Optical Digitizer and Scanner Market

Optical Digitizer and Scanner Market Size, Share & Trends Analysis Report by Product Type (3D Laser Scanners, Structured Light Scanners, Optical Coordinate Measuring Machines (CMMs), Laser Tracker Systems, and Optical Probes), by End-User Industry (Aerospace & Defense, Automotive, Healthcare & Medical, Architecture & Construction, Consumer Electronics, Energy & Power and Others) Forecast Period (2025-2035)

Industry Overview

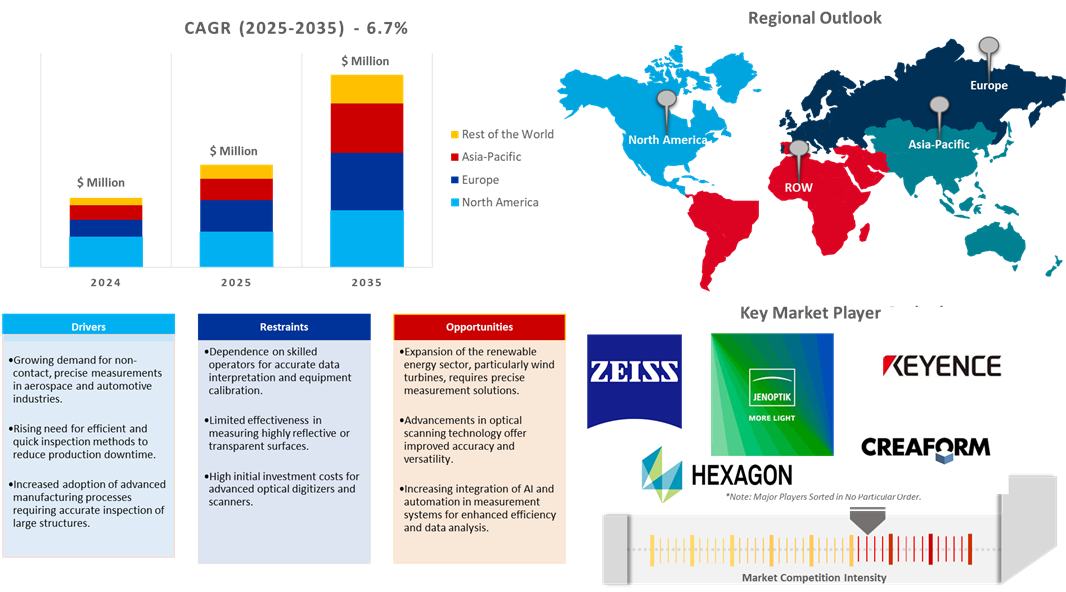

The Optical digitizer and scanner (ODS) market was valued at $1,500 million in 2024 and is projected to reach $3,072 million in 2035, growing at a CAGR of 6.7% during the forecast period (2025-2035). Integration into robotic systems for manufacturing and inspection automation, and integration with IoT devices and cloud platforms for instant data sharing and analysis, growing demand for customized scanning solutions, increasing use of portable and lightweight optical digitizers for on-site scanning, are some of the factors propelling the industry's expansion. According to the Photonics Industry and Market Data Report 2024, all photonic systems for the mobility sector (automotive, railway, aeronautics, etc.) account for a market of $57.5 billion in 2022. The market for large instruments and space segments will be valued at approximately $4.5 billion in 2022. The market for camera modules is worth $28 billion, whereas the market for smartphone modules, such as 3D sensors, is worth $6 billion. The total worth of computer accessories, such as optical disk drives, laser printers, and optical mice, is approximately $10 billion.

Market Dynamics

Growing Adoption in Healthcare Applications

The optical digitizers and scanners are utilized in surgery planning, bespoke implant fabrication, medical imaging, and other (prosthetics manufacture, and orthodontics) applications. Furthermore, advancements in portable and handheld scanners are making them more widely available for point-of-care diagnostics. As more clinics and hospitals transition to digital procedures, the industry is growing. AI is utilized in scanning systems to further enhance efficiency and data processing. As medical professionals focus on improving patient outcomes, it is expected that the use of these technologies will rise.

