NiMH Battery Market

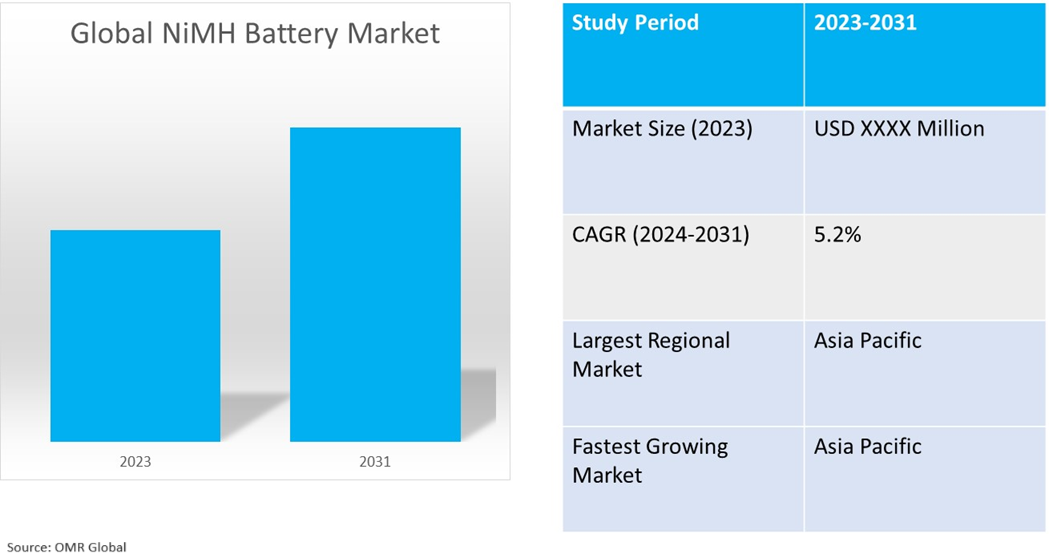

NiMH Battery Market Size, Share & Trends Analysis Report by Application (Consumer Electronics, Industrial, Automotive, and Others), Forecast Period (2024-2031)

NiMH battery market is anticipated to grow at a significant CAGR of 5.2% during the forecast period (2024-2031). The market growth is attributed to the rising use of NiMH batteries in the healthcare industry, increasing adoption of renewable energy sources, strong demand for portable electronics and gadgets, and rising demand for hybrid electric vehicles across the globe. As of now, Lithium-ion batteries have a commanding position in the market, however for full hybrid electric vehicles, NiMH batteries are still the most common battery on the road. Furthermore, NiMH batteries are more eco-friendly than nickel-cadmium (Ni-Cd) Batteries. The Ni-Cd batteries contain heavy metal which is hazardous to the environment and is highly toxic to all higher forms of life, which is not the case with NiMH batteries.

Market Dynamics

Increasing Use of NiMH Batteries in the Healthcare Industry

The healthcare sector mainly relies on battery-operated medical equipment and devices, to provide essential treatment and diagnostics. NiMH batteries have been shown to be an effective power source in this industry owing to their extended lifespan, steady performance, and capacity to deliver dependable power in emergency medical situations. NiMH batteries are essential for the continuous operation of a broad range of medical devices, including electric wheelchairs, portable diagnostic kits, and implanted medical devices. The healthcare sector's growing demand for advanced medical devices and the need for reliable power solutions contribute to the sustained demand for NiMH batteries in healthcare applications. This segment represents a vital driver in the global NiMH battery market. Medical device imports accounted for 75.0% of China's market in 2021, with US suppliers making up 27.2% of China's $5.62 billion worth of imports. Diagnostic imaging and consumables accounted for about half of the market value of the subsectors of medical devices. The National Medical Products Administration reports that there were 32,632 medical product businesses in China in 2022, showing a consistent upward trend. The growing medical devices industry is further driving the global market.

Rising Demand for Hybrid Electric Vehicles across the Globe

The rising demand for electric vehicles and hybrid electric vehicles globally owing to their eco-friendly attributes has driven the global NiMH battery market. Sales of electric vehicles have increased across all areas and powertrains globally, and China continues to lead the market. Sales of BEVs (Battery Electric Vehicles) rose by 60.0% in China in 2022 compared to 2021, reaching 4.4 million, while sales of PHEVs (Plug-in Hybrid Electric Vehicles) nearly tripled to 1.5 million. After growing moderately between 2018 and 2020, BEV sales in China tripled between 2020 and 2021.

