Neurorehabilitation Devices Market

Neurorehabilitation Devices Market Size, Share & Trends Analysis by Product (Neurorobotics, Brain-Computer Interface, Non-Invasive Stimulators), by Therapy Area (Stroke, Parkinson’s Disease, Multiple Sclerosis, Cerebral Palsy and Others), and by End-User (Rehabilitation Centers, Hospitals and Clinics, and Homecare) and Forecast Period (2025-2035)

Industry Overview

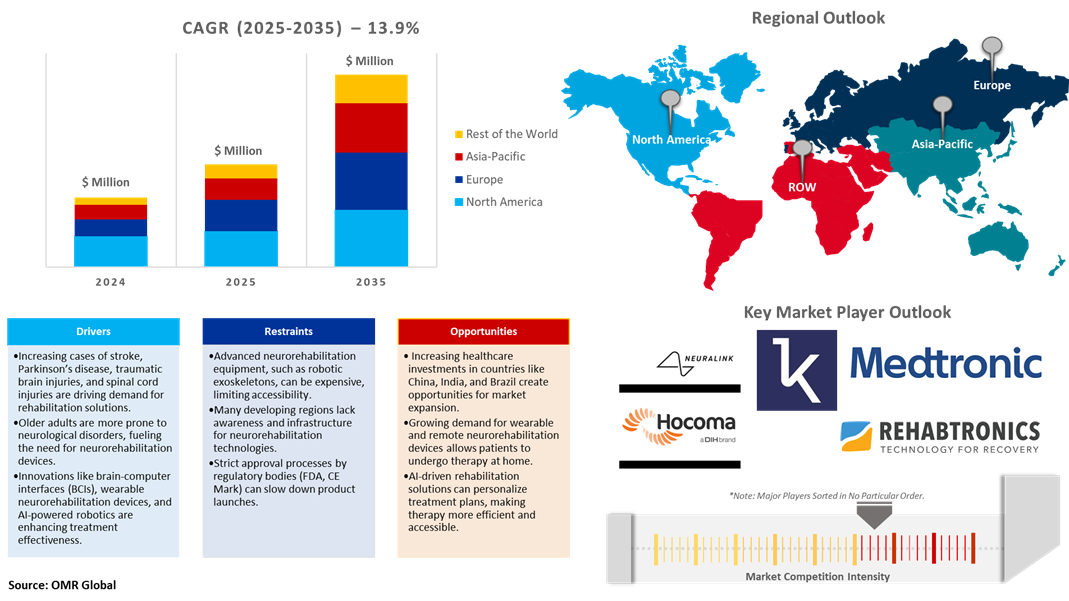

Neurorehabilitation devices market size was $2.1 billion in 2024 and is anticipated to grow at a CAGR of 13.9% during the forecast period (2025-2035). Neurorehabilitation devices refer to a category of medical devices designed to aid in the rehabilitation and recovery of individuals with neurological disorders. The rising prevalence of neurological disorders is anticipated to augment the industry's growth. Globally, one in four individuals faces the risk of experiencing a stroke in their lifetime, as per the World Health Organization (WHO). Additionally, an estimated 1.8 million people will be affected by multiple sclerosis in 2023, while over 10 million individuals suffer from Parkinson's disease globally. Thus, as the incidence of neurological disorders increases globally, there is a growing demand for effective rehabilitation solutions to address the resulting impairments and disabilities, thereby stimulating market growth.

Market Dynamics

Rising Prevalence of Neurological Disorders

The neurorehabilitation devices market is experiencing rapid growth due to the increasing prevalence of neurological disorders such as stroke, Parkinson’s disease, traumatic brain injuries (TBI), and spinal cord injuries. The rising aging population further fuels demand, as older individuals are more susceptible to these conditions. Technological advancements, including robotics, brain-computer interfaces (BCIs), wearable neurorehabilitation devices, and artificial intelligence (AI)-driven therapies, are enhancing treatment outcomes and making rehabilitation more accessible. Additionally, the growing trend toward home-based rehabilitation and telehealth solutions is expanding the market, allowing patients to receive therapy remotely.

Expanding Market for Neurorehabilitation Devices

The neurorehabilitation devices market is undergoing significant expansion, driven by a combination of demographic shifts, technological breakthroughs, and evolving healthcare delivery models. The rising incidence of neurological disorders, including multiple sclerosis, cerebral palsy, and Alzheimer’s disease, is intensifying the demand for advanced rehabilitation solutions. Meanwhile, the integration of AI-powered analytics, virtual reality (VR) therapy, and exoskeleton-assisted rehabilitation is revolutionizing patient care by improving precision and engagement. The shift toward personalized rehabilitation programs, supported by cloud-based data tracking and remote patient monitoring, is further reshaping the industry.

Market Segmentation

- Based on the product, the market is segmented into neurorobotics, brain-computer interfaces, and non-invasive stimulators.

- Based on the therapy area, the market is segmented into stroke, Parkinson’s disease, multiple sclerosis, cerebral palsy, and others.

