Next Generation Cancer Diagnostics Market

Next Generation Cancer Diagnostics Market by Technology (Next Generation Sequencing, QPCR and Multiplexing, Protein Microarrays, DNA Microarrays, and Others), by Application (Biomarker Development, Proteomic Analysis, Cancer Screening, and Others) by End-User (Hospital, Clinics and Research Centers) – Global Trends, Industry Size, Share, Growth, and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Next generation cancer diagnostics market is expected to grow at a significant rate during the forecast period 2019-2025. Next-generation sequencing is used as a cancer diagnostic tool for analyzing genome sequences in cancer. The technique uses several technologies for diagnosis of cancer, including protein microarrays, DNA microarrays, next-generation sequencing, and lab-on-a-chip & reverse transcriptase-PCR (RT-PCR), among others.

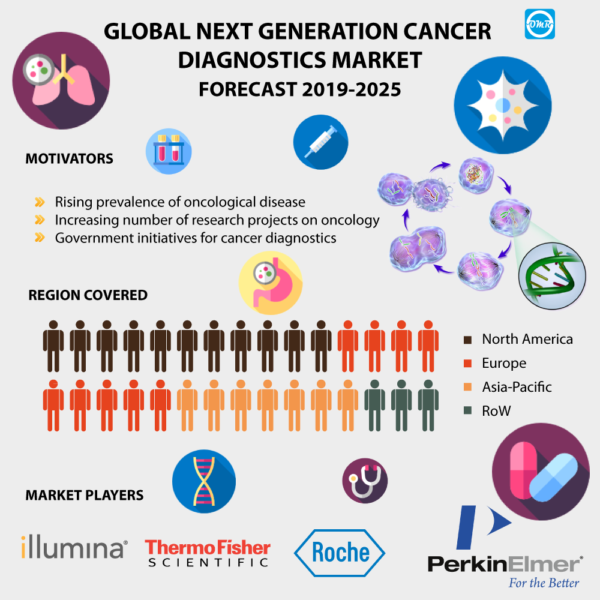

The rising number of research projects on oncology due to the increasing prevalence of oncological disorders across the globe is one of the major factors driving the growth of the market. Increasing demand for personalized medicine along with the rising deployment of tumor diagnostics in CTC analysis is further propelling the market growth. Moreover, government initiatives in the development of advanced techniques for cancer diagnostics are positively impacting market growth.

The global next-generation cancer diagnostics market is further analyzed on the basis geographical regions, including North America, Europe, Asia-Pacific and Rest of the World. North America held a dominant position in the global next-generation cancer diagnostics market in 2018. North America has a well-developed healthcare infrastructure that contributes to its growth. In addition, favorable government initiatives further contribute to the growth of the market in this region. Moreover, the increasing demand for personalized medicine for companion diagnostics drives the growth of the market in the region. Asia-Pacific is projected to exhibit the fastest growth in the global next-generation cancer diagnostics market during the forecast period. Rapidly developing healthcare infrastructure and rising medical tourism are some of the factors that are propelling the market growth in the region.

The key players operating in the global next-generation cancer diagnostics market include Agilent Technologies, Inc., Biospherex LLC, Cepheid, F. Hoffmann-La Roche Ltd, General Electric Co., Lunaphore Technologies S.A., QIAGEN N.V., and Thermo Fisher Scientific Inc., among others. The companies are focused on developing advanced technologies in next-generation cancer diagnostics market to stay competitive in the global market. Geographical expansion, merger & acquisition, partnerships & collaborations, finding a new market or innovate in their core competency in order to expand individual market share are some of the key strategies adopted by major market players. For instance, in February 2019, Lunaphore Technologies S.A. launched a LabSat TM, which is advanced next-generation equipment for tissue diagnostics and cancer research.

