Offshore Decommissioning Market

Offshore Decommissioning Market Size, Share & Trends Analysis Report By Service (Project Management, Engineering & Planning, Permitting & Regulatory Compliance, Platform Preparation, Well Plugging & Abandonment, Conductor Removal, Mobilization & Demobilization of Derrick Barges, Platform Removal, Pipeline & Power Cable Decommissioning, Materials Disposal, and Site Clearance), By Depth (Shallow Water and Deepwater), and By Structure (Topside, Substructure, and Sub Infrastructure), Forecast Period (2024-2031)

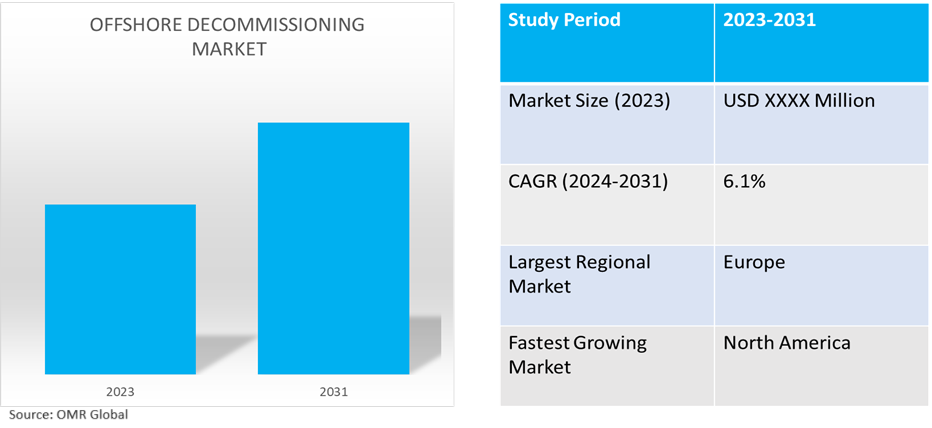

Offshore decommissioning market is anticipated to grow at a CAGR of 6.1% during the forecast period (2024-2031). Decommissioning involves the safe plugging of the hole in the earth’s surface and disposal of the equipment used in offshore oil production. Decommissioning is a rapidly developing market sector in the petroleum business, with major potential and major risks. It is a source of major liability for counties, operators, contractors, and the public and it must be understood if it is to be managed cost-effectively.

Market Dynamics

Green Technology Integration Trend to Revolutionize Offshore Decommissioning Market Growth

The offshore decommissioning services market is experiencing a transformative wave with the infusion of green technology, marking a paradigm shift in industry practices. Advancements in robotics, automation, and cutting-edge techniques are elevating efficiency, safety, and cost-effectiveness in decommissioning operations. This green innovation aligns with the emergence of a sustainable techno-economic paradigm, driven by eco-friendly technologies and production methods. As the industry capitalizes on digital technologies, particularly artificial intelligence in Industry 4.0, a new era unfolds. AI applications, ranging from predictive maintenance to fault diagnostics in machinery, promise to significantly reduce downtime, maintenance costs, and safety risks. This holistic integration of green technology and AI stands as a pivotal trend, ushering in a greener, smarter future for the offshore decommissioning services industry or market.

Advances in Post-Abandonment Monitoring Systems

Globally, the advances in post-abandonment monitoring systems and the use of single lifts in decommissioning are emerging trends in the market. The oil and gas industry has been facing difficulties in demonstrating and guaranteeing safe well abandonment and in meeting the monitoring requirements set by environmental regulators. In November 2018, the ShaleSafe consortium initially developed ShaleSafe, a multi-sensor survey system, to alert shale gas operators to contamination risks. The technology has been used for monitoring abandoned wells. When the system is deployed into shale gas wells, it monitors key parameters multiple times a day to notify shale gas operators whenever the presence of any gas or other unexpected chemical is detected. In addition to working in shale gas aquifers, the technology also helps monitor onshore wells that have been abandoned. Therefore, the advances in post-abandonment monitoring technologies will ensure the safety and integrity of well abandonment, which will drive the growth of the market.

Market Segmentation

Our in-depth analysis of the global offshore decommissioning market includes the following segments by service, depth, and structure:

- Based on service, the market is segmented into project management, engineering & planning, permitting & regulatory compliance, platform preparation, well plugging & abandonment, conductor removal, mobilization & demobilization of derrick barges, platform removal, pipeline & power cable decommissioning, materials disposal, and site clearance.

