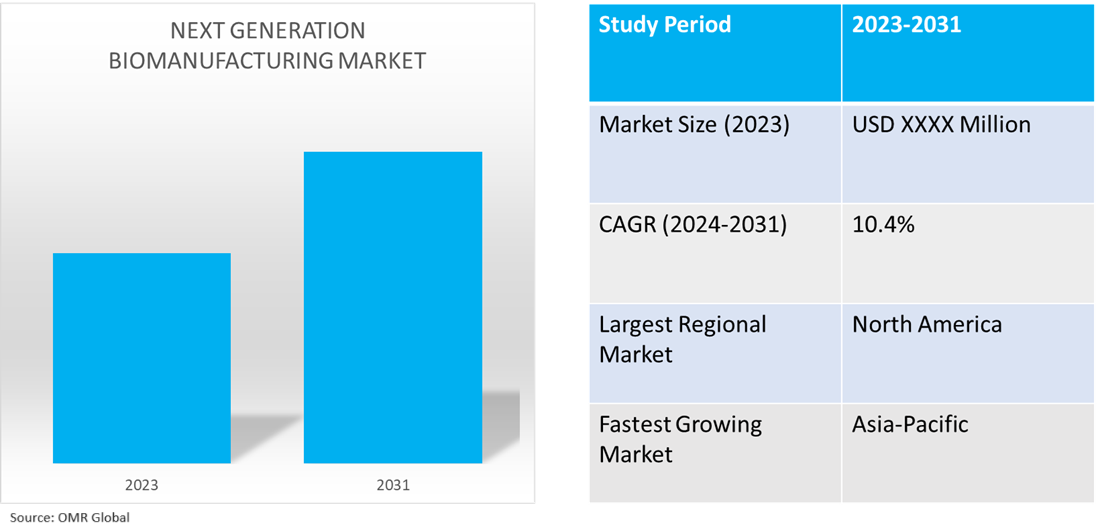

Next-Generation Biomanufacturing Market

Next-Generation Biomanufacturing Market Size, Share & Trends Analysis Report by Manufacturing Type (Upstream Manufacturing, and Downstream Manufacturing), by Product Type Biopharmaceuticals, Vaccines, Biofuels, Biopolymers, and Others (Recombinant Proteins, Monoclonal Antibodies)), and by End-User (Pharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Contract Development and Manufacturing Organizations (CDMOs), and Others (Biotechnology Companies, Research and Academic Institutions) Forecast Period (2024-2031)

Next-generation biomanufacturing market is anticipated to grow at a CAGR of 10.4% during the forecast period (2024-2031). Next-generation biomanufacturing involves an advanced approach to producing biological products, including pharmaceuticals, biofuels, and other biotechnological products, leveraging cutting-edge technologies and innovation. Further, the market is expected to experience significant growth in the future attributed to the growing demand for biopharmaceuticals, a supportive regulatory environment for industry development, and the growing integration of AI (Artificial Intelligence), ML (Machine Learning), and digital technologies.

