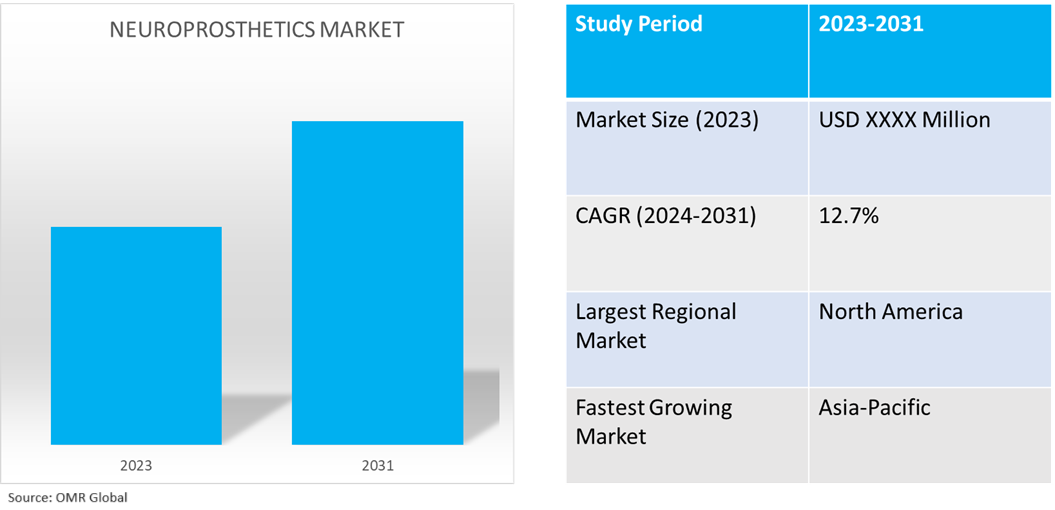

Neuroprosthetics Market

Neuroprosthetics Market Size, Share & Trends Analysis Report by Type (Motor Prosthetics, Sensory Prosthetics, Cognitive Prosthetics, and Visual Prosthetics), by Treatment Technique (Deep Brain Stimulation (DBS), Vagus Nerve Stimulation (VNS), Sacral Nerve Stimulator (SNS), and Spinal Cord Stimulator (SCS) and by Application (Motor Disorder, Physiological Disorder, and Cognitive Disorder) Forecast Period (2024-2031)

Neuroprosthetics market is anticipated to grow at a significant CAGR of 12.7% during the forecast period (2024-2031). The market growth is attributed to an increasing incidence rate of diseases such as Parkinson's, epilepsy, auditory, ophthalmology, neuromuscular junction/muscle disorders, Alzheimer's, and severe depression. According to the World Health Organization (WHO), in March 2024, over 1 in 3 people were affected by neurological conditions, the resulting cause of illness and disability globally. Over 80.0% of neurological deaths and health loss occur in low- and middle-income countries, and access to treatment varies widely, high-income countries have up to 70 times more neurological professionals per 1,00,000 people than low- and middle-income countries.

Market Dynamics

Increasing Demand for Wireless and Battery-Free Devices

The development of neuroprosthetics that do not require large batteries is improving user comfort and device longevity. This is made possible by newly developed wireless technologies and energy-harvesting techniques. The basis for lightweight, compact, and fully implantable wireless devices that connect with biological tissues to record and stimulate cerebral activity without the need for batteries or physical tethers is provided by recent developments in material science and neuro-engineering. The most advanced technologies that are currently approved for use in humans are cardiac pacemakers, cochlear implants, and deep brain stimulation. These devices use rather large, stiff electronic modules that are electrically coupled to metal electrodes that serve as neural cell interfaces.

Growing Expansion of Clinical Application

A growing number of neurological disorders, such as Parkinson's disease, epilepsy, and chronic pain, are being treated with neuroprosthetics. The spectrum of illnesses that can be treated is growing as new neurostimulation therapies are developed. New approaches to enhancing the quality of life for people with sensory impairments are being made possible by developments in neuroprosthetics for sensory restoration. Instances of these include cochlear implants for hearing loss and retinal implants for vision loss. The use of neuroprosthetics in therapeutic settings has expanded the scope of conventional rehabilitation therapy programs and enhanced the provision of care, functional outcomes, and management of patients with brain injuries and amputations. Neuroprosthetics has an exciting potential ahead of it, one that might significantly improve functional outcomes and quality of life for people with disabilities while also expanding the area of rehabilitation medicine.

