Optical Ceramics Market

Global Optical Ceramics Market Size, Share & Trends Analysis Report by Material (Sapphire, Spinel, Aluminum Oxynitride, Yttrium Aluminum Garnet (YAG), and Others), By End-User (Aerospace & Defense, Optics and Optoelectronics, Healthcare, and Others), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global optical ceramics market is estimated to exhibit a significant CAGR of over 12% during the forecast period. The market growth is primarily driven by the growing application of the alternative products of glass, metals, and plastics. The optical ceramics also are known as the transparent ceramics and have wide applications in various industries such as aerospace, optoelectronics products, and others. The advantageous properties such as lightweight, high heat resistance as compared to plastics and other materials drive the application of optical ceramics in various industries.

Moreover, technological advancements in the aerospace and defense industry such as body armors and helmets have been some of the driving factors for the market growth. The continuous focus on the R&D in this field for increasing the scope for applications and develop new products has resulted in achieving better efficiencies. The increased application of optical ceramics in the aerospace and defense industry has contributed significantly to the growth of the market. Many aerospace and defense applications require materials that are transparent in the ultraviolet, visible, and through the mid-infrared wavelength ranges, therefore these ceramics are adopted in the aerospace application that further contributes to the growth of the optical ceramics market.

Segmental Outlook

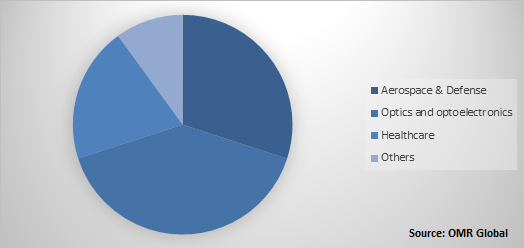

The global optical ceramics market is segmented on the basis of material and end-user. On the basis of material, the market is further classified into sapphire optical ceramics, spinel optical ceramics, aluminum oxynitride optical ceramics, yttrium aluminum garnet optical ceramics and others such as yttria-stabilized zirconia optical ceramics. The sapphire optical ceramics segment is projected to hold a significant share in the market and is expected to continue the same trend during the forecast period, exhibiting remarkable growth. Based on end-user, the market is segregated into aerospace & defense, optics & optoelectronics, healthcare and others such as energy. The aerospace and defense end-user segment is anticipated to grow at a significant growth rate during the forecast period due to the growing adoption of transparent technology in commercial aerospace and increasing defense expenditure across the globe.

Global Optical Ceramics Market Share by End-User, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global optical ceramics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. CeraNova Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Ceramtec GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Surmet Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. 3M Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. SCHOTT Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Recent Developments

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Optical Ceramics Market by Material

5.1.1. Sapphire

5.1.2. Spinel

5.1.3. Aluminum Oxynitride

5.1.4. Yttrium Aluminum Garnet (YAG)

5.1.5. Others (Yttria-stabilized zirconia)

5.2. Global Optical Ceramics Market by End-User

5.2.1. Aerospace & Defense

5.2.2. Optics and Optoelectronics

5.2.3. Healthcare

5.2.4. Others (Energy)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Ceramics Manufacturing, LLC

7.2. AGC Inc.

7.3. Blasch Precision Ceramics, Inc.

7.4. 3M Co.

7.5. CeramTec GmbH

7.6. CeraNova Corp.

7.7. CoorsTek Inc.

7.8. II-VI Inc.

7.9. IRD GLASS

7.10. Kyocera Corp.

7.11. Murata Manufacturing Co., Ltd.

7.12. Rauschert GmbH

7.13. Rayotek Scientific Inc.

7.14. Saint-Gobain Ceramics and Plastics, Inc.

7.15. SCHOTT Corp.

7.16. Surmet Corp.

7.17. Konoshima Chemical Co., Ltd.

7.18. McDanel Advanced Ceramic Technologies, LLC

7.19. Superior Technical Ceramics Corp.

1. GLOBAL OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

2. GLOBAL SAPPHIRE OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL SPINEL OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ALUMINUM OXYNITRIDE OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL YTTRIUM ALUMINUM GARNET OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

8. GLOBAL OPTICAL CERAMICS IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL OPTICAL CERAMICS IN OPTICS AND OPTOELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL OPTICAL CERAMICS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL OPTICAL CERAMICS IN OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

15. NORTH AMERICAN OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

16. EUROPEAN OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

18. EUROPEAN OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

22. REST OF THE WORLD OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

23. REST OF THE WORLD OPTICAL CERAMICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL OPTICAL CERAMICS MARKET SHARE BY MATERIAL, 2018 VS 2025 (%)

2. GLOBAL OPTICAL CERAMICS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL OPTICAL CERAMICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD OPTICAL CERAMICS MARKET SIZE, 2018-2025 ($ MILLION)