Open Banking Market

Open Banking Market Size, Share & Trends Analysis Report by Services (Banking & Capital Markets, Payments, Digital Currencies, and Value Added Services), by Deployment Mode (Cloud, and On-Premise), and by Distribution Channel (Bank Channels, App Markets, Distributors, and Aggregators) Forecast Period (2024-2031)

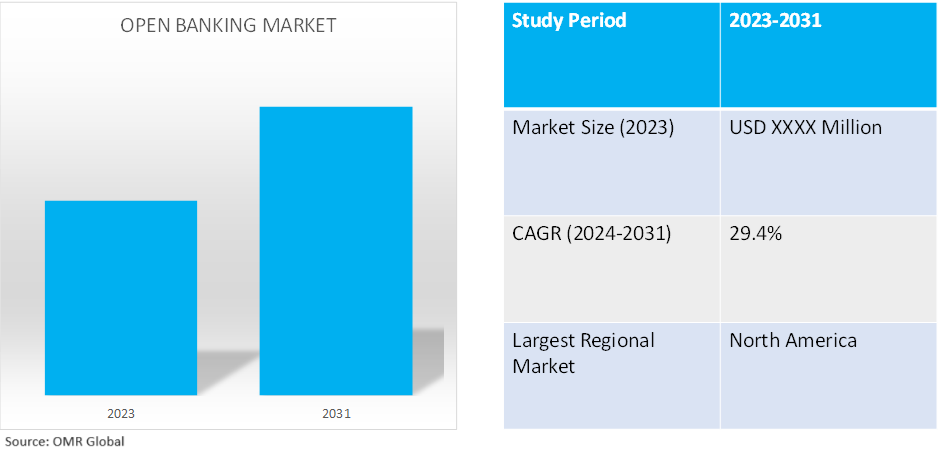

Open banking market is anticipated to grow at a CAGR of 29.4% during the forecast period (2024-2031). Open Banking is a framework in which banks and other financial institutions securely share customer financial data with authorized third-party providers using application programming interfaces (APIs). This essentially allows customers to control how their financial information is accessed and used by approved third-party applications and services.

Market Dynamics

Favorable Government Regulations

Governments around the world are recognizing the potential of open banking to promote financial inclusion, competition, and innovation in the financial sector. Regulatory frameworks like PSD2 (Payment Services Directive 2) in Europe and Open Banking standards in Australia have established guidelines for secure data sharing, giving consumers more control over their financial information.

In May 2024, India and Ghana are collaborating to link their payment systems, the Unified Payments Interface (UPI) and Ghana Interbank Payment and Settlement Systems (GHIPSS), to facilitate instant, low-cost fund transfers. The two countries are also discussing a Memorandum of Understanding (MoU) on digital transformation solutions, a local currency settlement system, and the African Continental Free Trade Agreement (AfCFTA). India's UPI has already reached Singapore, the UAE, and Nigeria. The bilateral trade between India and Ghana has increased to $2.9 billion in 2022-23, mainly due to gold imports. Such collaborations are further likely to drive the growth of the global market.

Increased Adoption of Fintech Services

The rise of FinTech (financial technology) companies is a major driver of an open banking market. These companies leverage open banking APIs to develop new and innovative financial products and services. This fosters a more dynamic and competitive financial landscape, ultimately benefiting consumers.

In April 2024 Visa launched its open banking offering in the US through its acquired vendor Tink. The product allows users to connect their accounts and grants trusted parties access to their financial data. Users can perform various financial tasks, including confirming bank account data, conducting real-time balance checks, and retrieving transaction information from multiple banks. Visa aims to revolutionize the US financial landscape with data access agreements with leading banks and FinTech companies.

Market Segmentation

- Based on service, the market is segmented into banking & capital markets, payments, digital currencies, and value-added services.

- Based on deployment mode, the market is bifurcated into cloud, and on-premise.

- Based on distribution channels, the market is segmented into bank channels, app markets, distributors, and aggregators.

Service is projected to Emerge as the Largest Segment

The primary factor supporting the segment's growth includes the growing demand for personalized financial tools in open banking. Features such as faster, secure payment processing, innovative services in banking and capital markets, and potential integration with digital currencies is further aiding the demand for the service segment.

