Orthopedic Digit Implants Market

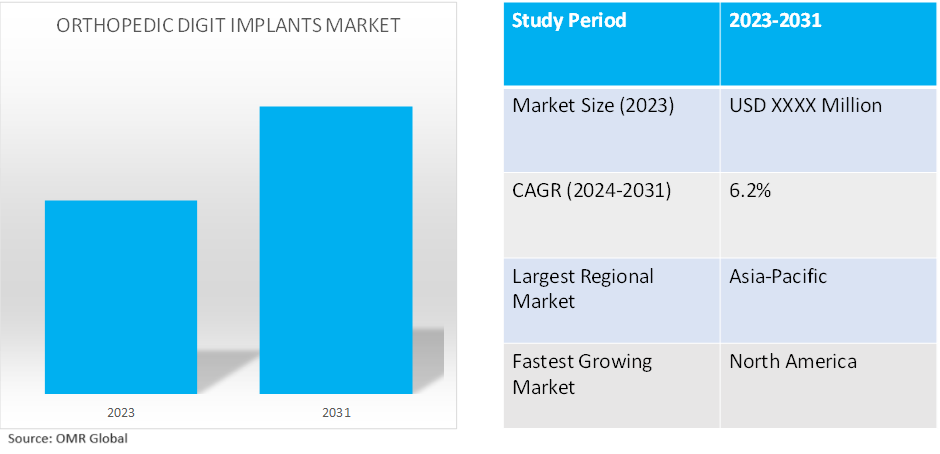

Orthopedic Digit Implants Market Size, Share & Trends Analysis Report by Product (Metatarsal Joint Implants, Metacarpal Joint Implants, Hemi Phalangeal Implants, Scaphoid Bone Implants, and Toe Intramedullary Implants), by Material (Titanium, Nitinol, Silicone, Stainless Steel, and Other Materials), by End-User (Hospitals, Outpatient Facilities) Forecast Period (2024-2031)

Orthopedic digit implants market is anticipated to grow at a CAGR of 6.2% during the forecast period (2024-2031). Orthopedic digit implants are medical devices used to replace or repair damaged or missing bones in fingers and toes. These biocompatible implants, made from titanium or stainless steel, help patients regain functionality and alleviate pain from various orthopedic conditions. They are used to treat a variety of digit-related conditions, including osteoarthritis, rheumatoid arthritis, fractures, joint deformities, and congenital disabilities. The market offers various types of implants, including joint replacement, intramedullary, and fixation implants.

Market Dynamics

Growing emphasis on minimally invasive techniques

The growing public awareness of digit joint problems along with the popularity of minimally invasive surgical techniques (MIS) is a key factor driving the growth of the global orthopedic digital implants market. To promote advancements in the field of orthopedic digit implants, in March 2024, OrthoVentions LLC invested in MotioOV, which is an early-stage company that was created in partnership with the Hospital for Special Surgery (HSS). MotioOV's focus is to develop a unique 3D printed implant as well as custom instruments that can help to address issues related to stiffness and pain caused by arthritis of the first metatarsophalangeal (MTP) joint.

Increasing prevalence of orthopedic diseases

The demand for orthopedic digit implants is primarily driven by conditions such as osteoarthritis, rheumatoid arthritis, and traumatic injuries, which cause pain and limited mobility, and the aging global population increases the risk of these conditions. In January 2024, Extremity Medical LLC, a medical engineering firm, announced a strategic relationship with Henry Schein, Inc., a global healthcare solutions company. This partnership will promote Extremity Medical to expand its innovative orthopedic extremity implant systems.

Market Segmentation

Our in-depth analysis of the global orthopedic digit implants market includes the following segments by type, product, and technology:

- Based on product, the market is segmented into metatarsal joint implants, metacarpal joint implants, hemi phalangeal implants, scaphoid bone implants, and toe intramedullary implants.

- Based on material, the market is segmented into titanium, nitinol, silicone, stainless steel, and other materials including pyrocarbon, composite, and plastics.

- Based on end-user, the market is segmented into hospitals and outpatient facilities.

Metatarsal Joint Implants are projected to Emerge as the Largest Segment

Metatarsal joint implants are the largest segment in orthopedic digit implants due to the increasing prevalence of hand injuries, their impact on daily life, the growing demand for minimally invasive techniques, and ongoing technological advancements. However, the market for foot and ankle procedures and advancements in other implant sub-segments could challenge the dominance of the metacarpal joint implant sub-segment. For instance, in 2023 according to a study published in the NIH metatarsal fractures are a common type of foot injury. They occur about ten times more often than Lisfranc fracture dislocations. In children, metatarsal fractures account for 61.0% of all foot fractures. Most of these fractures happen at the fifth (41.0%) and first (19.0%) ray. The fifth metatarsal is the most fractured bone (23.0%), followed by the third metatarsal in cases of industrial injuries.

