Neopentyl Glycol Market

Neopentyl Glycol Market Size, Share & Trends Analysis Report by Physical Form (Flakes, Molten and Slurry), Grade (Pharmaceutical Grade and Technical Grade), and End-User Industry (Automotive, Building & Construction, Pharmaceuticals, Furniture & Interiors, Electronics, and Others) Forecast Period (2025-2035)

Industry Overview

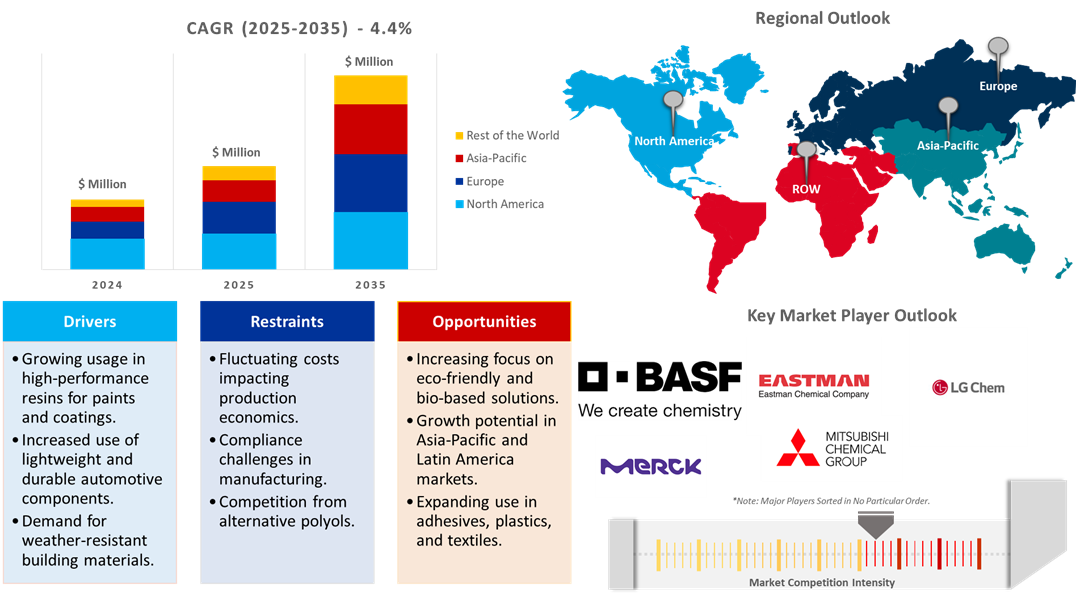

The neopentyl glycol market was valued at $1,720 million in 2024 and is projected to reach $2,751 million in 2035, growing at a CAGR of 4.4% during the forecast period (2025-2035). The rising neopentyl glycol demand across several end-user industries, such as transportation, building & construction, and automobiles is contributing to industry growth. Strong oxidation resistance has also been reported for this molecule, which is non-polar, advancements in paint and oil coatings significantly expand the market. The use of advanced sealants and adhesives that are easy to handle and have low volatile organic compounds (VOCs) is also contributing to this expansion. According to the Association of the European Adhesive & Sealant Industry (FEICA), the European adhesives and sealants (A&S) market in 2022 was 4.8 million tons with a value of €19.9 billion ($20.9 billion). Adhesives accounted for 83.5% share of the total volume in 2022 and 74.7% share of the value.

Market Dynamics

Growing Adoption of Neopentyl Glycol in Coating & Paints Industry

One of the emerging trends is the growing use of neopentyl glycol in the production of high-performance paints and coatings. Having excellent weather resistance, chemical stability, and adhesion, this chemical is one of the ingredients of preference for automotive, marine, and industrial coatings. Growth in construction and infrastructural development activities around the globe, especially within developing countries, has raised a demand for tough and long-lasting coatings containing neopentyl glycol. Further, its application in powder coatings that are progressively finding appeal owing to their eco-friendliness supports the market expansion. Governments and businesses are focused on VOC reduction and neopentyl glycol fits in well with the same. In addition, the longevity enhancement feature of the material and resistance against UV radiation is adding to the demand. Companies are investing significantly in R&D with a view to modifying formulations involving neopentyl glycol, thereby elevating the importance of this raw material. This increases dependence and further underlines the compound's importance in paints and coatings.

