Online Grocery Market

Online Grocery Market Size, Share & Trends Analysis Report by Platforms (App-based and Web-based), by Product Type (Fresh produce, Breakfast & dairy, Snacks & beverages, Meat & Seafood, Staples & cooking essentials), and by Purchase Type (One Time Purchase and Subscription), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Online grocery market is anticipated to grow at a CAGR of 15.1% during the forecast period (2023-2030). An increase in technological advancements, continued urbanization, and a paradigm shift in consumers' shopping habits drive the preference for grocery shopping through online channels. The growing adoption of online payments and the assurances for contactless delivery of the ordered groceries offered by online grocers is the key factor supporting the growth of the market globally. Innovative business models, such as slotted or express delivery and on-demand or subscription delivery models, being introduced by grocers are also encouraging consumers to opt for online grocery shopping. The market players are also focusing on introducing effortless and accessible app-based online grocery solutions that further bolster the market growth. For instance, in June 2023, Aldi launched a 30-minute delivery with a new Instacart-powered virtual convenience store. A new Instacart-powered virtual convenience store, that gets ALDI-exclusive products to customers' doors quicker than ever. Together both innovate and make the online grocery experience even more effortless and accessible.

Segmental Outlook

The global online grocery market is segmented on the platforms, product type, and purchase type. Based on the platforms, the market is sub-segmented into app-based and web-based. Based on the product type, the market is sub-segmented into Fresh produce, Breakfast & dairy, Snacks & beverages, Meat & Seafood, Staples & cooking essentials and others. Further, on the basis of purchase type, the market is sub-segmented into one-time purchases and subscriptions. Among the purchase type, the subscription sub-segment is anticipated to hold a considerable share of the market owing to the rise in development of affordable pricing and a variety of benefits ranging from price savings via cashbacks and discounts. Users also get free/priority delivery with the subscription plans.

The App-Based Sub-Segment is Anticipated to Hold a Considerable Share of the Global Online Grocery Market

Among the platforms, the app-based sub-segment is expected to hold a considerable share of the global online grocery market. The segmental growth is attributed to the growing influence of individualized daily meal plans for users, various app makes AI-created recommendations based on user data, dietary preferences and favourite cuisine types and lets users add them to their meal planner. Nutritional breakdowns of ingredients are available at any time, and users can add items to their food shopping list and then send it straight to a retailer’s e-commerce checkout. For instance, in August 2023, Samsung Electronics launched Samsung Food, a personalized, AI-powered food and recipe platform. The app analyzes recipes, standardizes their format and organizes them to create shopping lists based on their ingredients. In addition to mobile devices, users can also access the Samsung Food service with their Bespoke Family Hub™ refrigerators.

Regional Outlook

The global online grocery market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is anticipated to hold a prominent share of the market across the globe, owing to technological advances such as improved websites, mobile application design, faster delivery times, and improved logistics drive the growth of the market.

Global Online Grocery Market Growth, by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Online Grocery Market

Among all regions, the Asia-Pacific regions is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to initiatives pursued by the governments of countries such as India and China to promote e-commerce and digitalization. Increased integration of e-commerce platforms, expansion of online grocery retailers, rapid digitization, rapid urbanization, increasing adoption of smartphones, and internet usage across the region increases the demand for online grocery delivery services in this region.

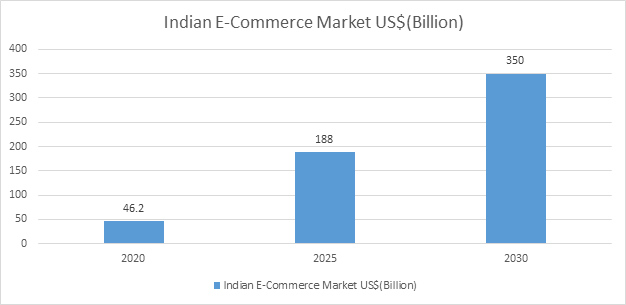

Indian E-Commerce Market US$(Billion)

Source: India Brand Equity Foundation

According to the India Brand Equity Foundation, in October 2023, The Indian online grocery market is estimated to reach US$ 26.93 billion in 2027 from US$ 3.95 billion in FY21, expanding at a CAGR of 33%. India's consumer digital economy is expected to become a US$ 1 trillion market by 2030, growing from US$ 537.5 billion in 2020, driven by the strong adoption of online services such as e-commerce and edtech in the country.

