Oilfield Services Market

Oilfield Services Market Size, Share & Trends Analysis Report by Type (Equipment Rental, Field Operation, Analytical and Consulting Services), by Application (Onshore and Offshore), and by Service (Workover and Completion Services, Production Services, Drilling Services, Subsea Services, Seismic Services, Processing and Separation Services) Forecast Period (2024-2031)

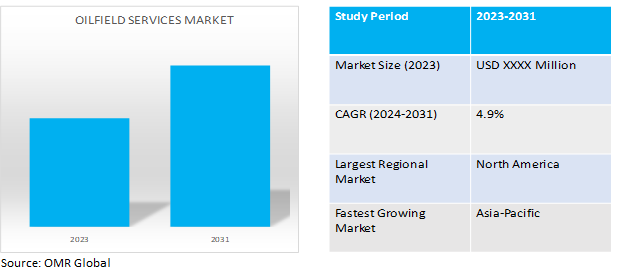

Oilfield services market is anticipated to grow at a moderate CAGR of 4.9% during the forecast period (2024-2031).The oilfield services industry provides specialized expertise and equipment throughout the oil and gas production lifecycle. They assist with exploration (seismic surveys), well drilling and completion, production optimization, and infrastructure maintenance, ensuring efficient and safe extraction of hydrocarbons.

Market Dynamics

E&P Activity in Untapped Regions Drives Oilfield Services Market

The depletion of existing oil and gas reserves is pushing energy companies outward, fueling a surge in exploration and production (E&P) activities in uncharted territories. For instance, in April 2024, Valeura Energy Inc. achieved three oil discoveries in the Gulf of Thailand, validating the successful migration of oil into the Nong Yao D area and identifying new reservoir zones. Exploration also yielded promising results north of the Wassana field. The company plans infill drilling to boost near-term production and anticipates further exploration to capitalize on expanding opportunities within its asset portfolio. This expansion, encompassing both land and offshore environments, presents unique geological challenges. To overcome these hurdles, companies rely heavily on the expertise of oilfield services providers. These specialists offer a comprehensive suite of services, ranging from sophisticated seismic surveys to pinpoint potential reserves, to the drilling and completion of wells in these demanding new locations. This growing dependence on oilfield services to unlock previously inaccessible resources is a key driver of market growth.

High Oil Prices: A Catalyst for Oilfield Services Market Growth

Rising oil prices act as a catalyst for the oilfield services market. For instance, March 2024 saw the Brent crude oil spot price averaging $85 per barrel, up $2 from February, marking the third consecutive monthly increase. Extended OPEC+ production cuts contributed to rising prices. Forecasts anticipate global oil inventories to decline by over 0.9 million b/d in 2Q24, exerting upward pressure on prices.When crude fetches a premium, oil and gas companies become more incentivized to invest in exploration and production (E&P) activities. This translates into increased drilling, well development, and infrastructure maintenance all areas where oilfield service providers play a critical role. Their expertise in well completion, seismic surveys, and other essential services becomes highly sought after during such periods. As E&P activity flourishes due to high oil prices, the demand for oilfield services consequently rises, propelling market growth.

Market Segmentation

Our in-depth analysis of global oilfield services market includes the following segments by type, by services, and by application:

- Based on type, the market is sub-segmented into equipment rental, field operation, analytical and consulting services.

- Based on application, the market is bifurcated into onshore and offshore.

- Based on service, the market is sub-segmented into workover and completion services, production services, drilling services, subsea services, seismic services, processing, and separation services.

Field Operation Segment to Exhibit the Highest CAGR

The expansion of unconventional resources, such as shale gas and tight oil, drives growth in the field operation segment of the oilfield services market. Extracting these resources requires specialized techniques like horizontal drilling and hydraulic fracturing. Field operation services play a critical role in deploying and managing these techniques efficiently. As companies increasingly explore unconventional reserves to meet energy demands, the demand for field operation services, which offer expertise and equipment for these complex operations, continues to rise, propelling the segment's growth.For instance, Petrofac extends its Field maintenance services contract with ADNOC (Abu Dhabi National Oil Company) for two years, supporting operations at the Haliba oil field in Abu Dhabi, UAE. The contract underscores Petrofac's commitment to delivering reliable and sustainable services locally. Haliba field is crucial to ADNOC's 2030 growth strategy, marking its first fully outsourced facilities maintenance project and emphasising the significance of outsourcing for future endeavors.

