Organ Preservation Market

Organ Preservation Market Size, Share & Trends Analysis Report By Technique (Static Cold Storage (SCS) Technique, and Dynamic Cold Storage (DCS) Technique), and by Organ Type (Kidney, Liver, Lung, Heart, and Others) Forecast Period (2024-2031)

Organ preservation market is anticipated to grow at a CAGR of 6.8% during the forecast period (2024-2031). The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and organ failures underscores the need for effective organ preservation methods. Advances in technologies like hypothermic and normothermic machine perfusion enhance transplant success rates. Additionally, the organ preservation market benefits from government and regulatory backing, enhanced healthcare infrastructure, and heightened public awareness of organ donation. Investments in dedicated transplant centers and preservation equipment further support this growth.

Market Dynamics

Rising Demand for Organ Preservation Technologies

The increasing incidence of organ transplants performed globally has rendered it essential to develop innovative organ preservation techniques to ensure organ integrity during transit and storage and enhance the success rates of transplants. According to the Organ Procurement & Transplantation Network, in January 2024, there were 46,632 organ transplants performed from both living and deceased donors in 2023, an 8.7 percent increase over 2022 and a 12.7 percent increase over 2021, the first year with more than 40,000 organ transplants. Deceased donors accounted for 39,679 transplants, representing an 8.9% increase over 2022 and the eleventh consecutive record-setting year. There were 6,953 transplants from living donors, the highest total since 2019 when there were 7,397 living donor transplants. While over 90.0% of living donor transplants are kidney transplants, living donor liver transplants have been increasing steadily, with 658 performed in 2023, setting a new record.

Demand for Improved Clinical Outcomes

The increasing demand for organ preservation solutions, which can reduce temperature-related damage risks and improve organ viability, is essential for enhancing transplant success rates. For instance, in April 2024, Vivalyx raised €5.4 million ($5.8 million) for a new organ preservation liquid, aimed at reducing the risk of organ damage owing to temperature changes. The liquid, Vivalyx Omnisol, is fully synthetic, outperforms blood-based benchmarks in preclinical trials, and significantly reduces costs. It is intended for all methods of perfusion at body temperature, including cold and warm perfusion and static cold storage, with expected beneficial clinical outcomes.

Market Segmentation

- Based on technique, the market is segmented into static cold storage (SCS) technique and dynamic cold storage (DCS) technique.

- Based on the organ type, the market is segmented into kidney, liver, lung, heart, and other organs (pancreas, intestine).

Kidney Holds a Considerable Market Share

The growing global transplantation rates, especially for kidneys, have driven the growth of this market segment. According to the United Network for Organ Sharing (UNOS) Org., in January 2023, the total number of kidney transplants performed in the US reached 25,000 for the first time, coming in at 25,498, up 3.4 percent from 2021. This is the continuation of a trend in deceased donation that reaches approximately 12 years.

Static Cold Storage (SCS) Technique Holds a Considerable Market Share

The development and promotion of new technologies can improve transplant outcomes and propel market growth, and regulatory authorities and funding agencies can help fund research into more effective organ preservation techniques. For instance, in December 2022, Danger signals released cold ischemia storage of the human liver, which activates the NLRP3 inflammasome in myeloid cells, potentially impacting short-term outcomes of liver transplantation. the results of the study, emphasize the NLRP3 inflammasome or DAMPs can boost transplantation results

