Next-Generation Solar Cell Market

Next-Generation Solar Cell Market Size, Share & Trends Analysis Report by Material Type (Transceivers, Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Amorphous Silicon (a-Si), Gallium-Arsenide (GaAs) and Others), by Installation (On-Grid and Off-Grid), and by End-Users (Residential, Commercial & Industrial and Utilities) Forecast Period (2024-2031)

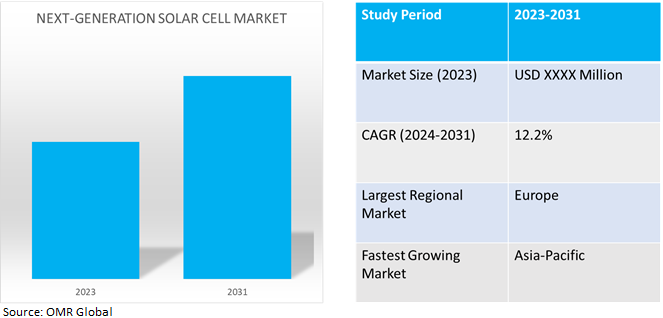

Next-generation solar cell market is anticipated to grow at a significant CAGR of 12.2% during the forecast period (2024-2031).The market growth is attributed to the increasing advancement in solar cell technologies and increasing investment in high-efficiency perovskite solar cells. According to the International Energy Agency (IEA), in July 2023, Global solar PV cell investments in capacity additions increased by over 20.0% in 2022 and surpassed $320.0 billion, marking another record year. Solar PV comprised almost 45.0% of total global electricity generation investment in 2022, triple the spending on all fossil fuel technologies collectively.

Market Dynamics

Increasing Adoption of Perovskite Solar Cells

The increasing adoption of Perovskite solar panels presents significant potential for the renewable energy shift. The advantages are indisputable, ranging from improving energy accessibility and stimulating economic growth to strengthening energy security and mitigating climate change.Perovskites' efficiency is increasing as a result of continuous R&D, which makes them a viable substitute for conventional energy sources. To ensure a steady and dependable supply of electricity from solar sources grid integration and energy storage technologies are needed.Perovskite materials provide superior lifetimes, charge-carrier mobilities, and light absorption, resulting in high device efficiencies and the potential to develop an affordable, industry-scalable technology.

Growing Development of Advanced Technology in Silicon Solar Cells

The growing development of advanced silicon solar cells with high efficiency provides performance advantages. The development of silicon wafers and ingots as well as other related material technologies are contrasted and explored by various mono- and polycrystalline PV cell technologies.The use of nanomaterials to boost solar cell efficiency, the creation of transparent solar panels that can be incorporated into windows and other building materials, and the application of artificial intelligence to maximize solar system performance are some of the recent advancements in solar technology.

Market Segmentation

Our in-depth analysis of the global next-generation solar cell market includes the following segments material type, installation, and end-users.

- Based on material type, the market is sub-segmented into transceivers, cadmium telluride (CdTe), copper indium gallium selenide (CIGS), amorphous silicon (a-Si), gallium-arsenide (GaAs) and others (dye-sensitized solar cells, perovskite solar cell).

- Based on installation, the market is sub-segmented into on-grid and off-grid.

- Based on end-users, the market is sub-segmented into residential, commercial & industrial, and utilities.

Amorphous Silicon (a-Si) is Projected to Emerge as the Largest Segment

Based on thematerial type, the global next-generation solar cell market is sub-segmented into transceivers, cadmium telluride (CdTe), copper indium gallium selenide (CIGS), amorphous silicon (a-Si), gallium-arsenide (GaAs) and others (dye-sensitized solar cells, perovskite solar cell). Among theseamorphous silicon (a-Si),the sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includesthe increasing use of amorphous silicon (a-Si) in large areasof electronics, with major applications in displays, image sensing, and solar power conversion.

