Naval Vessels Market

Global Naval Vessels Market Size, Share & Trends Analysis Report by By Vessel Type (Destroyers, Frigates, Submarines, Corvettes, Aircraft Carriers, Other Vessel Types) Forecast Period 2022-2028 Update Available - Forecast 2025-2031

The global market for naval vessels is projected to have a considerable CAGR of around 12.8% during the forecast period. Naval vessels are armed to the teeth, with a wide range of anti-surface, anti-submarine, and anti-aircraft firearms. Although frigates and corvettes are frequently referred to be support ships, they are capable of combating any military battle at sea. With a growing number of countries adopting strategies and tactics for strengthening their combat capabilities, naval vessels have witnessed massive growth during the forecast period. The importance of procuring innovative and state-of-the-art ships that comply with modern-day battlefield methods has grown among the world's maritime nations. Countries are preserving their naval supremacy by investing in the unmatched strike capabilities of naval submarines. In addition, the market may benefit from the integration of disruptive technologies, such as the Internet of Things, with maintenance, repair, and overhaul (MRO) solutions to improve operations. The availability of aftermarket components on a variety of e-commerce platforms may further contribute to the market's growth. Other factors such as increased military budgets, ongoing threats between nations, and the need to acquire natural resources from the sea will provide lucrative growth opportunities for naval vessels.

Segmental Outlook

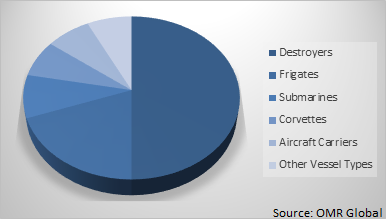

The global naval vessels market is segmented based on vessel type. Based on the vessel type, the market is further classified into destroyers, frigates, submarines, corvettes, aircraft carriers, other vessel types.

Global Naval Vessels Market Share by Vessel Types, 2021 (%)

The Aircraft Carriers is Considered the Dominating Segment in the Global Naval Vessels Market.

Among vessel types, the aircraft carriers are estimated as dominating segment during the forecast period. An aircraft carrier is a warship that acts as a seagoing airbase, consisting of a full-length flight deck and facilities to carry, arm, deploy, and recover aircraft. Aircraft carriers are the largest warships in the naval fleet as they require a large amount of deck room. The Gerald R Ford class and the Type 001A-class are two modern aircraft carriers developed by the US and China, respectively. The first Gerald R Ford-class vessel was commissioned in July 2017 and is scheduled to be deployed by 2022. Further, the Indian Navy is also planning to develop and acquire its third aircraft carrier (IAC-2) to supplement the INS Vikramaditya and the INS Vikrant.

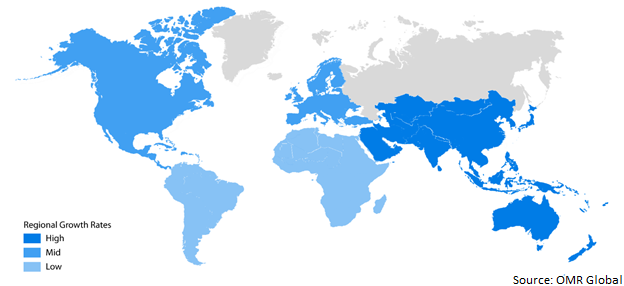

Regional Outlook

Geographically, the global Naval Vessels market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to have a significant CAGR in the Naval Vessels market. The growth is driven by the increased water conflicts, growth in piracy and illegal human and drug trafficking, and the growing emphasis on enhancing the naval capabilities by China.

Global Naval Vessels Market Growth, by Region 2022-2028

North America to Hold a Considerable Share in the Global Naval Vessels Market

Geographically, North America is projected to hold a significant share in the global naval vessels market. Currently, the US has the biggest naval fleet in the world. As of August 2019, the United States Navy was in talks with General Dynamics to strike a USD 20 billion deal for the production of a new Block V variant of Virginia class submarines that will have 28 vertical missile tubes, 14 more than past versions of Virginia submarines. The Navy countries have been working on force structure growth plans, to reach 355 ships by FY 2034 through a combination of service life extensions and new construction. The US Navy’s FY2021 five-year (FY2021-FY2025) shipbuilding plan includes 42 new ships, 13 less than the 55 included in the FY2020 (FY2020-FY2024) five-year plan.

Market Players Outlook

The key players in the naval vessels market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are General Dynamics Corp, ThyssenKrupp AG, BAE Systems PLC, The Naval Group, and Abu Dhabi Ship Building Co. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In December 2021, The Philippine Department of National Defense (DND) has approved Hyundai Heavy Industries (HHI) a contract to build two new corvettes. The contract was worth USD 554.8 million and was granted through the Navy's Corvette Acquisition Program (CAP) (PHP 28 billion). Additionally, the ships will measure 116 meters in length and 14.8 meters in width, with a displacement of 3,200 tonnes. They will be able to achieve a maximum speed of 25 knots with a travel range of 4,500 nautical miles.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global naval vessels market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Naval Vessels Industry

• Recovery Scenario of Global Naval Vessels Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Trade Analysis

2.2.3. Porter’s Analysis

2.2.4. Recommendations

2.2.5. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Naval Vessels Market, By Vessel Type

5.1.1. Destroyers

5.1.2. Frigates

5.1.3. Submarines

5.1.4. Corvettes

5.1.5. Aircraft Carriers

5.1.6. Other Vessel Types

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. Babcock International Group PLC

7.2. China Shipbuilding Industry Co

7.3. DSME

7.4. Fincantieri

7.5. Garden Reach Shipbuilders & Engineers

7.6. General Dynamics

7.7. Hyundai Heavy Industries

7.8. Kawasaki Heavy Industries

7.9. Lockheed Martin Corp

7.10. Mazagon docs Ltd

7.11. Mitsubishi Heavy Industries

7.12. Navantia

7.13. Reliance Naval and Engineering Limited

7.14. Thales group

1. GLOBAL NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2021-2028 ($ MILLION)

2. GLOBAL NAVAL VESSELS IN DESTROYERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL NAVAL VESSELS IN FRIGATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL NAVAL VESSELS IN SUBMARINES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL NAVAL VESSELS IN AIRCRAFT CARRIERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL NAVAL VESSELS IN CORVETTES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL NAVAL VESSELS IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. NORTH AMERICAN NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9. NORTH AMERICAN NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2021-2028 ($ MILLION)

10. EUROPEAN NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. EUROPEAN NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2021-2028 ($ MILLION)

12. ASIA-PACIFIC NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. ASIA-PACIFIC NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2021-2028 ($ MILLION)

14. REST OF THE WORLD NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. REST OF THE WORLD NAVAL VESSELS MARKET RESEARCH AND ANALYSIS BY VESSEL TYPE, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL NAVAL VESSELS MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL NAVAL VESSELS MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL NAVAL VESSELS MARKET, 2021-2028 (%)

4. GLOBAL NAVAL VESSELS MARKET SHARE BY VESSEL TYPE, 2021 VS 2028 (%)

5. GLOBAL NAVAL VESSELS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL NAVAL VESSELS IN DESTROYERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL NAVAL VESSELS IN FRIGATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL NAVAL VESSELS IN SUBMARINES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL NAVAL VESSELS IN CORVETTES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL NAVAL VESSELS IN AIRCRAFT CARRIERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL NAVAL VESSELS IN OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

14. UK NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD NAVAL VESSELS MARKET SIZE, 2021-2028 ($ MILLION