Oat-Based Snacks Market

Global Oat-Based Snacks Market Size, Share & Trends Analysis Report by Product (Oat-Based Bakery and Bars and Oat-based Savory), and by Distribution Channel (Offline Distribution and Online Distribution) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global oat-based snacks market is anticipated to grow at a significant CAGR of 4.5% during the forecast period. The growing prevalence of chronic diseases such as obesity, diabetes, and cardiovascular diseases globally is the major factor driving the growth of the oat-based snacks market. The demand for oats in daily meals is increasing as it is a rich source of soluble fiber in the form of beta-glucan. Beta- glucon acts as an immunomodulating agent which reduces cholesterol, lowers blood sugar levels, and boosts immunity. According to the Centers for Disease Control and Prevention and Control (CDC), in 2015–2018, nearly 12% of adults aged 20 years and above had total cholesterol higher than 240 mg/dL, and 28 million adults in the US have total cholesterol levels higher than 240 mg/dL. Increasing stress over such high cholesterol levels is anticipated to encourage the demand for healthy foods and snacks. Furthermore, an increase in consumption of oats also promotes metabolism and healthy weight loss as they contain more dietary fiber. Hence, the preference for a healthy diet is increasing among people due to growing obesity and other chronic diseases.

Impact of COVID-19 Pandemic on Global Oat-Based Snacks Market

The shutdown of various manufacturing plants has affected the global supply chains and negatively impacted the manufacturing and sale of the oat-based snacks market. The market experienced a delay in product deliveries and fluctuation in prices during the COVID-19 pandemic. However, the pandemic has also enforced a shift towards a healthier lifestyle among people which pushes the population towards the adoption of more fiber and nutrition intake in their diets. This factor has positively impacted the growth of the oat-based snacks market during the COVID-19 pandemic. Shoppers began looking for alternatives to in-store shopping to avoid in-person contact. Grocers globally reacted by expanding their availability of online shopping by adding delivery models.

Segmental Outlook

The global oat-based snacks market is segmented based on the product and distribution channel. Based on the product, the market is segmented into oat-based bakery and bars and oat-based savory. Based on the distribution channel, the market is sub-segmented into offline distribution and online distribution. The above-mentioned segments can be customized as per the requirements.

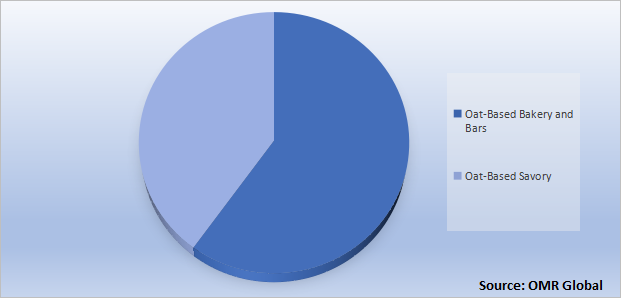

Global Oat-Based Snacks Market Share by Product, 2021 (%)

The Oat-Based Bakery and Bars Segment is Expected to Hold a Prominent Share in the Global Oat-Based Snacks Market

Oats add flavor and nutrition to a variety of baked goods as they alter the texture, flavor, and nutritional value of baked items by creating a hearty, mildly nutty flavor while at the same time boosting the fiber intake. Baked food products including bread, biscuits, and cookies, have become healthier by using oat flour, rolled oats, or oat bran. Owing to their high nutritional value oat-based bakeries and bars are gaining increasing consideration. Due to this increasing demand, product manufacturers have started adding fiber and nutrition to a range of bakery products using oats. For instance, in 2021 Snacking brand Graze added two new variants to its oat boosts range, cherry bakewell, and chocolate cookie. Both products are designed to deliver the required fiber missing from the diet. Additionally, in 2020 Grenade launched a trio of oat-based protein snack bars in blueberry muffins, chocolate chunks, and billionaires shortbread.

Regional Outlooks

The global Oat-Based Snacks market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

Global Oat-Based Snacks Market Growth, by Region 2022-2028

snacks-market-growth-by-region.png" alt="Global Oat-Based Snacks Market Growth, by Region" title="Global Oat-Based Snacks Market" class="img-fluid">

Europe is Anticipated to Hold the Prominent Share in the Global Oat-Based Snacks Market

Europe is anticipated to hold a prominent share in the global oat-based snacks market owing to the presence of major manufacturers in this region. Major manufacturers present in this region include Nestlé, Well&Truly, Pladis Global, Stoats Porridge Bars Ltd., and others, which are adopting various marketing strategies such as new product launches, product innovation, mergers, and acquisitions to gain a competitive edge in the market. For instance, in 2021, KWell&Truly made its first foray into vegan chocolate with the launch of a new range of oat milk chocolate bars. The products joined the brand’s range of savory snacks with three indulgent flavors such as oat m&lk, salted caramel, and caramelized hazelnuts. Well&Truly’s vegan chocolate bars are also gluten-free, non-GMO, and kosher. Furthermore, in 2019, Pladis, a British confectionery, and snack foods company made snack time healthier with the launch of the new McVitie’s Granola Oat Bakes. The McVitie’s baked biscuits are packed with oats and are available in two variants: dark chocolate & almond and cranberry.