Residential Sub-segment to Hold a Considerable Market Share

Based onend-users, the global next-generation solar cellmarket is sub-segmented intoresidential, commercial & industrial, and utilities.Among these, the residential sub-segment is expected to holdaconsiderable share of the market.The high market share of the segmentis attributed to the increasing use of next-generation solar cells in the residential sector. According to the International Energy Agency (IEA), in September 2022, roughly 40.0% represents distributed PV installations out of which more than one-third are in the residential sector. Around 130 GW of PV systems are deployed by households, which account for approximately 25 million units. There has been an exponential increase in the amount of solar power connected to the electric grid. Around 4 million houses in the US currently generate their electricity using solar power.

Regional Outlook

The globalnext-generation solar cell market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Next-Generation Solar Cells in Asia-Pacific

- An increase in PV installations owing to the growing consumer awareness about the cost and benefit advantages of renewable energy systems inthe region.According to the International Energy Agency (IEA), in July 2023, India installed 18 GW of solar PV in 2022, almost 40.0% more than in 2021. A new target to increase PV capacity auctioned to 40 GW annually and dynamic development of the domestic supply chain is expected to result in a further acceleration in PV growth shortly.

- According to the International Energy Agency (IEA), in 2022, global solar PV manufacturing capacity increased by over 70.0% to reach 450 GW for polysilicon and up to 640 GW for modules, with China accounting for more than 95.0% of new facilities throughout the supply chain.

Global Next-Generation Solar Cell Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe holds a significant share owing to numerous prominent companies such as Geo Green Power, Oxford Photovoltaics Ltd., SolarWorld and others and next-generation solar cell providers in the region. The growth is mainly attributed to technological advancements related to improving the operating efficiency of solar cellsin the residential, commercial & industrial, and utilities.According to the European Commission, in May 2022, to accelerate the deployment of solar technologies over 320 GW by 2025 and almost 600 GW by 2030 will be deployed.Additionally, collaborative efforts, government incentives, and international partnerships are further propelling the growth of the next-generation solar cellmarket in Europe. According to the International Energy Agency, in July 2023, the European Union is accelerating solar PV deployment in response to the energy crisis, with 38 GW added in 2022, a 50.0% increase compared to 2021. New policies and targets proposed in the REPowerEU Plan and the Green Deal Industrial Plan are expected to be important drivers of solar PV investment in the coming years.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global next-generation solar cell market include Enphase Energy, Inc., First Solar, Inc., Panasonic Corp., Sharp Corp., and SunPower Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in November 2023, ROSI and Yingli Solar partnered for a circular solar energy economy in Europe. This strategic partnership combines ROSI’s advanced technical expertise to recover high-purity raw materials such as silicon, silver, copper, and glass from the photovoltaic industry’s production.

Recent Development

- In October 2023, Canadian Solar Inc. established a 5 GW Solar PV cell production facility at the River Ridge Commerce Center in Jeffersonville, Indiana. The photovoltaic cell manufacturing plant with an annual output of 5 GW, equivalent to approximately 20,000 high-power modules per day.

- In October 2023, the International Solar Alliance (ISA) announced that the Global Solar Facility (GSF), a payment guarantee fund formed by ISA to stimulate investments into solar power projects, is set to receive a capital contribution of $35.0 million.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global next-generation solar cell market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Enphase Energy, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Panasonic Holdings Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SunPower Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Next-Generation Solar Cell Market by Material Type

4.1.1. Transceivers

4.1.2. Cadmium Telluride (CdTe)

4.1.3. Copper Indium Gallium Selenide (CIGS)

4.1.4. Amorphous Silicon (a-Si)

4.1.5. Gallium-Arsenide (GaAs)

4.1.6. Others (Organic Solar Cells, Dye-Sensitized Solar Cells, Perovskite Solar Cell)

4.2. Global Next-Generation Solar Cell Market by Installation

4.2.1. On-Grid

4.2.2. Off Grid

4.3. Global Next-Generation Solar Cell Market by End-Users

4.3.1. Residential

4.3.2. Commercial & Industrial

4.3.3. Utilities

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Hanergy Thin Film Power EME B.V.

