Non-Fungible Token Market

Global Non-Fungible Token Market Size, Share & Trends Analysis Report By Type (Insurance, Real Estate, Automobile, and Others (digital art, collectibles)) By Application (Personal Use, and Commercial Use) Forecast 2022-2028 Update Available - Forecast 2025-2035

The global non-fungible token market is anticipated to grow at a considerable CAGR of 10.6% during the forecast period. The non-fungible token is unique in its form, and there cannot exist another like it. A non-fungible token is a type of cryptographic token that represents a unique identity. These token can be digital or physical and includes items like sneakers, art, a plane ticket, a university degree, real estate, and in-game items for an online game. Moreover, non-fungible tokens enable the business or individuals to buy and sell items in a marketplace, as the non-fungible token unique ID, will match up with either the original issue of the item or the service which performs authenticity checks. The major attributes that drive the market growth are the property of uniqueness, as no two non-fungible tokens are the same, and are not interchangeable, non-fungible holds the property of ownership. The idea of having ownership of digitally created content and art is expected to drive the market.

The non-fungible token has some issues, such as data stolen, many participants use pseudonyms, fraud, and data of artists is stolen and sold on various digital platforms. Fear of data leakage in the market has restrained the growth of the market. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2022, Rap musician Snoop Dogg has collaborated with blockchain artist, Coldie, to create its first non-fungible token, to released, decentral eyes portrait series non-fungible token. Moreover, the decentralized Dogg non-fungible token is a 3D collage, this collage is traded via SupeRrar.

Impact of COVID-19 Pandemic on Non-Fungible Token Market

Due to prolonged-time periods of incarceration and lack of physical interaction between people across the globe, cuddle more sedentary lifestyles due to which the people has explored new solutions and an alternate way to maintain social relationships with each other, and spent time on social websites, and the people use various online metaverses to promote social engagement and get generate awareness for non-fungible tokens. Therefore, many people adopt the concept of cryptocurrency to a great deal, and this is the major driving factor that boosts the growth of the non-fungible token market. COVID-19 has locked people in their homes, increases the penetration of the internet, mobile phones, laptops, which helps in creating awareness about the non-fungible token market. Owing to the rising prevalence of smartphones, and digital devices, have positively impacted the growth of the non-fungible token market.

Segmental Outlook

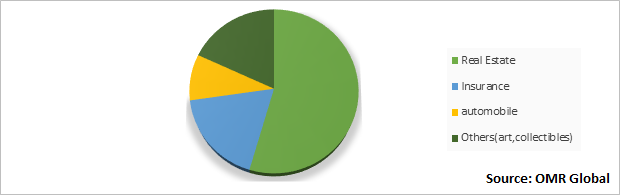

The global non-fungible token market is segmented based on type, and application. Based on type, the market is segmented into insurance, real estate, automobile, and others (digital art, collectibles), based on application, the market is sub-categorized into personal use, and commercial use. Based on type, the collectibles segment has the largest market share in terms of revenue, the collectibles non-fungible token market consists of art collectibles, sports collectibles, and gaming collectibles. Gaming collectibles have provided the online gaming industry with a new and better form. Players can buy and sell gaming collectibles items, such as weapons, clothing of avatar, and cartoons through the non-fungible token platform, and get the right of ownership of the item. Owing to these various benefits and online access to buy and sell the collectibles, the chances of stolen item and data has reduced, which in turn increases the demand for collectibles in the coming years.

Global Non-Fungible Token Market Share by Type, 2022 (%)

The Real Estate Segment Holds the Major Share in the Global Non-Fungible Token Market

Real estate is one of the fastest, most far-reaching, and boundless sectors. The concept of tokenization of real estate assets, along with blockchain technology, is transforming the real estate sector to another level. The factors that influence the demand of real estate in the non-fungible token market are the various options available for the owner of the property, as tokenization of real estate assets will bring in high volume liquidity that assists for a quick conversion of property values into cash, real estate tokenization removes geographical barriers and provides the policy of trading with anyone across the globe. Moreover, real estate assets in the non-fungible token market, allow the users to contact directly without the involvement of intermediaries, which in turn reduces risk and minimizes extra costs. The wider application and fastest-growing demand of real estate in non-fungible token has propelled the growth of the market in coming years.