- Based on depth, the market is segmented into shallow water and deepwater.

- Based on structure, the market is segmented into topside, substructure, and sub-infrastructure.

Shallow Water is Projected to Emerge as the Largest Segment

The shallow water segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the low functional price and retrieving oil costs in the oil and gas market. Many of the seaward activities being deactivated are in shallow water, because of the actuality that advanced offshore products were mostly in shallow water. Therefore, with several offshore oil and gas projects, along with the rising investments in the offshore oil and gas sector, the demand for decommissioning is expected to grow significantly during the forecast period.

Topside Segment to Hold a Considerable Market Share

Topsides account for the considerable market share of an offshore platform's weight, and decommissioning topsides and related equipment necessitates the use of specialized heavy lift vessels and removal equipment. Thus, by structure, the market for topsides is the largest segment of the market. In November 2022, A package of Norwegian offshore E&P from Wintershall Dea known as the North Sea Brage Field acquired by OKEA. The business has seen upside potential and is attempting to take advantage of it as Brage's operator. In the upcoming years, it is anticipated that the need to decommission outdated oil and gas infrastructure will increase, creating considerable opportunities for business and government.

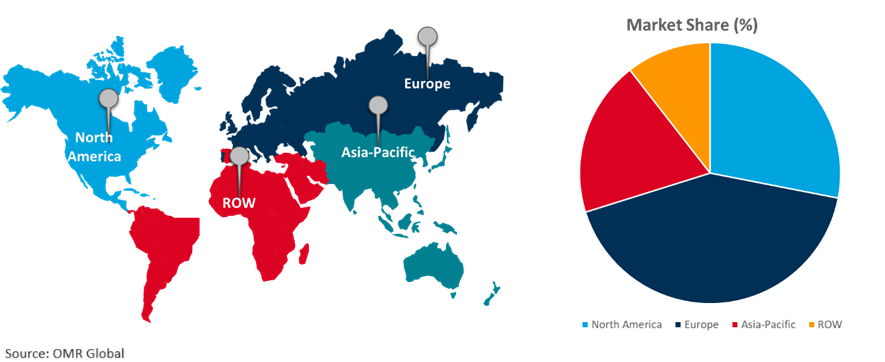

Regional Outlook

The global offshore decommissioning market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Grow at the Highest CAGR

North America is expected to witness a high CAGR in the global market during the forecasted period. North America will also play a significant role in growing offshore discharging market demand. Each year, the region accounted for the largest number of oil-well commissioned in the US and Gulf of Mexico, where they have been setting up an “Ocean Program” to materialize efforts.

Global Offshore Decommissioning Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe holds a significant share owing to the increasing number of mature offshore infrastructures in the basins of the North Sea and the stringent regulatory environment in major oil and gas-producing countries of the region, such as the UK and Norway. Moreover, several oil and gas fields are likely to be decommissioned during the forecast period. The vendors in the region are awarded contracts for decommissioning oil and gas fields. For instance, in June 2020, AF Gruppen was awarded a decommissioning contract by Shell UK Ltd. for dismantling and recycling the Curlew floating, production, storage, and offloading unit, which operated in the North Sea. Such an increase in the number of contracts for offshore decommissioning activities will drive the growth of the market in the region during the forecast period.

Additionally, the market is driven by alliances between many oil and gas companies. Several oil and gas companies in Europe formed an alliance aimed at creating a UK hub for the North Sea decommissioning. The companies aim to provide an integrated service for oil and gas installation decommissioning as the use of fossil fuels has been declining in the energy industry. Such collaborations are also expected to drive the growth of the market.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global offshore decommissioning market include AF Gruppen ASA, Aker Solutions, John Wood Group Plc., and TechnipFMC Plc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2021, Aker Solutions signed a contract with Heerema Marine Contractors for the decommissioning of the Heimdal and Veslefrikk fields offshore of Norway. Aker Solutions offers the goods, systems, and services needed to extract energy from sources like oil, gas, offshore wind, and CO2 capture. Three offshore installations from the Heimdal and Veslefrikk fields are included in the scope, along with their receiving, deconstruction, and recycling.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global offshore decommissioning market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AF Gruppen ASA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Aker Solutions

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. John Wood Group Plc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. TechnipFMC PLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Offshore Decommissioning Market by Service

4.1.1. Project Management, Engineering & Planning

4.1.2. Permitting & Regulatory Compliance

4.1.3. Platform Preparation

4.1.4. Well Plugging & Abandonment

4.1.5. Conductor Removal

4.1.6. Mobilization & Demobilization of Derrick Barges

4.1.7. Platform Removal

4.1.8. Pipeline & Power Cable Decommissioning

4.1.9. Materials Disposal

4.1.10. Site Clearance

4.2. Global Offshore Decommissioning Market by Depth

4.2.1. Shallow Water

4.2.2. Deepwater

4.3. Global Offshore Decommissioning Market by Structure

4.3.1. Topside

4.3.2. Substructure

4.3.3. Sub Infrastructure

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Able UK Ltd.