Cloud Deployment Dominates Market Growth

The drilling services segment is experiencing rapid growth in the oilfield services market due to several factors. Firstly, companies are exploring new and challenging geological formations, necessitating specialized drilling techniques and equipment. Technological advancements, including horizontal drilling and fracking, have further enhanced drilling efficiency.For Instance, in July 2022, Halliburton launched its new Hedron platform featuring fixed cutter polycrystalline diamond compact (PDC) drill bits. These bits leverage advanced technology and customization processes, including Halliburton’s Design at the Customer Interface (DatCISM) and iBitS software, to provide high-performance, application-specific designs. Incorporating Juggernaut cutters, Cerebro in-bit sensing, and Oculus dull grading analytics, Hedron bits offer enhanced drilling performance with increased penetration rates and extended run lengths globally, addressing diverse drilling challenges. Moreover, the increasing focus on unconventional resources like shale gas and tight oil drives demand for specialized drilling services. Routine maintenance and intervention activities, along with global energy demand and regulatory compliance, also contribute to the segment's growth trajectory.

Regional Outlook

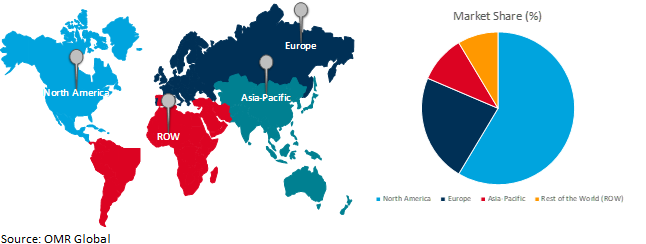

The global oilfield services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The Dynamic Forces Powering North America's Oilfield Services Market

The global demand for oil and the US role as a significant global supplier drive the oilfield services market in North America. With the USA being a prominent producer, particularly due to advancements in unconventional drilling technologies and the exploitation of vast shale oil and gas reserves, there is a constant need for exploration, drilling, production, and maintenance activities. For instance, in the past six consecutive years, the US has maintained its position as the world's top crude oil producer, as reported by International Energy Statistics. In 2023, US crude oil production, including condensate, averaged 12.9 million barrels per day (b/d), surpassing the previous US and global record set in 2019 at 12.3 million b/d. Notably, the average monthly US crude oil production reached a new milestone in December 2023, exceeding 13.3 million b/d. This aligns with the global oil demand, which remains robust across various sectors such as transportation, manufacturing, and energy production. As a result, oilfield service providers in North America experience sustained growth, fostering innovation, technological advancements, and market competitiveness in the region.

Global Oilfield Services Market Growth by Region 2024-2031

Asia-Pacific to Exhibit the Highest CAGR

The Asia-Pacific region is experiencing a surge in energy demand driven by several key factors. Rapid economic development across the region has led to a significant increase in energy consumption, particularly for oil and gas.This growing demand for energy resources necessitates increased exploration and production activities, creating a robust market for Oilfield Services (OFS) companies that can support these endeavors. As the region strives towards achieving energy security and fueling its continued economic growth, the demand for efficient and advanced oilfield services is expected to remain a key driver of market expansion in the Asia Pacific.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global oilfield services market include Halliburton Energy Services, Inc., Schlumberger Limited, Aker Solutions ASA, SAIPEM SpA, and EXPRO HOLDINGS UK 2 LIMITEDamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024,SLB entered into an all-stock acquisition agreement with ChampionX Corporation (NASDAQ: CHX) to bolster its presence in the oilfield services production space. The acquisition includes ChampionX's leading production chemicals and artificial lift technologies. The deal aims to enhance operational efficiency and extend well life, aligning with SLB's commitment to delivering integrated solutions and innovative technologies throughout the oil and gas production lifecycle. The transaction is expected to generate approximately $400 million in annual pre-tax synergies within three years.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global oilfield services market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aker Solutions ASA

