Orthopedic Braces and Supports Market

Global Orthopedic Braces and Supports Market Size, Share & Trends Analysis Report, By Product (Ankle and Foot, Wrist and Hand, Back and Shoulder, Hip and Knee, Elbow, Spine and Others), By End-User(Hospitals and Surgical Centers, Orthopedic Clinics, Homecare and Others), and Forecast, 2019-2025 Update Available - Forecast 2025-2031

The global orthopedic braces and supports market is estimated to grow at a CAGR of 6.1% during the forecast period. The major factors contributing to the growth of the market include the significant prevalence of orthopedic disorders and rising number of sports injuries. As per the National Safety Council (NSC), in the US, in 2017 personal exercise, with or without exercise equipment, accounted for some 526,000 injuries, the highest category of sports and recreation. Additionally, basketball followed with nearly 500,000 injuries, while bicycling ranked third, with 457,000 injuries and football ranked fourth, with 341,000 injuries. In 2017, there were nearly 199,000 swimming injuries treated in emergency rooms.

People aged 5 to 14 accounted for 50% of the football injuries treated in emergency rooms. This age group accounted for 45% of soccer injuries, 44% of baseball and 40% of lacrosse and rugby injuries treated in emergency rooms the same year. This, in turn, contributes to the demand for orthopedic braces for the treatment of sports-related injuries, including knee injuries and ankle sprains. These are designed to act as a support to keep bones and joints in correct alignment. It enables to protect and stabilize certain parts of the body (primarily bones, muscles and joints) as they heal from trauma or injury. It is usually prescribed for the patients to wear at the time of recovery and rehabilitation.

Several specialized areas of healthcare utilize orthopedic braces, such as those concerned with preventing and rehabilitating injuries, osteoarthritic care, post-operative care, among others. It is determined by the healthcare professional that what kind of orthopedic brace is suitable for the patient, and the fit, kind of function, support, and stability or protection level. Ankle braces are normally recommended for joints immobilization, and simultaneously, offering compression force and heat inside the bones. These braces are usually seen in patients engaged in sports activities, including soccer, basketball, and rugby. As a result, the growth in sports injuries is acting as one of the major driving factors for the market.

Segmentation

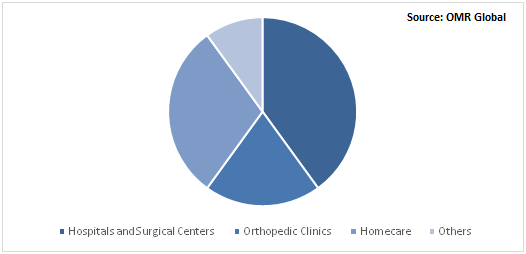

The global orthopedic braces and supports market is segmented based on product and end-user. Based on product, the market is classified into ankle and foot, wrist and hand, back and shoulder, hip and knee, elbow, spine, and others. Based on end-user, the market is classified into hospitals and surgical centers, orthopedic clinics, homecare and others.

Hospitals and Surgical Centers contributes to a significant share in the end-user segment in 2018

The adoption of orthopedic braces and supports in hospitals and surgical centers are being significantly driven by the rising number of orthopedic surgeries and significant presence of skilled professionals in the hospitals and clinics. A need for post-operative care is required after orthopedic procedures and therefore, hospitals and surgical center opted orthopedic braces to promote healing and regain strength. It is also prescribed by doctors to support musculoskeletal rehabilitation. In addition, the increasing number of multi-specialty hospitals are further encouraging the demand for orthopedic braces in hospitals and surgical centers.

Global Orthopedic Braces and Supports Market Share by End-User, 2018 (%)

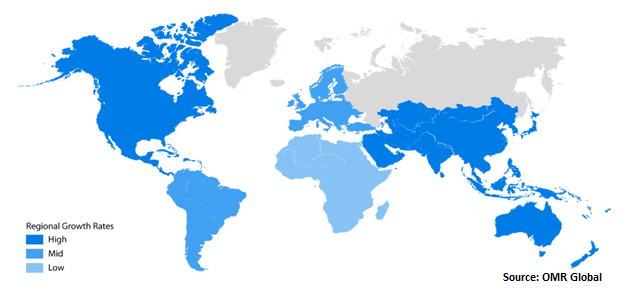

Regional Outlook

Geographically, the global orthopedic braces and supports market is segmented based on four major regions, including North America, Europe, Asia-Pacific, and RoW. North America has attracted a considerable share in the market in 2018. The significant prevalence of osteoporosis and the rising number of sports injuries are further strengthening the market growth in the region. However, Asia-Pacific is estimated to witness significant growth in the market during the forecast period owing to the significant prevalence of geriatric population and rising incidences of orthopedic disorders.

