Neuropathic Pain Treatment Market

Global Neuropathic Pain Treatment Market Size, Share & Trends Analysis Report, By Indication (Spinal Stenosis, Diabetic Neuropathy, Chemotherapy-Induced Peripheral Neuropathy, and Others), By Treatment (Tricyclic Antidepressants, Anticonvulsants, Opioids, Creams and Patches, Steroids, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global neuropathic pain treatment market is estimated to grow at a CAGR of nearly 5.8% during the forecast period. The major factors contributing to the growth of the market include increasing prevalence of diabetes and rising incidences of spinal cord injury. As per the data published by the National Spinal Cord Injury Statistical Center, as of 2019, in the US, the annual incidence of spinal cord injury is approximately 54 cases per one million people, or nearly 17,730 new spinal cord injury cases each year. As of 2019, the estimated number of individuals suffering from spinal cord injury in the US is nearly 291,000. Nearly 78% of new incidences were reported among males.

Since 2015-2018/2019, motor vehicle accidents are the major cause of spinal cord injuries (39.3%), which is followed by falls (31.8%), acts of violence (13.5%), sports (8%), medical/surgical (4.3%), and other (3.1%). Nearly 2/3rd of sports injuries were reported from diving. People with spinal cord injury may suffer from different kinds of pain in different areas of the body, which comprises musculoskeletal pain, visceral pain, and neuropathic pain. Spinal cord injury results in damage to any part of the nerves or spinal that causes abnormal communication between the nerves, which results in neuropathic pain. This contributes to the increasing demand for medications to treat neuropathic pain.

Some common medications and patches are used to treat neuropathic pain caused by spinal cord injury include gabapentin (Neurontin), amitriptyline (Elavil), pregabalin (Lyrica), and lidocaine (Lidoderm). Lidocaine patches are utilized for pain relief from post-herpetic neuralgia. The patch works by stopping nerves from transmitting pain signals. Pregabalin (Lyrica) is an anticonvulsant drug which is indicated for the treatment of epilepsy and neuropathic pain. Pregabalin is a substitute treatment for patients with neuropathic pain that has not responded to other drug alternatives. Additionally, innovations in neurostimulation devices will likely offer an opportunity for more reliable and efficient treatment of neuropathic pain.

Market Segmentation

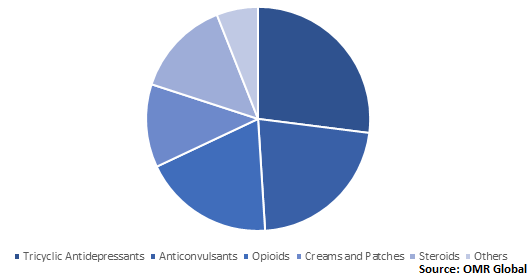

The global neuropathic pain treatment is segmented based on indication and treatment. Based on indication, the market is classified into spinal stenosis, diabetic neuropathy, chemotherapy-induced peripheral neuropathy, and others. Based on treatment, the market is classified into tricyclic antidepressants, anticonvulsants, opioids, creams and patches, steroids, and others.

Tricyclic antidepressants find its significant application in neuropathic pain treatment

Tricyclic antidepressants and anticonvulsants have been significantly used to treat neuropathic pain. Tricyclic antidepressants can provide relief from neuropathic pain coupled with their unique ability to restrict presynaptic reuptake of the noradrenaline and serotonin. However, other mechanisms such as blockage of the sodium channel and N-methyl-D-aspartate receptor may also play a crucial role in the pain-relieving effect. In several randomized and controlled trials associated with the effect of tricyclic antidepressants in neuropathic pain in man, it was found that tricyclic antidepressants provide relief to one in every 2-3 patients suffering from peripheral neuropathic pain.

Based on the effectiveness, tricyclic antidepressants tend to work effectively as compared to anticonvulsant (gabapentin). The most commonly used tricyclic antidepressants to treat neuropathic pain include desipramine, amitriptyline, nortriptyline, and imipramine. These drugs are effective norepinephrine reuptake inhibitors and thus, majorly supports in the treatment of neuropathic pain. The most common side-effect of tricyclic antidepressants includes constipation, dry mouth, somnolence, memory impairment, and weight gain. Less common side effects include cardiac arrhythmias, urinary retention, blurred vision, and orthostatic hypotension.