Research Methodology:

The market study of the global next-generation cancer diagnostics market is incorporated by extensive primary and secondary research conducted by a research team at OMR. Secondary research has been conducted to refine the available data to break down the market in various segments, derive total market size, market forecast, and growth rate. Different approaches have been worked on to derive the market value and market growth rate. Our team collects facts and data related to the market from different geography to provide a better regional outlook. In the report, the country-level analysis is provided by analyzing various regional players, regional tax laws and policies, consumer behavior and macroeconomic factors. Numbers extracted from secondary research have been authenticated by conducting proper primary research. It includes tracking down key people from the industry and interviewing them to validate the data. This enables our analyst to derive the closest possible figures without any major deviations in the actual number. Our analysts try to contact as many executives, managers, key opinion leaders, and industry experts. Primary research brings the authenticity of our reports.

Secondary Sources Include:

- Financial reports of companies involved in the market

- Authentic Public Databases such as National Center for Biotechnology Information (NCBI)

- Whitepapers, research-papers and news blogs

- Company websites and their product catalog.

The report is intended for biotechnology companies, research organizations, investment companies, government organizations for overall market analysis and competitive analysis. The report will serve as a source for 360-degree analysis of the market thoroughly delivering insights into the market for better business decisions.

Market Segmentation:

- Global Next Generation Cancer Diagnostics Market Research and Analysis by Technology

- Global Next Generation Cancer Diagnostics Market Research and Analysis by Application

- Global Next Generation Cancer Diagnostics Market Research and Analysis by End-User

The Report Covers:

- Comprehensive research methodology of the global next-generation cancer diagnostics market.

- This report also includes a detailed and extensive market overview with key analyst insights.

- An exhaustive analysis of macro and micro factors influencing the market guided by key recommendations.

- Analysis of regional regulations and other government policies impacting the global next-generation cancer diagnostics market.

- Insights about market determinants which are stimulating the global next-generation cancer diagnostics market.

- Detailed and extensive market segments with regional distribution of forecast revenues.

- Extensive profiles and recent developments of market players.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. F. Hoffmann-La Roche Ltd

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Illumina, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. PerkinElmer Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Thermo Fisher Scientific Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Next Generation Cancer Diagnostics Market by Technology

5.1.1. Next Generation Sequencing

5.1.2. QPCR & Multiplexing

5.1.3. Protein Microarrays

5.1.4. DNA Microarrays

5.1.5. Others (Lab-on- a- chip & Reverse Transcriptase-PCR (RT-PCR))

5.2. Global Next Generation Cancer Diagnostics Market by Application

5.2.1. Biomarker Development

5.2.2. Proteomic Analysis

5.2.3. Cancer Screening

5.2.4. Others (CTC Analysis)

5.3. Global Next Generation Cancer Diagnostics Market by End-User

5.3.1. Hospitals & Clinics

5.3.2. Research Centers

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Agilent Technologies, Inc.

7.2. Almac Group Ltd.

7.3. Biodesix, Inc.

7.4. Biospherex LLC

7.5. Cepheid

7.6. Cernostics, Inc.

7.7. F. Hoffmann-La Roche Ltd

7.8. General Electric Co.

7.9. Genomic Health, Inc.

7.10. Illumina, Inc.

7.11. Lunaphore Technologies S.A.

7.12. Metabiomics Corp.

7.13. Myriad Genetics, Inc.

7.14. Novartis International AG

7.15. OPKO Health Inc.

7.16. PerkinElmer Inc.

7.17. Personalis Inc.

7.18. QIAGEN N.V.

7.19. Sysmex Corp.

7.20. Thermo Fisher Scientific Inc.

1. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

2. GLOBAL NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL QPCR & MULTIPLEXING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PROTEIN MICROARRAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL DNA MICROARRAYS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

8. GLOBAL BIOMARKER DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PROTEOMICS ANALYSIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL CANCER SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. GLOBAL HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL RESEARCH CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. NORTH AMERICAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. EUROPEAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

22. EUROPEAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. EUROPEAN NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

28. REST OF THE WORLD NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

29. REST OF THE WORLD NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD NEXT GENERATION CANCER DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

2. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET SHARE BY END-USERS, 2018 VS 2025 (%)

4. GLOBAL NEXT GENERATION CANCER DIAGNOSTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD NEXT GENERATION CANCER DIAGNOSTICS MARKET SIZE, 2018-2025 ($ MILLION)