Increasing Demand in Resins & Plasticizers Manufacturing

Neopentyl glycol is increasingly used in the production of plasticizers and resins owing to its exclusive chemical structure and benefits regarding performance. The material is very important in polyester resin production as it provides better flexibility, stability, and thermal resistance. Polyester resins are used extensively in the production of plastics, adhesives, and sealants. Demand from the automotive and electronic industries for lightweight material increases the need for neopentyl glycol-based resins. Its role in elevating the hardness as well as the toughness of molded plastics positions it in several industrial applications and thrusts towards sustainability, the industry has been switching over to bio-based neopentyl glycol for a lower footprint from the environment. This green chemistry direction lends itself to global trends, furthering innovation in processes applied during manufacture.

Market Segmentation

- Based on the physical form, the market is segmented into flakes, molten, and slurry.

- Based on the grade, the market is segmented into pharmaceutical grade and technical grade.

- Based on the end-user industry, the market is segmented into automotive, building & construction, pharmaceuticals, furniture & interiors, electronics, and others (cosmetics and personal care).

Flake Segment to Lead the Market with the Largest Share

The neopentyl glycol market is increasing as flake form offers great flexibility in application as well as easier handling than any other forms of neopentyl glycol. As it possesses greater chemical and thermal stability, various industrial applications such as paints and coatings and construction, automobiles make use of it in flake form. The widespread use is also owing to its ability to enhance the performance and durability of the product. It has a strong market owing to the increasing demand for sustainable and high-performance materials. Advances in production technology are improving product quality and availability. The key player offers Neopentyl Glycol flakes as a versatile chemical compound with diverse applications across industries. For instance, The Perstorp Group offers Neopentyl Glycol flakes. Neo contains two hydroxyl primary groups. The product is available in flakes with white material. It is used as saturated polyesters for powder coatings, coil coatings, and other stoving enamels, unsaturated polyesters for gel coats, and reinforced plastics, and as esters in synthetic lubricants.

Building & Construction: A Key Segment in Market Growth

Neopentyl glycol market growth is significantly boosted by the strong expansion in the building and construction sector. Its demand surge arises from its essential role in making various construction materials, such as paints, coatings, and adhesives, more durable and efficient. The chemical properties of this compound contribute to improved resistance against weathering and corrosion, and it is preferred in the development of infrastructures. The increasing focus on sustainable construction practices adds to its use, which is also promoted by the environmentally friendly nature of Neopentyl glycol. For instance, Eastman Chemical Co. provides Neopentyl Glycol (NPG) 90, Eastman NPG is the industry standard glycol component in high-quality polyester resins for Building materials, industrial coatings, and fiberglass-reinforced plastics applications.

Regional Outlook

The global neopentyl glycol market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Neopentyl Glycol in Construction and Automotive in Asia-Pacific

The Asia-Pacific neopentyl glycol market is growing owing to rapid expansion in the construction and automotive segments. Urbanization and industrial activities in countries such as China and India, coupled with requirements for high-grade materials, tend to increase their demand. Across the region, infrastructure development led to increased utilization of coatings and resins. Growing awareness of sustainable manufacturing results in global support for environmentally friendly initiatives, expanding market expansion prospects. Growing production, science, and technology lead to increased cost-effectiveness and efficiency. Investing more in research and development also drives future advancements in the neopentyl glycol market.

Europe Region Dominates the Market with Major Share

Europe holds a significant share owing to increased demand in many industries such as the automotive and construction sectors, Neopentyl Glycol is used in the production of paints, resins, and plastics owing to its excellent thermal stability and chemical resistance. A sustainable manufacturing practice would have promoted more low-VOC and water-based coating applications. Technical improvements in manufacturing processes also provide increased efficiency while reducing the overall cost. Further, increasing durability and weather-resistant requirements drive a lot of consumption. High-performance materials are widely used, and the growing automotive and construction sectors in Europe further encourage their adoption. Neopentyl Glycol is a crucial component of environmentally friendly products that are increasingly popular as a result of growing awareness of environmental risks.

