Next Generation Sequencing Market

Global Next Generation Sequencing Market Size, Share & Trends Analysis Report by Product Type (Reagents and Kits, Instruments, and Services), by Technology (Pyrosequencing, Sequencing by Synthesis (SBS), Sequencing by Ligation (SBL), Whole Genome Sequencing, RNA Sequencing, Targeted Resequencing, and Others), by Application (Drug Discovery, Genomic Research, Disease Diagnostics, Personalized Medicine, and Others) and by End-User (Academic and Clinical Research Centers, Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CRO), Hospitals and Clinics) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global next generation sequencing market is growing significantly, at a CAGR of around 16.4% during the forecast period (2019-2025). Next generation sequencing, also known as high-throughput sequencing technology is used to produce multiple sequence reaction in a cost-effective and rapid manner. The advent of next generation sequencing has led various collaborative projects, such as the MetaHIT and HMP using next generation sequencing as a foundational tool. Next generation sequencing holds the ability to screen more samples effectively and enables the sequencing of millions of fragments in a single run. This, in turn, is contributing to the growth of the next generation sequencing market.

There are various pivotal factors that are driving the global next generation sequencing market, which includes the continuous decrease in the cost of genetic sequencing and increasing demand for personalized medicine. As per the Personalized Medicine Coalition (PMC) 2017 report, around 42% of all compounds and around 73% of oncology compounds in the pipeline have the potential to be included in personalized medicines. Along with this, the integration of big data and substantial support from governmental bodies regarding large-scale sequencing are certain factors that are expected to offer growth opportunity to the market during the forecast period.

Segmental Outlook

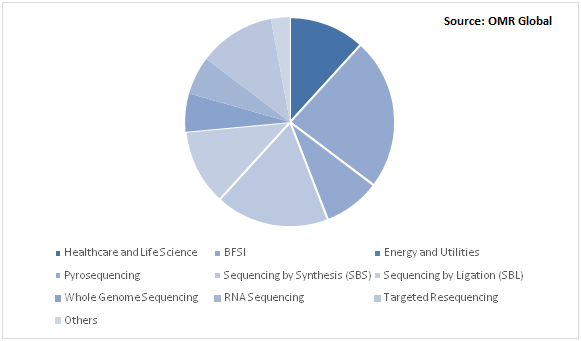

The next generation sequencing market is classified on the basis of product type, technology, application, and end-user. Based on product type, the market is segregated into reagents and kits, instruments, and services. Based on the technology, the market is segmented into pyrosequencing, sequencing by synthesis (SBS), sequencing by ligation (SBL), whole genome sequencing, RNA sequencing, targeted resequencing, and others. Based on application, the market is segmented into drug discovery, genomic research, disease diagnostics, personalized medicine, and others. Based on end-user, the market is segmented into academic and clinical research centers, pharmaceutical and biotechnology companies, contract research organizations (CRO), and hospitals and clinics.

Global Next Generation Sequencing Market Share by Vertical, 2018 (%)

Global next generation sequencing market to be driven by Sequencing by Synthesis (SBS) technology

SBS technology is primarily adopted in the next generation sequencing, as it delivers accurate and robust performance and base-by-base sequencing across the genome. SBS approach is used by Illumina, Inc. and was originally developed at the University of Cambridge. The company has acquired and improved the original technology. According to the company, SBS technology is a highly adopted NGS technology globally. The technology is responsible for generating over 90% of the global sequencing data. It supports both paired-end and single-end libraries and provides a short-insert paired-end capability. This enables high-resolution genome sequencing and long-insert paired-end reads enable proper sequence assembly, such as de novo sequencing that involves novel genome sequencing.

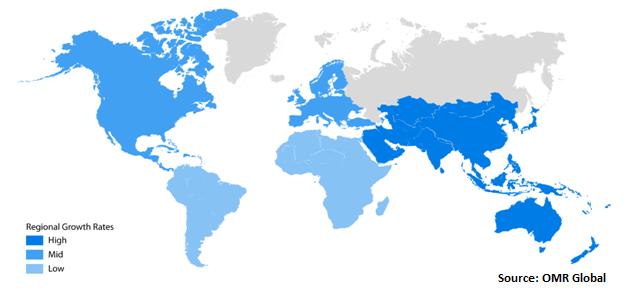

Regional Outlook

The global next generation sequencing market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World.North Americais estimated to have considerable market share in the global next generation sequencing market. The major countries which contributesin the North Americanmarket growth includes the US. The well-developed healthcare infrastructure and significant government healthcare spending is promoting R&D of such advanced technology across the region thereby promoting the growth of the market. In addition, the presence of key market players, such as Thermo Fisher Scientific Inc. and Illumina, Inc., is another major factor that drives the market growth in the region.