- Based on the end-user industry, the market is segmented into rehabilitation centers, hospitals and clinics, and home care.

Neurorehabilitation Devices Demand By Neurological Disorder, 2024 (%)

Wearable: A Key Segment in Market Growth

The wearable devices segment is expected to expand at a significant pace in the coming years the wearable devices' unique attributes, such as portability, user-friendliness, and real-time data tracking. These devices, equipped with sensors and connectivity features, enable continuous monitoring and management of neurological conditions, making them an ideal choice for home-based rehabilitation. The multifaceted features powered by virtual assistants and AI technology are projected to create lucrative opportunities for this segment during the projection period.

Regional Outlook

The global neurorehabilitation devices market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the growing aging population, neurological disorders, and the rising disposable income in emerging economies are driving the neurorehabilitation devices market in the Asia Pacific.

North America Region Dominates the Market with Major Share

North American region is anticipated to grow at a considerable CAGR over the forecast period. The primary factor supporting the North American market growth includes the growing aging population, and an increasing number of neurological disorders, which increases the need for neurorehabilitation equipment in North America. In 2022, according to the Centers for Disease Control and Prevention (CDC), every year, more than 795,000 people in the US have a stroke. About 610,000 of these are first or new strokes. About 185,000 strokes nearly 1 in 4 are in people who have had a previous stroke. About 87% of all strokes are ischemic strokes, in which blood flow to the brain is blocked. Every 40 seconds, someone in the US has a stroke. Every 3 minutes and 14 seconds, someone dies of a stroke. Such factors compelled the market players to expand the market in North America. In February 2023, MindMaze launched the Izar neurological rehabilitation device in the US and Europe. Izar is described as a “first-of-its-kind”, US Food and Drug Administration (FDA)-listed and CE-marked smart peripheral for patients with impairment in hand motor function. This proprietary peripheral is part of a comprehensive, omni-site approach to the treatment and maintenance of neurological diseases, including stroke, Parkinson’s disease, Alzheimer’s disease, and traumatic brain injury (TBI), among others.

Market Players Outlook

The major companies serving the neurorehabilitation devices market include Neuralink Corp., Kernel, Inc., Medtronic Plc, Rehabtronics Inc, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2024, Australian company Synchron developed a non-invasive BCI that integrates with devices such as Amazon Alexa and OpenAI's ChatGPT, enabling individuals with severe paralysis to control smart devices through thought alone. This technology has shown promising results in clinical trials, with no adverse effects reported over 12 months.

Recent Development

- In February 2025, the FDA approved Medtronic's adaptive brain pacemaker for treating Parkinson's disease symptoms. This device represents a significant advancement in brain-computer interface technology, adjusting treatment based on the patient's immediate needs and improving quality of life.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neurorehabilitation devices market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Neurorehabilitation Devices Market Sales Analysis – Therapy Area | End-User | Product | Service ($ Million)

• Neurorehabilitation Devices Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Neurorehabilitation Devices Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Neurorehabilitation Devices Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Neurorehabilitation Devices Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Neurorehabilitation Devices Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Neurorehabilitation Devices Market Revenue and Share by Manufacturers

• Neurorehabilitation Devices Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Neuralink Corp.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Kernel, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Medtronic Plc

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Rehabtronics, Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Neurorehabilitation Devices Market Sales Analysis by Product ($ Million)

5.1. Neurorobotics

5.2. Brain-Computer Interface

5.3. Non-Invasive Stimulators

6. Global Neurorehabilitation Devices Market Sales Analysis by Therapy Area ($ Million)

6.1. Stroke

6.2. Parkinson’s Disease

6.3. Multiple Sclerosis

6.4. Cerebral Palsy

6.5. Others

7. Global Neurorehabilitation Devices Market Sales Analysis by End-User ($ Million)

7.1. Rehabilitation Centers

7.2. Hospitals and Clinics

7.3. Homecare

8. Regional Analysis

8.1. North American Neurorehabilitation Devices Market Sales Analysis – Therapy Area | End-User | Product | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Neurorehabilitation Devices Market Sales Analysis – Therapy Area | End-User | Product |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Neurorehabilitation Devices Market Sales Analysis – Therapy Area | End-User | Product |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.3.8. Rest of the World Neurorehabilitation Devices Market Sales Analysis – Therapy Area | End-User | Product |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.3.9. Latin America

8.3.10. Middle East and Africa

9. Company Profiles

9.1. Abbott Laboratories

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. AiM Medical Robots

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BioXtreme Ltd.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Bitbrain Technologies

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Blackrock Neurotech

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Ekso Bionics Holdings, Inc.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. electroCore, Inc

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. EMOTIV, Inc

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Helius Medical Technologies, Inc.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Kernel, Inc.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Kinestica d.o.o.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Medtronic Plc

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. MindMaze Group SA

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Neurable Inc.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Neuralink Corp.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Reha Technology AG

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Rehab-Robotics Co., Ltd.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Rehabtronics Inc.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. ReWalk Robotics Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Saebo, Inc.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Subsense