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. EXPRO Holdings UK 2 Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Halliburton Energy Services, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SAIPEM SpA

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Schlumberger Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Oilfield Services Market by Type

4.1.1. Equipment Rental

4.1.2. Field Operation

4.1.3. Analytical and Consulting Services

4.2. Global Oilfield Services Market by Application

4.2.1. Onshore

4.2.2. Offshore

4.3. Global Oilfield Services Market by Service

4.3.1. Workover and Completion Services

4.3.2. Production Services

4.3.3. Drilling Services

4.3.4. Subsea Services

4.3.5. Seismic Services

4.3.6. Processing and Separation Services

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Baker Hughes Company

6.2. China Oilfield Services Limited

6.3. Diamond Offshore Drilling, Inc.

6.4. Nabors Industries, Inc.

6.5. National Energy Services Reunited Corp.

6.6. NOV Inc.

6.7. OiLSERV

6.8. Transocean Ltd.

6.9. Valaris Limited

6.10. Weatherford International plc

1. GLOBAL OILFIELD SERVICESMARKET RESEARCH AND ANALYSIS BYTYPE, 2023-2031 ($ MILLION)

2. GLOBAL OILFIELD EQUIPMENT OILFIELD SERVICES MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OILFIELD OPERATIONSERVICES MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OILFIELD ANALYTICAL AND CONSULTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OILFIELD SERVICESMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL OILFIELD SERVICES FOR ONSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OILFIELD SERVICES FOR OFFSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OILFIELD SERVICESMARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

9. GLOBAL WORKOVER AND COMPLETION OILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PRODUCTION OILFIELD SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DRILLINGOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SUBSEAOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SEISMICOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL PROCESSING AND SEPARATIONOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBALOILFIELD SERVICES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN OILFIELD SERVICES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN OILFIELD SERVICES RESEARCH AND ANALYSIS BYTYPE 2023-2031 ($ MILLION)

18. NORTH AMERICAN OILFIELD SERVICES RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN OILFIELD SERVICES RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

20. EUROPEAN OILFIELD SERVICES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN OILFIELD SERVICES RESEARCH AND ANALYSIS BYTYPE2023-2031 ($ MILLION)

22. EUROPEAN OILFIELD SERVICES RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. EUROPEAN OILFIELD SERVICES RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC OILFIELD SERVICES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICOILFIELD SERVICES RESEARCH AND ANALYSIS BYTYPE, 2023-2031 ($ MILLION)

26. ASIA- PACIFIC OILFIELD SERVICES RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. ASIA-PACIFICOILFIELD SERVICES RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD OILFIELD SERVICES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. REST OF THE WORLD OILFIELD SERVICES RESEARCH AND ANALYSIS BYTYPE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD OILFIELD SERVICES RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD OILFIELD SERVICES RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

1. GLOBAL OILFIELD SERVICES RESEARCH AND ANALYSIS BY TYPE, 2023 VS 2031 (%)

2. GLOBAL OILFIELD EQUIPMENT RENTALSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL OILFIELD OPERATIONSERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL OILFIELD ANALYTICAL AND CONSULTING SERVICESSERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL OILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

6. GLOBALOILFIELD SERVICESFOR ONSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBALOILFIELD SERVICES MARKET FOR OFFSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL OILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023 VS 2031 (%)

9. GLOBAL WORKOVER AND COMPLETIONOILFIELD SERVICESMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL PRODUCTIONOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL DRILLINGOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL SUBSEAOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL SEISMICOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL PROCESSING AND SEPARATIONOILFIELD SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL OILFIELD SERVICES RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. US OILFIELD SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

18. UK OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

19. FRANCE OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

20. GERMANY OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

21. ITALY OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

22. SPAIN OILFIELD SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

24. INDIA OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

25. CHINA OILFIELD SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN OILFIELD SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC OILFIELD SERVICESMARKETSIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA OILFIELD SERVICESMARKET SIZE, 2023-2031 ($ MILLION)

30. THE MIDDLE EAST & AFRICA OILFIELD SERVICESMARKET SIZE, 2023-2031 ($ MILLION)