Increasing Demand for Quality Control and Manufacturing

Optical digitizers and scanners increasingly integrating in quality control and manufacturing. The rising demand in industries including automotive, aerospace, and electronics. These scanners are essential in automated workflows owing to their ability to capture accurate 3D data, which makes it easier to create detailed digital models that are necessary for designing complex components. Scanner devices are growing increasingly common owing to their versatility on production floors and their capacity to minimize material waste via smart planning. To monitor and analyze in real time, which reduces production errors and ensures consistency. The growing use of optical scanners and digitizers to automate processes in smart manufacturing.

Market Segmentation

- Based on the product type, the market is segmented into 3D laser scanners, structured light scanners, coordinate measuring machines (CMMs), laser tracker systems, and optical probes.

- Based on the end-user industry, the market is segmented into aerospace & defense, automotive, healthcare & medical, architecture & construction, consumer electronics, energy & power, and others (education & research).

3D Laser Scanners Segment to Lead the Market with the Largest Share

3D laser scanning is indispensable across several industries including manufacturing, construction, and healthcare with effective precision and enables. The growing integration of advanced technology such as AI and IoT enhanced utility and commercial appeal. Businesses are using these solutions in increasing numbers to boost productivity and enhance operations. The heightened emphasis on digital transformation accelerates market expansion. Industry players introduced the second generation of 3D scanners, that satisfied industrial measuring demands, using standard industrial cameras, composite functions, and 450-nm blue lasers. For instance, (in April 2024), SCANTECH (HANGZHOU) CO., LTD launched two products the automated 3D measurement system AM-CELL C and the intelligent and wireless 3D scanning system NimbleTrack. They also gave a brief overview of the upcoming all-in-one software platform Definsight, which is expected to transform precision measurement in industrial and manufacturing settings.

Automotive: A Key Segment in Market Growth

The factors such as increasing demand for optical digitizers and scanners for improved design and accurate measurement. The utilization of optical digitizers and scanners for more efficient production processes is a result of the need for high-quality components. Furthermore, their function in reverse engineering fosters creativity and quick prototyping. For instance, (in September 2024), EINSTAR launched a brand new product, the EINSTAR VEGA, a wireless all-in-one 3D scanner. SHINING 3D has continuously concentrated on offering full-size evaluation and high-precision 3D measurement options with an accuracy of 4 to 50 microns, supporting professional users in industrial and medical applications such as automotive, aerospace, energy, electronics, dentistry, and machinery.

Regional Outlook

The global optical digitizer and scanner market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

Growing Production in Photonics Industry in Europe

Germany's strong optical component manufacturing base allows it to account for more than 40.0% of European production. The UK and France each own 15.0%. According to the Photonics Industry and Market Data Report (2024), European photonics production totaled in 2022 is valued at €124.6 billion ($131.3 billion). The largest segment (20.0%) consists of photonics products used in industrial manufacturing and accounted for €25.2 billion ($26.5 billion). This includes production technology products (industrial laser systems and semiconductor manufacturing systems) worth €18.2 billion ($19.1 billion) and optical measurement & machine vision products worth about €7 billion ($7.3 billion). Optical systems for telecommunications accounted for a total market of €6.9 billion ($7.2 billion) (5.5% of the total). In (2022), European manufacturing totaled €21.1 billion (22.2 billion), or 18.0% of the global market for components and materials (17.0% of the overall output in Europe).