Market Dynamics

Growing Demand for Biopharmaceuticals

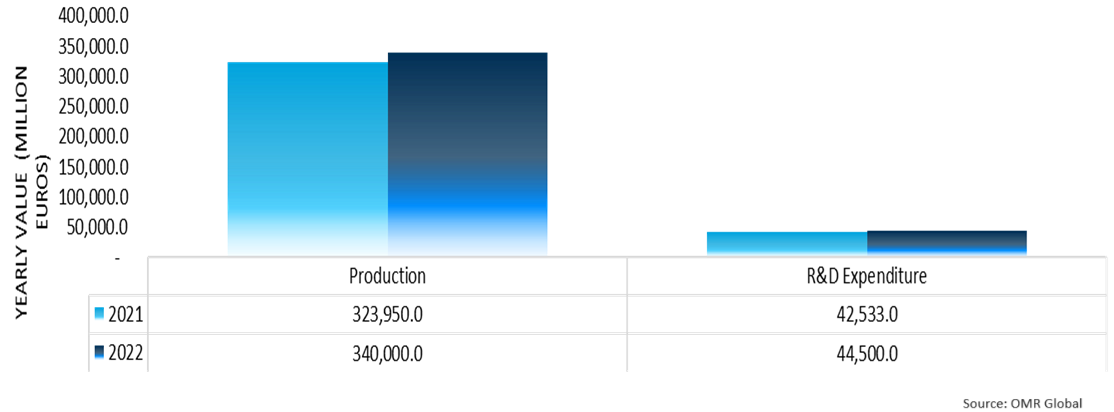

The increasing demand for biopharmaceuticals is anticipated to significantly drive the growth of the next-generation biomanufacturing market. Biopharmaceuticals encompass monoclonal antibodies, recombinant proteins, and gene therapies, and play a crucial role in the treatment of various diseases, including cancer, autoimmune disorders, and rare genetic conditions. The increasing prevalence of these diseases worldwide, coupled with a rise in the approval of biosimilars and advancements in drug discovery, is accelerating the expansion of the biomanufacturing sector. Additionally, the market is actively integrating next-generation solutions, such as continuous manufacturing and single-use technologies, into existing production processes to enhance cost-effectiveness and efficiency, which are collectively expected to benefit the market. For instance, as reported by the European Federation of Pharmaceutical Industries and Associations, the pharmaceutical market in Europe is experiencing significant growth. The market's production value has risen from $317,069 million in 2020 to $371,341 million in 2022, reflecting an increase of 14.3%. Furthermore, in 2022, pharmaceutical research firms allocated approximately $48,608 million towards R&D in Europe.

European Pharmaceutical Industry Figures, 2021 & 2022 (€ Million)

Source - European Federation of Pharmaceutical Industries and Associations

Commercialization of Cell & Gene Therapy

The commercialization of cell and gene therapies is significantly supporting the market growth. These treatments necessitate a highly specialized manufacturing process that involves accurate gene modifications and tailored cell preparations, thereby driving advancements and expansion in biomanufacturing technologies. Additionally, the increasing discovery and regulatory approvals are gaining momentum owing to the favorable clinical outcomes of these therapies and the anticipated therapeutic advancements in the field, which are further propelling growth in the next-generation biomanufacturing market. For instance, in October 2022, Lonza, a prominent global manufacturing partner serving the pharmaceutical, biotech, and nutrition sectors, announced that its two additional cell and gene therapies produced at its Houston facility in the US have achieved commercial approval in the third quarter of 2022. ZYNTEGLO, designed for the treatment of transfusion-dependent beta-thalassemia, and SKYSONA, intended for the treatment of early, active cerebral adrenoleukodystrophy, are both developed by Bluebird Bio, located in Somerville, Massachusetts, and received approval in August and September, respectively. These regulatory approvals mark the second and third commercial approvals for cell and gene therapies facilitated by Lonza's Houston facility.

Segmental Outlook

- Based on manufacturing type, the market is segmented into upstream manufacturing and downstream manufacturing.

- Based on product type, the market is segmented into biopharmaceuticals, vaccines, biofuels, biopolymers, and others (recombinant proteins, monoclonal antibodies).

- Based on end-users, the market is segmented into pharmaceutical companies, contract manufacturing organizations (CMOs), contract development and manufacturing organizations (CDMOs), and others (biotechnology companies, research, and academic institutions).

Upstream Manufacturing is the Preferred Manufacturing Type

Upstream manufacturing is the preferred manufacturing type in the next-generation biomanufacturing market owing to its pivotal role in cell culture and the production of biologics. This phase involves optimizing cell lines and bioreactor conditions and is crucial for generating high-quality, large-scale biological products such as proteins and vaccines. Further, the segmental growth is driven by factors such as advancements in bioreactor technology, improved media formulations, and the increasing demand for personalized medicine and biologics.