Market Segmentation

- Based on the type, the market is segmented into motor prosthetics, sensory prosthetics, cognitive prosthetics, and visual prosthetics.

- Based on the treatment technique, the market is segmented into deep brain stimulation (DBS), vagus nerve stimulation (VNS), sacral nerve stimulation (SNS), and spinal cord stimulator (SCS).

- Based on the application, the market is segmented into motor disorders, physiological disorders, and cognitive disorders.

Spinal Cord Stimulator (SCS) is Projected to Hold the Largest Segment

The primary factors supporting the growth include increased adoption in conjunction with the arrival of advanced devices with better uses, which are applied to conditions affecting the motor, sensory, and autonomic systems. Conventional fixed-output SCS devices interfere with pain signals before they reach the brain by delivering mild, continuous electrical impulses. Certain motions, such as laughing, bending, or sneezing, might cause momentary painful overstimulation while patients go about their regular lives. This could also cause some patients to reduce the stimulation output of their device, resulting in less-than-ideal therapeutic outcomes. For instance, in April 2024, Medtronic plc, in healthcare technology, announced that the US FDA has approved the Inceptiv™ closed-loop rechargeable spinal cord stimulator (SCS) for the treatment of chronic pain. Inceptiv is the first Medtronic SCS device to offer a closed-loop feature that senses biological signals along the spinal cord and automatically adjusts stimulation in real time, keeping therapy in harmony with the motions of daily life.

Motor Disorder to Hold a Considerable Market Share

The factors supporting segment growth include the growing prevalence of Parkinson's and epilepsy along with growing usage in these conditions, expanding the market for consumers. According to the World Health Organization (WHO), in August 2023, the prevalence of Parkinson's disease (PD) has doubled in the past 25 years. Global estimates in 2019 showed over 8.5 million individuals with PD. Current estimates suggest that, in 2019, PD resulted in 5.8 million disability-adjusted life years (DALYs), an increase of 81.0% in 2000, and caused 329,000 deaths, an increase of over 100.0% in 2000. The treatment of severe motor fluctuations in people living with advanced Parkinson's disease whose symptoms are inadequately controlled by other therapies. For instance, in January 2024, AbbVie introduced PRODUODOPA® (foslevodopa/foscarbidopa) in the European Union for the treatment of advanced Parkinson's disease with severe motor fluctuations and hyperkinesia (excessive movement) or dyskinesia (involuntary movement), and when available combinations of Parkinson's medicinal products have not given satisfactory results.

Regional Outlook

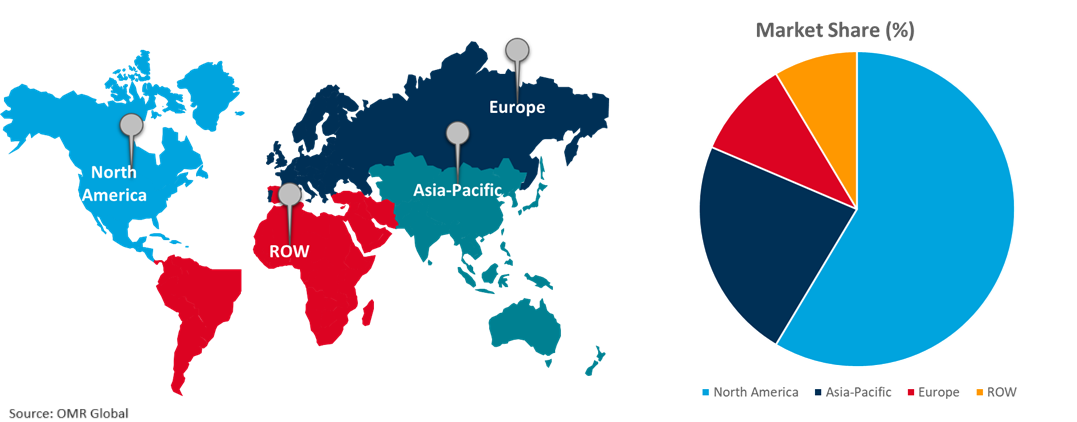

Global neuroprosthetics market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Neuroprosthetics in Asia-Pacific

- The regional growth is attributed to the growing neurological problems that have grown increasingly prevalent. Neuroprosthetics are employed when conventional therapies are not successful in curing a disease or condition. In developed countries such as China, Japan, and South Korea, the use of neuroprosthetics technologies including sacral cord stimulation (SCS), DBS, vagus nerve stimulation (VNS), and Deep Brain Stimulation (DBS) is expanding, driving the market's growth.

