Nuclear Turbine Generator Market

Nuclear Turbine Generator Market Size, Share & Trends Analysis Report by Type (Thermal Reactors, Fast Neutron Reactors, and Nuclear Fusion Reactors), and by Technology (Pressurized Water Reactors, Liquid Metal Fast Breeder Reactor, Pebble Bed Reactors, Molten Salt Reactors, Gas Cooled Reactor, and Others) Forecast Period (2024-2031)

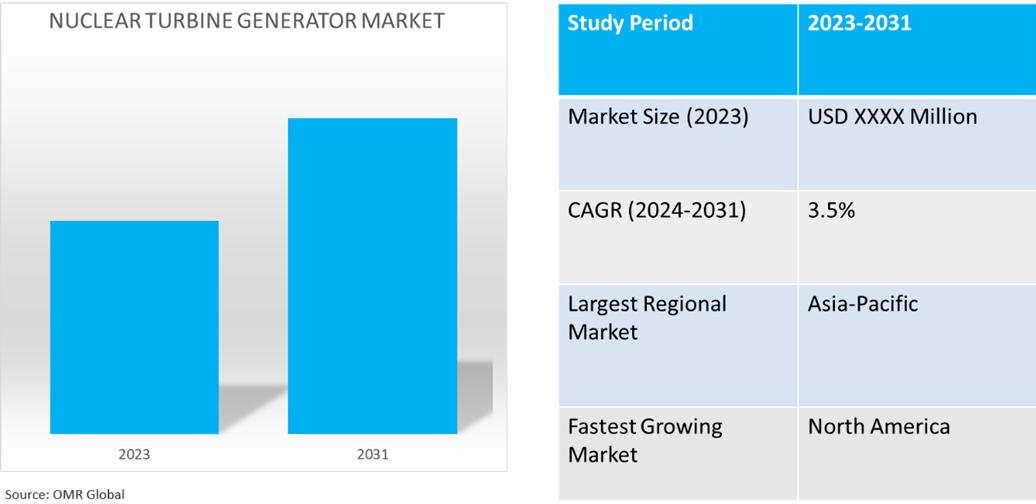

Nuclear turbine generator market is anticipated to grow at a CAGR of 3.5% during the forecast period (2024-2031). Nuclear power generation is influenced by expansion, technological advancements, environmental goals, energy security, diversification, government policies, capital investment, economic growth, safety requirements, technological synergies, global market dynamics, and regional and geopolitical factors. Countries such as India, China, and the US are investing in new technologies and infrastructure to meet performance and efficiency requirements.

Market Dynamics

Development of Nuclear Infrastructure

Increased funding for nuclear energy drives the construction of new power plants and upgrades, requiring new turbine generators and efficient models for existing plants. According to Iea.Org, in 2023, an estimated $2.8 trillion will be invested in energy, with over $1.7 trillion allocated to clean energy sources such as renewable power, nuclear, grids, storage, low-emission fuels, efficiency improvements, and end-use renewables and electrification. The remaining amount, slightly more than $1.0 trillion, will go to unabated fossil fuel supply and power, including approximately 15.0% for coal and the rest for oil and gas. Thus, for every $1.0 allocated to fossil fuels, $1.7 is directed towards clean energy.

Advancements in Reactor Technology

The rise of smaller reactors and modular design drive increased demand for turbine generators, resulting in the adoption of small modular reactors and scalable energy solutions. For instance, in May 2023, Westinghouse launched a smaller version of its flagship AP1000 nuclear reactor, the AP300, which generated about a third of the power as the full reactor. The reactor powers 300,000 homes and is set up for $1.0 billion. This move is part of Westinghouse's efforts to address climate change and expand access to nuclear power.

Market Segmentation

- Based on the type, the market is segmented into thermal reactors, fast neutron reactors, and nuclear fusion reactors.

- Based on the verticals, the market is segmented into pressurized water reactors, liquid metal fast breeder reactors, pebble bed reactors, molten salt reactors, gas-cooled reactors, and others (supercritical water reactors (SCWRs), and very-high-temperature reactors (VHTRs)).

Thermal Reactors Segment is projected to Hold the Largest Market Share

India's nuclear power expansion and infrastructure development are expected to boost demand for turbine generators, leading to market growth owing to modern reactor performance and efficiency requirements. According to Investindia.Gov., in June, India possessed 242.99 GW of total installed thermal capacity, of which 210.96 GW is derived from coal. States and the Centre provide 24.1% and 23.4% of the nation's power, respectively, while the private sector generates 52.4%. It is projected to bring significant major changes in the Indian power sector by 2031, with nuclear power capacity expected to reach 22,800 MW.

