Organic Soap Market

Organic Soap Market Size, Share & Trends Analysis Report by Form (Liquid, Bar, and Paper), by Process Type (Handmade, and Machine Made), and by Distribution Channel (Online Channel, and Offline Channel) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

organic soap market is anticipated to grow at a considerable CAGR of 7.9% during the forecast period. Rising consumer awareness regarding the benefits of soaps derived from organic and natural ingredients is one of the major factors adding to the growth of the market. The market is observing a shift in consumer preferences towards organic soaps as these products contain a mix of basic oils and other toxic-free natural ingredients that promote skin health. Moreover, the clinical properties of these organic products aid skin conditions such as eczema, acne, and even sunburn among others. Due to the medicinal potential of natural ingredients, the demand for natural and organic ingredients-based products is rising among consumers. Thereby, many consumers are preferring organic products in daily life for efficacy, and longer-lasting protection, which is resulting in the growth of the organic soap market. This demand has further led to a majority of companies launching products with nature-inspired and plant-based ingredients. For instance, in April 2020, Bonvera launched and announced a new product line in our house of brands called Bonvera At Home. The company launched the product with two premium homemade bar soaps for personal hygiene and household requirements. The company soaps are palm oil-free and made instead of lard and coconut oils as they’re more sustainable ingredients. Each bar of soap is made with a completely natural scent, color, and texture and is completely biodegradable.

Segmental Outlook

The global organic soap market is segmented based on form, process type, and distribution channel. Based on the form, the market is segmented into liquid, bar, and paper. Based on the process type, the market is sub-segmented into handmade, and machine-made. Based on distribution channels, the market is categorized into online channels and offline channels. Among the form, the soap bar segment is anticipated to cater to prominent growth over the forecast period. However, the liquid soap segment is anticipated to grow at a faster rate owing to factors such as convenience and hygiene as it reduces the exchange of germs between users.

Among the form, the soap bar segment is anticipated to hold a prominent share in the global organic soap market owing to its several advantages over liquid soap. Soaps are available in both liquid and bars, which are equally effective at reducing bacteria and removing dirt from the skin. However, several characteristics of soap bars provide added advantages to the user which is the major factor considered for higher adoption. Characteristics of organic bar soaps include ease to use and storage, economical, eco-friendly, and stronger exfoliating capacity making these soaps preferable over liquid soaps. Organic soap bars are harmless to the environment and more eco-friendly as there is no use of plastic bottles involved. Bar soap usually comes packaged in a recyclable box, and promotes zero waste. Thus, owing to these factors have pushed the key players to continuously manufacture and launch organic bar soaps, further anticipated to increase the consumer base of this segment. For instance, in June 2022, Bio-D introduced a new range of 100 % naturally derived soap bars with over 65% certified organic content. The soap bars come in 100% recyclable cardboard packaging and feature three fragrances including Lime & Aloe Vera, Plum & Mulberry, and Mandarin. Each bar soap is also free from sulphates including SLS, SLES and ALS, and MPG.

Regional Outlooks

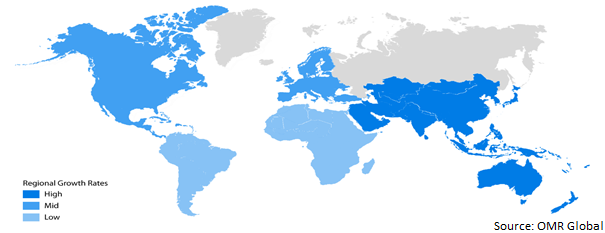

The global organic soaps market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the European regional market is expected to cater to prominent growth over the forecast period. However, the Asia-Pacific region is expected to experience considerable growth in the organic soap market.

Global Organic Soap Market Growth, by Region 2022-2028

The European Region is Expected to Hold a Prominent Share in the Global Organic Soap Market

The European region is expected to hold a prominent share in the global organic soap market owing to the growing demand and adoption of natural and organic skincare products among consumers. According to Soil Association 2020 Beauty and Wellbeing Report, the total sales of certified organic and natural beauty products in the UK were $111.9 million with a year-on-year growth of 23%. Moreover, key manufacturers of the region are adopting several strategies such as product launches and others to gain a stronghold in the market. For instance, in 2020, Stephenson, a company that provides syndet bases and natural ingredients for soap, launched its COSMOS Range. COSMOS certified products that comply with the updated standards include four products including Stephenson’s COSMOS certified Bodywash Base which contains a natural liquid soap base made from organic oils.

