Natural Refrigerant Market

Natural Refrigerant Market Size, Share & Trends Analysis Report by Refrigerant Type (Inorganic Refrigerants, and Hydrocarbon Refrigerant), and by Application (Refrigeration, and Air-Conditioning) Forecast Period (2024-2031)

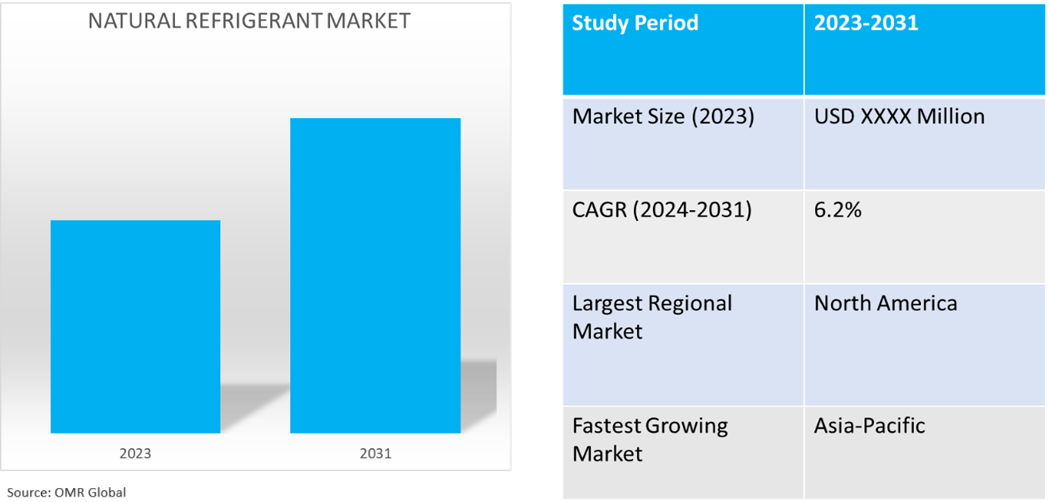

Natural refrigerant market is anticipated to grow at a significant CAGR of 6.2% during the forecast period (2024-2031). The utilization of natural refrigerants is influenced by financial incentives, energy efficiency, emission requirements, and environmental laws. Natural refrigerants are energy-efficient and emit fewer greenhouse gases, which renders them useful for a variety of applications. The introduction of corporate social responsibility programs and rising consumer and business demand for sustainable products further encourage the adoption of these items. Long-term cost savings and the avoidance of future expenses have increased the demand for natural refrigerants. Growing commercial and industrial applications, the expansion of emerging markets, and technological improvements are all driving the growth of the natural refrigerant market. The process of integrating natural refrigerants with other technologies to develop hybrid systems is getting easier and is helping the market expansion. The market for natural refrigerants is largely driven by the commercial and industrial refrigeration sectors.

Market Dynamics

Increasing Consumer Awareness

Consumer awareness of environmental sustainability is driving demand for eco-friendly refrigeration and air conditioning systems, the companies are adopting natural refrigerants to demonstrate corporate responsibility. For instance, in May 2023, Hoshizaki released 68 natural refrigerant refrigerators and freezers, catering to growing interest in eco-friendly products amid the increasing global demand for non-carbon dioxide (CFC) alternatives. The company's products, which use natural refrigerants, aim to reduce greenhouse gas emissions and contribute to the United Nations Sustainable Development Goals.

Increasing Industry Standards and Certifications

Adherence to industry standards and certifications, such as LEED, is essential for businesses to promote the use of natural refrigerants, promoting environmental performance and market growth. For instance, in May 2024, Ideal Heating launched its next-generation ECOMOD heat pumps, the ECOMOD 290HT and ECOMOD CO2. The ECOMOD 290HT is a monobloc air source heat pump with an ultra-low global warming potential (GWP), rendering it appropriate for wider companies. Available in three chassis sizes and five outputs from 15kW through to 50kW, it can be installed alongside other Ideal Heating solutions to create a low-carbon hybrid heating system. It is ideal for Domestic Hot Water applications and district heating systems.

Market Segmentation

- Based on the refrigerant type, the market is segmented into inorganic refrigerants (carbon dioxide, ammonia, water, sulfur dioxide) and hydrocarbon refrigerants (ethane, propane, N-butane, and others (Isobutane).

