Nucleic Acid Labeling Market

Global Nucleic Acid Labeling Market Size, Share & Trends Analysis Report by Labeling Type (Biotin Based, Fluorescent, Radioactive Phosphates, Others), by Application (Polymerase Chain Reaction (PCR), Microarray, In-Situ Hybridization, DNA Sequencing, and Others), by End-user (Hospitals, Diagnostic Centres, Others), Forecast 2019-2025 Update Available - Forecast 2025-2035

The nucleic acid labeling market is projected to grow at a considerable CAGR of around 8% during the forecast period (2019-2025). The rapid production of indexed DNA groupings and assembly into new genomes has been possible due to the continuous efforts by life science research scientists’ and specialists. This has have made significant contributions to the nucleic acid labeling market. In addition, technical advancements in the life science field have resulted in increased speed and a decrease in the cost of DNA fusion. These researchers became capable to design and incorporate adapted bacterial chromosomes which can be used as part of the development of cutting-edge biofuels, bio-items, renewable chemicals, and others.

The advancements in modern engineering have enabled scientists to build new sequences of DNA. New organisms that produce biofuels and excrete medical drugs are being designed by scientists with the aid of new advanced software systems and laboratory chemicals. In addition, growing research activities, creative and advanced nuclear acid labeling technologies, and growing R&D investments in drug discovery and production are also driving the growth of the global market for nucleic acid labeling. However, costly research methods, strict regulatory criteria are the factors that inhibit the growth of the global market for nucleic acid labeling. The rising US FDA approval for personalized medicine is anticipated to create opportunities for the growth of the global nucleic acid labeling market.

Segmental Outlook

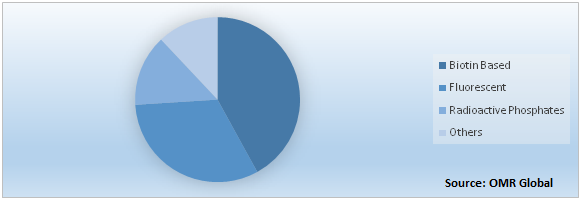

The nucleic acid labeling market is segmented on the basis of labeling type, application, and end-user. Based on labeling type the market is segmented into biotin based, fluorescent, radioactive phosphates, and others. Biotin based labeling is anticipated to hold major market share based on labeling type during the forecast period. Based on application the market is segmented into PCR, microarray, in-situ hybridization, DNA sequencing, and others. Based on the application, PCR is anticipated to exhibit considerable growth during the forecast period. Based on end-user the market is segmented into hospitals, diagnostic centers, and others.

Biotin Based will be considerable segment by Labeling Type

Based on labeling type, the non-radioactive labeling type, such as biotin-based labeling is highly preferred owing to the harmful radioactive labeling. Biotin-based labeling has increased stability and is non-hazardous in nature. The biotin-based labels make use of non-toxic materials and are having faster detection rates in comparison to other radioactive labeling types. Furthermore, the long half-life, high stability, and high production capability in bulk and stored at -20°C for repeated uses are the key characteristics of the biotin based labeling which is anticipated to make major contributions towards the growth of the segment. Moreover, the ongoing advancements in biotin-based techniques, such as the addition of long tails of biotinylated nucleotides through enzymatic methods to further drive the growth of this market segment.

Global Nucleic Acid Labeling Market Share by Labeling Type, 2018 (%)

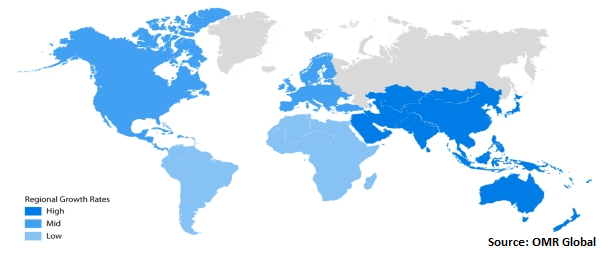

Regional Outlook

The global nucleic acid labeling market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold a major market share in the global Nucleic Acid Labeling market during the forecast period. The major factor for the high market share in the region is the substantial number and amount of funding for gene-editing technology in the US and Canada. Moreover, the presence of major market players in the US is supporting the considerable presence of North America in the market by investing a significant amount in R&D activities. North America is followed by Europe and the Asia Pacific is projected to be the fastest-growing market during the forecasted period.