Market Players Outlook

The major companies serving the global organic soap market include EarthHero, LLC., Lush Ltd., Neal’s Yard (Natural Remedies) Ltd., Procter & Gamble Ireland, Unilever PLC, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2019, Makes 3 Organics launched Creamy Castile Organic Liquid Soaps for bath and body in Lavender, Peppermint, and Fragrance-Free aromas. Certified Organic by the USDA, the Organic Liquid Soaps are made with innovative technology to ensure shelf-stability, even in the heat of a shower. Developed to be completely non-toxic, and free from synthetic chemicals, the product is packaged in environmentally-responsible recycled and recyclable plastics with non-toxic inks and adhesives.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global organic soap market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. EarthHero, LLC.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. Lush Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. Neal’s Yard (Natural Remedies) Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Procter & Gamble Ireland

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Development

3.6. Unilever PLC

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Development

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Organic Soaps Market by Form

4.1.1. Liquid

4.1.2. Bar

4.1.3. Paper

4.2. Global Organic Soaps Market by Process Type

4.2.1. Handmade

4.2.2. Machine-Made

4.3. Global Organic Soaps Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. APCOS NATURALS Pvt. Ltd. (Just Herbs)

6.2. Beauty and the Bees

6.3. Biome Living Pty Ltd.

6.4. Chagrin Valley Soap & Salve Co.

6.5. Clorox

6.6. Corvus Botanicals

6.7. Deyga Organics

6.8. Drunk Elephant Skincare

6.9. Earth Harbor

6.10. EcoRoots

6.11. EO Product

6.12. Gramodaya Ashram (KVIC) (Khadi Natural)

6.13. Johnson & Johnson Pvt. Ltd.

6.14. Juicy Chemistry

6.15. Meow Meow Tweet

6.16. Oregon Soap Co.

6.17. Osmia Organics

6.18. Pangea Organics

6.19. PT BALI SOAP

6.20. Rocky Mountain Soap

6.21. Rykim LLC dba Brittanie's Thyme

6.22. Simply Organic Soap

6.23. Skin Bath Ltd.

6.24. Stephenson Group Ltd

6.25. SUNDIAL BRANDS LLC.

6.26. Syscom Organic World Pvt. Ltd. (Organic Harvest)

6.27. The Earth Reserve

6.28. Truly's Natural Products

1. GLOBAL ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

2. GLOBAL ORGANIC LIQUID SOAPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ORGANIC BAR SOAPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ORGANIC PAPERS OAPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY PROCESS TYPE, 2021-2028 ($ MILLION)

6. GLOBAL HANDMADE ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MACHINE-MADE ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

9. GLOBAL ORGANIC SOAPS BY ONLINE CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ORGANIC SOAPS BY OFFLINECHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

14. NORTH AMERICAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY PROCESS TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

16. EUROPEAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

18. EUROPEAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY PROCESS TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY PROCESS TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

24. REST OF THE WORLD ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. REST OF THE WORLD ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

26. REST OF THE WORLD ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY PROCESS TYPE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD ORGANIC SOAPS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1. GLOBAL ORGANIC SOAPS MARKET SHARE BY FORM, 2021 VS 2028 (%)

2. GLOBAL ORGANIC LIQUID SOAPS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL ORGANIC BAR SOAPS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL ORGANIC PAPER SOAPS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL ORGANIC SOAPS MARKET SHARE BY PROCESS TYPE, 2021 VS 2028 (%)

6. GLOBAL HANDMADE ORGANIC SOAPS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL MACHINE-MADE ORGANIC SOAPS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL ORGANIC SOAPS MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

9. GLOBAL ORGANIC SOAPSBYONLINECHANNELMARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL ORGANIC SOAPSBYOFFLINECHANNEL MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL ORGANIC SOAPS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. US ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

14. UK ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD ORGANIC SOAPS MARKET SIZE, 2021-2028 ($ MILLION)