Operator Training Simulator Market

Global Operator Training Simulator Market Size, Share & Trends Analysis Report by Component (Hardware, Software, and Service), by Operator Type (Console Operator and Field Operator), and by End-User (Automotive & Transportation, Aerospace & Defense, Energy & Power, Oil & Gas, Medical & Healthcare, and Others) Forecast 2021-2027 Update Available - Forecast 2025-2031

The global operator training simulator market is anticipated to grow at a significant CAGR of nearly 9.8% during the forecast period. The major factor contributing to the growth of the market includes the rise in integration of high-end technologies such as artificial intelligence (AI), virtual reality (VR), cloud services, and augmented reality (AR), among others. Moreover, the manufacturing organizations globally are training their employees using innovative operator training simulator to ensure maximum safety of assets and improved output from a range of operations which is another factor which is majorly driving the growth of the market. These operator training simulators are used by the employees for operator training to induce new skills necessary to keep up with changes in the workplace. This is especially for the process, and manufacturing industries where the increased inclination toward automation is leading to massive infrastructural changes. As these industries spend increased funds on operator training activities, the demand for OTS platforms is also likely to significantly increase hence drive the market growth.

Impact of COVID-19 Pandemic on Global Operator Training Simulator Market

The COVID-19 pandemic had disrupted the manufacturing operations of various industries across the globe. However, COVID-19 has supported the growth of operator training simulators due to the rising adoption of high-end technology by companies. Therefore, the demand for operator training simulator was increasing by the COVID-19 pandemic. In addition to this the COVID-19 pandemic has restraint to the market due to operational activities of several players in the industry.

Segmental Outlook

The global operator training simulator market is segmented based on the component, operator type, and end-user. Based on the component, the market is segmented into hardware, software, and service. Based on the operator type, the market is sub-segmented into the console operator, and field operator. Based on the end-user, the market is sub-segmented into automotive, aerospace & defense, energy & power, oil & gas, medical & healthcare, and others.

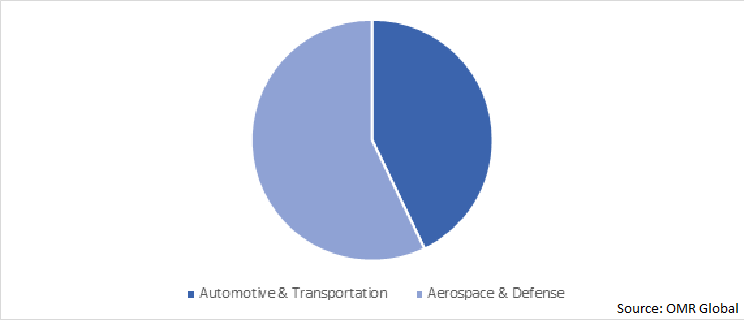

Global Operator Training Simulator Market Share by End-User, 2020 (%)

Aerospace & Defense End-User Segment Holds the Considerable Share in the Global Operator Training Simulator Market

Based on the end-user, the aerospace and defense hold the considerable share of the market globally. The segment is growing due to the introduction of new technologies in the market for different aviation applications. Several businesses are utilizing the software system to educate their employees about the additional features. For instance, in November 2021, the UK Ministry of Defense ("UK MOD") awarded a $88 million contract to Elbit Systems Ltd. for setting up a training program for Texan T-6C aircraft. The UK military flying training system program will support procurement, RAF pilot training, maintenance services, and operations. The growing acceptance of customized training solutions for specific applications will lead the market growth.

Regional Outlook

The global Operator Training Simulator market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Germany, Italy, Spain, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

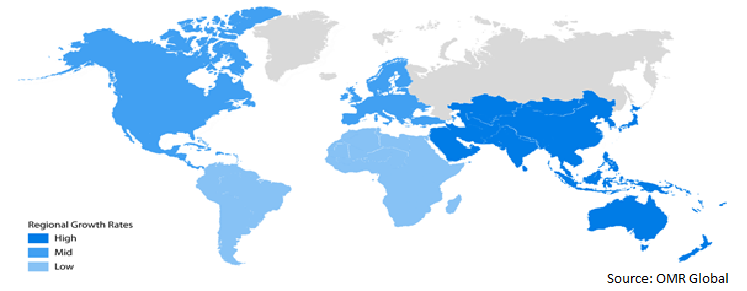

Global Operator Training Simulator Market Growth by Region, 2021-2027

North American Region Projected to Hold the Significant Market Share in the Global Operator Training Simulator Market

North American region is expected to hold considerable market share of the operator training simulator market during the forecast period (2021-2027). The factor that boosts the growth of the market in this region is the rising adoption of automation, innovations, and technological advancements in the industrial domain in the region. For instance, in April 2018, Honeywell International Inc. launched a cloud-based simulator solution that combines VR/ AR to train industrial workers. Moreover, the use of effective training programs to train employees on the latest technologies is likely to contribute in increased demand for effective OTS solutions over the forecast period. Furthermore, the growing awareness about workplace safety and the requirement of teaching new skills to current employees are some of the major trends instrumental in driving the growth of the regional operator training simulator market.