Global Next generation sequencing Market Growth, by Region 2019-2025

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is expected to project a considerable growth in the global next generation sequencing market. This growth can be attributed to the increasing R&D projects in cancer and other biomedical research, various collaborations with research institutes, and superior healthcare infrastructure in major economies such as China and Japan. There is an increasing demand for highly efficient screening systems and rising drug discovery initiatives among pharmaceuticals and biotechnology companies in the region. Despite of economic slowdown in some countries such as India, the increasing public healthcare programs is expected to boost the healthcare spending of the region.

Market Players Outlook

The key players in the next generation sequencing market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global next generation sequencing market include Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences of California, Inc., F. Hoffmann-La Roche Ltd., and Qiagen N.V. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global next generation sequencing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Illumina, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Thermo Fisher Scientific, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Pacific Biosciences of California, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. F. Hoffmann-La Roche Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Qiagen N.V.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Next Generation Sequencing Market by Product Type

5.1.1. Reagents and Kits

5.1.2. Instruments

5.1.3. Services

5.2. Global Next Generation Sequencing Market by Technology

5.2.1. Pyrosequencing

5.2.2. Sequencing by Synthesis (SBS)

5.2.3. Sequencing by Ligation (SBL)

5.2.4. Whole Genome Sequencing

5.2.5. RNA Sequencing

5.2.6. Targeted Resequencing

5.2.7. Others (Methyl Sequencing)

5.3. Global Next Generation Sequencing Market by Application

5.3.1. Drug Discovery

5.3.2. Genomic Research

5.3.3. Disease Diagnostics

5.3.4. Personalized Medicine

5.3.5. Others (Agricultural and Animal Research)

5.4. Global Customer Next Generation Sequencing Market by End-User

5.4.1. Academic and Clinical Research Centers

5.4.2. Pharmaceutical and Biotechnology Companies

5.4.3. Contract Research Organizations (CRO)

5.4.4. Hospitals and Clinics

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 10x Genomics, Inc.

7.2. Agilent Technologies, Inc.

7.3. Agilent Technologies, Inc.

7.4. Becton, Dickinson and Co.

7.5. BGI Group

7.6. CD Genomics

7.7. CeGaT GmbH

7.8. Charles River Laboratories International, Inc.

7.9. F. Hoffmann-La Roche Ltd.

7.10. GENEWIZ

7.11. Illumina, Inc.

7.12. Macrogen, Inc.

7.13. Novogene Corp.

7.14. Oxford Nanopore Technologies Ltd.

7.15. Pacific Biosciences of California, Inc.

7.16. PerkinElmer Inc.

7.17. Phalanx Biotech Group

7.18. Qiagen N.V.

7.19. Thermo Fisher Scientific, Inc.

7.20. Xcelris Genomics

1. GLOBAL NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL REGAENTS AND KITS FOR NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INSTRUMENTS FOR NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SERVICES FOR NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

6. GLOBAL PYROSEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL SEQUENCING BY SYNTHESIS (SBS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL SEQUENCING BY LIGATION (SBL) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL WHOLE GENOME SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL RNA SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL TARGETED RESEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL OTHER NEXT GENERATION SEQUENCING TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. GLOBAL NEXT GENERATION SEQUENCING IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL NEXT GENERATION SEQUENCING IN GENOMIC RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL NEXT GENERATION SEQUENCING IN DISEASE DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL NEXT GENERATION SEQUENCING IN PERSONALIZED MEDICINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL NEXT GENERATION SEQUENCING IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

19. GLOBAL NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. GLOBAL ACADEMIC AND CLINICAL RESEARCH CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

21. GLOBAL PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

22. GLOBAL CONTRACT RESEARCH ORGANIZATIONS (CRO) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

23. GLOBAL HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

24. GLOBAL NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

25. NORTH AMERICAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. NORTH AMERICAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

27. NORTH AMERICAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

28. NORTH AMERICAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

29. NORTH AMERICAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

30. EUROPEAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

31. EUROPEAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

32. EUROPEAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

33. EUROPEAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

34. EUROPEAN NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

35. ASIA-PACIFIC NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

36. ASIA-PACIFIC NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

37. ASIA-PACIFIC NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

38. ASIA-PACIFIC NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

39. ASIA-PACIFIC NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

40. REST OF THE WORLD NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

41. REST OF THE WORLD NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

42. REST OF THE WORLD NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

43. REST OF THE WORLD NEXT GENERATION SEQUENCING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL NEXT GENERATION SEQUENCING MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL NEXT GENERATION SEQUENCING MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

3. GLOBAL NEXT GENERATION SEQUENCING MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL NEXT GENERATION SEQUENCING MARKET SHARE BY END-USER, 2018 VS 2025 (%)

5. GLOBAL NEXT GENERATION SEQUENCING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

6. USNEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

7. CANADA NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

8. UKNEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

9. FRANCE NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

10. GERMANY NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

11. ITALY NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

12. SPAIN NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

13. ROE NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

15. CHINA NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

16. JAPAN NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF ASIA-PACIFIC NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)

18. REST OF THE WORLD NEXT GENERATION SEQUENCING MARKET SIZE, 2018-2025 ($ MILLION)