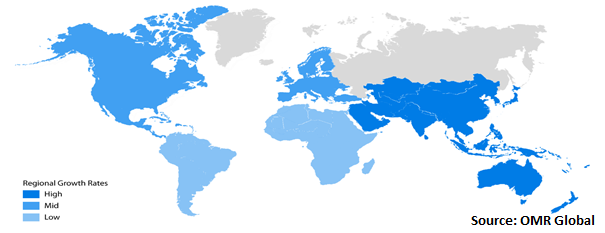

Regional Outlooks

The global non-fungible token market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America. North America has witnessed the largest market share owing to rising demand for digital arts, growing awareness about the non-fungible token platform, which provides access of ownership to the original owner, and the presence of major market players, in the region, has propelled the growth of the market.

Global Non-Fungible Token Market Growth, by Region 2022-2028

The North-America Region Holds the Major Share in the Global Non-Fungible Token Market

North America contributes to the growth of the non-fungible token market. Increasing traction of a metaverse in the region of the US and Canada is one of the key factors driving the market growth. Moreover, the rising demand for digital artworks along with the increasing number of digital creators and artists creating content on the digital platform, in the country is expected to boost the market growth. Moreover, increasing demand and usage of the concept of cryptocurrencies is projected to drive North America's non-fungible token market revenue growth. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November Gannett Co. Inc has announced a collaboration with US artist Peter Tunney, for auction of signature collages, tilted ”GRATITUDE”, and “LIBERTY”. With this collaboration, the company has launched a second non-fungible token collection. The tilted was available for sale via OpenSea, which is the marketplace for the non-fungible token market. With the growing demand of the market in the region and the launching of various strategies by market players, has propelled the market growth.

Market Players Outlook

The major companies serving the global non-fungible token market are Axie Infinity., Bacasable Global Ltd., Currency Works Inc., Oriental Culture Holding Ltd., Dolphin Entertainment., Wisekey International Holding Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2022, Dolphin Entertainment Inc, announced the creation of new marketing, consulting, and communication agency that focused on developing and marketing blockchain, metaverse, and Web3 projects, for both current and future clients. The new project will utilize the company’s non-fungible token division and provides expanded services to more than two dozen of active Web3 projects and partners of the company.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global non-fungible token market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Non-Fungible Token Market

- Recovery Scenario of Global Non-Fungible Token Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Oriental Culture Holding Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Wisekey International Holding Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Axie Infinity

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Dolphin Entertainment, Inc.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Liquid Media Group Ltd.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Non-Fungible Token Market, by Type

5.1.1. Insurance

5.1.2. Real-Estate

5.1.3. Automobile

5.1.4. Others(digital art, collectibles)

5.2. Global Non-Fungible Token Market, by Application

5.2.1. Personal Use

5.2.2. Commercial Use

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Bacaasable Global Ltd.

7.2. Currency Works Inc.

7.3. Dapper Labs Inc.

7.4. Gemini Trust Company, LLC

7.5. Rarible, Inc.

7.6. Sky Mavis

7.7. Cloudflare, Inc

7.8. PLBY Group, Inc

7.9. Funko Inc.

7.10. OpenSea (Ozone Networks, Inc.)

7.11. Oriental Culture Holding Ltd

7.12. Takung Art Co., Ltd.

7.13. Dapper Labs, Inc.

7.14. MakersPlace (Onchain Labs, Inc.)

1. GLOBAL NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028($ MILLION)

2. GLOBAL INSURANCE NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL REAL ESTATE NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AUTOMOBILE NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL OTHERS(DIGITAL ART,COLLECTIBLES) NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2021-2028 ($ MILLION)

7. GLOBAL NON-FUNGIBLE TOKEN FOR PERSONAL USE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL NON-FUNGIBLE TOKEN FOR COMMERCIAL USE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY APPLICATION 2021-2028 ($ MILLION)

13. EUROPEAN NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD NON-FUNGIBLE TOKEN MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL NON-FUNGIBLE TOKEN MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL NON-FUNGIBLE TOKEN MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL NON-FUNGIBLE TOKEN MARKET, 2021-2028 (%)

4. GLOBAL NON-FUNGIBLE TOKEN MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL INSURANCE NON-FUNGIBLE TOKEN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL REAL ESTATE NON-FUNGIBLE TOKEN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL AUTOMOBILE NON-FUNGIBLE TOKEN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL OTHERS(DIGITAL ART,COLLECTIBLES) NON-FUNGIBLE TOKEN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL NON-FUNGIBLE TOKEN MARKET SHARE BY APPLICATION , 2021 VS 2028 (%)

10. GLOBAL NON-FUNGIBLE TOKEN FOR PERSONAL USE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL NON-FUNGIBLE TOKEN FOR COMMERCIAL USE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

14. UK NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD NON-FUNGIBLE TOKEN MARKET SIZE, 2021-2028 ($ MILLION)