North America Region Dominates the Market with Major Share

North America holds a significant share owing to the presence of optical digitizer and scanner offering companies such as Artec 3D, Creaform Inc., Quantic BEI, Mitutoyo America Corp. Novacam Technologies, Inc., and others. In North America, the increasing demand for optical digitizers and scanners in healthcare industry applications such as surgical planning, dental imagining, and radiology drives the growth of the market. According to the National Center for Biotechnology Information (NCBI), (in September 2023), the 2023 global technology revenue valuation of biomedical optical tools is $128 billion per year while that of radiological tools is $48 billion per year. A direct comparison of US NIH funding in radiology shows $8.5 billion/year, whereas optical devices are nearer to $3.6 billion per year. By giving patients clear, understandable 3D models, the major provider of OCT technology helps dentists identify dental problems with confidence and increase patient trust. For instance, Perceptive, in dental robots and next-generation intraoral scanners, worked with PDS HealthTM to complete an early feasibility study of the first in-vivo 3D intraoral Optical Coherence Tomography (OCT) system. PDS Health is a dental and medical support firm that operates more than 1,000 facilities in the US. Collaborated on this historic study to investigate the possibilities of innovative imaging technologies in actual dentistry practice.

Market Players Outlook

- The major companies operating in the global optical digitizer and scanner market include FARO Technologies, Inc., Creaform Inc., Hexagon AB, JENOPTIK AG, KEYENCE CORP., and ZEISS Group, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In April 2024, Hexagon's AB introduced an effective structured light scanner. The SmartScan VR800 is an optical 3D scanner with a motorized zoom lens and a completely revamped base. Through software options, users can completely alter the measurement volume and data resolution.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global optical digitizer and scanner market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Optical Digitizer and Scanner Market Sales Analysis – Product Type| End-User Industry ($ Million)

• Optical Digitizer and Scanner Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Optical Digitizer and Scanner Industry Trends

2.2.2. Market Recommendations

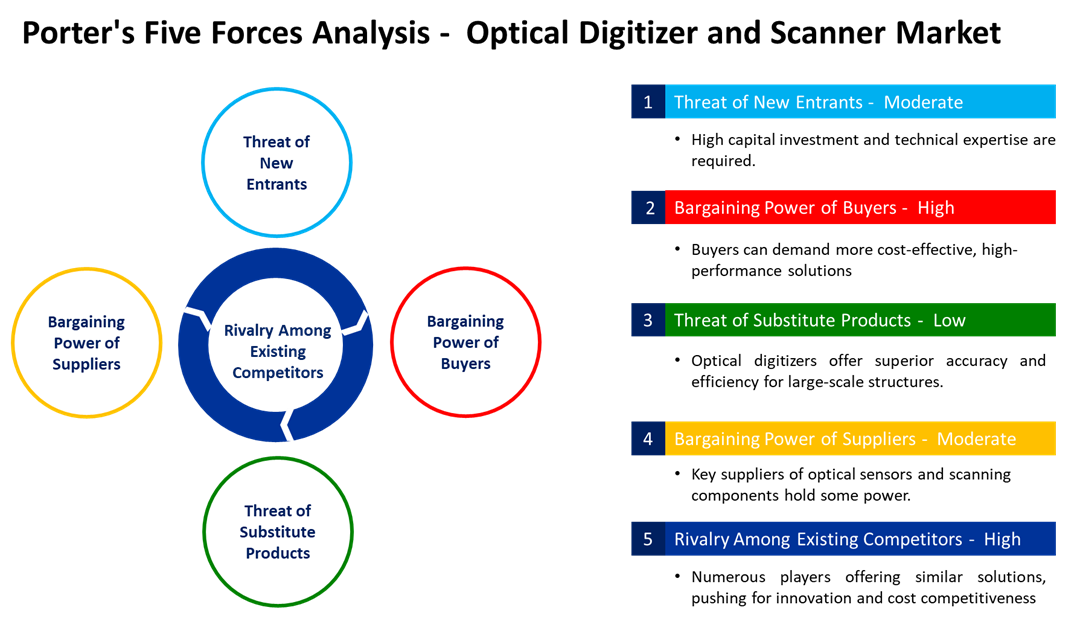

2.3. Porter's Five Forces Analysis for the Optical Digitizer and Scanner Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Optical Digitizer and Scanner Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Optical Digitizer and Scanner Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Optical Digitizer and Scanner Market Revenue and Share by Manufacturers

