Ophthalmic Drugs Market

Global Ophthalmic Drugs Market Size, Share & Trends Analysis Report by Indication (Dry Eye, Eye Allergy, Glaucoma, Eye Infection, Retinal Disorders, and Others), By Drug Class (Anti-glaucoma Drugs, Anti-allergy Drugs, Anti-infective Drugs, Dry Eye Drugs, Retinal Drugs, Other Drugs), Forecast 2019-2025 Update Available - Forecast 2025-2035

The global ophthalmic drugs market is projected to grow at a significant CAGR of around 5% during the forecast period. The factors that are contributing to the growth of the market includes the increasing incidences of eye related disorders such as infections, diabetic retinopathy and others. The incidence and prevalence rate of ophthalmic diseases is growing at a significant rate across the globe. According to the WHO in 2019, around 2.2 billion people across the globe suffered from one or the other kind of visual impairment and 80% of these are considered avoidable.

Most of these vision impairments are due to uncorrected refractive errors (123.7 million) and cataract (65.2 million). Some other causes of visual impairment include glaucoma (6.9 million), unaddressed presbyopia (826 million), diabetic retinopathy (3 million), corneal opacity (4.2 million) and trachoma (2 million). Visual impairment may lead to various conditions such as accidents, depression and anxiety disorders hence these must be treated, which increases the demand for ophthalmic drugs and hence drives the market growth.

Rising R&D activities to introduce novel drugs in the market and government initiatives in the healthcare sectors are some other factors driving the growth of the market over the forecast period. However, factors such as low awareness and scarcity of suitable drugs among the population especially in rural areas are likely to hamper the growth of the market.

Segmental Outlook

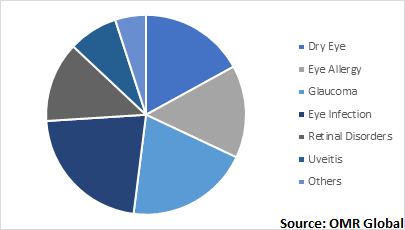

The global ophthalmic drugs market is segmented on the basis of indication, drug class and type. Based on the indication, the market is segmented as dry eye, eye allergy, glaucoma, eye infection, retinal disorders, uveitis, and others. Based on the drug class, the market is segmented as anti-glaucoma drugs, anti-allergy drugs, anti-inflammatory drugs, anti-infective drugs, dry eye drugs, other (nonsteroidal drugs and steroidal drugs). And based on the type, the market is segmented as gels, eye solutions, capsules & tablets, eye drops, and others (ointments).

Dry Eye Disease Indication to Hold the Significant Share in the Market

Amongst the indication segment of the global ophthalmic drugs market, dry eye diseases segment is projected to hold the considerable share in the market. The segmental growth is accredited to the increased dry eye cases among the peoples. One of the primary causes of the dry eye is the exposure to smartphone, laptops and tablet screens. Continuous exposure to such screens causes the dryness in the eyes and reduces the moisture and tears in the eyes which certainly leads to the dry eye diseases. In addition, glaucoma disease is another indication for concern. Glaucoma slowly leads to blindness, and requires long term treatment. Thus, such indications are expected to create scope for the growth of the market during the forecast period.

Global Ophthalmic Drugs Market, by Indication 2018 (%)

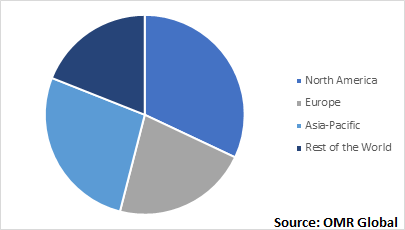

Regional Outlook

The global ophthalmic drugs market is segmented into North America, Europe, Asia-Pacific and the Rest of the World. North America is expected to hold the significant share in the global market during the forecast period. This is attributed to the advanced healthcare infrastructure in the regions. Further, the presence of the key players and adoption of technologically advanced products in the countries such as the US and Canada is directly affecting the growth of the market during the forecast period. Asia-Pacific is also expected to hold considerable share as it has a large pool of older age peoples in the region. The prevalence of high myopia is expected to increase to nearly 24% by the end of 2050 in the high-income Asia-Pacific economies.

Global Ophthalmic Drugs Market, by Region 2018 (%)

Market Players Outlook

The prominent players functioning in the global ophthalmic drugs market includes Allergan Inc., Bayer AG, F.Hoffmann-La Roche, Johnson & Johnson Co., Novartis AG, Pfizer Inc., Sun Pharmaceuticals Industries Ltd., Valeant Pharmaceutical International among many others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global ophthalmic drugs market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ophthalmic drugs market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Novartis International AG

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Allergan PLC

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Santen Pharmaceutical Co., Ltd

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Bausch Health Companies Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Johnson & Johnson Services, Inc.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Ophthalmic Drugs Market by Indication

5.1.1. Dry Eye

5.1.2. Eye Allergy

5.1.3. Glaucoma

5.1.4. Eye Infection

5.1.5. Retinal Disorders

5.1.6. Others (Uveitis)

5.2. Global Ophthalmic Drugs Market by Drug Class

5.2.1. Anti-Glaucoma Drugs

5.2.2. Anti-Allergy Drugs

5.2.3. Anti-Inflammatory Drugs

5.2.4. Anti-Vascular Endothelial Growth Factor (Anti-VEGF) Agents

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acucela Inc.

7.2. AFT Pharmaceuticals Ltd.

7.3. Akron Inc.

7.4. Allergan PLC

7.5. Bayer AG

7.6. Bausch Health Companies Inc.

7.7. Daiichi Sankyo Co. Ltd.

7.8. EyePoint Pharmaceuticals Inc.

7.9. F. Hoffmann-La Roche Ltd.

7.10. Johnson & Johnson Services Inc.

7.11. Merck & Co., Inc.

7.12. Novartis International AG

7.13. Omeros Corp.

7.14. Otsuka Pharmaceutical Co. Ltd.

7.15. Oxurion NV.

7.16. Pfizer Inc.

7.17. Regeneron Pharmaceuticals, Inc.

7.18. Santen Pharmaceutical Co. Ltd.

7.19. Senju Pharmaceutical Co. Ltd.

7.20. Sun Pharmaceuticals Industries Inc.

1. GLOBAL OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2018-2025 ($ MILLION)

2. GLOBAL DRY EYE DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL EYE ALLERGY DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL GLAUCOMA DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL EYE INFECTION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL RETINAL DISORDERS DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OTHER OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

9. GLOBAL ANTI-GLAUCOMA DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ANTI-ALLERGY DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL ANTI-INFLAMMATORY DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ANTI-VEGF AGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2018-2025 ($ MILLION)

16. NORTH AMERICAN OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

17. EUROPEAN OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2018-2025 ($ MILLION)

19. EUROPEAN OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

23. REST OF THE WORLD OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2018-2025 ($ MILLION)

24. REST OF THE WORLD OPHTHALMIC DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

1. GLOBAL OPHTHALMIC DRUGS MARKET SHARE BY INDICATION, 2018 VS 2025 (%)

2. GLOBAL OPHTHALMIC DRUGS MARKET SHARE BY DRUG CLASS, 2018 VS 2025 (%)

3. GLOBAL OPHTHALMIC DRUGS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD OPHTHALMIC DRUGS MARKET SIZE, 2018-2025 ($ MILLION)