Additionally, in July 2021, NASA and the DOE collaborated to advance space nuclear technologies, with three reactor design concepts for a nuclear thermal propulsion system. Contracts valued at $5.0 million funded design strategies for deep space exploration.

Regional Outlook

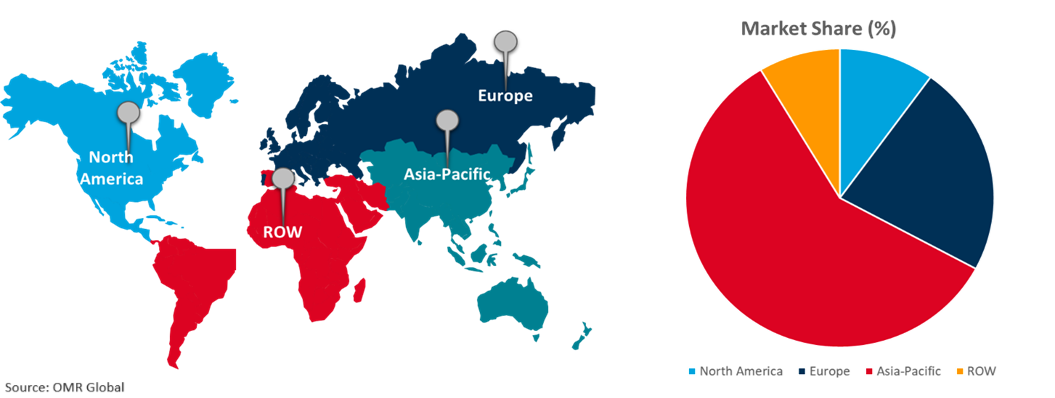

The global nuclear turbine generator market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increased Focus on Nuclear Technology in North America Region

The increased emphasis on nuclear technology for military applications across the globe is driving investments in nuclear power infrastructure and technology, which subsequently is driving up demand for nuclear turbine generators. Investing in technology and security can produce dependable results.

- In September 2023, North Korea launched a nuclear attack submarine, a step leader Kim Jong Un believes is crucial for building a nuclear-armed navy to counter the US and its Asian allies. The submarine used to conduct underwater nuclear strikes and add a maritime threat to North Korea's growing collection of solid-fuel weapons. The development of a nuclear-capable army is an urgent task.

- In August 2023, Georgia Power launched a new reactor at its Vogtle nuclear power plant is now in commercial operation, marking the first new nuclear reactor to start up in the US since 2016. The 1,114 MW Unit 3 reactor joins two existing reactors at the plant, which is jointly owned by Georgia Power and three other electric utility companies. The plant is expected to begin another reactor between November 2023 and March 2024, making it the largest nuclear power plant in the US.

Global Nuclear Turbine Generator Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

The Indian government's strategic plan to expand nuclear power capacity aligns with broader energy goals, driving investment in nuclear infrastructure and the turbine generator market. According to the Foreign Investment in Nuclear Energy in India, in March 2024, the Indian government launched plans to increase the country's nuclear power capacity from 7,480 MW to 22,480 MW by 2032. This includes the construction and commissioning of ten reactors with a total capacity of 8,000 MW across the states of Gujarat, Rajasthan, Tamil Nadu, Haryana, Karnataka, and Madhya Pradesh. Additionally, preliminary activities have begun for ten more reactors, and in-principle approval has been given for a 6 x 1,208 MW nuclear power plant in collaboration with Westinghouse Electric in Kovvada, Andhra Pradesh.

- In February 2024, India inaugurated the first Indian-designed 700 MWe pressurized heavy water reactors, Kakrapar 3 and 4, in a ceremony. The reactors, which were built at a cost of over INR 22,500 crore ($2.70 billion), produced about 10.4 billion units of clean electricity per year, benefiting consumers in multiple states. The Indian government is in talks with private firms to invest in the country's nuclear sector.

- In July 2024, China planned to launch the globe's first molten salt nuclear power station in the Gobi Desert next year, using thorium as fuel instead of uranium. The reactor uses liquid salt and carbon dioxide for heat transfer and electricity generation, reducing concerns about uranium shortages.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the nuclear turbine generator market include Bharat Heavy Electricals Limited (BHEL), General Electric Co., Hitachi, Ltd., Mitsubishi Heavy Industries, Ltd., and Siemens Energy among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In April 2024, Equinix signed a pre-agreement with Oklo reactors to procure up to 500MW of nuclear power, marking the first SMR deal for a colocation company. The deal allows Equinix to first refuse output from certain powerhouses with power capacities of 100MWe and up.

