Optical encryption market

Optical Encryption Market by Encryption Layer (Layer 1, Layer 2 and Layer 3), by Vertical (Military and Defense, Government, BFSI, Healthcare, Retail, Transportation, Telecom, IT and Others) - Global Industry Share, Growth, Competitive Analysis and Forecast, 2019-2025 Update Available - Forecast 2025-2035

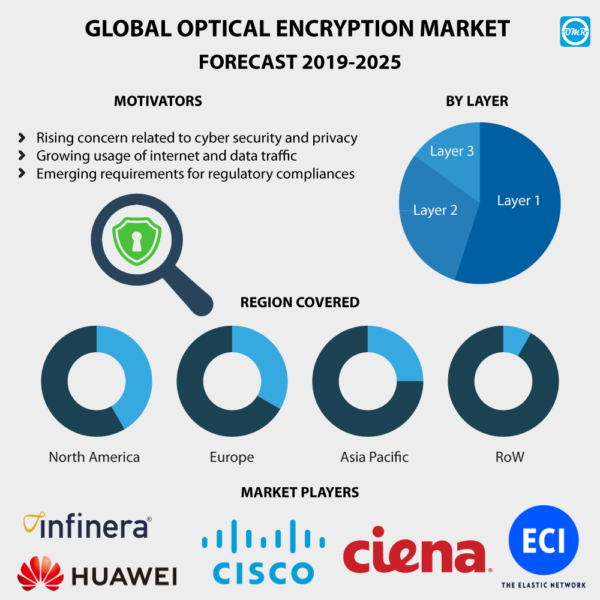

Optical encryption market is expected to grow at a moderate rate during the forecast period 2019-2025. Optical encryption is a medium to secure in-flight data in the network transport layer. It is carried over optical waves across fiber-optic cables. With an increasing number of data leaks and high-profile breaches, cybersecurity is a major concern. For instance, according to the Executive Officer of the President of the US, the US economy has incurred the loss due to malicious cyber activity costing between $57 billion to $109 billion in 2016. Three Ukrainian energy distribution companies were targeted for cyber-attacks in December 2015. This resulted in electricity outages for nearly 225,000 customers across Western Ukraine’s Ivano-Frankivsk region. The attackers achieved unauthorized access into the corporate network of a regional electricity distribution company. About twenty-three 35kV and seven 110 kV substations were disconnected for three hours. This became possible due to the theft of credentials from corporate networks. The attackers were trying to theft credentials from 6 months before and finally succeed. Such kinds of cybersecurity threats are expected to encourage the demand for optical encryption technologies. Optical encryption provides benefits such as providing no information about underlying services and adding no latency. This enables to provide an exceptionally secure connection to the infrastructure by protecting data from theft. Other crucial factors that are contributing to the growth of the market include rising investment in smart city projects and advances in optical encryption techniques.

The global optical encryption market is segmented on the basis of the encryption layer and vertical. Based on the encryption layer, the market is further classified into layer 1, layer 2 and layer 3. Additionally, on the basis of vertical, the market is further classified into military and defense, government, BFSI (Banking, financial services, and insurance), healthcare, retail, transportation, telecom & IT, and others. There has been a significant demand for optical encryption in BFSI to protect information of their customers. BFSI industry is susceptible to a breach of data. Hence, it requires upgrading transaction and processing technologies. In addition, the industry requires end-to-end security solutions for optimizing operations against external and internal threats. Due to services, including mobile banking, smart banking, and internet banking, the payment security transmitted over the network is a prime object for BFSI organizations. This, in turn, increases the demand for optical encryption solutions to control and secure sensitive data of customers by encrypting data, files, and emails, as well as offers financial security.

Geographically, the global optical encryption market is segmented into four major regions, such as North America, Europe, Asia-Pacific, and rest of the world (RoW). The factors that are encouraging the demand for optical encryption market in North America include well-developed IT infrastructure and significant cyber-attacks in the region. However, Asia-Pacific is anticipated to witness considerable growth in the market due to the increasing number of smart city projects and rising adoption of cloud-based services. The major players in the market include Cisco Systems, Inc., Infinera Corp., Ciena Corp., ECI Telecom Ltd., and Huawei Technologies Co., Ltd. The crucial strategies adopted by these companies include merger and acquisitions, product launches and collaborations to expand market share globally. As an instance, in October 2018, Infinera Corp. acquired Coriant, Inc., a global supplier of open network solutions. It offers solutions for major global network operators. The acquisition will enable Infinera Corp. to position as one of the major providers of vertically integrated optical network equipment across the globe. This will enable the company to deliver a strong portfolio of end-to-end and advanced packet optical network solutions for internet content providers and communication service providers.