Global Neuroprosthetics Market Growth by Region 2024-2031

North America Holds Major Market Share

The market growth is attributed to the increasing number of patients experiencing neurological conditions and nerve damage, hearing loss is growing more common, amputation cases are rising as a result of more accidents and injuries, and diabetes is increasingly prevalent. According to the US Centers for Disease Control and Prevention, in April 2024, there were over 69,000 Traumatic brain injury (TBI) -related deaths in the US in 2021. That is about 190 TBI-related deaths every day. Firearm-related suicide is the most common cause of TBI-related deaths in the US. Motor vehicle crashes and assaults are other common ways a person may get a TBI. The market player introducing a rechargeable system with remote programming capabilities to treat movement disorders related to neurological diseases. For instance, in January 2024, Abbott Laboratories announced that it had received approval from the US FDA Liberta RC™ DBS system, the smallest rechargeable deep brain stimulation (DBS) device with remote programming, to treat people living with movement disorders. The Liberta RC DBS system also requires the fewest recharges of any FDA-approved DBS system, needing only 10 recharge sessions a year for most people.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the neuroprosthetics market include Abbott Laboratories, Axonics Modulation Technologies, Inc., Boston Scientific Corp., Medtronic plc, and Oticon Medical among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In October 2023, Boston Scientific Corp. announced that the US (FDA) has approved an expanded indication of the WaveWriter Alpha™ Spinal Cord Stimulator (SCS) Systems for the treatment of painful diabetic peripheral neuropathy (DPN), a complication of diabetes that can affect the lower extremities of the body.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the neuroprosthetics market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Axonics Modulation Technologies, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Boston Scientific Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Medtronic plc

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Oticon Medical

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Membrane Separation Technology Market by Type

4.1.1. Motor Prosthetics

4.1.2. Sensory Prosthetics

4.1.3. Cognitive Prosthetics

4.1.4. Visual Prosthetics

4.2. Global Membrane Separation Technology Market by Treatment Technique

4.2.1. Deep Brain Stimulation (DBS)

4.2.2. Vagus Nerve Stimulation(VNS)

4.2.3. Sacral Nerve Stimulator(SNS)

4.2.4. Spinal Cord Stimulator(SCS)

4.3. Global Membrane Separation Technology Market by Application

4.3.1. Motor Disorder

4.3.2. Physiological Disorder

4.3.3. Cognitive Disorder

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Advanced Bionics AG

6.2. Bioness Inc.

6.3. CorTec GmbH

6.4. Livallova, PLC

6.5. MED-EL Elektromedizinische Geräte Gesellschaft m.b.H.

6.6. MicroTransponder Inc.

6.7. Natus Medical Inc.

6.8. NDIE Medical, LLC

6.9. NeuroDerm Ltd.

6.10. NeuroMetrix, Inc.

6.11. NeuroPace, Inc.

6.12. Nevro Corp.

6.13. Paradromics Inc.

6.14. ReNeuron Group plc

6.15. Sonova AG

6.16. Synchron Inc.

1. Global Membrane Separation Technology Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Motor Prosthetics Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Sensory Prosthetics Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Cognitive Prosthetics Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Visual Prosthetics Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Membrane Separation Technology Market Research And Analysis By Treatment Technique, 2023-2031 ($ Million)

7. Global Deep Brain Stimulation (DBS) For Membrane Separation Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Vagus Nerve Stimulation (VNS) For Membrane Separation Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Sacral Nerve Stimulator(SNS) For Membrane Separation Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Spinal Cord Stimulator (SCS) For Membrane Separation Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Membrane Separation Technology Market Research And Analysis By Application, 2023-2031 ($ Million)

12. Global Membrane Separation Technology For Motor Disorder Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Membrane Separation Technology For Physiological Disorder Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Membrane Separation Technology For Cognitive Disorder Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Membrane Separation Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

16. North American Membrane Separation Technology Market Research And Analysis By Country, 2023-2031 ($ Million)

17. North American Membrane Separation Technology Market Research And Analysis By Type, 2023-2031 ($ Million)

18. North American Membrane Separation Technology Market Research And Analysis By Treatment Technique, 2023-2031 ($ Million)