Contract Development and Manufacturing Organizations (CDMOs) are the Biggest End-User

Contract development and manufacturing organizations (CDMOs) are the biggest end users in the next-generation biomanufacturing market. Their key role in both the development and large-scale production of biopharmaceuticals makes them essential for efficiently bringing new biologics and advanced therapies to market. Further, the segmental growth is driven by increasing demand for personalized medicine, the need for scalable production solutions, and the rising complexity of biologics.

Regional Outlook

The global next-generation biomanufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America is projected to dominate the Global Next-Generation Biomanufacturing Market

North America is projected to deliver the highest growth rate in the future, attributed to the ongoing expansion of advanced biomanufacturing capabilities in the region, increasing investments in biotechnology and biomanufacturing sectors, a strong R&D ecosystem, growing demand for personalized medicine, a supportive market ecosystem in the region, and the presence of major next-generation biomanufacturing companies such as AstraZeneca, Amgen, and Genentech, among others. For instance, in September 2022, the fact sheet released by the White House outlined substantial investments and initiatives designed to propel President Biden's National Biotechnology and Biomanufacturing Initiative forward. Among the key points is a $2.0 billion allocation intended to enhance biomanufacturing capabilities, promote R&D, and facilitate the establishment of advanced manufacturing facilities. This initiative is centered on fortifying the domestic biomanufacturing industry, expediting innovation in biotechnology, and ensuring a robust supply chain for essential biological products. By encouraging collaboration among government, industry, and academic institutions, the initiative seeks to establish the US as a frontrunner in biotechnology and bolster the nation's preparedness for future health crises.

Global Next-Generation Biomanufacturing Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing in Next-Generation Biomanufacturing Market

- Asia-Pacific countries, including India, Vietnam, and China, are significantly investing in biotechnology and biomanufacturing infrastructure through both the public and private sectors, fueling rapid growth for the market in the region.

- The rising prevalence of chronic diseases and the growing demand for advanced therapies in Asia-Pacific are expected to drive the need for more sophisticated biomanufacturing solutions.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order*.

The major companies serving the global next-generation biomanufacturing market include Amgen Inc., AstraZeneca, and Genentech, Inc. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others.

Recent Development

- In November 2023, AstraZeneca revealed a partnership and investment agreement with Cellectis, a biotechnology firm currently in the clinical stage, aimed at expediting the advancement of next-generation therapeutics in critical areas with significant unmet medical needs, such as oncology, immunology, and rare diseases. According to the terms of this collaboration, AstraZeneca will utilize Cellectis's proprietary gene editing technologies and manufacturing expertise to create innovative cell and gene therapy products, thereby enhancing AstraZeneca's expanding portfolio in this domain. Additionally, the agreement stipulates that 25 genetic targets have been exclusively allocated to AstraZeneca, from which up to 10 candidate products may be considered for development.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global next-generation biomanufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Next-Generation Biomanufacturing Market by Manufacturing Type

4.1.1. Upstream Manufacturing

4.1.2. Downstream Manufacturing

4.2. Global Next-Generation Biomanufacturing Market by Product Type

4.2.1. Biopharmaceuticals

4.2.2. Vaccines

4.2.3. Biofuels

4.2.4. Biopolymers

4.2.5. Others (Recombinant Proteins, Monoclonal Antibodies)

4.3. Global Next-Generation Biomanufacturing Market by End-User

4.3.1. Pharmaceutical Companies

4.3.2. Contract Manufacturing Organizations (CMOs)

4.3.3. Contract Development and Manufacturing Organizations (CDMOs)

4.3.4. Others (Biotechnology Companies, Research, and Academic Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Allogene Therapeutics

6.2. Amgen Inc.

6.3. AstraZeneca

6.4. Azenta US, Inc.

6.5. BioMarin

6.6. Bio-Techne

6.7. Boehringer Ingelheim International GmbH.

6.8. Bluebird Bio, Inc.

6.9. BSP Pharmaceuticals S.p.A

6.10. Catalent, Inc.

6.11. Charles River Laboratories

6.12. Genentech, Inc.

6.13. Ginkgo Bioworks, Inc.

6.14. Global Life Sciences Solutions USA LLC

6.15. Jubilant Biosys Ltd.

6.16. KBI Biopharma, Inc.

6.17. Lonza

6.18. NantKwest, Inc.

6.19. Recipharm AB

6.20. Samsung Biologics

6.21. Thermo Fisher Scientific Inc.

6.22. WuXi Biologics Co., Ltd

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Next-Generation Biomanufacturing Market by Manufacturing Type