Regional Outlook

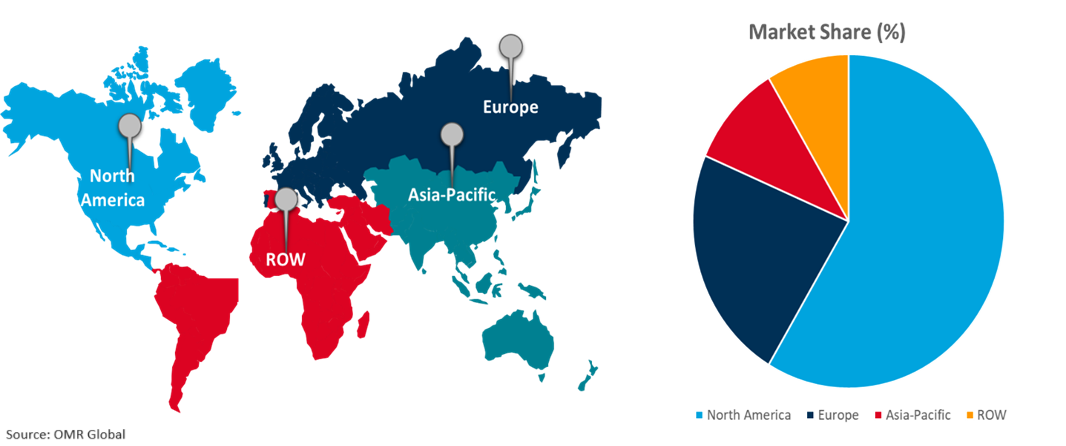

The organ preservation market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Prevalence of Chronic Diseases In the Asia-Pacific Region

The increasing prevalence of chronic diseases such as diabetes, hypertension, and liver diseases in Asia-Pacific countries increased the demand for organ transplants, necessitating effective preservation methods. According to the National Center for Biotechnology Information, in February 2024, India was the third-highest primary organ transplant country in the globe, towards the US and China, with over 17,000–18,000 performed each year. The country continues to possess a lower transplantation rate than other high-income countries, at 0.65 per million individuals.

Organ Preservation Market Growth by Region 2024-2031

North America Holds Major Market Share

The increasing transplant demand in Canada necessitates the use of effective organ preservation techniques to enhance the availability of viable organs that propels the market growth. According to the Canadian Institute for Health Information, in June 2024, Canada performed a total of 3,428 organ transplants, with 83.0% using deceased donor organs and 17.0% using living donor organs. Among the living donor transplants, 54.0% were from related donors, while 46.0% were from unrelated donors. The transplants included 59.0% kidney, 19.0% liver, 13.0% lung, 5.0% heart, 2.0% pancreas, and 2.0% combination transplants. Additionally, 4.0% of all transplants in 2023 involved organs donated after medical assistance in dying (MAID). Out of the 952 deceased donors, 67.0% donated following neurological determination of death, 27.0% following death determination by circulatory criteria (non-MAID), and 6.0% following MAID. By December 31, 2023, there were 3,427 Canadians on transplant wait lists, with 60.0% actively waiting and 40.0% on hold temporarily.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global organ preservation market include BioLife Solutions Inc., Organ Recovery Systems, Inc. TransMedics, Inc., and Preservation Solutions, Inc. XVIVO., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2023, LiveOnNY and MediGO collaborated to track organs' movements using proprietary technology. The goal is to increase transparency, identify issues proactively, and save more lives through donation, thereby enhancing the overall efficiency of the organ donation and transplant industry.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global organ preservation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BioLife Solutions Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. TransMedics, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. XVIVO

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Organ Preservation Market by Technique

4.1.1. Static Cold Storage (SCS) Technique

4.1.2. Dynamic Cold Storage (DCS) Technique

4.2. Global Organ Preservation Market by Organ Type

4.2.1. Kidney

4.2.2. Liver

4.2.3. Lung

4.2.4. Heart

4.2.5. Others (Pancreas, Intestine)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. 21st Century Medicine

6.2. Astellas Pharma Inc.

6.3. Bridge to Life Ltd.

6.4. Bristol Myers Squibb (BMS),

6.5. Dr. Franz Köhler Chemie GmbH

6.6. Essential Pharmaceuticals LLC.

6.7. HIbernicor

6.8. IGLOO Inc.

6.9. Lifeline Scientific, Inc.

6.10. Lineage Cell Therapeutics, Inc.

6.11. Novartis AG

6.12. Organ Recovery Systems, Inc.

6.13. Organon & Co.

6.14. OrganOx Ltd.

6.15. Paragonix Technologies, Inc

6.16. Preservation Solutions, Inc.

6.17. TransMedics, Inc.

6.18. Waters Medical Systems LLC

1. Global Organ Preservation Market Research And Analysis By Technique, 2023-2031 ($ Million)

2. Global Organ Preservation By Static Cold Storage (SCS) Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Organ Preservation By Dynamic Cold Storage (DCS) Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Organ Preservation Market Research And Analysis By Organ Type, 2023-2031 ($ Million)