- In May 2024, GE Vernova generated sales of a portion of its nuclear conventional islands technology and services, including Arabelle steam turbines, to EDF, developing Arabelle Solutions a wholly owned subsidiary. The deal includes manufacturing equipment for new nuclear power plants and maintenance and upgrade activities for existing plants.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global nuclear turbine generator market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. General Electric Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hitachi, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mitsubishi Heavy Industries, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Nuclear Turbine Generator Market by Type

4.1.1. Thermal Reactors

4.1.2. Fast Neutron Reactors

4.1.3. Nuclear Fusion Reactors

4.2. Global Nuclear Turbine Generator Market by Technology

4.2.1. Pressurized Water Reactors

4.2.2. Liquid Metal Fast Breeder Reactor

4.2.3. Pebble Bed Reactors

4.2.4. Molten Salt Reactors

4.2.5. Gas Cooled Reactor

4.2.6. Others (Supercritical Water Reactors (SCWRs), and Very-High-Temperature Reactors (VHTRs))

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Ansaldo Energia S.p.A.

6.2. Atlas Copco AB

6.3. Babcock & Wilcox Enterprises, Inc.

6.4. Bharat Heavy Electricals Limited (BHEL)

6.5. Bruce Power Inc.

6.6. Cameco Corp.

6.7. China National Nuclear Corp.

6.8. DEC Dongfeng Electric Machinery Co., Ltd.

6.9. Doosan Škoda Power

6.10. Ebara Elliott Energy

6.11. Fuji Electric Co., Ltd.

6.12. Harbin Electric Corporation Co., Ltd

6.13. JSC "Ukrainian Energy Machines

6.14. KEPCO KPS

6.15. Nuclear Power Corporation of India Ltd.

6.16. Shanghai Electric Power Generation Group

6.17. Siemens Energy

6.18. Toshiba America Energy Systems Corp.

6.19. Voith GmbH & Co. KGaA

6.20. Westinghouse Electric Company LLC.

1. Global Nuclear Turbine Generator Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Nuclear Thermal Reactors Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Nuclear Fast Neutron Reactors Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Nuclear Fusion Reactors Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Nuclear Turbine Generator Market Research And Analysis By Technology, 2023-2031 ($ Million)

6. Global Pressurized Water Reactors For Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Liquid Metal Fast Breeder Reactor For Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Pebble Bed Reactors For Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Molten Salt Reactors For Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Gas Cooled Reactor For Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Other Technology For Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

13. North American Nuclear Turbine Generator Market Research And Analysis By Country, 2023-2031 ($ Million)

14. North American Nuclear Turbine Generator Market Research And Analysis By Type, 2023-2031 ($ Million)

15. North American Nuclear Turbine Generator Market Research And Analysis By Technology, 2023-2031 ($ Million)

16. European Nuclear Turbine Generator Market Research And Analysis By Country, 2023-2031 ($ Million)

17. European Nuclear Turbine Generator Market Research And Analysis By Type, 2023-2031 ($ Million)

18. European Nuclear Turbine Generator Market Research And Analysis By Technology, 2023-2031 ($ Million)

19. Asia-Pacific Nuclear Turbine Generator Market Research And Analysis By Country, 2023-2031 ($ Million)

20. Asia-Pacific Nuclear Turbine Generator Market Research And Analysis By Type, 2023-2031 ($ Million)

21. Asia-Pacific Nuclear Turbine Generator Market Research And Analysis By Technology, 2023-2031 ($ Million)

22. Rest Of The World Nuclear Turbine Generator Market Research And Analysis By Region, 2023-2031 ($ Million)

23. Rest Of The World Nuclear Turbine Generator Market Research And Analysis By Type, 2023-2031 ($ Million)

24. Rest Of The World Nuclear Turbine Generator Market Research And Analysis By Technology, 2023-2031 ($ Million)

1. Global Nuclear Turbine Generator Market Share By Type, 2023 Vs 2031 (%)

2. Global Nuclear Thermal Reactors Market Share By Region, 2023 Vs 2031 (%)

3. Global Nuclear Fast Neutron Reactors Market Share By Region, 2023 Vs 2031 (%)

4. Global Nuclear Fusion Reactors Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

5. Global Nuclear Turbine Generator Market Share By Technology, 2023 Vs 2031 (%)

6. Global Pressurized Water Reactors For Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

7. Global Liquid Metal Fast Breeder Reactor For Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

8. Global Pebble Bed Reactors For Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

9. Global Molten Salt Reactors For Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

10. Global Gas Cooled Reactor For Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

11. Global Other Technology For Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

12. Global Nuclear Turbine Generator Market Share By Region, 2023 Vs 2031 (%)

13. US Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

14. Canada Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

15. UK Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

16. France Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

17. Germany Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

18. Italy Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

19. Spain Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

20. Rest Of Europe Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

21. India Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

22. China Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

23. Japan Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

24. South Korea Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

25. Rest Of Asia-Pacific Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

26. Latin America Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)

27. Middle East And Africa Nuclear Turbine Generator Market Size, 2023-2031 ($ Million)