Market Players Outlook

The major companies serving the global oat-based snacks market include General Mills, Inc., Nairn’s Oatcakes Ltd., Nestlé Group (Uncle Tobys), PepsiCo, Inc. (The Quaker Oats Co.), Stoats Porridge Bars Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2021, Airly Foods, part of Bright Future Foods LLC, a subsidiary of Post Holdings, Inc. launched Oat Clouds, a climate-friendly snack. The snack crackers are made with wholesome grains and oats and are available in cheddar, sea salt, chocolate, and salted caramel varieties. The product is climate-friendly, as every 7.5-oz box removes 18 to 21 grams of CO2 from the air.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global oat-based snacks market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

?Current Industry Analysis and Growth Potential Outlook

?Impact of COVID-19 on the Global Oat-Based Snacks Market

?Recovery Scenario of Global Oat-Based Snacks Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.2.General Mills, Inc.

3.2.1.Overview

3.2.2.Financial Analysis

3.2.3.SWOT Analysis

3.2.4.Recent Developments

3.3.Nairn’s Oatcakes Ltd.

3.3.1.Overview

3.3.2.Financial Analysis

3.3.3.SWOT Analysis

3.3.4.Recent Developments

3.4.Nestlé Group (Uncle Tobys)

3.4.1.Overview

3.4.2.Financial Analysis

3.4.3.SWOT Analysis

3.4.4.Recent Developments

3.5.PepsiCo, Inc. (The Quaker Oats Co.)

3.5.1.Overview

3.5.2.Financial Analysis

3.5.3.SWOT Analysis

3.5.4.Recent Developments

3.6.Stoats Porridge Bars Ltd.

3.6.1.Overview

3.6.2.Financial Analysis

3.6.3.SWOT Analysis

3.6.4.Recent Developments

3.7.Key Strategy Analysis

3.8.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Oat-Based Snacks Market by Product

4.1.1.Oat-based bakery and bars

4.1.2.Oat-based savory

4.2.Global Oat-Based Snacks Market by Distribution Channel

4.2.1.Offline Distribution

4.2.2.Online Distribution

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Britannia Industries Ltd.

6.2.CORE Foods

6.3.Del Monte Foods, Inc.

6.4.Evolve Snacks

6.5.Grenade

6.6.Happi Free From

6.7.Hearthside Food Solutions LLC

6.8.Insurgent Brands LLC

6.9.Kallo Foods Ltd (Mrs. Crimble’s)

6.10.Kellogg Europe Trading Ltd.

6.11.Lantmännen ek för

6.12.Libre Naturals Inc.

6.13.Naturell (India) Pvt Ltd.

6.14.Nature Delivered Ltd.

6.15.Nutty Yogi

6.16.RIP VAN INC.

6.17.Seven Sundays

6.18.Simply Delicious, Inc. dba Bobo’s Oat Bars

6.19.SNACKZILLA

6.20.Thunderbird Real Food Bar

6.21.United Biscuit Private Ltd.

6.22.Weetabix Ltd.

6.23.Well&Truly Ltd.

1.GLOBAL OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2.GLOBAL OAT-BASED BAKERY AND BARS PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL OAT-BASED SAVORY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

5.GLOBAL OAT-BASED SNACKS BY OFFLINE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.GLOBAL OAT-BASED SNACKS BY ONLINE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

8.NORTH AMERICAN OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9.NORTH AMERICAN OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

10.NORTH AMERICAN OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

11.EUROPEAN OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12.EUROPEAN OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

13.EUROPEAN OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

14.ASIA-PACIFIC OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15.ASIA-PACIFIC OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

16.ASIA-PACIFIC OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

17.REST OF THE WORLD OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18.REST OF THE WORLD OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

19.REST OF THE WORLD OAT-BASED SNACKS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL OAT-BASED SNACKS MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL OAT-BASED SNACKS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL OAT-BASED SNACKS MARKET, 2022-2028 (%)

4.GLOBAL OAT-BASED SNACKS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

5.GLOBAL OAT-BASED BAKERY AND BARS PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL OAT-BASED SAVORY PRODUCTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL OAT-BASED SNACKS MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

8.GLOBAL OAT-BASED SNACKS BY OFFLINE DISTRIBUTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.GLOBAL OAT-BASED SNACKS BY ONLINE DISTRIBUTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL OAT-BASED SNACKS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.US OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

12.CANADA OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

13.UK OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

14.FRANCE OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

15.GERMANY OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

16.ITALY OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

17.SPAIN OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

18.REST OF EUROPE OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

19.INDIA OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

20.CHINA OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

21.JAPAN OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

22.SOUTH KOREA OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

23.REST OF ASIA-PACIFIC OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)

24.REST OF THE WORLD OAT-BASED SNACKS MARKET SIZE, 2021-2028 ($ MILLION)