Global Neuropathic Pain Treatment Market Share by Treatment, 2019 (%)

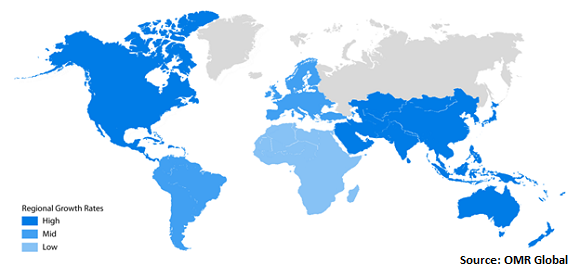

Regional Outlook

Geographically, the market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). North America is anticipated to hold a significant share in the market owing to the rising spinal cord injuries and increasing prevalence of diabetes in the region. As per the American Diabetes Association, in 2018, 10.5% of the population or 34.2 million Americans had diabetes. Diabetic neuropathy is a common and severe complication associated with type 1 and type 2 diabetes. It is a kind of nerve damage resulted due to long-term high blood sugar levels. Depending on the affected nerves, the symptoms of diabetic neuropathy can vary from pain and numbness in the feet and leg to problems with the blood vessels, digestive system, heart, and urinary tract. This, in turn, contributes to the increasing demand for diabetic neuropathy treatment in the region.

Global Neuropathic Pain Treatment Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include Eli Lilly and Co., Pfizer Inc., Biogen Inc., Grünenthal GmbH, and Assertio Therapeutics, Inc. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. For instance, in July 2019, InvaGen Pharmaceuticals, Inc., a completely owned subsidiary of Cipla Ltd. declared that it has received final approval for Pregabalin Capsules, 25mg, 50mg, 75mg, 100mg, 150mg, 200mg, 225mg and 300mg from US FDA. These capsules are AB-rated generic therapeutic which is an equivalent version of Pfizer’s Lyrica. This is indicated for the management of pain associated with diabetic peripheral neuropathy and spinal cord injury and more. This approval will enable Cipla to increase its revenue generation from the US.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neuropathic pain treatment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Eli Lilly and Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Pfizer Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Biogen Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Grünenthal GmbH

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Assertio Therapeutics, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Neuropathic Pain Treatment Market by Indication

5.1.1. Spinal Stenosis

5.1.2. Diabetic Neuropathy

5.1.3. Chemotherapy-Induced Peripheral Neuropathy

5.1.4. Others

5.2. Global Neuropathic Pain Treatment Market by Treatment

5.2.1. Tricyclic Antidepressants

5.2.2. Anticonvulsants

5.2.3. Opioids

5.2.4. Creams and Patches

5.2.5. Steroids

5.2.6. Others (Neurostimulation and Local Anesthesia)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Acorda Therapeutics, Inc.

7.3. Assertio Therapeutics, Inc.

7.4. Astellas Pharma Inc.

7.5. AstraZeneca plc

7.6. Biogen Inc.

7.7. BioIntervene, Inc.

7.8. Boston Scientific Corp.

7.9. Cipla Ltd.

7.10. Dr. Reddy’s Laboratories Ltd.

7.11. Eli Lilly and Co.

7.12. GlaxoSmithKline plc

7.13. Glenmark Pharmaceuticals Ltd.

7.14. Grünenthal GmbH

7.15. Johnson & Johnson Services, Inc.

7.16. Lexicon Pharmaceuticals, Inc.

7.17. Lupin Ltd.

7.18. Medtronic plc

7.19. Pfizer Inc.

7.20. Sanofi S.A.

7.21. Teva Pharmaceutical Industries Ltd.

1. GLOBAL NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

2. GLOBAL SPINAL STENOSIS NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL DIABETIC NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CHEMOTHERAPY-INDUCED PERIPHERAL NEUROPATHY TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER NEUROPATHIC PAIN INDICATIONS TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

7. GLOBAL TRICYCLIC ANTIDEPRESSANTS FOR NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ANTICONVULSANTS FOR NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OPIOIDS FOR NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL CREAMS AND PATCHES FOR NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL STEROIDS FOR NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHER NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

16. NORTH AMERICAN NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

17. EUROPEAN NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

19. EUROPEAN NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

23. REST OF THE WORLD NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

24. REST OF THE WORLD NEUROPATHIC PAIN TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2019-2026 ($ MILLION)

1. GLOBAL NEUROPATHIC PAIN TREATMENT MARKET SHARE BY INDICATION, 2019 VS 2026 (%)

2. GLOBAL NEUROPATHIC PAIN TREATMENT MARKET SHARE BY TREATMENT, 2019 VS 2026 (%)

3. GLOBAL NEUROPATHIC PAIN TREATMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

6. UK NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD NEUROPATHIC PAIN TREATMENT MARKET SIZE, 2019-2026 ($ MILLION)