Neural Processor Market

Neural Processor Market Size, Share & Trends Analysis Report by Application (Fraud Detection, Hardware Diagnostics, Financial Forecasting, Image Optimization, and Others (Disease diagnostics, Algorithm Trading)), and by End-User (BFSI, Healthcare, Retail, Defense Agencies, Media, Logistics, and Others), Forecast Period (2024-2031)

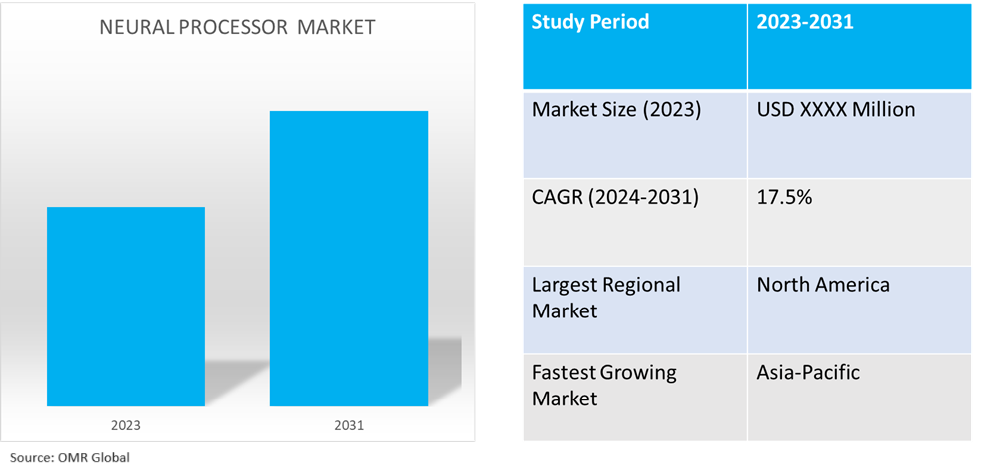

Neural processor market is anticipated to grow at a CAGR of 17.5% during the forecast period (2024-2031). A neural processor, also known as a neural processing unit (NPU), is a specialized circuit that implements all the control and arithmetic logic required to run machine learning algorithms, typically by working with predictive models such as artificial neural networks (ANNs) or random forests (RFs). Neural processors can be designed digitally or analogously. Analog chips are more closely related to the biological properties of brain networks than digital processors. As a result, they ought to use less energy than digital neuromorphic computers, theoretically. Furthermore, they have the potential to extend the processing duration beyond the time limit, allowing the pace to be adjusted to process data faster than in real time.

Market Dynamics

Rising Application of AI

AI applications are gaining popularity in a variety of end-use industries, including healthcare, finance, and automotive. These processors play a significant role in accelerating AI-generated activities such as image recognition, natural language processing, and deep learning, to meet the need for AI-powered solutions, which is likely to drive the neural processor market growth. For instance, August 2021, at the annual Hot Chips conference, IBM revealed details about the impending new IBM Telum Processor, which is intended to deliver deep learning inference to enterprise workloads to combat fraud in real-time. Telum is IBM's first processor to include on-chip acceleration for AI inference while a transaction is ongoing. The breakthrough of this new on-chip hardware acceleration, which has been in development for three years, is intended to assist customers in achieving business insights at scale across banking, finance, trading, insurance, and consumer engagements.

Increasing Focus on Cloud-Based Processor

Cloud-based neural processors allow access to hardware resources based on AI via the cloud and are gaining popularity in the industry. These processors allow users to take advantage of high-performance computing capabilities without the requirement for large upfront investments in dedicated hardware. For instance, in March 2024, Akamai Technologies, a cloud company that powers and protects life online, and Neural Magic, a developer of software that accelerates AI workloads, announced a strategic partnership to enhance deep learning capabilities on Akamai's distributed computing infrastructure. Neural Magic's technology allows deep learning models to run on cost-effective CPU-based servers rather than expensive GPU resources. The product speeds AI workloads using automated model sparsification methods, which are offered as a CPU inference engine and complement Akamai's capacity to scale, defend, and deliver edge applications. This enables the companies to deploy their capabilities across Akamai's global distributed computing infrastructure, providing customers with lower latency and higher performance for data-intensive AI applications.

Segmental Outlook

- Based on the application the market is segmented into fraud detection, hardware diagnostics, financial forecasting, image optimization, and others (disease diagnostics, algorithm trading).

- Based on end-users, the market is segmented into BFSI, healthcare, retail, defense agencies, media, logistics, and others.

Hardware Diagnostics is the Most Prominent Application Segment

A neural network is used to diagnose the machine's faults with learning and memory capabilities. The application of such networks requires high-performance processor to have the ability to process huge volumes of data, and problem-solving features, which are achieved through neural processors. Further, the advancement in artificial intelligence (AU), and machine learning (ML) has made the application more feasible, creating demand for AI-based neural processors.

Retail is the Major End-User Segment

Neural network helps retail businesses increase sales effectiveness and retain consumers by improving search results, making sales projections, and providing purchasers with personalized shopping experiences. Neural processor technology enables the processing of such data efficiently and effectively. Furthermore, increased adoption of AI is expected to improve consumer services and lower operating costs, propelling the neural processor market forward.