5. Global Kidney Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Liver Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Lung Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Heart Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Other Organs Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Organ Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

11. North American Organ Preservation Market Research And Analysis By Country, 2023-2031 ($ Million)

12. North American Organ Preservation Market Research And Analysis By Technique, 2023-2031 ($ Million)

13. North American Organ Preservation Market Research And Analysis By Organ Type, 2023-2031 ($ Million)

14. European Organ Preservation Market Research And Analysis By Country, 2023-2031 ($ Million)

15. European Organ Preservation Market Research And Analysis By Technique, 2023-2031 ($ Million)

16. European Organ Preservation Market Research And Analysis By Organ Type, 2023-2031 ($ Million)

17. Asia-Pacific Organ Preservation Market Research And Analysis By Country, 2023-2031 ($ Million)

18. Asia-Pacific Organ Preservation Market Research And Analysis By Technique, 2023-2031 ($ Million)

19. Asia-Pacific Organ Preservation Market Research And Analysis By Organ Type, 2023-2031 ($ Million)

20. Rest Of The World Organ Preservation Market Research And Analysis By Region, 2023-2031 ($ Million)

21. Rest Of The World Organ Preservation Market Research And Analysis By Technique, 2023-2031 ($ Million)

22. Rest Of The World Organ Preservation Market Research And Analysis By Organ Type, 2023-2031 ($ Million)

1. Global Organ Preservation Market Share By Technique, 2023 Vs 2031 (%)

2. Global Organ Preservation By Static Cold Storage (SCS) Market Share By Region, 2023 Vs 2031 (%)

3. Global Organ Preservation By Dynamic Cold Storage (DCS) Market Share By Region, 2023 Vs 2031 (%)

4. Global Organ Preservation Market Share By Organ Type, 2023 Vs 2031 (%)

5. Global Kidney Preservation Market Share By Region, 2023 Vs 2031 (%)

6. Global Liver Preservation Market Share By Region, 2023 Vs 2031 (%)

7. Global Lung Preservation Market Share By Region, 2023 Vs 2031 (%)

8. Global Heart Preservation Market Share By Region, 2023 Vs 2031 (%)

9. Global Other Organ Preservation Market Share By Region, 2023 Vs 2031 (%)

10. Global Organ Preservation Market Share By Region, 2023 Vs 2031 (%)

11. US Organ Preservation Market Size, 2023-2031 ($ Million)

12. Canada Organ Preservation Market Size, 2023-2031 ($ Million)

13. UK Organ Preservation Market Size, 2023-2031 ($ Million)

14. France Organ Preservation Market Size, 2023-2031 ($ Million)

15. Germany Organ Preservation Market Size, 2023-2031 ($ Million)

16. Italy Organ Preservation Market Size, 2023-2031 ($ Million)

17. Spain Organ Preservation Market Size, 2023-2031 ($ Million)

18. Rest Of Europe Organ Preservation Market Size, 2023-2031 ($ Million)

19. India Organ Preservation Market Size, 2023-2031 ($ Million)

20. China Organ Preservation Market Size, 2023-2031 ($ Million)

21. Japan Organ Preservation Market Size, 2023-2031 ($ Million)

22. South Korea Organ Preservation Market Size, 2023-2031 ($ Million)

23. Rest Of Asia-Pacific Organ Preservation Market Size, 2023-2031 ($ Million)

24. Latin America Organ Preservation Market Size, 2023-2031 ($ Million)

25. Middle East And Africa Organ Preservation Market Size, 2023-2031 ($ Million)