Market Segmentation

- Based on the application, the market is segmented into consumer electronics, industrial, automotive, and others (medical devices).

Automotive Segment to Hold a Considerable Market Share

NiMH batteries are anticipated to exhibit constant growth in the automotive industry due to the rising adoption of hybrid electric vehicles globally. The implementation of government policies to promote the use of hybrid and electric vehicles is further aiding the growth of this market segment. For instance, the Japanese government is continuing to subsidize the purchase of new electric vehicles (EVs) to increase demand for EVs, with a revised budget of JPY 70.0 billion (about $501.001 million) for fiscal year 2022. The subsidy amounts for new purchases are JPY 650,000.0 ($4,656.0) for BEVs, JPY 450,000 ($3,223) for Kei EVs and Plug-In Hybrid Electric Vehicles (PHEVs), and JPY 2,300,000 ($16,474) for Fuel Cell Electric Vehicles (FCEVs). A vehicle may be eligible for a larger subsidy amount if it satisfies specific conditions, such as having a power supply function that may draw power from an onboard outlet (1500W/AC100V) or the capacity to extract power via an external power supply or V2H charger.

Regional Outlook

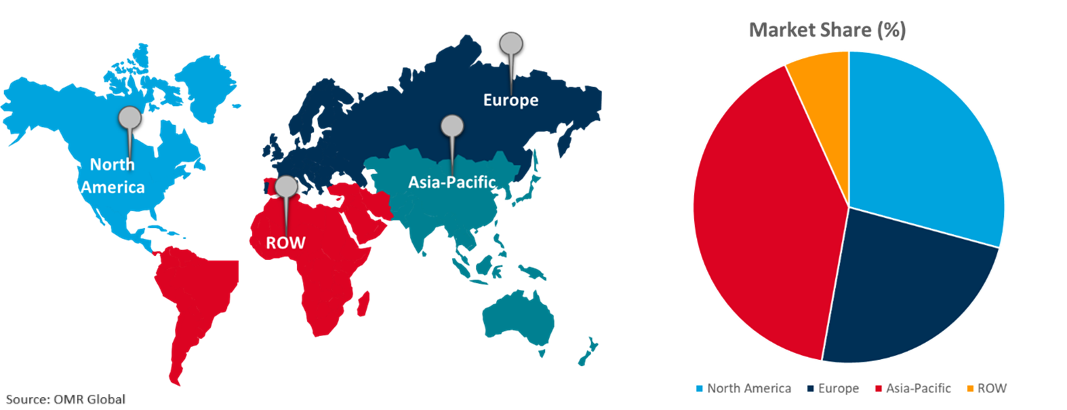

Global NiMH battery market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global NiMH Battery Market Growth by Region 2024-2031

Asia-Pacific Region Holds Major Market Share

Asia-Pacific is anticipated to hold a major market share owing to the rising use of NiMH batteries in the healthcare industry, increasing investment in the medical device sector, strong demand for portable electronics and gadgets, and rising demand for hybrid electric vehicles in the region. Indian medical devices sectors have also become even more prominent due to investment from global manufacturers. Many manufacturers have recently made huge investments to set up a medical device manufacturing plant in India. For instance, in May 2023, Omron Healthcare, a Japan-based manufacturer, and distributor of personal healthcare products, announced that it will set up a medical device manufacturing plant in Tamil Nadu for Rs. INR 128.0 crore ($15.5 million).