4.1.1. Upstream Manufacturing

4.1.2. Downstream Manufacturing

4.2. Global Next-Generation Biomanufacturing Market by Product Type

4.2.1. Biopharmaceuticals

4.2.2. Vaccines

4.2.3. Biofuels

4.2.4. Biopolymers

4.2.5. Others (Recombinant Proteins, Monoclonal Antibodies)

4.3. Global Next-Generation Biomanufacturing Market by End-User

4.3.1. Pharmaceutical Companies

4.3.2. Contract Manufacturing Organizations (CMOs)

4.3.3. Contract Development and Manufacturing Organizations (CDMOs)

4.3.4. Others (Biotechnology Companies, Research, and Academic Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Allogene Therapeutics

6.2. Amgen Inc.

6.3. AstraZeneca

6.4. Azenta US, Inc.

6.5. BioMarin

6.6. Bio-Techne

6.7. Boehringer Ingelheim International GmbH.

6.8. Bluebird Bio, Inc.

6.9. BSP Pharmaceuticals S.p.A

6.10. Catalent, Inc.

6.11. Charles River Laboratories

6.12. Genentech, Inc.

6.13. Ginkgo Bioworks, Inc.

6.14. Global Life Sciences Solutions USA LLC

6.15. Jubilant Biosys Ltd.

6.16. KBI Biopharma, Inc.

6.17. Lonza

6.18. NantKwest, Inc.

6.19. Recipharm AB

6.20. Samsung Biologics

6.21. Thermo Fisher Scientific Inc.

6.22. WuXi Biologics Co., Ltd

1. Global Next-Generation Biomanufacturing Market Share By Manufacturing Type, 2023 Vs 2031 (%)

2. Global Next-Generation Upstream Biomanufacturing Market Share By Region, 2023 Vs 2031 (%)

3. Global Next-Generation Downstream Biomanufacturing Market Share By Region, 2023 Vs 2031 (%)

4. Global Next-Generation Biomanufacturing Market Share By Product Type, 2023 Vs 2031 (%)

5. Global Next-Generation Biomanufacturing For Biopharmaceuticals Market Share By Region, 2023 Vs 2031 (%)

6. Global Next-Generation Biomanufacturing For Vaccines Market Share By Region, 2023 Vs 2031 (%)

7. Global Next-Generation Biomanufacturing For Biofuels Market Share By Region, 2023 Vs 2031 (%)

8. Global Next-Generation Biomanufacturing For Biopolymers Market Share By Region, 2023 Vs 2031 (%)

9. Global Next-Generation Biomanufacturing For Other Product Type Market Share By Region, 2023 Vs 2031 (%)

10. Global Next-Generation Biomanufacturing Market Share By End-User, 2023 Vs 2031 (%)

11. Global Next-Generation Biomanufacturing For Pharmaceutical Companies Market Share By Region, 2023 Vs 2031 (%)

12. Global Next-Generation Biomanufacturing For Contract Manufacturing Organizations (CMOS) Market Share By Region, 2023 Vs 2031 (%)

13. Global Next-Generation Biomanufacturing For Contract Development And Manufacturing Organizations (CDMOS) Market Share By Region, 2023 Vs 2031 (%)

14. Global Next-Generation Biomanufacturing For Other End-User Market Share By Region, 2023 Vs 2031 (%)

15. Global Next-Generation Biomanufacturing Market Share By Region, 2023 Vs 2031 (%)

16. US Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

17. Canada Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

18. UK Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

19. France Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

20. Germany Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

21. Italy Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

22. Spain Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

24. India Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

25. China Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

26. Japan Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

27. South Korea Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

29. Latin America Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)

30. Middle East And Africa Next-Generation Biomanufacturing Market Size, 2023-2031 ($ Million)