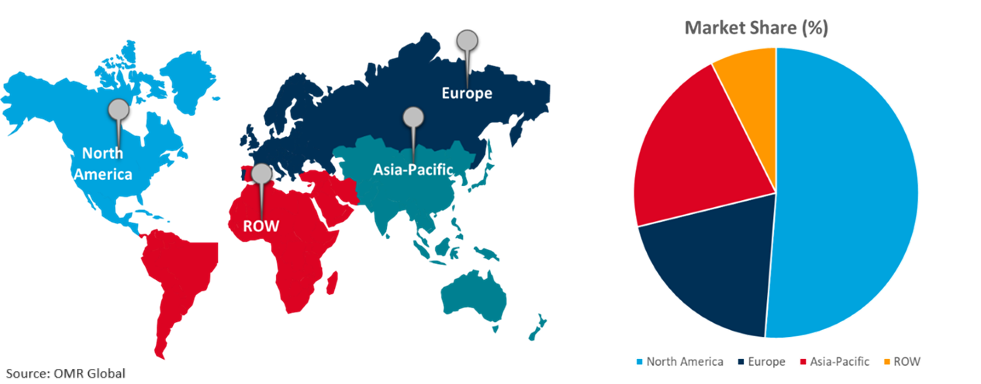

Regional Outlook

The global neural processor market is segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Neural Processor Market

Several factors, including expansion in research and development capabilities, rising investment in processing technology, rapid adoption of AI & ML in the region, the growth of the neural network industry, and the presence of major technology companies drive the regional expansion. For instance, in April 2024, Intel announced that it had created the world's largest neuromorphic system. This large-scale neuromorphic system, code-named Hala Point, was initially deployed at Sandia National Laboratories and uses Intel's Loihi 2 processor. It aims to support research for future brain-inspired artificial intelligence (AI) and addresses challenges related to the efficiency and sustainability of today's AI. Hala Point improves Intel's first-generation large-scale research system, Pohoiki Springs, with architectural enhancements that result in over ten times more neuron capacity and up to twelve times higher performance.

Global Neural Processor Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in the Neural Processor market

- The increased adoption of IoT and AI in Asian countries drives up demand for neural processes in the region.

- The Asia-Pacific neural processor market is also expected to grow owing to growth in the neural network industry and increasing demand for high-performance processors across sectors.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global neural processor market include Google LLC., IBM Corp., Intel Corp., AMD Inc., and Qualcomm Technologies Inc., among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion, among others. For instance, in November 2021, Qualcomm Technologies, Inc. and Google Cloud are collaborating to accelerate neural network development and differentiation for Snapdragon® mobile, ACPC, and XR platforms, Snapdragon Ride™ Platform, and Qualcomm Technologies' IoT platforms. Google Cloud Vertex AI Neural Architecture Search (NAS) will be combined with the Qualcomm® Artificial Intelligence (AI) Engine.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neural processor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Google LLC.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Intel Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. NVIDIA Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Qualcomm Technologies, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Neural Processor Market by Application

4.1.1. Fraud Detection

4.1.2. Hardware Diagnostics

4.1.3. Financial Forecasting

4.1.4. Image Optimization

4.1.5. Others (Disease diagnostics, Algorithm Trading)

4.2. Global Neural Processor Market by End-User

4.2.1. BFSI

4.2.2. Healthcare

4.2.3. Retail

4.2.4. Defense Agencies

4.2.5. Media

4.2.6. Logistics

4.2.7. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Advanced Micro Devices, Inc.

6.2. TeraDeep Inc.

6.3. BrainChip Holdings Inc.

6.4. Ceva Inc.

6.5. Graphcore

6.6. Intel Corp.

6.7. Synopsys Inc.

6.8. Syntiant Corp.

6.9. Applied Brain Research Inc.

6.10. Aspinity, Inc.

6.11. Bit & Brain Technologies, S.L.

6.12. BrainCo, Inc.

6.13. General Vision Inc.

6.14. Hailo Technologies Ltd.

6.15. HRL Laboratories, LLC

6.16. Hewlett Packard Enterprise Development LP

6.17. Samsung Electronics Co., Ltd

1. GLOBAL NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL NEURAL PROCESSOR IN FRAUD DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NEURAL PROCESSOR IN HARDWARE DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NEURAL PROCESSOR IN FINANCIAL FORECASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL NEURAL PROCESSOR IN IMAGE OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL NEURAL PROCESSOR IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

8. GLOBAL NEURAL PROCESSOR FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL NEURAL PROCESSOR FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL NEURAL PROCESSOR FOR RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL NEURAL PROCESSOR FOR DEFENSE AGENCIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL NEURAL PROCESSOR FOR MEDIA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL NEURAL PROCESSOR FOR LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL NEURAL PROCESSOR FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. EUROPEAN NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. REST OF THE WORLD NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD NEURAL PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL NEURAL PROCESSOR MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL NEURAL PROCESSOR IN FRAUD DETECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NEURAL PROCESSOR IN HARDWARE DIAGNOSTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NEURAL PROCESSOR IN FINANCIAL FORECASTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL NEURAL PROCESSOR IN IMAGE OPTIMIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL NEURAL PROCESSOR IN OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL NEURAL PROCESSOR MARKET SHARE BY END-USER, 2023 VS 2031 (%)

8. GLOBAL NEURAL PROCESSOR FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL NEURAL PROCESSOR FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL NEURAL PROCESSOR FOR RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL NEURAL PROCESSOR FOR DEFENSE AGENCIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL NEURAL PROCESSOR FOR MEDIA MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL NEURAL PROCESSOR FOR LOGISTICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL NEURAL PROCESSOR FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL NEURAL PROCESSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

18. UK NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)

30. THE MIDDLE EAST AND AFRICA NEURAL PROCESSOR MARKET SIZE, 2023-2031 ($ MILLION)