On the other hand, the regional market is expected to grow considerably owing to rising demand for Hybrid Electric Vehicles (HEVs) in the region. Manufacturers such as Toyota in the region leverage NiMH batteries for HEVs for the foreseeable future, with most of their line-up now using either NiMH or Li-ion depending on the specifications. NiMH is sufficient to meet the requirements for the relatively small batteries that are used in HEVs. The Japan Automobile Dealers Association (JADA) reports that 40.5% of the 3,675,650 new automobiles sold in 2021 were electric. Also, 96.8 % of new electric vehicle sales are made up of HEVs, and sales of BEVs, PHEVs, and Fuel Cell Electric Vehicles (FCEVs) have increased significantly in the past year.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the NiMH battery market include Panasonic Holdings Corp., FDK Corp., Energizer, Camelion Batterien GmbH, and Enix Power Solutions among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in March 2022, FDK Corp. launched the new NiMH battery HR-AAUTEWM for a variety of applications such as security, medical, and in-vehicle applications, which includes tracking devices, e-call, dashboard cameras, car alarms, and other in-vehicle applications.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the NiMH battery market. Based on the availability of data, information related to new service deployment, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current End-User Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Panasonic Holdings Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. FDK Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Energizer

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. GP Energy Tech International Pte. Ltd

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global NiMH Battery Market by Application

4.1.1. Consumer Electronics

4.1.2. Industrial

4.1.3. Automotive

4.1.4. Others (Medical Devices)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Camelion Batterien GmbH

6.2. Enix Power Solutions

6.3. Godson Technology Co., Ltd.

6.4. GPIndustrial

6.5. Harding Energy, Inc.

6.6. JYH TECHNOLOGY CO., LTD.

6.7. Maha Energy

6.8. NEXcell Battery Co., Ltd.

6.9. Rayovac

6.10. Shenzhen Grepow Battery Co., Ltd.

6.11. Shenzhen Himax Electronics Co., Ltd.

6.12. Spektrum

6.13. Taurac

6.14. Uniross

6.15. VARTA AG

1. Global NiMH Battery Market Research And Analysis By Application, 2023-2031 ($ Million)

2. Global NiMH Battery For Consumer Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global NiMH Battery For Industrial Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global NiMH Battery For Automotive Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global NiMH Battery For Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global NiMH Battery Market Research And Analysis By Region, 2022-2030 ($ Million)

7. North American NiMH Battery Market Research And Analysis By Country, 2023-2031 ($ Million)

8. North American NiMH Battery Market Research And Analysis By Application, 2023-2031 ($ Million)

9. European NiMH Battery Market Research And Analysis By Country, 2023-2031 ($ Million)

10. European NiMH Battery Market Research And Analysis By Application, 2023-2031 ($ Million)

11. Asia-Pacific NiMH Battery Market Research And Analysis By Country, 2023-2031 ($ Million)

12. Asia-Pacific NiMH Battery Market Research And Analysis By Application, 2023-2031 ($ Million)

13. Rest Of The World NiMH Battery Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Rest Of The World NiMH Battery Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global NiMH Battery Market Share By Application, 2023 Vs 2031 (%)

2. Global NiMH Battery For Consumer Electronics Market Share By Region, 2023 Vs 2031 (%)

3. Global NiMH Battery For Industrial Market Share By Region, 2023 Vs 2031 (%)

4. Global NiMH Battery For Automotive Market Share By Region, 2023 Vs 2031 (%)

5. Global NiMH Battery For Other Application Market Share By Region, 2023 Vs 2031 (%)

6. Global NiMH Battery Market Share By Region, 2023 Vs 2031 (%)

7. US NiMH Battery Market Size, 2023-2031 ($ Million)

8. Canada NiMH Battery Market Size, 2023-2031 ($ Million)

9. UK NiMH Battery Market Size, 2023-2031 ($ Million)

10. France NiMH Battery Market Size, 2023-2031 ($ Million)

11. Germany NiMH Battery Market Size, 2023-2031 ($ Million)

12. Italy NiMH Battery Market Size, 2023-2031 ($ Million)

13. Spain NiMH Battery Market Size, 2023-2031 ($ Million)

14. Rest Of Europe NiMH Battery Market Size, 2023-2031 ($ Million)

15. India NiMH Battery Market Size, 2023-2031 ($ Million)

16. China NiMH Battery Market Size, 2023-2031 ($ Million)

17. Japan NiMH Battery Market Size, 2023-2031 ($ Million)

18. South Korea NiMH Battery Market Size, 2023-2031 ($ Million)

19. Rest Of Asia-Pacific NiMH Battery Market Size, 2023-2031 ($ Million)

20. Latin America NiMH Battery Market Size, 2023-2031 ($ Million)

21. Middle East And Africa NiMH Battery Market Size, 2023-2031 ($ Million)