Regional Outlook

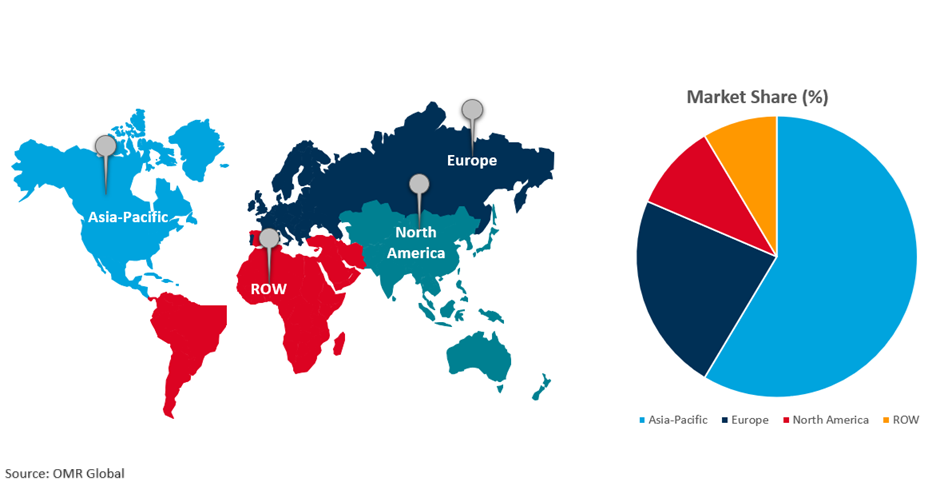

The global orthopedic digit implants market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Orthopedic Digit Implants Market Growth by Region 2024-2031

Asia Pacific Holds Major Market Share

Asia-Pacific region holds the largest market share of the orthopedic digit implants market due to its large and growing population, aging population, rising disposable income, and increasing awareness of treatment options. According to data released by credit rating agency Crisil, the number of medical tourists visiting India is projected to be around 7.3 million in calendar year (CY) 2024, up from 6.1 million estimated in CY 2023. The increasing medical tourism across this region is further aiding the regional market growth.

Market Players Outlook

The major companies serving the global orthopedic digit implants market include Stryker Corp., Acumed LLC, Advin Healthcare, Johnson & Johnson, and Smith & Nephew plc among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive. For instance, in March 2021, Accufix SurgicalTM received approval from the US FDA for its Accu-Joint Hemi Implant. This implant is designed for the Metatarsophalangeal (MTP) Joint and is a Hemi-arthroplasty Metatarsal Head or Phalangeal Base Implant. Its purpose is to restore arthritic toe joints functionally and accurately, without compromising the original anatomic bone structure.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global orthopedic digit implants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Acumed LLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Smith and Nephew Plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Stryker Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Orthopedic Digit Implants Market by Product

4.1.1. Metatarsal Joint Implants

4.1.2. Metacarpal Joint Implants

4.1.3. Hemi Phalangeal Implants

4.1.4. Scaphoid Bone Implants

4.1.5. Toe Intramedullary Implants

4.2. Global Orthopedic Digit Implants Market by Material

4.2.1. Titanium

4.2.2. Nitinol

4.2.3. Silicone

4.2.4. Stainless steel

4.2.5. Other materials (Pyrocarbon, Composite, and Plastics)

4.3. Global Orthopedic Digit Implants Market by End-User

4.3.1. Hospitals

4.3.2. Outpatient Facilities

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Advin Health Care

6.2. Anika Therapeutics, Inc.

6.3. Arthrex GmbH

6.4. Extremity Medical LLC

6.5. Integra Lifesciences

6.6. Johnson & Johnson

6.7. Merete Medical GmbH

6.8. Signature Orthopedic Implants

6.9. Teijin Ltd.

6.10. Vilex In Tennessee Inc.

6.11. Wright Medical Group N.V.

6.12. Zimmer Biomet Holdings, Inc.

1. GLOBAL ORTHOPEDIC DIGIT IMPLANTS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

2. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF TITANIUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF NITINOL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF SILICONE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF STAINLESS STEEL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF OTHER MATERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT 2023-2031 ($ MILLION)

8. GLOBAL ORTHOPEDIC DIGIT METATARSAL JOINT IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ORTHOPEDIC DIGIT METACARPAL JOINT IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ORTHOPEDIC DIGIT HEMI PHALANGEAL IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ORTHOPEDIC DIGIT SCAPHOID BONE IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ORTHOPEDIC DIGIT TOE INTRAMEDULLARY IMPLANT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

14. GLOBAL ORTHOPEDIC DIGIT IMPLANTS IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ORTHOPEDIC DIGIT IMPLANTS IN OUTPATIENT FACILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. NORTH AMERICAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

20. NORTH AMERICAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. EUROPEAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION

23. EUROPEAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

24. EUROPEAN ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

29. REST OF THE WORLD ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

31. REST OF THE WORLD ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

32. REST OF THE WORLD ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL ORTHOPEDIC DIGIT IMPLANTS TREATMENT MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

2. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF TITANIUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF NITINOL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF SILICONE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF STAINLESS STEEL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ORTHOPEDIC DIGIT IMPLANTS OF OTHER MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ORTHOPEDIC DIGIT IMPLANTS MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

8. GLOBAL ORTHOPEDIC DIGIT METATARSAL JOINT IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ORTHOPEDIC DIGIT METACARPAL JOINT IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ORTHOPEDIC DIGIT HEMI PHALANGEAL IMPLANTS BATTERIES MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ORTHOPEDIC DIGIT SCAPHOID BONE IMPLANTS MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ORTHOPEDIC DIGIT TOE INTRAMEDULLARY IMPLANT MATERIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ORTHOPEDIC DIGIT IMPLANTS MARKET SHARE BY END-USER, 2023 VS 2031 (%)

14. GLOBAL ORTHOPEDIC DIGIT IMPLANTS IN HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ORTHOPEDIC DIGIT IMPLANTS IN OUTPATIENT FACILITIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ORTHOPEDIC DIGIT IMPLANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

19. UK ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA ORTHOPEDIC DIGIT IMPLANTS MARKET SIZE, 2023-2031 ($ MILLION)