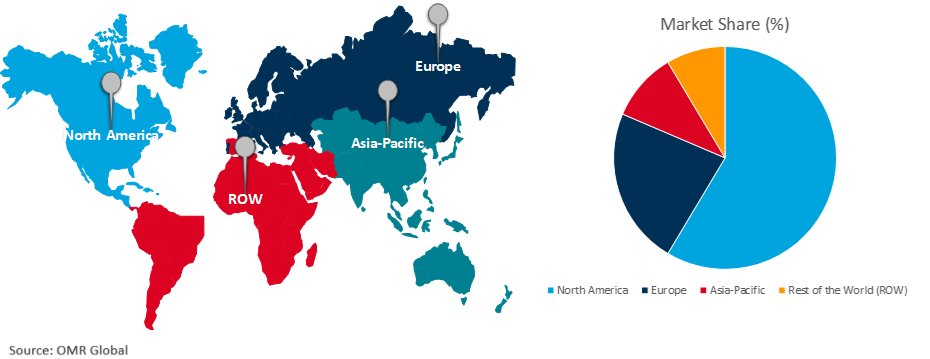

Regional Outlook

The global open banking market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Open Banking Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to its robust FinTech ecosystem, early adoption of new technologies, large and tech-savvy population, evolving regulatory landscape, and presence of major players. The US and Canada are known for their early adoption of new technologies, creating a fertile ground for open banking solutions. The market is also fueled by a large and tech-savvy population.

Market Players Outlook

The major companies serving the global open banking market include Plaid Inc., Finastra, Tink AB, True Layer, and Bud among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions, and partnerships among others to stay competitive in the market. For instance, in September 2023, Saxo Bank announced its partnership with Mastercard to integrate open banking payments into Saxo Bank’s investment platforms. Saxo Bank customers can seamlessly transfer money into their investment accounts without having to log in to a separate bank account to transfer funds into their investment accounts.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global open banking market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Finastra

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Plaid Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Tink AB

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Open Banking Market by Services

4.1.1. Banking & Capital Markets

4.1.2. Payments

4.1.3. Digital Currencies

4.1.4. Value Added Services

4.2. Global Open Banking Market by Deployment Mode

4.2.1. Cloud

4.2.2. On-premises

4.3. Global Open Banking Market by Distribution Channel

4.3.1. Bank Channels

4.3.2. App Markets

4.3.3. Distributors

4.3.4. Aggregators

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Axway Software

6.2. Banco Bilbao Vizcaya Argentaria, S.A.

6.3. Bud

6.4. Crédit Agricole

6.5. DemystData, Ltd.

6.6. Envestnet

6.7. FormFree Holdings Corporation

6.8. Jack Henry & Associates, Inc.

6.9. Mambu

6.10. MineralTree, Inc.

6.11. NCR Corp.

6.12. Qwist

6.13. Salt Edge Ltd.

6.14. Token

6.15. True Layer

6.16. Yapily

6.17. Yodlee

1. GLOBAL OPEN BANKING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

2. GLOBAL OPEN BANKING FOR BANKING AND CAPITAL MARKETS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OPEN BANKING FOR PAYMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OPEN BANKING FOR DIGITAL CURRENCIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OPEN BANKING FOR VALUE ADDED SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

7. GLOBAL CLOUD-BASED OPEN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ON-PREMISES OPEN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

10. GLOBAL OPEN BANKING VIA BANK CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OPEN BANKING VIA APP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OPEN BANKING VIA DISTRIBUTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL OPEN BANKING VIA AGGREGATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL OPEN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

17. NORTH AMERICAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

19. EUROPEAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

21. EUROPEAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

22. EUROPEAN OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC OPEN BANKING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC OPEN BANKING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

27. REST OF THE WORLD OPEN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD OPEN BANKING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2023-2031 ($ MILLION)

29. REST OF THE WORLD OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD OPEN BANKING MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL OPEN BANKING MARKET SHARE BY SERVICES, 2023 VS 2031 (%)

2. GLOBAL OPEN BANKING FOR BANKING AND CAPITAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL OPEN BANKING FOR PAYMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OPEN BANKING FOR DIGITAL CURRENCIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OPEN BANKING FOR VALUE-ADDED SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OPEN BANKING MARKET SHARE BY DEPLOYMENT MODE, 2023 VS 2031 (%)

7. GLOBAL CLOUD-BASED OPEN BANKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ON-PREMISES OPEN BANKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL OPEN BANKING MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

10. GLOBAL OPEN BANKING VIA BANK CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OPEN BANKING VIA APP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OPEN BANKING VIA AGGREGATORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL OPEN BANKING VIA DISTRIBUTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL OPEN BANKING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

17. UK OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA OPEN BANKING MARKET SIZE, 2023-2031 ($ MILLION)