Neonatal and Prenatal Devices Market

Global Neonatal and Prenatal Devices Market Size, Share & Trends Analysis Report by Product Type (Prenatal & Fetal Equipment and Neonatal Equipment), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global neonatal and prenatal devices market is anticipated to grow at a significant CAGR during the forecast period. The neonatal and prenatal devices are used for the purpose of neonatal care that is given to newborn premature or sick babies in a neonatal unit. Neonatal and prenatal devices can be both invasive and non-invasive in operation. Generally, non-invasive devices are preferred in neonatal care considering the severity of the health of newborns.

The major factor contributing to the growth of the market includes the rise in the Neonatal Intensive Care Unit (NICU) in the hospital across the globe. Additionally, the technological advancements in the NICU related devices such as integration of data generated by devices to electronic medical records (EMR) will also drive the global neonatal and prenatal devices market. However, the high cost associated with the device will challenge the market growth. In addition to this, less developed healthcare systems in developing economies will also present challenge to the neonatal and prenatal devices market.

Segmental Outlook

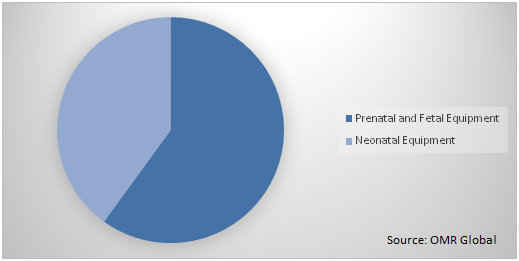

The global neonatal and prenatal devices market is segmented based on the product type. Based on the product type, the market is bifurcated into prenatal & fetal equipment and neonatal equipment. Prenatal & Fetal Equipment include ultrasound & ultrasonography devices, fetal doppler, fetal magnetic resonance imaging (MRI), fetal heart monitors, and others. Additionally, the neonatal equipment includes incubators, neonatal monitoring devices, phototherapy equipment, respiratory assistance & monitoring devices, and others.

Global Neonatal and Prenatal Devices Market Share by Product Type, 2018 (%)

Prenatal & Fetal Equipment to Contribute a Prominent Share

Prenatal & fetal equipment is anticipated to hold a significant share in the market owing to the increasing demand for effective devices for the prenatal and fetal care across the globe. Prenatal and fetal equipment is necessary to ensure the healthy growth of the fetus inside the womb. According to the Center for Disease Control and Prevention (CDC), Stillbirth that is fetus mortality affects about 1 in 100 pregnancies, and each year about 24,000 babies are stillborn in the US alone. Hence, the prenatal and fetal equipment segment will increase during the forecast period to minimize the fetus mortality across the globe.

Regional Outlooks

The global neonatal and prenatal devices market is further segmented based on geography into North America, Europe, Asia-Pacific, and Rest of the World. North America is expected to hold the largest market share in the neonatal and prenatal devices during the forecast period. The growth of the region is owing to the presence of advanced healthcare system and surge in the adoption of neonatal and prenatal devices considering the fatality rate across the region. For instance, according to 2018 America's Health Ranking Annual Report, the US infant mortality rate was 5.9 deaths per 1,000 live infant births.

Asia-Pacific to Exhibit Considerable Growth Rate During the Forecast Period

Asia-Pacific is anticipated to exhibit considerable growth rate in the market owing to the increasing cases of premature fatalities and raising awareness regarding prenatal care. Government initiatives to meet the Sustainable Development Goals with the target of getting maternal deaths below 70 for every 100,000 live births by 2030 will also drive the adoption of neonatal and prenatal devices in the Asia-Pacific market. Additionally, the rapid development of the healthcare sector is also driving the adoption of neonatal and prenatal devices across the region.

Market Players Outlook

Some of the key players of the neonatal and prenatal devices market include Becton, Dickinson and Company, General Electric Company, Getinge AB, FUJIFILM Holdings Corp., Koninklijke Philips N.V. Medtronic plc, and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, merger, and acquisition, collaborations to stay competitive in the market.

Recent Activities

- In February 2019, General Electric Co. launched an ultrasound machine called Versana Essential. The ultrasound machine provides high-quality ultrasound for OB/GYN care with quality and desired reliability. Versana Essential is practical and delivers an image with quality to support prenatal exams with the detail that are required for the right diagnoses.

- In September 2018, Koninklijke Philips N.V. launched the latest addition to Philips comprehensive obstetrical care (OB) solution called Philips Avalon beltless solution. The solution has received CE mark approval and it can aid in continuous fetal and maternal monitoring. The solution automatically streams patient data to the EMR through Philips obstetrical information management system, IntelliSpace Perinatal.

- In October 2017, Koninklijke Philips N.V. received the FDA clearance to market the eL18-4 transducer with a full solution for small parts imaging. It is also used to assess diseases and disorders of small organs such as breasts, testicles, and thyroid, as well as musculoskeletal injuries such as sprains and tears.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neonatal and prenatal devices market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Becton, Dickinson and Company

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Company

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Getinge AB

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Koninklijke Philips N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Medtronic plc

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Neonatal and Prenatal Devices Market by Product Type

5.1.1. Prenatal and Fetal Equipment

5.1.1.1. Ultrasound and Ultrasonography Devices

5.1.1.2. Fetal Doppler

5.1.1.3. Fetal Magnetic Resonance Imaging (MRI)

5.1.1.4. Fetal Heart Monitors

5.1.1.5. Others

5.1.2. Neonatal Equipment

5.1.2.1. Incubators

5.1.2.2. Neonatal Monitoring Devices

5.1.2.3. Phototherapy Equipment

5.1.2.4. Respiratory Assistance and Monitoring Devices

5.1.2.5. Other

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Atom Medical Corp

7.2. Becton, Dickinson and Co.

7.3. Dragerwerk AG & Co. KGaA

7.4. Fisher & Paykel Healthcare Ltd.

7.5. FUJIFILM Holdings Corp.

7.6. General Electric Co. (GE Healthcare)

7.7. Getinge AB

7.8. Hamilton Medical AG

7.9. Inspiration Healthcare Group plc

7.10. Koninklijke Philips N.V.

7.11. Masimo Corp.

7.12. Medela AG

7.13. Medtronic plc

7.14. Natus Medical Inc.

7.15. Nihon Kohden Corp.

7.16. Nonin Medical, Inc.

7.17. NUVO Inc.

7.18. Phoenix Medical Systems (P) Ltd.

7.19. Smiths Group PLC.

7.20. Vyaire Medical, Inc.

1. GLOBAL NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL PRENATAL AND FETAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL NEONATAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

5. NORTH AMERICAN NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

6. NORTH AMERICAN NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

7. EUROPEAN NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

8. EUROPEAN NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

9. ASIA-PACIFIC NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. ASIA-PACIFIC NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

11. REST OF THE WORLD NEONATAL AND PRENATAL DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

1. GLOBAL NEONATAL AND PRENATAL DEVICES MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL NEONATAL AND PRENATAL DEVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

5. UK NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD NEONATAL AND PRENATAL DEVICES MARKET SIZE, 2018-2025 ($ MILLION)