Market Players Outlook

The major companies operating in the global neopentyl glycol market include BASF SE, Eastman Chemical Co., LG Chem, Ltd., Merck KGaA, and Mitsubishi Chemical Group Corp., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In July 2023, Perstorp launched two new grades for the base polyols neopentyl glycol (Neeture N100) and trimethylolpropane (Evyron T100). Neeture N100 (neopentyl glycol) and Evyron T100 (trimethylolpropane) are designed to reduce the carbon footprint throughout the value chain and to support the sustainable sourcing of renewable and recycled raw materials.

- In October 2022, BASF invested in a Neopentyl Glycol (NPG) plant with an annual production capacity of 80,000 metric tons at its new Zhanjiang Verbund site, in China. With the new NPG plant expected to come on stream in 2025, BASF’s global NPG capacity increased from 255,000 metric tons to 335,000 metric tons annually, strengthening its position as one of the NPG manufacturers.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neopentyl glycol market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Neopentyl Glycol Market Sales Analysis – Physical Form| Grade| End-User Industry ($ Million)

• Neopentyl Glycol Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Neopentyl Glycol Industry Trends

2.2.2. Market Recommendations

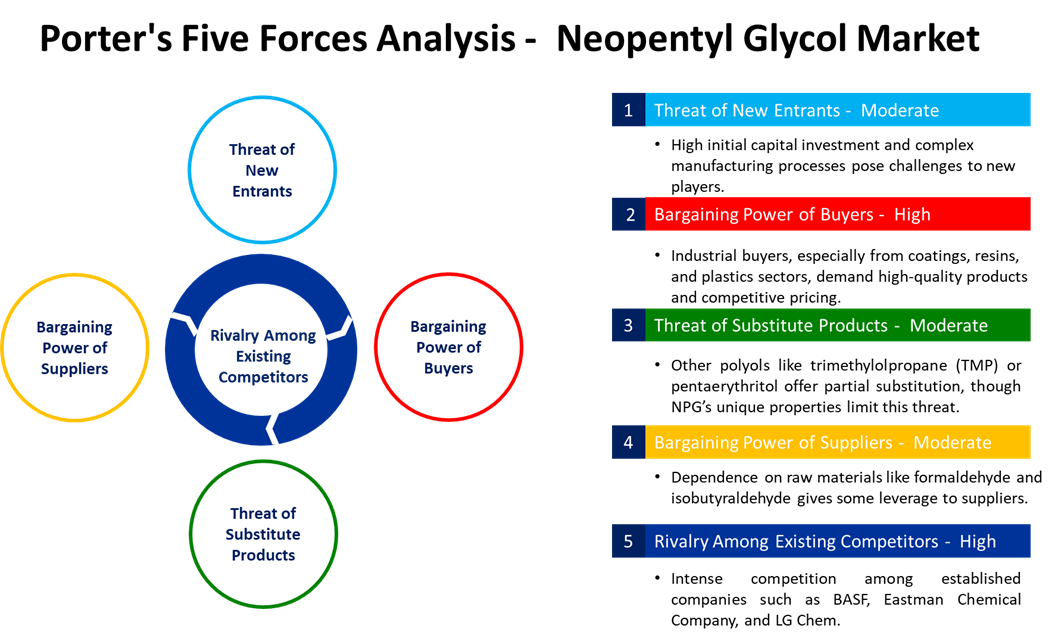

2.3. Porter's Five Forces Analysis for the Neopentyl Glycol Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Neopentyl Glycol Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Neopentyl Glycol Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Neopentyl Glycol Market Revenue and Share by Manufacturers

• Neopentyl Glycol Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Eastman Chemical Co.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. LG Chem, Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Merck KGaA

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Mitsubishi Chemical Group Corp.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Neopentyl Glycol Market Sales Analysis by Physical Form ($ Million)