Research Methodology:

The market study of the optical encryption market is incorporated by extensive primary and secondary research conducted by the research team at OMR. Secondary research has been conducted to refine the available data to breakdown the market in various segments, derive total market size, market forecast, and growth rate. Different approaches have been worked on to derive the market value and market growth rate. Our team collects facts and data related to the market from different geography to provide a better regional outlook. In the report, the country-level analysis is provided by analyzing various regional players, regional tax laws and policies, consumer behavior and macro-economic factors. Numbers extracted from Secondary research have been authenticated by conducting proper primary research. It includes tracking down key people from the industry and interviewing them to validate the data. This enables our analyst to derive the closest possible figures without any major deviations in the actual number. Our analysts try to contact as many executives, managers, key opinion leaders, and industry experts. Primary research brings authenticity in our reports.

Secondary Sources Include

- Financial reports of companies involved in the market.

- Authentic public databases such as the National Cyber Security Center, and so on.

- Whitepapers, research-papers, and news blogs.

- Company websites and their product catalog.

The report is intended for government and private companies for overall market analysis and competitive analysis. The report provides in-depth analysis on market size, intended quality of the service preferred by consumers. The report will serve as a source for 360-degree analysis of the market thoroughly integrating different models.

Market Segmentation

- Global Optical Encryption Market Research and Analysis by Encryption Layer

- Global Optical Encryption Market Research and Analysis by Vertical

The Report Covers

- Comprehensive research methodology of the global optical encryption market.

- This report also includes a detailed and extensive market overview with key analyst insights.

- An exhaustive analysis of macro and micro factors influencing the market guided by key recommendations.

- Analysis of regional regulations and other government policies impacting the global optical encryption market.

- Insights about market determinants which are stimulating the global optical encryption market.

- Detailed and extensive market segments with regional distribution of forecasted revenues.

- Extensive profiles and recent developments of market players.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cisco Systems, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Infinera Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Ciena Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. ECI Telecom, Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Huawei Technologies Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Optical Encryption Market by Encryption Layer

5.1.1. Layer 1

5.1.2. Layer 2

5.1.3. Layer 3

5.2. Global Optical Encryption Market by Vertical

5.2.1. Military & Defense

5.2.2. BFSI (Banking, Financial Services & Insurance)

5.2.3. Healthcare

5.2.4. Retail

5.2.5. Transportation

5.2.6. Telecom & IT

5.2.7. Others (Energy and Utilities)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acacia Communications, Inc.

7.2. ADVA Optical Networking SE

7.3. Arista Networks, Inc.

7.4. CenturyLink, Inc.

7.5. Ciena Corp.

7.6. Cisco Systems, Inc.

7.7. Crown Castle International Corp.

7.8. ECI Telecom, Ltd.

7.9. Ericsson AB

7.10. Huawei Technologies Co., Ltd.

7.11. ID Quantique SA

7.12. Infinera Corp.

7.13. Microsemi Corp.

7.14. Nokia Corp.

7.15. NuCrypt, LLC.

7.16. PacketLight Networks Ltd.

7.17. SSE Telecoms, Ltd.

7.18. Thales eSecurity, Inc.

7.19. Windstream Holdings, Inc.

1. GLOBAL OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY ENCRYPTION LAYER, 2018-2025 ($ MILLION)

2. GLOBAL LAYER 1 MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL LAYER 2 MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL LAYER 3 MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

6. GLOBAL MILITARY & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL HEALTHCARE RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL TELECOM & IT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY ENCRYPTION LAYER, 2018-2025 ($ MILLION)

16. NORTH AMERICAN OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

17. EUROPEAN OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY ENCRYPTION LAYER, 2018-2025 ($ MILLION)

19. EUROPEAN OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY ENCRYPTION LAYER, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

23. REST OF THE WORLD OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY ENCRYPTION LAYER, 2018-2025 ($ MILLION)

24. REST OF THE WORLD OPTICAL ENCRYPTION MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL OPTICAL ENCRYPTION MARKET SHARE BY ENCRYPTION LAYER, 2018 VS 2025 (%)

2. GLOBAL OPTICAL ENCRYPTION MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

3. GLOBAL OPTICAL ENCRYPTION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

6. UK OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD OPTICAL ENCRYPTION MARKET SIZE, 2018-2025 ($ MILLION)