Non-alcoholic Steatohepatitis Biomarkers Market

Global Non-Alcoholic Steatohepatitis (NASH) Biomarkers Market Size, Share & Trends Analysis Report by Biomarker Type (Serum Biomarkers, Hepatic Fibrosis Biomarkers, Apoptosis Biomarkers, Oxidative Stress Biomarkers, and Others), and by End-Users (Hospitals, Diagnostic Laboratories, Academic Research Institute, and Pharmaceutical Companies/CRO) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global NASH biomarkers market is anticipated to grow at a considerable CAGR of 28.6% during the forecast period. NASH is a condition in which fat develops in the liver. NASH normally develops in patients affected with one of the conditions, including dyslipidemia, glucose intolerance, and obesity. The growing number of non-alcoholic fatty liver diseases (NAFLD) is significantly propelling the growth of the global NASH biomarkers market. According to Frontiersin.org, it is one of the most common causes of chronic liver disease across the globe with a prevalence rate of around 25-30%. To detect NASH disease, some invasive and non-invasive methods are available which include liver biopsy, imaging technology, and biomarkers. Biomarkers are considered one of the non-invasive techniques for the diagnosis of NASH among patients. Several non-invasive biomarkers and panels have been tested to determine liver fibrosis. For instance, Enhanced liver fibrosis (ELF) and NASH FibroSure are certain panels used to test for liver fibrosis. Non-alcoholic Steatohepatitis Biomarkers are used to diagnose the fatty liver, it is a non-invasive technology. Biomarkers are considered one of the non-invasive techniques for the diagnosis of NASH among patients.

However, the high cost of liver biopsy, its invasiveness, and patients’ reduced acceptance are the reasons that contribute to the lower use of invasive procedures for disease diagnosis. Which in turn boosts the growth of the non-invasive treatment and global Non-alcoholic Steatohepatitis Biomarkers market.

Impact of COVID-19 Pandemic on Global Non-Alcoholic Steatohepatitis (NASH) Biomarkers Market

The COVID-19 pandemic had limited options along with several travel restrictions, which in turn created hurdles to international trade, movement, and transportation, which disrupted the diagnosis of fatty liver and treatment procedures across the globe. In the healthcare industry, the diagnosis and treatment of chronic and major diseases which required surgeries or severe medications were majorly put on hold. The patients and doctors were mostly preferring to provide online consultations instead of a face-to-face consultations, owing to the rapidly surging COVID-19 cases. Thus, such factors have hampered the growth of global NASH biomarkers, as these are being utilized in hospitals and diagnostic centers.

Segmental Outlook

The global NASH biomarkers market is segmented based on biomarker type and end-users. Based on biomarker type, the market is sub-segmented into serum biomarkers, hepatic fibrosis biomarkers, apoptosis biomarkers, oxidative stress biomarkers, and others. Based on the end-users, the market is sub-segmented into hospitals, diagnostic laboratories, academic research institutes, and pharmaceutical companies/CROs. Among the biomarker type segment, the serum biomarker is anticipated to hold a prominent share of the market over the forecast period. Serum biomarkers are mostly used in the diagnosis and identification of NASH.

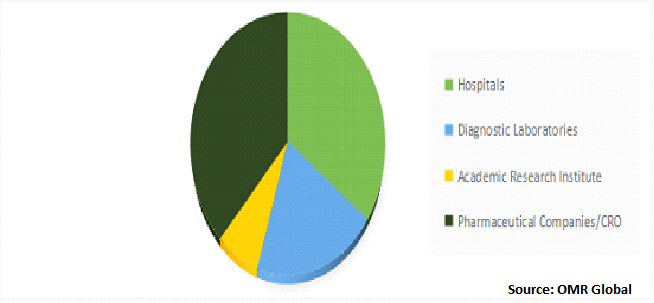

Global Non-Alcoholic Steatohepatitis (NASH) Biomarkers Market Share by End User, 2021 (%)

Pharmaceutical Companies/CRO Segment is Expected to Hold a Prominent Share in the Global NASH Biomarkers Market

Based on the end-users, the pharmaceutical companies/CRO segment is expected to hold a prominent share in the market during the forecast period. Due to the increased R&D activities such as innovations, and integration of technologies in biomarkers by major pharmaceutical companies. In addition, an upsurge in the occurrence of liver diseases has propelled the pharmaceutical companies/CRO segment growth. For instance, in 2020, GENFIT presented new data on the identification of at-risk NASH using NIS4 technology alone or in combination with other non-invasive tests. This new clinical data on NIS4 technology has a prognostic biomarker to identify patients with a higher likelihood of disease progression.

Regional Outlooks

The global NASH biomarkers market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). North America is expected to hold market prominently, and the region is further expected to hold is position in the market during the forecast period. The regional growth is attributed due to the factors such as increasing awareness programs and significant funding provided by government organizations and pharmaceutical companies. Moreover, the presence of major players in these regions is further leveraging the market growth in these regions.

