Nicotine Gum Market

Nicotine Gum Market Size, Share & Trends Analysis Report by Product Type (2 Mg Nicotine Gum, 4 Mg Nicotine Gum, and 6 Mg Nicotine Gum), and by Distribution Channel (Supermarkets/Hypermarkets, Pharmacy, and Online Retail Stores) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Nicotine gum market is anticipated to grow at a significant CAGR of 8.9% during the forecast period. The growing awareness regarding the health hazards associated with smoking is growing the nicotine gum market across the globe during the forecast period as quitting smoking lowers risk for smoking-related diseases and improves health. Cigarette smoking harms nearly every organ of the body, causes many diseases, and reduces the health of smokers in general. According to the WHO latest report of 2022, tobacco kills more than 8 million people each year. More than 7 million of those deaths are the result of direct tobacco use while around 1.2 million are the result of non-smokers being exposed to second-hand smoke. In 2020, 22.3% of the global population used tobacco, 36.7% of all men and 7.8% of the world’s women, also around 80% of the world's 1.3 billion tobacco users live in low- and middle-income countries hence creating demand for nicotine gums in these countries more. All forms of tobacco are harmful, and there is no safe level of exposure to tobacco. Cigarette smoking is the most common form of tobacco use worldwide. Other tobacco products include waterpipe tobacco, various smokeless tobacco products, cigars, cigarillos, roll-your-own tobacco, pipe tobacco, and bidis which are widely consumed by people across the globe, which rises diseases and indirectly propels the demand for nicotine gum.

Segmental Outlook

The global nicotine gum market is segmented based on product type and distribution channel. Based on the product type, the market is segmented into 2mg nicotine gum, 4 mg nicotine gum, and 6 mg nicotine gum. Based on distribution channel, the market is sub-segmented into supermarkets/ hypermarkets, pharmacy, and online retail stores. The above mentioned segments can be customized as per the requirements.

Among the product type, the 2 mg sub-segment is anticipated to grow at a considerable CAGR during the forecast period as it is suppportive for light smoking person who smokes less than 20 cigarettes per day. Furthermore, the easy availability of 2 mg nicotine gums in several other flavors attracts the potential user, which in turn, is expected to drive the demand over the forecast period. Nicotine 2 mg gum reduces and controls craving and nicotine withdrawal symptoms related to tobacco dependence. It is suggested to aids smokers to quit or lower before quitting. It also aids smokers who are unwilling or incapable of quitting, and as a safer alternative to smoking for smokers.

Regional Outlooks

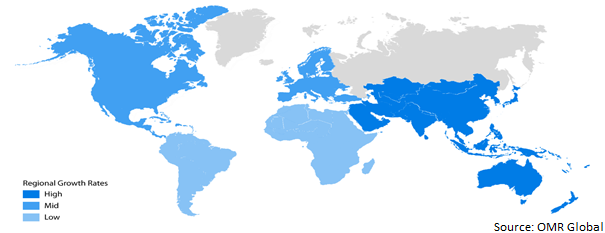

The global nicotine gum market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North America is anticipated to grow at the fastest rate during the forecast period owing to the increasing health consciousness among the peoples coupled with increasing number of diseases and deaths due to the use of tobacco in form of smoking Increasing number of chronic diseases such as lung cancer is pushing people to quit smoking by the use of products such as nicotine gums. According to the Center for disease control and prevention (CDC), smoking cigarette caused more than 480,000 deaths each year in the US, which is nearly one in five deaths. Smoking causes about 90% of all lung cancer deaths, it also causes about 80% (or 8 out of 10) of all deaths from chronic obstructive pulmonary disease. These factors has resulted in a rise in the number of people trying to discontinue smoking, which is the major factor driving the nicotine gum market growth.

Global Nicotine Gum Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Nicotine Gum Market

The Asia-Pacific region is anticipated to hold the considerable share in the global nicotine gum market during the forecast period. The rising population and increasing competition between the big tobacco companies, and increasing market opportunities is boosting the market for nicotine gum market across the region. According to the World data, the population of Asia-Pacific is estimated was around 4.6 billion in 2019, and is further expected to reach 5.3 billion by 2050. Due to the increasing population the number of smokers will increase which in turn also increases the demand for nicotine gum, as many smokers will try to quit smoking and for this they will require these products which will further boost the nicotine gum market during the forecast period.

Market Players Outlook

The major companies serving the global nicotine gum market include Cipla Inc., GlaxoSmithKline plc , Itc ltd., Johnson & Johnson Services, Inc., Perrigo Company plc, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2020, Nicotex, a brand of Cipla Health Ltd.’s collaborated with the state governments of Karnataka and Goa to provide NRT (Nicotine replacement therapy) to frontline workers and provide counselling support to general population about the life saving therapy. In addition, the company distributed 40,000 packs to over 10,000 healthcare workers as the therapy (NRT) is a medically approved way to treat people with tobacco use disorder by taking nicotine, by means other than tobacco.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global nicotine gum market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cipla Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GlaxoSmithKline plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. ITC Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Johnson & Johnson Services, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Perrigo Co. plc

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Nicotine Gum Market by Product Type

4.1.1. 2 mg Nicotine Gum

4.1.2. 4 mg Nicotine Gum

4.1.3. 6 mg Nicotine Gum

4.2. Global Nicotine Gum Market by Distribution Channel

4.2.1. Supermarkets/ Hypermarkets

4.2.2. Pharmacy

4.2.3. Online Retail Stores

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Alchem International Pvt. Ltd.

6.2. British American Tobacco plc

6.3. Cambrex Corp.

6.4. Cipla Health Ltd.

6.5. Dr. Reddy’s Laboratories Ltd.

6.6. Fertin Pharma A/S.

6.7. Pfizer, Inc.

6.8. Reynolds American Inc.

6.9. Takeda Pharmaceutical Co. Ltd.

1. GLOBAL NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL 2 MG NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL 4 MG NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL 6 MG NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

6. GLOBAL NICOTINE GUM BY SUPERMARKETS/HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL NICOTINE GUM BY PHARMACY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL NICOTINE GUM BY ONLINE RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICAN NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

13. EUROPEAN NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

19. REST OF THE WORLD NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD NICOTINE GUM MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1. GLOBAL NICOTINE GUM MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL 2 MG NICOTINE GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL 4 MG NICOTINE GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL 6 MG NICOTINE GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL NICOTINE GUM MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

6. GLOBAL NICOTINE GUM BY SUPERMARKETS/HYPERMARKETS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL NICOTINE GUM BY PHARMACY MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL 6 NICOTINE GUM BY ONLINE RETAIL STORES MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL NICOTINE GUM MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. US NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

12. UK NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD NICOTINE GUM MARKET SIZE, 2021-2028 ($ MILLION)