OSAT Market

OSAT Market Size, Share & Trends Analysis Report by Service (Packaging and Testing), Type of Packaging (Ball Grid Array Packaging, Chip-scale Packaging, Stacked Die Packaging, Multi-chip Packaging, and Quad Flat & Dual-inline Packaging), by Application (Communication, Consumer Electronics, Automotive, Computing & Networking, Industrial) Forecast Period (2022-2030)

Outsourced Semiconductor Assembly and Test Services (OSAT) market is anticipated to grow at a considerable CAGR of 8.4% during the forecast period. The increasing usage of OSAT in different industrial vertical is a key factor driving the growth of the global OSAT market. The considerable rise in the number of connected devices and consumer electronics, and the emphasis on quality improvement and end-to-end testing solutions by companies is a major motivator to the market growth. Additionally, the OSAT market is projected to benefit from the growing dominance of fabless market players in IC sales.

Cohesive government policies are further contributing to the market growth. For instance, in May 2023, Indian government has announced its plan to approve the proposal by Micron Technology to set up an assembly, testing, marking and packaging (ATMP) facility in the country involving an investment of about $1 billion. India’s flagship $10 billion semiconductor scheme offers financial incentives to set up fab plants, ATMPs, outsourced semiconductor assembly and test (OSAT) units, and chip design facilities. The government offers 50.0% fiscal support for the capital expenditure to eligible companies setting up ATMPs or OSATs.

Segmental Outlook

The global OSAT market is segmented based on service, packaging type, and application. Based on service, the market is segmented into packaging and testing. Based on packaging type, the market is segmented into ball grid array packaging, chip-scale packaging, stacked die packaging, multi-chip packaging, and quad flat & dual-inline packaging. Based on application, the market is segmented into communication, consumer electronics, automotive, computing & networking, and industrial.

Automotive Segment held Considerable Share in 2022

The increasing number of semiconductor products per vehicle and trends like autonomous and electric vehicles are becoming the primary drivers for semiconductor manufacturers and OSAT vendors. Semiconductor products form the base for the hardware required to run the software to make electric, hybrid, autonomous, and alternate-fuel vehicles. Additionally, advanced-level semiconductor packaging is required with trends like autonomous vehicles and V2X, further expanding the market scope.

Furthermore, evolving infotainment systems are increasingly creating the demand for large displays and touch screens in the automotive industry, fueling the demand among OSAT and semiconductor vendors. This demand is exceptionally high from the electric car manufacturers, as advanced touchscreen displays instead of traditional dials are considered to provide futuristic aesthetics, better response, and facilitate multiple functionalities in a small space, creating a minimalistic design.

Regional Outlooks

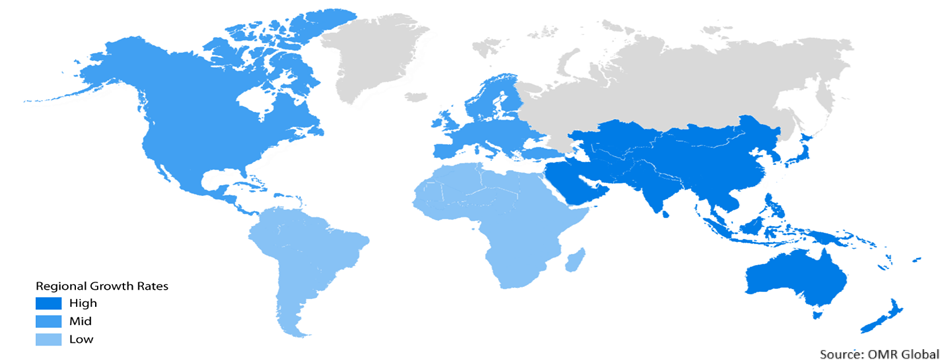

The global OSAT market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific market is anticipated to cater to a considerable growth over the forecast period. The presence of major players and key innovators is driving the regional market growth. The rapid adoption of robotic processes in various industries such as automotive and consumer electronics sectors, across Japan, South Korea, India, and China has further driven the market demand.

Global OSAT Market Growth, by Region 2023-2030

The North America Region held Considerable Share in the Global OSAT Market

North America held a considerable share in the global OSAT market. In North America, the US held a major market share. The increasing investments, technological advancements, and innovation of new applications of OSAT are some of the prominent factors driving the regional market growth. Though China held major share in the global OSAT and semiconductor market, a significant portion of the technology patents is from the US, which gives the country a strong position. Its healthy innovation rate in the OSAT market has attracted several Asian vendors in the past; which in turn driving the regional market growth.

Market Players Outlook

The major market player of the OSAT market includes Powertech Technology Inc., Amkor Technology Inc., Advanced Semiconductor Engineering Inc., Chipmos Technologies Inc., and King Yuan Electronics Co. Ltd. among others. These players are actively adopting growth strategies such as mergers and acquisitions, partnerships, collaboration and agreements to improve their dominance among competitors. Technological innovation and new product launching are the core strength of key market players in the cloud computing market.