5.1. Flakes

5.2. Molten

5.3. Slurry

6. Global Neopentyl Glycol Market Sales Analysis by Grade ($ Million)

6.1. Pharmaceutical Grade

6.2. Technical Grade

7. Global Neopentyl Glycol Market Sales Analysis by End-User Industry ($ Million)

7.1. Automotive

7.2. Building & Construction

7.3. Pharmaceuticals

7.4. Furniture & Interiors

7.5. Electronics

7.6. Others (Cosmetics and Personal Care)

8. Regional Analysis

8.1. North American Neopentyl Glycol Market Sales Analysis – Physical Form | Grade | End-User Industry | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Neopentyl Glycol Market Sales Analysis – Physical Form | Grade | End-User Industry| Country ($ Million)

• Macroeconomic Factors for North America

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Neopentyl Glycol Market Sales Analysis – Physical Form | Grade | End-User Industry| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Neopentyl Glycol Market Sales Analysis – Physical Form | Grade | End-User Industry| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ACETO US, LLC

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Anhui Jinhe Industrial Co., Ltd.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Arkema S.A.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. ATAMAN Kimya A.S

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. BASF SE

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Nansong Chemi-Tech Pharma Co., Ltd.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Eastman Chemical Co.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Glentham® Life Sciences Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Huntsman Corp.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Jiuan Chemical Industry Co., Ltd.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. KOKYU ALCOHOL KOGYO CO., LTD.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. LANXESS AG

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. LG Chem, Ltd.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Merck KGaA

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Mitsubishi Chemical Group Corp.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. OQ Chemicals GmbH

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Ruibao Chemical Co., LTD.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Reform Petro-Chemical CO., LTD.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Xinhua Pharmaceutical I&E Co., Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. The Perstorp Group

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Theorem Chemical Technology Co., Ltd.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Tokyo Chemical Industry Co., Ltd. (TCI)

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Unilong Industry Co., Ltd.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

1. Global Neopentyl Glycol Market Research And Analysis By Physical Form, 2024-2035 ($ Million)

2. Global Neopentyl Glycol Flakes Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Neopentyl Glycol Molten Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Neopentyl Glycol Slurry Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Neopentyl Glycol Market Research And Analysis By Grade, 2024-2035 ($ Million)

6. Global Neopentyl Glycol Pharmaceutical Grade Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Neopentyl Glycol Technical Grade Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Neopentyl Glycol Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

9. Global Neopentyl Glycol For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Neopentyl Glycol For Building & Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Neopentyl Glycol For Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Neopentyl Glycol For Furniture & Interiors Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Neopentyl Glycol For Electronics Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Neopentyl Glycol For Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Neopentyl Glycol For Other End-User Industry Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Neopentyl Glycol Market Research And Analysis By Region, 2024-2035 ($ Million)

17. North American Neopentyl Glycol Market Research And Analysis By Country, 2024-2035 ($ Million)

18. North American Neopentyl Glycol Market Research And Analysis By Physical Form, 2024-2035 ($ Million)

19. North American Neopentyl Glycol Market Research And Analysis By Grade, 2024-2035 ($ Million)

20. North American Neopentyl Glycol Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

21. European Neopentyl Glycol Market Research And Analysis By Country, 2024-2035 ($ Million)

22. European Neopentyl Glycol Market Research And Analysis By Physical Form, 2024-2035 ($ Million)

23. European Neopentyl Glycol Market Research And Analysis By Grade, 2024-2035 ($ Million)

24. European Neopentyl Glycol Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

25. Asia-Pacific Neopentyl Glycol Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Asia-Pacific Neopentyl Glycol Market Research And Analysis By Physical Form, 2024-2035 ($ Million)