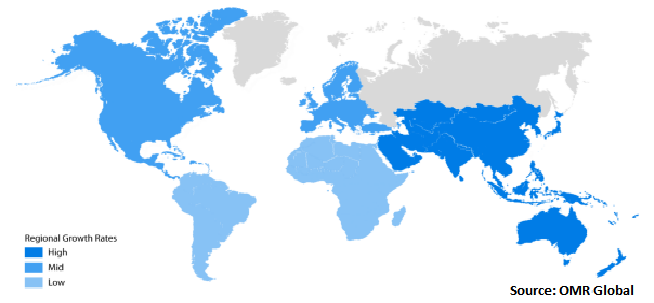

Global Non-Alcoholic Steatohepatitis (NASH) Biomarkers Market Growth, by Region 2022-2028

The Asia-Pacific Region to Grow at a Considerable CAGR in the Global NASH Biomarkers Market

The Asia-Pacific is expected to grow at a considerable CAGR over the forecast period. The growth is attributed owing to the increasing prevalence of NAFLD cases, the region is propelling the growth of the market. According to the National Library of Medicine, in 2019 there were 170,000 incident cases of NAFLD across the globe. Other factors such as increased body mass index, diabetes, insulin resistance, and metabolic syndrome also significantly contribute to the overall growth of the global NASH biomarkers as these biomarkers are used for the diagnosis and treatment of fatty liver disease. Furthermore, the presence of a well-established pharmaceutical industry also contributes to growth.

Market Players Outlook

The major companies serving the global NASH biomarkers market are Allergan PLC, Bristol-Myers Squibb Co., Gilead Sciences, Inc., Siemens Healthcare Medical Solutions Ltd., and Thermo Fisher Scientific, Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, geographical expansion, and new product launches, to stay competitive in the market. For instance, in 2020 Gilead Sciences, a major biotech company in the US, acquired immune medicine specialists from antibody-drug conjugate (ADC).

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global NASH biomarkers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global NASH Biomarkers Market

- Recovery Scenario of Global NASH Biomarkers Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Overview

3.1.2.Financial Analysis

3.1.3.SWOT Analysis

3.1.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global NASH Biomarkers Market by Biomarker Type

4.1.1.Serum Biomarkers

4.1.2.Hepatic Fibrosis Biomarkers

4.1.3.Apoptosis Biomarkers

4.1.4.Oxidative Stress Biomarkers

4.1.5.Others (Carbon Isotope Markers and miRNA Biomarkers)

4.2.Global NASH Biomarkers Market by End-Users

4.2.1.Hospitals

4.2.2.Diagnostic Laboratories

4.2.3.Academic Research Institute

4.2.4. Pharmaceutical Companies/CRO

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Allergan PLC

6.2.ALPCO

6.3.Antaros Medical AB

6.4.BioPredictive S.A.S

6.5.Boehringer Ingelheim International GmbH

6.6.Bristol-Myers Squibb Co.

6.7.Covance Inc.

6.8.Enterome SA

6.9.GENFIT SA

6.10.Gilead Sciences, Inc.

6.11.Laboratory Corporation of America Holdings

6.12.NGM Biopharmaceuticals, Inc.

6.13.Nordic Bioscience

6.14.OWL Metabolomics

6.15.Perspectum Diagnostics Ltd

6.16.Prometheus Laboratories Inc.

6.17.ProSciento

6.18.Quest Diagnostics Inc.

6.19.Siemens Healthcare Medical Solutions Ltd.

6.20.Thermo Fisher Scientific, Inc.

6.21.Xeptagen SpA

1.GLOBAL NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY BIOMARKER TYPE, 2021-2028 ($ MILLION)

2.GLOBAL SERUM BIOMARKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL HEPATIC FIBROSIS BIOMARKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL ADOPTOSIS BIOMARKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL OXIDATIVE STRESS BIOMARKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.GLOBAL OTHER BIOMARKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

8.GLOBAL NASH BIOMARKERS IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9.GLOBAL NASH BIOMARKERS IN DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.GLOBAL NASH BIOMARKERS IN ACADEMIC RESEARCH INSTITUTE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.GLOBAL NASH BIOMARKERS IN PHARMACEUTICAL COMPANIES/CRO MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12.GLOBAL NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13.NORTH AMERICA NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14.NORTH AMERICA NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY BIOMARKER TYPE, 2021-2028 ($ MILLION)

15.NORTH AMERICA NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

16.EUROPE NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17.EUROPE NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY BIOMARKER TYPE, 2021-2028 ($ MILLION)

18.EUROPE NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

19.ASIA-PACIFIC NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20.ASIA-PACIFIC NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY BIOMARKER TYPE, 2021-2028 ($ MILLION)

21.ASIA-PACIFIC NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

22.ROW NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY BIOMARKER TYPE, 2021-2028 ($ MILLION)

23.ROW NASH BIOMARKERS MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL NASH BIOMARKERS MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL NASH BIOMARKERS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL NASH BIOMARKERS MARKET, 2022-2028 (%)

4.GLOBAL NASH BIOMARKERS MARKET SHARE BY BIOMARKER TYPE, 2021 VS 2028 (%)

5.GLOBAL SERUM BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL HEPATIC FIBROSIS BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL ADOPTOSIS BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL OXIDATIVE STRESS BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

GLOBAL OTHER BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL NASH BIOMARKERS MARKET SHARE BY END-USERS, 2021 VS 2028 (%)

11.GLOBAL NASH BIOMARKERS IN HOSPITALS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL NASH BIOMARKERS IN DIAGNOSTIC LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.GLOBAL NASH BIOMARKERS IN ACADEMIC RESEARCH INSTITUTE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14.GLOBAL NASH BIOMARKERS IN PHARMACEUTICAL COMPANIES/CRO MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15.GLOBAL NASH BIOMARKERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.US NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

17.CANADA NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

18.UK NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

19.GERMANY NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

20.ITALY NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

21.SPAIN NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

22.FRANCE NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

23.ROE NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

24.INDIA NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

25.CHINA NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

26.JAPAN NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

27.REST OF ASIA-PACIFIC NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)

28.ROW NASH BIOMARKERS MARKET SIZE, 2021-2028 ($ MILLION)