For instance, in February 2023, US packaging firm Amkor Technologies Inc. has formed a European partnership with GlobalFoundries Inc. Under the arrangement foundry chipmaker Globalfoundries will transfer bump and sort lines for 300mm wafers from its Dresden wafer fab to Amkor’s facility in Porto, Portugal. The move will create a comprehensive EU supply chain for GF from semiconductor wafer production through to Outsourced Semiconductor Assembly and Test (OSAT). It will also open up additional clean room space in Dresden.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global OSAT market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Powertech Technology Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Amkor Technology Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Advanced Semiconductor Engineering Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

3.6. Impact of COVID on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Outsourced Semiconductor Assembly and Test Services (OSAT) Market By Packaging Type

5.1.1. Ball Grid Array (BGA) Packaging

5.1.2. Chip-scale Packaging (CSP)

5.1.3. Stacked Die Packaging

5.1.4. Multi-chip Packaging

5.1.5. Quad Flat and Dual-inline Packaging

5.2. Global Outsourced Semiconductor Assembly and Test Services (OSAT) Market by Service Type

5.2.1. Packaging

5.2.2. Testing

5.3. Global Outsourced Semiconductor Assembly and Test Services (OSAT) Market by Application

5.3.1. Communication

5.3.2. Consumer Electronics

5.3.3. Automotive

5.3.4. Computing & Networking

5.3.5. Industrial

5.3.6. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amkor Technology Inc.

7.2. ASE Group

7.3. Chipbond Technology Corp.

7.4. ChipMOS Technologies Inc.

7.5. Formosa Advanced Technologies Co. Ltd.

7.6. Hana Micron Inc.

7.7. Integrated Micro-electronics Inc.

7.8. Jiangsu Changjiang Electronics Technology Co. Ltd.

7.9. King Yuan Electronics Co. Ltd.

7.10. Lingsen Precision Industries Ltd.

7.11. Powertech Technology Inc.

7.12. Tianshui Huatian Technology Co. Ltd.

7.13. Tongfu Microelectronics Co.

7.14. UTAC Holdings Ltd.

1. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET BY PACKAGING TYPE , 2020-2027 ($ MILLION)

2. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR BALL GRID ARRAY (BGA) PACKAGING MARKET BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR CHIP-SCALE PACKAGING (CSP) MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR STACKED DIE PACKAGING MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR MULTI-CHIP PACKAGING MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR QUAD FLAT AND DUAL-INLINE PACKAGING BY PACKAGING TYPE MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET BY SERVICE TYPE, 2020-2027 ($ MILLION)

8. GLOBAL PACKAGING IDENTITY AND ACCESS MANAGEMENT (IAM) MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL TESTING IDENTITY AND ACCESS MANAGEMENT (IAM) MARKET BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET BY APPLICATION, 2020-2027 ($ MILLION)

11. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR COMMUNICATION MARKET BY REGION,2020-2027 ($ MILLION)

12. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR CONSUMER ELECTRONICS MARKET BY REGION,2020-2027 ($ MILLION)

13. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR AUTOMOTIVE MARKET BY REGION,2020-2027 ($ MILLION)

14. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR COMPUTING & NETWORKING MARKET BY REGION,2020-2027 ($ MILLION)

15. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR INDUSTRIAL MARKET BY REGION,2020-2027 ($ MILLION)

16. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR OTHER APPLICATION MARKET BY REGION,2020-2027 ($ MILLION)

17. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE , 2020-2027 ($ MILLION)

19. NORTH AMERICAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. NORTH AMERICAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. EUROPEAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE , 2020-2027 ($ MILLION)

23. EUROPEAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2020-2027 ($ MILLION)

24. EUROPEAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

25. EUROPEAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE , 2020-2027 ($ MILLION)

27. ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. REST OF THE WORLD OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE , 2020-2027 ($ MILLION)

31. REST OF THE WORLD OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SHARE BY PACKAGING TYPE, 2020 VS 2027 (%)

2. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SHARE BY SERVICE TYPE, 2020 VS 2027 (%)

3. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

4. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SHARE BY GEOGRAPHY, 2020 VS 2027, (%)

5. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR BALL GRID ARRAY (BGA) PACKAGING MARKET BY REGION, 2020 VS 2027 (%)

6. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR CHIP-SCALE PACKAGING (CSP) MARKET BY REGION, 2020 VS 2027 (%)

7. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR STACKED DIE PACKAGING MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR MULTI-CHIP PACKAGING MANAGEMENT MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR QUAD FLAT AND DUAL-INLINE PACKAGING BY PACKAGING TYPE MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL PACKAGING IDENTITY AND ACCESS MANAGEMENT (IAM) MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL TESTING IDENTITY AND ACCESS MANAGEMENT (IAM) MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR COMMUNICATION MARKET BY REGION, 2020 VS 2027 (%)

13. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR CONSUMER ELECTRONICS MARKET BY REGION, 2020 VS 2027 (%)

14. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR AUTOMOTIVE MARKET BY REGION, 2020 VS 2027 (%)

15. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR COMPUTING & NETWORKING MARKET BY REGION, 2020 VS 2027 (%)

16. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR INDUSTRIAL MARKET BY REGION, 2020 VS 2027 (%)

17. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR OTHER MARKET BY REGION, 2020 VS 2027 (%)

18. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR HEALTHCARE MARKET BY REGION, 2020 VS 2027 (%)

19. GLOBAL OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) FOR QUAD FLAT AND DUAL-INLINE PACKAGING END-USER MARKET BY REGION, 2020 VS 2027 (%)

20. US OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

21. CANADA MARKET OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

22. UK OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

23. GERMANY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

24. SPAIN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

25. FRANCE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

26. ITALY OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF EUROPE OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

28. INDIA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

29. CHINA OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

30. JAPAN OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OFASIA-PACIFIC OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF WORLD OUTSOURCED SEMICONDUCTOR ASSEMBLY AND TEST SERVICES (OSAT) MARKET SIZE, 2020-2027 ($ MILLION)