6.2. Allseas Group S.A.

6.3. Baker Hughes Co.

6.4. Boskalis

6.5. Claxton Engineering Services Ltd.

6.6. DeepOcean

6.7. Equinor ASA

6.8. Halliburton Energy Services, Inc.

6.9. Heerema International Group

6.10. Linch-pin

6.11. Mactech Offshore Machining & Cutting Solutions

6.12. Petrofac Ltd.

6.13. Ramboll Group A/S

6.14. SAIPEM SpA

6.15. SUBSEA TECH

6.16. Subsea7

6.17. Tetra Technologies, Inc.

1. GLOBAL OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

2. GLOBAL OFFSHORE PROJECT MANAGEMENT, ENGINEERING & PLANNING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OFFSHORE PERMITTING & REGULATORY COMPLIANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OFFSHORE PLATFORM PREPARATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OFFSHORE WELL PLUGGING & ABANDONMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OFFSHORE CONDUCTOR REMOVAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OFFSHORE MOBILIZATION & DEMOBILIZATION OF DERRICK BARGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OFFSHORE PLATFORM REMOVAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OFFSHORE PIPELINE & POWER CABLE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OFFSHORE MATERIALS DISPOSAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OFFSHORE SITE CLEARANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY DEPTH, 2023-2031 ($ MILLION)

13. GLOBAL SHALLOW WATER OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL DEEPWATER OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2023-2031 ($ MILLION)

16. GLOBAL OFFSHORE DECOMMISSIONING TOPSIDE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL OFFSHORE DECOMMISSIONING SUBSTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL OFFSHORE DECOMMISSIONING SUB-INFRASTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY DEPTH, 2023-2031 ($ MILLION)

23. NORTH AMERICAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2023-2031 ($ MILLION)

24. EUROPEAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

26. EUROPEAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY DEPTH, 2023-2031 ($ MILLION)

27. EUROPEAN OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY DEPTH, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY DEPTH, 2023-2031 ($ MILLION)

35. REST OF THE WORLD OFFSHORE DECOMMISSIONING MARKET RESEARCH AND ANALYSIS BY STRUCTURE, 2023-2031 ($ MILLION)

1. GLOBAL OFFSHORE DECOMMISSIONING MARKET SHARE BY SERVICE, 2023 VS 2031 (%)

2. GLOBAL OFFSHORE PROJECT MANAGEMENT, ENGINEERING & PLANNING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL OFFSHORE PERMITTING & REGULATORY COMPLIANCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OFFSHORE PLATFORM PREPARATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OFFSHORE WELL PLUGGING & ABANDONMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OFFSHORE CONDUCTOR REMOVAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OFFSHORE MOBILIZATION & DEMOBILIZATION OF DERRICK BARGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OFFSHORE PLATFORM REMOVAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL OFFSHORE PIPELINE & POWER CABLE DECOMMISSIONING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OFFSHORE MATERIALS DISPOSAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL OFFSHORE SITE CLEARANCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL OFFSHORE DECOMMISSIONING MARKET SHARE BY DEPTH, 2023 VS 2031 (%)

13. GLOBAL SHALLOW WATER OFFSHORE DECOMMISSIONING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL DEEPWATER OFFSHORE DECOMMISSIONING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL OFFSHORE DECOMMISSIONING MARKET SHARE BY STRUCTURE, 2023 VS 2031 (%)

16. GLOBAL OFFSHORE DECOMMISSIONING TOPSIDE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL OFFSHORE DECOMMISSIONING SUBSTRUCTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL OFFSHORE DECOMMISSIONING SUB-INFRASTRUCTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL OFFSHORE DECOMMISSIONING MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. US OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

21. CANADA OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

22. UK OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST AND AFRICA OFFSHORE DECOMMISSIONING MARKET SIZE, 2023-2031 ($ MILLION)