Global Nucleic Acid Labeling Market Growth, by Region 2019-2025

Asia-Pacific will augment with the significant growth rate in the Nucleic Acid Labeling market

Asia-Pacific is expected to grow at a considerable CAGR during the forecast period. The increasing R&D projects in cancer and other biomedical research, various collaborations with research institutes, and superior healthcare infrastructure in major economies such as China and Japan are the key factors to promote the growth of the market in the region. The increase in demand for highly efficient screening systems and rising drug discovery initiatives among pharmaceuticals and biotechnology companies in the region is anticipated to further promote the growth of the nucleic acid labeling market in the region.

Market Players Outlook

The major companies operating in the nucleic acid labeling market includeF. Hoffman La Roche AG, New England Biolabs, Inc., GE Healthcare, Merck KgaA, Thermo Fisher Scientific Corp., PerkinElmer, Inc., and Promega Corp. among others. The market players operating in the market are actively adopting different growth strategies such as mergers and acquisitions, partnership, collaboration, investment in R&D and new product launches to stay competitive in the marketplace. For instance, in June 2018, New England Biolabs launched NEBNext single-cell input RNA library prep kit for the detection of the increased transcript with ultra-low input amounts.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global nucleic acid labeling market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. F.Hoffman La Roche AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. PerkinElmer Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Thermo Fisher Scientific Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Merck KgaA

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. GE Healthcare

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Nucleic Acid Labeling Market by Labeling Type

5.1.1. Biotin Based

5.1.2. Fluorescent

5.1.3. Radioactive Phosphates

5.1.4. Others

5.2. Global Nucleic Acid Labeling Market by Application

5.2.1. Polymerase Chain Reaction (PCR)

5.2.2. Microarray

5.2.3. In-situ Hybridization

5.2.4. DNA Sequencing

5.2.5. Others

5.3. Global Nucleic Acid Labeling Market by End-User

5.3.1. Hospitals

5.3.2. Diagnostic Centers

5.3.3. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abcam PLC

7.2. Agilent Technologies, Inc.

7.3. baseclick GmbH

7.4. Enzo Biochem, Inc.

7.5. F. Hoffmann La-Roche AG

7.6. GE Healthcare

7.7. Interchim

7.8. Leica Biosystems Nussloch GmbH

7.9. Jena Bioscience GmbH

7.10. Merck KGaA

7.11. New England Biolabs, Inc.

7.12. PerkinElmer, Inc.

7.13. Promega Corp.

7.14. Thermo Fisher Scientific Corp.

7.15. VWR International, LLC

1. GLOBAL NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY LABELING TYPE, 2018-2025 ($ MILLION)

2. GLOBAL BIOTIN BASED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL FLUORESCENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL RADIOACTIVE PHOSPHATES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

7. GLOBAL POLYMERASE CHAIN REACTION (PCR) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL MICROARRAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL IN-SITU HYBRIDIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL DNA SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. GLOBAL HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION,2018-2025 ($ MILLION)

15. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION,2018-2025 ($ MILLION)

16. NORTH AMERICAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY LABELING TYPE, 2018-2025 ($ MILLION)

18. NORTH AMERICAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. NORTH AMERICAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. EUROPEAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY LABELING TYPE, 2018-2025 ($ MILLION)

22. EUROPEAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. EUROPEAN NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY LABELING TYPE, 2018-2025 ($ MILLION)

26. ASIA PACIFIC NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. ASIA PACIFIC NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

28. REST OF THE WORLD NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY LABELING TYPE, 2018-2025 ($ MILLION)

29. REST OF THE WORLD NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD NUCLEIC ACID LABELING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL NUCLEIC ACID LABELING MARKET SHARE BY LABELING TYPE, 2018 VS 2025 (%)

2. GLOBAL NUCLEIC ACID LABELING MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL NUCLEIC ACID LABELING MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL NUCLEIC ACID LABELING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. THE US NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

7. UK NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD NUCLEIC ACID LABELING MARKET SIZE, 2018-2025 ($ MILLION)