• Optical Digitizer and Scanner Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Creaform Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Hexagon AB

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. JENOPTIK AG

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. KEYENCE CORP.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. ZEISS Group

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Optical Digitizer and Scanner Market Sales Analysis by Product Type ($ Million)

5.1. 3D Laser Scanners

5.2. Structured Light Scanners

5.3. Optical Coordinate Measuring Machines (CMMs)

5.4. Laser Tracker Systems

5.5. Optical Probes

6. Global Optical Digitizer and Scanner Market Sales Analysis by End-User Industry ($ Million)

6.1. Aerospace & Defense

6.2. Automotive

6.3. Healthcare & Medical

6.4. Architecture & Construction

6.5. Consumer Electronics

6.6. Energy & Power

6.7. Others (Education & Research)

7. Regional Analysis

7.1. North American Optical Digitizer and Scanner Market Sales Analysis – Product Type | End-User Industry | Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Optical Digitizer and Scanner Market Sales Analysis – Product Type | End-User Industry | Country ($ Million)

• Macroeconomic Factors for North America

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Rest of Europe

7.3. Asia-Pacific Optical Digitizer and Scanner Market Sales Analysis – Product Type | End-User Industry | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Optical Digitizer and Scanner Market Sales Analysis – Product Type | End-User Industry | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Artec 3D

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Automated Precision Inc. (API)

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. CITIZEN CHIBA PRECISION CO., LTD.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Creaform Inc.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Crown Windey Ltd.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. FARO Technologies, Inc.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. FormFactor, Inc.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Hexagon AB

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. I.D.I.L. SAS

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. InspecVision Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Instrument Systems GmbH

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. JENOPTIK AG

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Jinan EagleTec Machinery Co., Ltd.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. KEYENCE CORP.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Mahlo GmbH + Co. KG

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. MCE Metrology

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Metronor

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. MICRO-EPSILON MESSTECHNIK GmbH & Co. KG

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Mitutoyo America Corp.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Novacam Technologies, Inc.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. Quantic BEI

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Renishaw plc.

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. SCANTECH (HANGZHOU) CO., LTD.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Shining 3D Tech Co., Ltd.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Sino-Galvo (Sino-Galvo (Jiangsu) Technology Co., Ltd.

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

8.26. Vision Engineering Ltd.

8.26.1. Quick Facts

8.26.2. Company Overview

8.26.3. Product Portfolio

8.26.4. Business Strategies

8.27. VMT GmbH

8.27.1. Quick Facts

8.27.2. Company Overview

8.27.3. Product Portfolio

8.27.4. Business Strategies

8.28. WEINERT Industries AG

8.28.1. Quick Facts

8.28.2. Company Overview

8.28.3. Product Portfolio

8.28.4. Business Strategies

8.29. WENZEL Group

8.29.1. Quick Facts

8.29.2. Company Overview

8.29.3. Product Portfolio

8.29.4. Business Strategies

8.30. ZEISS Group

8.30.1. Quick Facts

8.30.2. Company Overview

8.30.3. Product Portfolio

8.30.4. Business Strategies

1. Global Optical Digitizer and Scanner Market Research And Analysis By Product Type, 2024-2035 ($ Million)

2. Global 3D Laser Scanners Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Structured Light Scanners Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Optical Coordinate Measuring Machines (CMMs) Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Laser Tracker Systems Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Optical Probes Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Optical Digitizer and Scanner Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

8. Global Optical Digitizer and Scanner For Aerospace & Defense Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Optical Digitizer and Scanner For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Optical Digitizer and Scanner For Healthcare & Medical Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Optical Digitizer and Scanner For Architecture & Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Optical Digitizer and Scanner For Consumer Electronics Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Optical Digitizer and Scanner For Energy & Power Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Optical Digitizer and Scanner For Others End-User Industry Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Optical Digitizer and Scanner Market Research And Analysis By Region, 2024-2035 ($ Million)

