected to enhance Oterra’s natural color offerings and expand its product portfolio, supported by advanced manufacturing facilities and robust R&D capabilities.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global natural food colors and flavors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Market Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. DuPont de Nemours, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ottera Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Symerise AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Natural Food Colors & Flavors Market by Color Type

4.1.1. Carmine

4.1.2. Caramel

4.1.3. Carotenoids

4.1.4. Anthocyanin

4.1.5. Curcumin

4.1.6. Annatto

4.1.7. Others (Betanin, Spirulina, Paprika)

4.2. Global Natural Food Colors & Flavors Market by Flavor Type

4.2.1. Natural Extracts

4.2.2. Essential Oils

4.3. Global Natural Food Colors & Flavors Market by Source

4.3.1. Animal

4.3.2. Plant

4.4. Global Natural Food Colors & Flavors Market by Application

4.4.1. Processed Foods

4.4.2. Beverages

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Arômes & Saveurs

6.2. Amar Bio Organics India Pvt. Ltd.

6.3. Archer-Daniels-Midland Co. (ADM)

6.4. Aromatagroup Srl Con Socio Unico

6.5. Besmoke Ltd.

6.6. Firmenich SA

6.7. Foodie Flavors Ltd.

6.8. Givaudan

6.9. Gulf Flavors & Fragrances

6.10. International Flavors & Fragrances, Inc.

6.11. Kerry Group PLC

6.12. MANE Group

6.13. Sensient Technologies Corp.

6.14. Synergy Flavors

6.15. Taiyo International, Inc.

6.16. Takasago International Corp.

6.17. Hasegawa Co., Ltd.

1. Global Natural Food Colors & Flavors Market Research and Analysis by Color Type, 2023-2031 ($ Million)

2. Global Natural Carmine Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Natural Caramel Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Natural Carotenoids Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global Natural Anthocyanin Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global Natural Curcumin Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Natural Annatto Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Others Natural Colors Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global Natural Food Colors & Flavors Market Research and Analysis By Flavor Type, 2023-2031 ($ Million)

10. Global Natural Extracts Flavors Market Research and Analysis by Region, 2023-2031 ($ Million)

11. Global Essential Oils Market Research and Analysis by Region, 2023-2031 ($ Million)

12. Global Natural Food Colors & Flavors Market Research and Analysis by Source, 2023-2031 ($ Million)

13. Global Animal-Based Natural Food Colors & Flavors Market Research and Analysis by Region, 2023-2031 ($ Million)

14. Global Plant-Based Natural Food Colors & Flavors Market Research and Analysis by Region, 2023-2031 ($ Million)

15. Global Natural Food Colors & Flavors Market Research and Analysis by Application, 2023-2031 ($ Million)

16. Global Natural Food Colors & Flavors in Processed Foods Market Research and Analysis by Region, 2023-2031 ($ Million)

17. Global Natural Food Colors & Flavors Market Research and Analysis by Region, 2023-2031 ($ Million)

18. North American Natural Food Colors & Flavors Market Research and Analysis by Country, 2023-2031 ($ Million)

19. North American Natural Food Colors & Flavors Market Research and Analysis by Color Type, 2023-2031 ($ Million)

20. North American Natural Food Colors & Flavors Market Research and Analysis by Flavor Type, 2023-2031 ($ Million)

21. North American Natural Food Colors & Flavors Market Research and Analysis Application, 2023-2031 ($ Million)

22. North American Natural Food Colors & Flavors Market Research and Analysis by Source, 2023-2031 ($ Million)

23. European Natural Food Colors & Flavors Market Research and Analysis by Country, 2023-2031 ($ Million)

24. European Natural Food Colors & Flavors Market Research and Analysis by Color Type, 2023-2031 ($ Million)

25. European Natural Food Colors & Flavors Market Research and Analysis by Flavor Type, 2023-2031 ($ Million)

26. European Natural Food Colors & Flavors Market Research and Analysis by Source, 2023-2031 ($ Million)

27. European Natural Food Colors & Flavors Market Research and Analysis by Application, 2023-2031 ($ Million)

28. Asia-Pacific Natural Food Colors & Flavors Market Research and Analysis by Country, 2023-2031 ($ Million)

29. Asia-Pacific Natural Food Colors & Flavors Market Research and Analysis by Color Type, 2023-2031 ($ Million)

30. Asia-Pacific Natural Food Colors & Flavors Market Research and Analysis by Flavor Type, 2023-2031 ($ Million)

31. Asia-Pacific Natural Food Colors & Flavors Market Research and Analysis by Source, 2023-2031 ($ Million)

32. Asia-Pacific Natural Food Colors & Flavors Market Research and Analysis by Application, 2023-2031 ($ Million)

33. Rest of The World Natural Food Colors & Flavors Market Research and Analysis by Region, 2023-2031 ($ Million)

34. Rest of The World Natural Food Colors & Flavors Market Research and Analysis by Color Type, 2023-2031 ($ Million)

35. Rest of The World Natural Food Colors & Flavors Market Research and Analysis by Flavor Type, 2023-2031 ($ Million)

36. Rest of The World Natural Food Colors & Flavors Market Research and Analysis by Source, 2023-2031 ($ Million)

37. Rest of The World Natural Food Colors & Flavors Market Research and Analysis by Application 2023-2031 ($ Million)

1. Global Natural Food Colors & Flavors Market Share by Color Type, 2023 Vs 2031 (%)

2. Global Natural Carmine Colors Market Share by Region, 2023 Vs 2031 (%)

3. Global Natural Caramel Colors Market Share by Region, 2023 Vs 2031 (%)

4. Global Natural Carotenoids Colors Market Share by Region, 2023 Vs 2031 (%)

5. Global Natural Anthocyanine Colors Market Share by Region, 2023 Vs 2031 (%)

6. Global Natural Curcumin Colors Market Share by Region, 2023 Vs 2031 (%)

7. Global Natural Annatto Colors Market Share by Region, 2023 Vs 2031 (%)

8. Global Other Natural Colors Market Share by Region, 2023 Vs 2031 (%)

9. Global Natural Food Colors & Flavors Market Share by Flavor Type, 2023 Vs 2031 (%)

10. Global Natural Extracts Flavors Market Share by Region, 2023 Vs 2031 (%)

11. Global Essential Oils Flavors Market Share by Region, 2023 Vs 2031 (%)

12. Global Natural Food Colors & Flavors Market Share by Source, 2023 Vs 2031 (%)

13. Global Animal-Based Natural Food Colors & Flavors Market Share by Region, 2023 Vs 2031 (%)

14. Global Plant-Based Natural Food Colors & Flavors Market Share by Region, 2023 Vs 2031 (%)

15. Global Natural Food Colors & Flavors Market Share by Application, 2023 Vs 2031 (%)

16. Global Natural Food Colors & Flavors in Processed Foods Market Share by Region, 2023 Vs 2031 (%)

17. Global Natural Food Colors & Flavors in Beverages Market Share by Region, 2023 Vs 2031 (%)

18. Global Natural Food Colors & Flavors Market Share by Region, 2023 Vs 2031 (%)

19. US Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

20. Canada Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

21. UK Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

22. France Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

23. Germany Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

24. Italy Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

25. Spain Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

26. Rest of Europe Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

27. India Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

28. China Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

29. Japan Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

30. South Korea Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

31. Rest of Asia-Pacific Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

32. Latin America Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)

33. Middle East And Africa Natural Food Colors & Flavors Market Size, 2023-2031 ($ Million)