19. North American Membrane Separation Technology Market Research And Analysis By Application, 2023-2031 ($ Million)

20. European Membrane Separation Technology Market Research And Analysis By Country, 2023-2031 ($ Million)

21. European Membrane Separation Technology Market Research And Analysis By Type, 2023-2031 ($ Million)

22. European Membrane Separation Technology Market Research And Analysis By Treatment Technique, 2023-2031 ($ Million)

23. European Membrane Separation Technology Market Research And Analysis By Application, 2023-2031 ($ Million)

24. Asia-Pacific Membrane Separation Technology Market Research And Analysis By Country, 2023-2031 ($ Million)

25. Asia-Pacific Membrane Separation Technology Market Research And Analysis By Type, 2023-2031 ($ Million)

26. Asia-Pacific Membrane Separation Technology Market Research And Analysis By Treatment Technique, 2023-2031 ($ Million)

27. Asia-Pacific Membrane Separation Technology Market Research And Analysis By Application, 2023-2031 ($ Million)

28. Rest Of The World Membrane Separation Technology Market Research And Analysis By Region, 2023-2031 ($ Million)

29. Rest Of The World Membrane Separation Technology Market Research And Analysis By Type, 2023-2031 ($ Million)

30. Rest Of The World Membrane Separation Technology Market Research And Analysis By Treatment Technique, 2023-2031 ($ Million)

31. Rest Of The World Membrane Separation Technology Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Membrane Separation Technology Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Motor Prosthetics Market Share By Region, 2023 Vs 2031 (%)

3. Global Sensory Prosthetics Market Share By Region, 2023 Vs 2031 (%)

4. Global Cognitive Prosthetics Market Share By Region, 2023 Vs 2031 (%)

5. Global Visual Prosthetics Market Share By Region, 2023 Vs 2031 (%)

6. Global Membrane Separation Technology Market Research And Analysis By Treatment Technique, 2023 Vs 2031 (%)

7. Global Deep Brain Stimulation (DBS) For Membrane Separation Technology Market Share By Region, 2023 Vs 2031 (%)

8. Global Vagus Nerve Stimulation (VNS) For Membrane Separation Technology Market Share By Region, 2023 Vs 2031 (%)

9. Global Sacral Nerve Stimulator (SNS) For Membrane Separation Technology Market Share By Region, 2023 Vs 2031 (%)

10. Global Spinal Cord Stimulator (SCS)For Membrane Separation Technology Market Share By Region, 2023 Vs 2031 (%)

11. Global Membrane Separation Technology Market Research And Analysis By Application, 2023 Vs 2031 (%)

12. Global Membrane Separation Technology For Motor Disorder Market Share By Region, 2023 Vs 2031 (%)

13. Global Membrane Separation Technology For Physiological Disorder Market Share By Region, 2023 Vs 2031 (%)

14. Global Membrane Separation Technology For Cognitive Disorder Market Share By Region, 2023 Vs 2031 (%)

15. Global Membrane Separation Technology Market Share By Region, 2023 Vs 2031 (%)

16. US Membrane Separation Technology Market Size, 2023-2031 ($ Million)

17. Canada Membrane Separation Technology Market Size, 2023-2031 ($ Million)

18. UK Membrane Separation Technology Market Size, 2023-2031 ($ Million)

19. France Membrane Separation Technology Market Size, 2023-2031 ($ Million)

20. Germany Membrane Separation Technology Market Size, 2023-2031 ($ Million)

21. Italy Membrane Separation Technology Market Size, 2023-2031 ($ Million)

22. Spain Membrane Separation Technology Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Membrane Separation Technology Market Size, 2023-2031 ($ Million)

24. India Membrane Separation Technology Market Size, 2023-2031 ($ Million)

25. China Membrane Separation Technology Market Size, 2023-2031 ($ Million)

26. Japan Membrane Separation Technology Market Size, 2023-2031 ($ Million)

27. South Korea Membrane Separation Technology Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Membrane Separation Technology Market Size, 2023-2031 ($ Million)

29. Rest Of The World Membrane Separation Technology Market Size, 2023-2031 ($ Million)

30. Latin America Membrane Separation Technology Market Size, 2023-2031 ($ Million)

31. Middle East And Africa Membrane Separation Technology Market Size, 2023-2031 ($ Million)