Neurovascular Embolization Devices Market

Neurovascular Embolization Devices Market Size, Share & Trends Analysis Report by Product (Embolic Coils and Flow Diversion Devices), and by End-Use (Hospitals and Specialty Clinics), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Neurovascular embolization devices market is anticipated to grow at a CAGR of 6.3% during the forecast period (2023-2030). The market growth is attributed to the increasing prevalence of cerebral aneurysms, and severe risks associated with intracranial aneurysms, such as permanent loss of cognitive functions and neurological disorders. Brain aneurysm is equally prevalent in individuals of all age groups, however individuals 35 years and above are at high risk. According to the Brain Aneurysm Foundation (BAF), an estimated 6.7 million people in the US have an unruptured brain aneurysm or 1 in 50 people. Brain aneurysms are most prevalent in people aged between 35 to 60 years, however it may occur in children as well. Most aneurysms is developed after the age of 40 years. Women are more likely than men to have a brain aneurysm (3:2 ratio). All these factors have compelled manufacturers to introduce novel and cutting-edge neurovascular embolization devices and rising Food and Drug Administration (FDA) clearance globally. For instance, in March 2022, Artio Medical, Inc., a medical device company developing innovative products for the peripheral vascular, neurovascular, and cardiology markets, received US FDA clearance for its solus gold embolization device, a next-generation product for peripheral vascular occlusion.

Segmental Outlook

The global neurovascular embolization devices market is segmented on the product, and end-use. Based on the product, the market is sub-segmented into embolic coils and flow diversion devices. Further, based on end-use, the market is sub-segmented into hospitals and specialty clinics. Among the end-use, the hospitals sub-segment is anticipated to hold a considerable share of the market, owing to the easy availability, offer flexible scheduling options, appealing to individuals with busy lifestyles who are seeking quick and effective treatments.

Embolic Coils Sub-Segment is Anticipated to Hold a Considerable Share of the Global Neurovascular embolization devices Market

Among the products, the embolic coils sub-segment is expected to hold a considerable share of the global neurovascular embolization devices market, owing to the allowing treatment of cerebral aneurysms that previously were considered inoperable. As per the study published by Beaumont Health System, coil embolization of small aneurysms with small neck has better results than embolization of large or giant aneurysm with wide necks. Long term follow up has shown permanent success in more than 80% of aneurysms treated with coil embolization. The advancements in the products designed for the treatment of neurological disorders developed by the industry market players drive the growth of the market. For instance, in July 2023, Boston Scientific Corp., launched its Embold soft and packing coils for minimally invasive peripheral embolization procedures. Similarly, in June 2023, the US FDA cleared the coils. Embold coils contain a delivery mechanism that allows users to detach the coil easily.

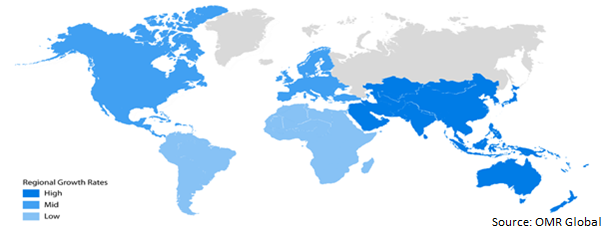

Regional Outlook

The global neurovascular embolization devices market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific region is anticipated to hold a prominent share of the market around the globe, owing to the growing aging population, neurological disorders, and the rising disposable income in emerging economies are driving the market growth in the Asia-Pacific.

Global Neurovascular embolization devices Market Growth, by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the Global Neurovascular Embolization Devices Market

Among all the regions, the North America region is anticipated to grow at a considerable CAGR over the forecast period. The primary factor supporting the regional market growth includes the growing the aging population, increasing incidence of neurovascular diseases such as brain aneurysm, carotid stenosis, and stroke, which increases the requirement of neurovascular embolization devices in Noth America. According to the Centers for Disease Control and Prevention (CDC), in 2022, yearly more than 795,000 people in the US encountered with a stroke. About 610,000 of these are first or new strokes. About 185,000 strokes nearly 1 in 4 are in people who have had a previous stroke. About 87.0% of all strokes are ischemic strokes, in which blood flow to the brain is blocked. Every 40 seconds, someone in the US has a stroke. Every 3 minutes and 14 seconds, someone dies of a stroke.

Market Players Outlook

The major companies serving the global neurovascular embolization devices market include B. Braun Melsungen AG, Cerenovus Inc., Medtronic plc, Stryker Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2023, Fluidx Medical Technology, Inc. released the IMPASS Embolic Device in in-vivo research related to middle meningeal artery (MMA) embolization which can be used to treat chronic subdural hematomas (CSDH) on the surface of the brain.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global neurovascular embolization devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. B. Braun Melsungen AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cerenovus Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Medtronic plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Stryker Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Neurovascular Embolization Devices Market by Product

4.1.1. Embolic Coils

4.1.2. Flow Diversion Devices

4.2. Global Neurovascular Embolization Devices Market by End-Use

4.2.1. Hospitals

4.2.2. Specialty Clinics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Acandis GmbH

6.2. Balt Extrusion SA

6.3. Boston Scientific Corp.

6.4. DePuy Synthes (Johnson & Johnson Services, Inc.)

6.5. Integra Lifesciences Holdings Corp.

6.6. MicroVention Inc.

6.7. Penumbra Inc.

6.8. Phenox GmbH

6.9. Resonetics LLC

6.10. Spartan Micro, Inc.

6.11. Terumo Medical Corp.

1. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

2. GLOBAL NEUROVASCULAR EMBOLIC COILS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL FLOW DIVERSION NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

5. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES FOR SPECIALTY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. NORTH AMERICAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

9. NORTH AMERICAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

10. NORTH AMERICAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

11. EUROPEAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. EUROPEAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

13. EUROPEAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

17. REST OF THE WORLD NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. REST OF THE WORLD NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

19. REST OF THE WORLD NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

1. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES MARKET SHARE BY PRODUCT, 2022 VS 2030 (%)

2. GLOBAL NEUROVASCULAR EMBOLIC COILS MARKET SHARE, 2022 VS 2030 (%)

3. GLOBAL FLOW DIVERSION NEUROVASCULAR EMBOLIZATION DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022 VS 2030 (%)

5. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES FOR HOSPITALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES FOR SPECIALTY CLINICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL NEUROVASCULAR EMBOLIZATION DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. US NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

9. CANADA NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

10. UK NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

11. FRANCE NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

12. GERMANY NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

13. ITALY NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

14. SPAIN NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

15. REST OF EUROPE NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

16. INDIA NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

17. CHINA NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

18. JAPAN NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

19. SOUTH KOREA NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF ASIA-PACIFIC NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF THE WORLD NEUROVASCULAR EMBOLIZATION DEVICES MARKET SIZE, 2022-2030 ($ MILLION)