Further, the increasing number of multi-specialty hospitals and orthopedic clinics is further encouraging market growth in the region. Significant rise in medical tourism is also expected to propel the market growth in the region. For instance, IBEF estimated that the medical tourism market in India was valued $3 billion in 2017, which is expected to reach $9 billion by 2020. This, in turn, may lead to drive the orthopedic surgeries and consequently encourage the demand for orthopedic braces and supports.

Global Orthopedic Braces and Supports Market Growth, by Region 2019-2025

Market Players Outlook

The major players in the market include 3M Co., DJO Global LLC, Breg, Inc., Bauerfeind AG, and Össur Hf. Mergers and acquisitions, partnerships and collaborations, and product launches are considered as crucial strategies adopted by the market players to expand market share and gain a competitive advantage over their competitors. For instance, in July 2019, Össur Hf signed an agreement to acquire College Park Industries, a provider of lower and upper limb prostheses and supporting services. College Park has more than 140 employees and is headquartered in Detroit, the US and total sales were valued $22 million in 2018. Together, Össur and College Park will work to increase their offerings in both lower and upper limb prosthetics.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global orthopaedic braces and supports market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. 3M Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. DJO Global LLC (a Subsidiary of Colfax Corp.)

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Breg, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Bauerfeind AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Össur Hf

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Orthopedic Braces and Supports Market by Product

5.1.1. Ankle and Foot

5.1.2. Wrist and Hand

5.1.3. Back and Shoulder

5.1.4. Hip and Knee

5.1.5. Elbow

5.1.6. Spine

5.1.7. Others (Facial and Neck)

5.2. Global Orthopedic Braces and Supports Market by End-User

5.2.1. Hospitals and Surgical Centers

5.2.2. Orthopedic Clinics

5.2.3. Homecare

5.2.4. Others (Sports Academies)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. ALCARE Co., Ltd.

7.3. Aspen Medical Products, LLC

7.4. Bauerfeind AG

7.5. Breg, Inc.

7.6. BSN medical GmbH (a subsidiary of Essity AB)

7.7. DeRoyal Industries, Inc.

7.8. DJO Global LLC (a Subsidiary of Colfax Corp.)

7.9. Dynatronics Corp.

7.10. Hely& Weber

7.11. KineMedics

7.12. McDavid Inc.

7.13. medi GmbH & Co. KG

7.14. Mueller Sports Medicine, Inc.

7.15. OPPO Medical Inc.

7.16. Össur hf.

7.17. Performance Health Holding, Inc.

7.18. Reh4Mat

7.19. Remington Products Co.

7.20. Thuasne Group

7.21. Trulife

7.22. Tynor Orthotics Private Limited

7.23. Zimmer Biomet Holdings, Inc.

1. GLOBAL ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL ANKLE AND FOOTORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL WRIST AND HANDORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL BACK AND SHOULDERORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL HIP AND KNEEORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ELBOWORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL SPINEORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHERORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

10. GLOBAL ORTHOPEDIC BRACES AND SUPPORTSIN HOSPITALS AND SURGICAL CENTERSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL ORTHOPEDIC BRACES AND SUPPORTSIN ORTHOPEDIC CLINICSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ORTHOPEDIC BRACES AND SUPPORTSIN HOMECAREMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL ORTHOPEDIC BRACES AND SUPPORTSIN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

17. NORTH AMERICAN ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. EUROPEAN ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPEAN ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

20. EUROPEAN ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY FABRIC END-USER, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

24. REST OF THE WORLD ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

25. REST OF THE WORLD ORTHOPEDIC BRACES AND SUPPORTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL ORTHOPEDIC BRACES AND SUPPORTS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL ORTHOPEDIC BRACES AND SUPPORTS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL ORTHOPEDIC BRACES AND SUPPORTS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ORTHOPEDIC BRACES AND SUPPORTSMARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ORTHOPEDIC BRACES AND SUPPORTS MARKET SIZE, 2018-2025 ($ MILLION)