27. Asia-Pacific Neopentyl Glycol Market Research And Analysis By Grade, 2024-2035 ($ Million)

28. Asia-Pacific Neopentyl Glycol Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

29. Rest Of The World Neopentyl Glycol Market Research And Analysis By Region, 2024-2035 ($ Million)

30. Rest Of The World Neopentyl Glycol Market Research And Analysis By Physical Form, 2024-2035 ($ Million)

31. Rest Of The World Neopentyl Glycol Market Research And Analysis By Grade, 2024-2035 ($ Million)

32. Rest Of The World Neopentyl Glycol Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

1. Global Neopentyl Glycol Market Share By Physical Form, 2024 Vs 2035 (%)

2. Global Neopentyl Glycol Flakes Market Share By Region, 2024 Vs 2035 (%)

3. Global Neopentyl Glycol Molten Market Share By Region, 2024 Vs 2035 (%)

4. Global Neopentyl Glycol Slurry Market Share By Region, 2024 Vs 2035 (%)

5. Global Neopentyl Glycol Market Share By Grade, 2024 Vs 2035 (%)

6. Global Neopentyl Glycol Pharmaceutical Grade Market Share By Region, 2024 Vs 2035 (%)

7. Global Neopentyl Glycol Technical Grade Market Share By Region, 2024 Vs 2035 (%)

8. Global Neopentyl Glycol Market Share By End-User Industry, 2024 Vs 2035 (%)

9. Global Neopentyl Glycol For Automotive Market Share By Region, 2024 Vs 2035 (%)

10. Global Neopentyl Glycol For Building & Construction Market Share By Region, 2024 Vs 2035 (%)

11. Global Neopentyl Glycol For Pharmaceuticals Market Share By Region, 2024 Vs 2035 (%)

12. Global Neopentyl Glycol For Furniture & Interiors Market Share By Region, 2024 Vs 2035 (%)

13. Global Neopentyl Glycol For Electronics Market Share By Region, 2024 Vs 2035 (%)

14. Global Neopentyl Glycol For Other End-User Industry Market Share By Region, 2024 Vs 2035 (%)

15. Global Neopentyl Glycol Market Share By Region, 2024 Vs 2035 (%)

16. US Neopentyl Glycol Market Size, 2024-2035 ($ Million)

17. Canada Neopentyl Glycol Market Size, 2024-2035 ($ Million)

18. UK Neopentyl Glycol Market Size, 2024-2035 ($ Million)

19. France Neopentyl Glycol Market Size, 2024-2035 ($ Million)

20. Germany Neopentyl Glycol Market Size, 2024-2035 ($ Million)

21. Italy Neopentyl Glycol Market Size, 2024-2035 ($ Million)

22. Spain Neopentyl Glycol Market Size, 2024-2035 ($ Million)

23. Russia Neopentyl Glycol Market Size, 2024-2035 ($ Million)

24. Rest Of Europe Neopentyl Glycol Market Size, 2024-2035 ($ Million)

25. India Neopentyl Glycol Market Size, 2024-2035 ($ Million)

26. China Neopentyl Glycol Market Size, 2024-2035 ($ Million)

27. Japan Neopentyl Glycol Market Size, 2024-2035 ($ Million)

28. South Korea Neopentyl Glycol Market Size, 2024-2035 ($ Million)

29. Australia and New Zealand Neopentyl Glycol Market Size, 2024-2035 ($ Million)

30. ASEAN Economies Neopentyl Glycol Market Size, 2024-2035 ($ Million)

31. Rest Of Asia-Pacific Neopentyl Glycol Market Size, 2024-2035 ($ Million)

32. Latin America Neopentyl Glycol Market Size, 2024-2035 ($ Million)

33. Middle East And Africa Neopentyl Glycol Market Size, 2024-2035 ($ Million)

FAQS

The size of the Neopentyl Glycol market in 2024 is estimated to be around $1,720 million.

Europe holds the largest share in the Neopentyl Glycol market.

Leading players in the Neopentyl Glycol market include BASF SE, Eastman Chemical Co., LG Chem, Ltd., Merck KGaA, and Mitsubishi Chemical Group Corp., among others.

Neopentyl Glycol market is expected to grow at a CAGR of 4.4% from 2025 to 2035.

The Neopentyl Glycol (NPG) Market is growing due to increasing demand in coatings, resins, and lubricants, driven by the construction and automotive industries. Additionally, its rising use in plastics, adhesives, and eco-friendly products fuels market ex