- Based on the application, the market is segmented into refrigeration (domestic, commercial, transportation, and industrial) air-conditioning (domestic, commercial, transportation, and industrial)

Refrigeration Segment is projected to hold the Largest Market Share

Natural refrigerants offer operational efficiency and sustainability benefits, reducing operational costs and promoting the adoption of sustainable solutions, it additionally offers a curated selection of products for market growth. For instance, in April 2024, ATMOsphere launched NaturalRefrigerants.com, a one-stop shop for natural refrigerant news and products. It involves cooling and heating technologies using CO2, hydrocarbons, ammonia, water, and air. It consolidates previous platforms and offers a comprehensive view of natural refrigerant offerings in residential, commercial, and industrial sectors.

Regional Outlook

The global natural refrigerant market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Demand For Effective Refrigeration Solutions In Asia-Pacific

The regional growth is attributed to the growing commercial refrigeration sector, especially in emerging markets such as India. The increasing requirement for advanced technologies compressors to meet the rising demand for efficient solutions is driving the regional market growth. For instance, in March 2023, Tecumseh launched its TC Series compressor platform for the Indian market, featuring models with R-290 refrigerant. These energy-efficient compressors, ranging from 3cc to 8cc, are designed for L/MBP applications and are ideal for small to medium-sized commercial refrigeration systems. The compressor's advanced motor technology ensures high efficiency, lower operating costs, and improved performance.

In February 2021, the Indian Institute of Science (IISc) partnered with Danfoss Industries to promote the use of natural refrigerants. The agreement aims to develop a research and training center focusing on natural or CO2-based refrigerants, as traditional refrigerants contribute to global warming and ozone depletion. Training is provided to various levels, including teachers, students, field and maintenance engineers, technicians, and practicing engineers.

In March 2021, Godrej Group introduced a new ‘super-efficient’ anti-viral R290 room air conditioner, featuring twin rotary compressors and 100.0% copper condensing and connecting pipes. These units offer long-term reliability, durability, and a sleep mode for comfort.

Global Natural Refrigerant Market Growth by Region 2024-2031

North America Holds Major Market Share

The market demand for energy-efficient refrigeration systems is driving the growth of the regional natural refrigerants market. According to United4efficiency.Org, in July 2023, improving the energy efficiency of commercial refrigeration equipment could result in annual savings of over 66 TWh of electricity by 2040, potentially avoiding the construction of 30 large power plants. This would also reduce CO2 emissions by more than 64 million tons and save businesses approximately $9.5 billion on their electricity bills. These measures highlight the significant financial and environmental benefits of adopting more efficient refrigeration technologies.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the natural refrigerant market include A-Gas International Ltd., Danfoss A/S, Honeywell International Inc., Emerson Electric Co., and Samsung Electronics Co., Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In July 2024, SWEP launched the SWEP 190 range, designed for low-GWP and natural refrigerants. The 190 range offers single-circuit and dual-circuit versions, operating from 60kW to 150kW. It is ideal for use with R32, R454B, and R290, and features integrated distribution for responsive distribution stability.

- In June 2023, Johnson Controls acquired M&M Carnot to enhance its sustainable Industrial Refrigeration portfolio, offering natural refrigeration solutions with ultra-low global warming potential, helping customers meet sustainability goals and environmental regulations.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global natural refrigerant market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. A-Gas International Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Danfoss A/S

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Honeywell International Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Natural Refrigerant Market by Refrigerant Type