6.2. Trina Solar

6.3. Canadian Solar Inc.

6.4. JA Solar Technology Co., Ltd.

6.5. Sunrun Inc.

6.6. Tesla

6.7. LONGi Green Energy Technology Co. Ltd.

6.8. JinkoSolar

6.9. Hanwha Q CELLS Australia Pty Ltd

6.10. REC Solar Holdings AS

6.11. Wuxi Suntech Power Co., Ltd.

6.12. SolaX Power Network Technology (Zhejiang) Co. , Ltd.

6.13. SMA Solar Technology AG

6.14. Sungrow Power Supply Co., Ltd.

6.15. Meyer Burger (Industries) GmbH

6.16. Risen Energy Co., Ltd.

6.17. First Solar, Inc.

6.18. Sharp Corp.

6.19. SolarEdge Technologies, Inc.

1. GLOBAL NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BYMATERIAL TYPE,2023-2031 ($ MILLION)

2. GLOBAL NEXT-GENERATION TRANSCEIVERSSOLAR CELLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NEXT-GENERATION CADMIUM TELLURIDE (CDTE)SOLAR CELLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NEXT-GENERATION COPPER INDIUM GALLIUM SELENIDE (CIGS) SOLAR CELLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL NEXT-GENERATION AMORPHOUS SILICON (A-SI)SOLAR CELLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL NEXT-GENERATION GALLIUM-ARSENIDE (GAAS)SOLAR CELLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHERS NEXT-GENERATION SOLAR CELLMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY INSTALLATION,2023-2031 ($ MILLION)

9. GLOBAL ON-GRID NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OFF GRID NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

12. GLOBAL NEXT-GENERATION SOLAR CELL FOR RESIDENTIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL NEXT-GENERATION SOLAR CELL FOR COMMERCIAL & INDUSTRIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL NEXT-GENERATION SOLAR CELL FOR UTILITIESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BYMATERIAL TYPE,2023-2031 ($ MILLION)

18. NORTH AMERICAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY INSTALLATION,2023-2031 ($ MILLION)

19. NORTH AMERICAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

20. EUROPEAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BYMATERIAL TYPE,2023-2031 ($ MILLION)

22. EUROPEAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY INSTALLATION,2023-2031 ($ MILLION)

23. EUROPEAN NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

24. ASIA-PACIFIC NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICNEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BYMATERIAL TYPE,2023-2031 ($ MILLION)

26. ASIA-PACIFICNEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY INSTALLATION,2023-2031 ($ MILLION)

27. ASIA-PACIFICNEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

28. REST OF THE WORLD NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BYMATERIAL TYPE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY INSTALLATION,2023-2031 ($ MILLION)

31. REST OF THE WORLD NEXT-GENERATION SOLAR CELL MARKET RESEARCH AND ANALYSIS BY END-USERS,2023-2031 ($ MILLION)

1. GLOBAL NEXT-GENERATION SOLAR CELL MARKET SHARE BYMATERIAL TYPE,2023 VS 2031 (%)

2. GLOBAL NEXT-GENERATION TRANSCEIVERS SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NEXT-GENERATION CADMIUM TELLURIDE (CDTE)SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NEXT-GENERATION COPPER INDIUM GALLIUM SELENIDE (CIGS) SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL NEXT-GENERATION AMORPHOUS SILICON (A-SI)SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL NEXT-GENERATION GALLIUM-ARSENIDE (GAAS)SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHERS NEXT-GENERATION SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL NEXT-GENERATION SOLAR CELLMARKET SHAREBY INSTALLATION,2023 VS 2031 (%)

9. GLOBAL ON-GRID NEXT-GENERATION SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OFF GRIDNEXT-GENERATION SOLAR CELL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL NEXT-GENERATION SOLAR CELLMARKET SHAREBY END-USERS,2023 VS 2031 (%)

12. GLOBAL NEXT-GENERATION SOLAR CELLFOR RESIDENTIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL NEXT-GENERATION SOLAR CELLFOR COMMERCIAL & INDUSTRIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL NEXT-GENERATION SOLAR CELLFOR UTILITIESMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

17. UK NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC NEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICANEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICANEXT-GENERATION SOLAR CELL MARKET SIZE, 2023-2031 ($ MILLION)