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

1. Global Neurorehabilitation Devices Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Neurorobotics Devices Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Brain-Computer Interface Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Non-Invasive Stimulators Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Neurorehabilitation Devices Market Research And Analysis By Therapy Area, 2024-2035 ($ Million)

6. Global Neurorehabilitation Devices For Stroke Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Neurorehabilitation Devices For Parkinson’s Disease Market Research And Analysis By Region, 2024-2035 ($ Million

8. Global Neurorehabilitation Devices For Multiple Sclerosis Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Neurorehabilitation Devices For Cerebral Palsy Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Neurorehabilitation Devices For Other Therapy Area Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Neurorehabilitation Devices Market Research And Analysis By End-User, 2024-2035 ($ Million)

12. Global Neurorehabilitation Devices For Rehabilitation Centers Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Neurorehabilitation Devices For Hospitals And Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Neurorehabilitation Devices For Homecare Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Neurorehabilitation Devices Market Research And Analysis By Region, 2024-2035 ($ Million)

16. North American Neurorehabilitation Devices Market Research And Analysis By Country, 2024-2035 ($ Million)

17. North American Neurorehabilitation Devices Market Research And Analysis By Product, 2024-2035 ($ Million)

18. North American Neurorehabilitation Devices Market Research And Analysis By Therapy Area, 2024-2035 ($ Million)

19. North American Neurorehabilitation Devices Market Research And Analysis By End-User, 2024-2035 ($ Million)

20. European Neurorehabilitation Devices Market Research And Analysis By Country, 2024-2035 ($ Million)

21. European Neurorehabilitation Devices Market Research And Analysis By Product, 2024-2035 ($ Million)

22. European Neurorehabilitation Devices Market Research And Analysis By Therapy Area, 2024-2035 ($ Million)

23. European Neurorehabilitation Devices Market Research And Analysis By End-User, 2024-2035 ($ Million)

24. Asia-Pacific Neurorehabilitation Devices Market Research And Analysis By Country, 2024-2035 ($ Million)

25. Asia-Pacific Neurorehabilitation Devices Market Research And Analysis By Product, 2024-2035 ($ Million)

26. Asia-Pacific Neurorehabilitation Devices Market Research And Analysis By Therapy Area, 2024-2035 ($ Million)

27. Asia-Pacific Neurorehabilitation Devices Market Research And Analysis By End-User, 2024-2035 ($ Million)

28. Rest Of The World Neurorehabilitation Devices Market Research And Analysis By Product, 2024-2035 ($ Million

29. Rest Of The World Neurorehabilitation Devices Market Research And Analysis By Therapy Area, 2024-2035 ($ Million)

30. Rest Of The World Neurorehabilitation Devices Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Neurorehabilitation Devices Market Share By Product, 2024 Vs 2035 (%)

2. Global Neurorobotics Devices Market Share By Region, 2024 Vs 2035 (%)

3. Global Brain-Computer Interface Market Share By Region, 2024 Vs 2035 (%)

4. Global Non-Invasive Stimulators Market Share By Region, 2024 Vs 2035 (%)

5. Global Neurorehabilitation Devices Market Share By Therapy Area, 2024 Vs 2035 (%)

6. Global Neurorehabilitation Devices For Stroke Market Share By Region, 2024 Vs 2035 (%)

7. Global Neurorehabilitation Devices For Parkinson’s Disease Market Share By Region, 2024 Vs 2035 (%)

8. Global Neurorehabilitation Devices For Multiple Sclerosis Market Share By Region, 2024 Vs 2035 (%)

9. Global Neurorehabilitation Devices For Cerebral Palsy Market Share By Region, 2024 Vs 2035 (%)

10. Global Neurorehabilitation Devices For Other Therapy Area Market Share By Region, 2024 Vs 2035 (%)

11. Global Neurorehabilitation Devices Market Research And Analysis By End-User, 2024 Vs 2035 (%)

12. Global Neurorehabilitation Devices For Rehabilitation Centers Market Share By Region, 2024 Vs 2035 (%)

13. Global Neurorehabilitation Devices For Hospitals And Clinics Market Share By Region, 2024 Vs 2035 (%)

14. Global Neurorehabilitation Devices For Homecare Market Share By Region, 2024 Vs 2035 (%)

15. Global Neurorehabilitation Devices Market Share By Region, 2024 Vs 2035 (%)

16. US Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

17. Canada Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

18. UK Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

19. France Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

20. Germany Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

21. Italy Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

22. Spain Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

23. Rest Of Europe Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

24. India Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

25. China Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

26. Japan Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

27. South Korea Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

29. Rest Of The World Neurorehabilitation Devices Market Size, 2024-2035 ($ Million)

FAQS

The size of the Neurorehabilitation Devices market in 2024 is estimated to be around $2.1 billion.

North America holds the largest share in the Neurorehabilitation Devices market.

Leading players in the Neurorehabilitation Devices market include Neuralink Corp., Kernel, Inc., Medtronic Plc, Rehabtronics Inc, and others.

Neurorehabilitation Devices market is expected to grow at a CAGR of 13.9% from 2025 to 2035.

Increasing neurological disorders, aging population, and technological advancements are driving neurorehabilitation devices market growth.