4.1.1. Inorganic Refrigerants

4.1.1.1. Carbon Dioxide

4.1.1.2. Ammonia

4.1.1.3. Sulfur Dioxide

4.1.2. Hydrocarbon Refrigerant

4.1.2.1. Ethane

4.1.2.2. Propane

4.1.2.3. N-Butane

4.1.2.4. Others (Isobutane, and Propylene)

4.2. Global Natural Refrigerant Market by Application

4.2.1. Refrigeration

4.2.1.1. Domestic

4.2.1.2. Commercial

4.2.1.3. Transportation

4.2.1.4. Industrial

4.2.2. Air-Conditioning

4.2.2.1. Domestic

4.2.2.2. Commercial

4.2.2.3. Transportation

4.2.2.4. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AGC Group

6.2. Airgas, Inc.

6.3. BITZER Kühlmaschinenbau GmbH

6.4. Daikin Industries Ltd.

6.5. Danfoss A/S

6.6. Deepfreeze Refrigerants Inc.

6.7. Emerson Electric Co.

6.8. engas Australasia

6.9. Evonik

6.10. Gas Servei S.A

6.11. Harp International Ltd.

6.12. HyChill

6.13. Linde PLC

6.14. MAYEKAWA MFG. CO., LTD.

6.15. National Refrigerants Inc.

6.16. Samsung Electronics Co., Ltd

6.17. Secop GmbH

6.18. Sinochem Australia Pty Ltd.

6.19. SRF Ltd.

6.20. Tazzetti S.p.A

6.21. Temprite

6.22. True Manufacturing Co., Inc.

6.23. Vaisala Oyj

1. Global Natural Refrigerant Market Research And Analysis By Refrigerant Type, 2023-2031 ($ Million)

2. Global Inorganic Natural Refrigerant Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Hydrocarbon Natural Refrigerant Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Natural Refrigerant Market Research And Analysis By Application, 2023-2031 ($ Million)

5. Global Natural Refrigerant For Refrigeration Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Natural Refrigerant For Air-Conditioning Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Natural Refrigerant Market Research And Analysis By Region, 2023-2031 ($ Million)

8. North American Natural Refrigerant Market Research And Analysis By Country, 2023-2031 ($ Million)

9. North American Natural Refrigerant Market Research And Analysis By Refrigerant Type, 2023-2031 ($ Million)

10. North American Natural Refrigerant Market Research And Analysis By Application, 2023-2031 ($ Million)

11. European Natural Refrigerant Market Research And Analysis By Country, 2023-2031 ($ Million)

12. European Natural Refrigerant Market Research And Analysis By Refrigerant Type, 2023-2031 ($ Million)

13. European Natural Refrigerant Market Research And Analysis By Application, 2023-2031 ($ Million)

14. Asia-Pacific Natural Refrigerant Market Research And Analysis By Country, 2023-2031 ($ Million)

15. Asia-Pacific Natural Refrigerant Market Research And Analysis By Refrigerant Type, 2023-2031 ($ Million)

16. Asia-Pacific Natural Refrigerant Market Research And Analysis By Application, 2023-2031 ($ Million)

17. Rest Of The World Natural Refrigerant Market Research And Analysis By Region, 2023-2031 ($ Million)

18. Rest Of The World Natural Refrigerant Market Research And Analysis By Refrigerant Type, 2023-2031 ($ Million)

19. Rest Of The World Natural Refrigerant Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Natural Refrigerant Market Share By Refrigerant Type, 2023 Vs 2031 (%)

2. Global Inorganic Natural Refrigerant Market Share By Region, 2023 Vs 2031 (%)

3. Global Hydrocarbon Natural Refrigerant Market Share By Region, 2023 Vs 2031 (%)

4. Global Natural Refrigerant Market Share By Application, 2023 Vs 2031 (%)

5. Global Natural Refrigerant For Refrigeration Market Share By Region, 2023 Vs 2031 (%)

6. Global Natural Refrigerant For Air-Conditioning Market Share By Region, 2023 Vs 2031 (%)

7. Global Natural Refrigerant Market Share By Region, 2023 Vs 2031 (%)

8. US Natural Refrigerant Market Size, 2023-2031 ($ Million)

9. Canada Natural Refrigerant Market Size, 2023-2031 ($ Million)

10. UK Natural Refrigerant Market Size, 2023-2031 ($ Million)

11. France Natural Refrigerant Market Size, 2023-2031 ($ Million)

12. Germany Natural Refrigerant Market Size, 2023-2031 ($ Million)

13. Italy Natural Refrigerant Market Size, 2023-2031 ($ Million)

14. Spain Natural Refrigerant Market Size, 2023-2031 ($ Million)

15. Rest Of Europe Natural Refrigerant Market Size, 2023-2031 ($ Million)

16. India Natural Refrigerant Market Size, 2023-2031 ($ Million)

17. China Natural Refrigerant Market Size, 2023-2031 ($ Million)

18. Japan Natural Refrigerant Market Size, 2023-2031 ($ Million)

19. South Korea Natural Refrigerant Market Size, 2023-2031 ($ Million)

20. Rest Of Asia-Pacific Natural Refrigerant Market Size, 2023-2031 ($ Million)

21. Latin America Natural Refrigerant Market Size, 2023-2031 ($ Million)

22. Middle East And Africa Natural Refrigerant Market Size, 2023-2031 ($ Million)