16. North American Optical Digitizer and Scanner Market Research And Analysis By Country, 2024-2035 ($ Million)

17. North American Optical Digitizer and Scanner Market Research And Analysis By Product Type, 2024-2035 ($ Million)

18. North American Optical Digitizer and Scanner Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

19. European Optical Digitizer and Scanner Market Research And Analysis By Country, 2024-2035 ($ Million)

20. European Optical Digitizer and Scanner Market Research And Analysis By Product Type, 2024-2035 ($ Million)

21. European Optical Digitizer and Scanner Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

22. Asia-Pacific Optical Digitizer and Scanner Market Research And Analysis By Country, 2024-2035 ($ Million)

23. Asia-Pacific Optical Digitizer and Scanner Market Research And Analysis By Product Type, 2024-2035 ($ Million)

24. Asia-Pacific Optical Digitizer and Scanner Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

25. Rest Of The World Optical Digitizer and Scanner Market Research And Analysis By Region, 2024-2035 ($ Million)

26. Rest Of The World Optical Digitizer and Scanner Market Research And Analysis By Product Type, 2024-2035 ($ Million)

27. Rest Of The World Optical Digitizer and Scanner Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

1. Global Optical Digitizer and Scanner Market Research And Analysis By Product Type, 2024 Vs 2035 (%)

2. Global 3D Laser Scanners Market Share By Region, 2024 Vs 2035 (%)

3. Global Structured Light Scanners Market Share By Region, 2024 Vs 2035 (%)

4. Global Optical Coordinate Measuring Machines (CMMs) Market Share By Region, 2024 Vs 2035 (%)

5. Global Laser Tracker Systems Market Share By Region, 2024 Vs 2035 (%)

6. Global Optical Probes Market Share By Region, 2024 Vs 2035 (%)

7. Global Optical Digitizer and Scanner Market Research And Analysis By End-User Industry, 2024 Vs 2035 (%)

8. Global Optical Digitizer and Scanner For Aerospace & Defense Market Share By Region, 2024 Vs 2035 (%)

9. Global Optical Digitizer and Scanner For Automotive Market Share By Region, 2024 Vs 2035 (%)

10. Global Optical Digitizer and Scanner For Healthcare & Medical Market Share By Region, 2024 Vs 2035 (%)

11. Global Optical Digitizer and Scanner For Architecture & Construction Market Share By Region, 2024 Vs 2035 (%)

12. Global Optical Digitizer and Scanner For Consumer Electronics Market Share By Region, 2024 Vs 2035 (%)

13. Global Optical Digitizer and Scanner For Energy & Power Market Share By Region, 2024 Vs 2035 (%)

14. Global Optical Digitizer and Scanner For Others End-User Industry Market Share By Region, 2024 Vs 2035 (%)

15. Global Optical Digitizer and Scanner Market Share By Region, 2024 Vs 2035 (%)

16. US Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

17. Canada Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

18. UK Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

19. France Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

20. Germany Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

21. Italy Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

22. Spain Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

23. Rest Of Europe Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

24. India Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

25. China Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

26. Japan Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

27. South Korea Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

29. Latin America Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Optical Digitizer and Scanner Market Size, 2024-2035 ($ Million)

FAQS

The size of the Optical Digitizer and Scanner market in 2024 is estimated to be around $1,500 million.

North America holds the largest share in the Optical Digitizer and Scanner market.

Leading players in the Optical Digitizer and Scanner market include FARO Technologies, Inc., Creaform Inc., Hexagon AB, JENOPTIK AG, KEYENCE CORP., and ZEISS Group, among others.

Optical Digitizer and Scanner market is expected to grow at a CAGR of 6.7% from 2025 to 2035.

The Optical Digitizer and Scanner Market is growing due to rising demand for 3D scanning in industrial automation, healthcare, and aerospace sectors.