Market Players Outlook

The major companies serving the global operator training simulator market include Siemens AG, Honeywell International Inc. ABB, AVEVA Group plc, Andritz, Aspen Technology Inc., Mynah Technologies LLC and CORYS. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, partnerships and collaborations, and geographical expansion, to stay competitive in the market. For instance, in July 2021, United Academy and Serious Labs announced the development of an advanced forklift, and mobile elevating work platform simulators. The motion-based VR system will offer training in rough terrains.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global operator training simulator market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Operator Training Simulator Market

• Recovery Scenario of Global Operator Training Simulator Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Andritz Automation

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Applied Research Associate, Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Aspen Technology, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Aveva Group PLC

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. DuPont de Numerous, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Operator Training Simulator Market by Component

4.1.1. Hardware

4.1.2. Software

4.1.3. Service

4.2. Global Operator Training Simulator Market by Operator Type

4.2.1. Console Operator

4.2.2. Field Operator

4.3. Global Operator Training Simulator Market by End-User

4.3.1. Automotive & Transportation

4.3.2. Aerospace & Defense

4.3.3. Energy & Power

4.3.4. Oil & Gas

4.3.5. Medical & Healthcare

4.3.6. Others (Manufacturing)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Group

6.2. Ansys, Inc.

6.3. Bae Systems

6.4. Cae Inc.

6.5. Cubic Corp.

6.6. ESI Group

6.7. FLSmidth

6.8. Kratos Defense & Security Solutions, Inc.

6.9. L3 Link Training & Simulation

6.10. Lockheed Martin Corp.

6.11. On24, Inc.

6.12. Saab Ab

6.13. Schneider Electric SE

6.14. Siemens AG

6.15. The Disti Corp.

6.16. Vendor Adoption Matrix

6.17. Yokogawa Electric Corp.

1. GLOBAL OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

2. GLOBAL HARDWARE FOR OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL SOFTWARE FOR OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SERVICE FOR OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY OPERATOR TYPE, 2020-2027 ($ MILLION)

6. GLOBAL CONSOLE OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL FIELD OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

9. GLOBAL OPERATOR TRAINING SIMULATOR IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OPERATOR TRAINING SIMULATOR IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL OPERATOR TRAINING SIMULATOR IN ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL OPERATOR TRAINING SIMULATOR IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL OPERATOR TRAINING SIMULATOR IN MEDICAL & HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL OPERATOR TRAINING SIMULATOR IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. NORTH AMERICAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

18. NORTH AMERICAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY OPERATOR TYPE, 2020-2027 ($ MILLION)

19. NORTH AMERICAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

20. EUROPEAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. EUROPEAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

22. EUROPEAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY OPERATOR TYPE, 2020-2027 ($ MILLION)

23. EUROPEAN OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY OPERATOR TYPE, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

28. REST OF THE WORLD OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

29. REST OF THE WORLD OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2020-2027 ($ MILLION)

30. REST OF THE WORLD OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY OPERATOR TYPE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD OPERATOR TRAINING SIMULATOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL OPERATOR TRAINING SIMULATOR MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL OPERATOR TRAINING SIMULATOR MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL OPERATOR TRAINING SIMULATOR MARKET, 2021-2027 (%)

4. GLOBAL OPERATOR TRAINING SIMULATOR MARKET SHARE BY COMPONENT, 2020 VS 2027 (%)

5. GLOBAL HARDWARE FOR OPERATOR TRAINING SIMULATOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL SOFTWARE FOR OPERATOR TRAINING SIMULATOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL SERVICE FOR OPERATOR TRAINING SIMULATOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL OPERATOR TRAINING SIMULATOR MARKET SHARE BY OPERATOR TYPE, 2020 VS 2027 (%)

9. GLOBAL CONSOLE OPERATOR TRAINING SIMULATOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL FIELD OPERATOR TRAINING SIMULATOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL OPERATOR TRAINING SIMULATOR MARKET SHARE BY END-USER, 2020 VS 2027 (%)

12. GLOBAL OPERATOR TRAINING SIMULATOR IN AUTOMOTIVE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL OPERATOR TRAINING SIMULATOR IN AEROSPACE & DEFENSE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL OPERATOR TRAINING SIMULATOR IN ENERGY & POWER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL OPERATOR TRAINING SIMULATOR IN OIL & GAS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL OPERATOR TRAINING SIMULATOR IN MEDICAL & HEALTHCARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL OPERATOR TRAINING SIMULATOR IN OTHERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL OPERATOR TRAINING SIMULATOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. US OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

20. CANADA OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

21. UK OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

22. FRANCE OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

23. GERMANY OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

24. ITALY OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

25. SPAIN OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF EUROPE OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

27. INDIA OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

28. CHINA OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

29. JAPAN OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

30. SOUTH KOREA OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF ASIA-PACIFIC OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD OPERATOR TRAINING SIMULATOR MARKET SIZE, 2020-2027 ($ MILLION)