Orthodontic Supplies Market

Global Orthodontic Supplies Market Size, Share & Trends Analysis Report, By Product (Fixed Braces and Removable Braces), By Patient (Children and Adults), and Forecast, 2019-2025

The global orthodontic supplies market is estimated to grow at a significant CAGR of nearly 9.0% during the forecast period. The major factors contributing to the market growth include the increasing demand for orthodontic treatment and the rising number of orthodontists. There is an increasing demand for orthodontic treatment among children and adults for medical or cosmetic need. Orthodontics is a part of dentistry that aims to correct improperly positioned teeth and jaws. Misaligned teeth and crooked teeth are harder to keep clean and therefore, there is a risk of being tooth loss early due to periodontal disease and dental caries.

It can cause extra stress on the chewing muscles that resulting temporomandibular joint (TMJ) syndrome, headaches, shoulder, neck, and back pain. As a result, parents are becoming aware of the orthodontic treatment of their children to avoid further dental complications in children. The adult population are primarily electing for orthodontic treatment for aesthetics as it corrects teeth and jaws that are improperly positioned. As per the American Dental Association (ADA), females used 70% of braces, mostly for aesthetics. This includes a large number of patients aged 12-15 years. The advantages of orthodontic treatment comprise a more pleasing appearance, healthier mouth, and teeth that are more expected to last a lifetime.

Owing to the emerging demand for orthodontic treatment, a significant rise in orthodontists has reported in certain countries. For instance, as per the ADA, in 2017, the number of orthodontists practicing in the US were 10,658, which signifies 3.27 orthodontists per 100,0000 population. Since 2001, there was an increase of 15% in the number of orthodontists in the country. This will support the availability of reliable orthodontic treatment to the patients.

Market Segmentation

The global orthodontic supplies market is segmented based on product and patient. Based on the product, the market is classified into fixed braces and removable braces. Based on the patient, the market is classified into children and adults.

Fixed braces are estimated to hold a significant share in the market

Fixed braces are anticipated to hold a significant share in 2018. Fixed braces are among the most popular choices for straightening of teeth owing to their reliable and predictable outcomes. Most NHS orthodontics utilize fixed braces as they can be fitted for patients of any age. These braces consist of small brackets that are cemented to the teeth and combine together with wire, which is normally produced from metal. Less visible ceramic versions of fixed braces are also available. Fixed braces are mostly used to treat children and it allows to move teeth in a very precise manner.

In case of a medical cause for orthodontic treatment, the dentist might recommend fixed braces as they can support to treat more complex problems, including the abnormal eruption of teeth, severe overcrowding, and an excessively deep overbite or overjet. It offers predictable outcomes, as patients can’t interrupt the process of treatment by removing braces. The cost of orthodontic treatment relies on the type of treatment selected and the complexity of the problems associated with the teeth. Lingual and ceramic braces cost more as compared to traditional metal fixed braces, however, offer a much more discreet option for straightening of teeth.

Regional Outlook

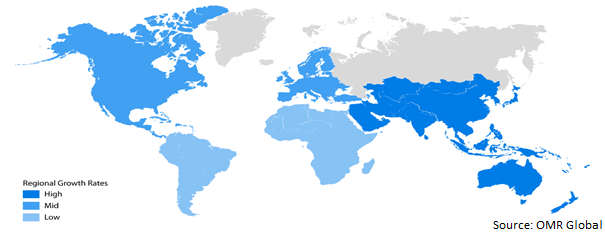

The global orthodontic supplies market is segmented based on four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2018, North America is anticipated to hold a significant share in the market owing to the increasing orthodontic conditions and significant awareness regarding oral problems in the region. During the period, 2012 to 2014, adults looking for treatment from orthodontists in the US and Canada grew 16%, which results in a record high of 1,441,000 patients with the age group of 18 and over. This, in turn, is contributing to the demand for orthodontic braces to help patients achieve proper alignment of their teeth.

Global Orthodontic Supplies Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include Envista Holdings Corp., Dentsply Sirona, Inc., Henry Schein, Inc., 3M Co., and American Orthodontics. These players are adopting some crucial strategies, including mergers and acquisitions, product launches, and partnerships and collaborations, to gain a competitive advantage. For instance, in August 2019, Henry Schein, Inc., declared the acquisition of a majority equity stake in Cliniclands, a distributor that serves dental practices across Sweden, Norway, and Denmark. Cliniclands is based in Trelleborg, Sweden represented the first presence of Dental business of Henry Schein in Scandinavia and provides a comprehensive range of orthodontic, implants, dental consumables, prosthetic solutions. Cliniclands generated sales of $9.5 million (12 months) by 31st March 2019. The addition of Cliniclands has led the expansion of Henry Schein operations in 32 countries across the globe.

in June 2019, Danaher Corp. declared the name of its separate company, Envista Holdings Corp. which will consist of three operating companies of Danaher Dental segments, including Ormco, Nobel Biocare Systems, and KaVo Kerr. Such companies have significant positions in dental equipment and consumables, orthodontics, and dental implants, which comprise brands such as Metrex, Implant Direct, Nobel Biocare, Pelton & Crane, Kerr, i-CAT, Dexis, Orascoptic, KaVo, and Ormco.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global orthodontic supplies market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Envista Holdings Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Dentsply Sirona Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Henry Schein, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. 3M Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. American Orthodontics

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Orthodontic Supplies Market by Product

5.1.1. Fixed Braces

5.1.1.1. Brackets

5.1.1.2. Archwires

5.1.1.3. Anchorage Appliances

5.1.1.4. Ligatures

5.1.2. Removable Braces

5.2. Global Orthodontic Supplies Market by Patient

5.2.1. Children

5.2.2. Adults

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Adenta GmbH

7.3. Aditek Orthodontics

7.4. Align Technology, Inc.

7.5. American Orthodontics

7.6. Astar Orthodontics Inc.

7.7. BioMers Pte Ltd.

7.8. CDB Corp.

7.9. DB Orthodontics Ltd.

7.10. Dentos India Pvt. Ltd.

7.11. Dentsply Sirona Inc.

7.12. Envista Holdings Corp.

7.13. G&H Orthodontics

7.14. Great Lakes Dental Technologies

7.15. Henry Schein, Inc.

7.16. JJ Orthodontics

7.17. LightForce Orthodontics

7.18. Morelli Orthodontics

7.19. The Straumann Group

7.20. Tomy Inc.

1. GLOBAL ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL FIXED ORTHODONTIC BRACES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL REMOVABLE ORTHODONTIC BRACES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

5. GLOBAL ORTHODONTIC SUPPLIES FOR CHILDREN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ORTHODONTIC SUPPLIES FOR ADULTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

8. NORTH AMERICAN ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

10. NORTH AMERICAN ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

11. EUROPEAN ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. EUROPEAN ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

13. EUROPEAN ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

14. ASIA-PACIFIC ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

18. REST OF THE WORLD ORTHODONTIC SUPPLIES MARKET RESEARCH AND ANALYSIS BY PATIENT, 2018-2025 ($ MILLION)

1. GLOBAL ORTHODONTIC SUPPLIES MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL ORTHODONTIC SUPPLIES MARKET SHARE BY PATIENT, 2018 VS 2025 (%)

3. GLOBAL ORTHODONTIC SUPPLIES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ORTHODONTIC SUPPLIES MARKET SIZE, 2018-2025 ($ MILLION)