Grocery spending in Asia is set to outstrip every other region of the globe over the next decade, and online remains the fastest-growing channel in grocery across the region. For instance, in July 2023, Ocado Group and AEON the official go-live of their first Customer Fulfilment Centre (CFC) in Japan. The state-of-the-art CFC was launched by AEON and Ocado executives. AEON introduced AEON NEXT to its online grocery delivery brand, Green Beans. The service offers a 50,000 SKU product range at scale as well as a Smart Cart function and one-hour delivery slots to customers.

Market Players Outlook

The major companies serving the online grocery market include AEON Co., Ltd., Amazon.com, Inc., Costco Wholesale Corp., The Kroger Co. Walmart Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2021, Groceries on-demand delivery pioneer, Gorillas, and Britain’s retailer, Tesco, announced a partnership for grocery deliveries to consumers in the UK. The partnership marks a global industry first in the rapid delivery and retail industries.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global online grocery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon.com, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. The Kroger Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Walmart Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Online Grocery Market by Platforms

4.1.1. App-based

4.1.2. Web-based

4.2. Global Online Grocery Market by Product Type

4.2.1. Fresh produce

4.2.2. Breakfast & dairy

4.2.3. Snacks & beverages

4.2.4. Meat & seafood

4.2.5. Staples & cooking essentials

4.2.6. Others (Household and Cleaning Products, Beauty and Personal Care)

4.3. Global Online Grocery Market by Purchase Type

4.3.1. One Time Purchase

4.3.2. Subscription

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AEON Co.,Ltd.

6.2. Albertsons Companies, Inc.

6.3. Blink Commerce Pvt. Ltd.

6.4. Costco Wholesale Corp.

6.5. Fresh Direct, LLC

6.6. Hungryroot

6.7. Instacart

6.8. JD.com, Inc.

6.9. Loblaws Inc.

6.10. Natures Basket Ltd.

6.11. Peapod Digital Labs

6.12. Reliance Retail

6.13. Swiggy

6.14. Target Brands, Inc.

6.15. Tesco.com

6.16. Zomato™ Ltd.

1. GLOBAL ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PLATFORMS, 2022-2030 ($ MILLION)

2. GLOBAL APP-BASED ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL WEB-BASED ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2022-2030 ($ MILLION)

5. GLOBAL FRESH PRODUCE ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

6. GLOBAL BREAKFAST & DAIRY ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL SNACKS & BEVERAGES ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL MEAT & SEAFOOD ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL STAPLES & COOKING ESSENTIALS ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL OTHERS ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PURCHASE TYPE, 2022-2030 ($ MILLION)

12. GLOBAL ONE TIME PURCHASE ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL SUBSCRIPTION ONLINE GROCERY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

14. GLOBAL ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PLATFORMS, 2022-2030 ($ MILLION)

17. NORTH AMERICAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

18. NORTH AMERICAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PURCHASE TYPE, 2022-2030 ($ MILLION)

19. EUROPEAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. EUROPEAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PLATFORMS, 2022-2030 ($ MILLION)

21. EUROPEAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

22. EUROPEAN ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PURCHASE TYPE, 2022-2030 ($ MILLION)

23. ASIA- PACIFIC ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. ASIA- PACIFIC ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PLATFORMS, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PURCHASE TYPE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

28. REST OF THE WORLD ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PLATFORMS, 2022-2030 ($ MILLION)

29. REST OF THE WORLD ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD ONLINE GROCERY MARKET RESEARCH AND ANALYSIS BY PURCHASE TYPE, 2022-2030 ($ MILLION)

1. GLOBAL ONLINE GROCERY MARKET SHARE BY PLATFORMS, 2022 VS 2030 (%)

2. GLOBAL APP-BASED ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL WEB-BASED ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL ONLINE GROCERY MARKET SHARE BY PRODUCT TYPE, 2022 VS 2030 (%)

5. GLOBAL FRESH PRODUCE ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL BREAKFAST & DAIRY ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL SNACKS & BEVERAGES ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL MEAT & SEAFOOD ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL STAPLES & COOKING ESSENTIALS ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL OTHERS ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL ONLINE GROCERY MARKET SHARE ANALYSIS BY PURCHASE TYPE, 2022-2030 ($ MILLION)

12. GLOBAL ONE TIME PURCHASE ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL SUBSCRIPTION ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL ONLINE GROCERY MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

17. UK ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD ONLINE GROCERY MARKET SIZE, 2022-2030 ($ MILLION)