Over the Counter (OTC) Drugs Market

Global Over the Counter (OTC) Drugs Market Size, Share & Trends Analysis Report By Product Type (Analgesics & Pain Relievers; Cough, Cold & Flu Products; Vitamin & Mineral Supplements; Ophthalmic Products; and Others), By Distribution Channel (Retail & Supermarkets and Online Platform), and Forecast 2019-2025

The global over the counter (OTC) drugs market is anticipated to grow at a CAGR of around 7% during the forecast period. OTC drugs are intended to relieve from minor aches, pains, and itches and it can be bought easily without any prescription. Hundreds of OTC drugs are available at pharmacy stores including cosmetics and dietary supplements that can be sold directly to the consumer. According to Consumer Healthcare Product Association (CHPA) in 2018, around 81% adults in the US, uses OTC drugs as a first line of treatment.

The major factors contributing to the growth of the OTC drugs market include the benefits offered by these drugs such as the lower chances of misuse and abuse and easy to use for self-diagnosed health conditions. In addition, health professional and prescription is not required. Additionally, government and regulations, funding and various initiatives will also drive the global OTC drugs market. For instance, in December 2019, Over-the-Counter Monograph Safety, Innovation, and Reform Act of 2019 was passed in the US. The new law will work to reform and affect the safety, innovation, and affordability of over-the-counter drugs.

However, certain risks associated with the OTC drug usage will restrict the growth of OTC drugs market. In addition to this, the OTC drugs still pose a risk for developing an addiction. Abuse of OTC drugs can lead to various health risks such as heart problems, heart problems, memory loss, and causality in some cases. The most commonly abused OTC medications include cough medicines. This abuse problem associated with OTC drug use will present as a challenge to the growth of the OTC drugs market during the forecast period.

Segmental Outlook

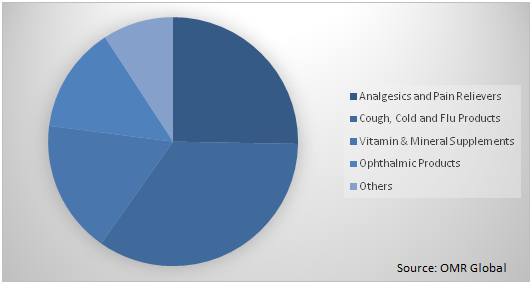

The global Over the counter (OTC) drugs market is segmented based on product type and distribution channel. Based on the product type, the market is sub-segmented into the analgesics & pain relievers; cough, cold & flu products; vitamin & mineral supplements; ophthalmic products; and others. Based on the distribution channel, the market is bifurcated into retail & supermarkets and online platform.

Global Over the Counter (OTC drugs) Market Share by Product Type, 2018 (%)

Cough, Cold & Flu Products will be the Largest Segment by Product Type

Cough, cold and flu products segment is anticipated to hold a significant share in the market owing to increasing demand for effective and easily available drugs for the treatment across the globe. Additionally, the increasing cases of cold, cough and flu cases will also drive the cough, cold and flu products segment in the OTC drug market. According to the Center Of Disease Control and Prevention’s (CDC) FluView report published in January 2020, there have been 13 million influenza (also known as ‘the flu’) illnesses.

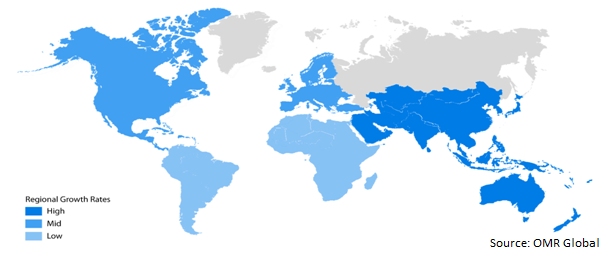

Regional Outlooks

The global over the counter drugs market is further segmented based on geography into North America, Europe, Asia-Pacific, and Rest of the World. North America is expected to hold the largest market share in the OTC drugs market during the forecast period. The growth of the region is attributed to the shifting trend from Rx to OTC drugs by the drug manufacturers. Additionally, the increase in adoption of various OTC drugs by parents for the treatment of children’s minor health problems will drive OTC drugs market across the region.

Global Over the Counter (OTC) Drugs Market Growth by Region, 2019-2025

Asia-Pacific will Augment with the Fastest Growth Rate in the Over the Counter (OTC) Drugs Market

Asia-Pacific is anticipated to exhibit the fastest growth rate in the OTC drugs market due to the increasing number of pharmaceutical companies in the developing economies such as China and India. Moreover, the presence of technologically advanced pharmaceutical companies in countries such as Japan and South Korea will also drive the OTC drugs market. Additionally, the rapid increasing population with the large share of geriatric populations will also driving the adoption of OTC drugs across the region.

Market Players Outlook

Some of the key players of the OTC drugs market include Bayer AG, GlaxoSmithKline Plc, Novartis International AG, Merck KGaA, Pfizer Inc., Sanofi SA, Sun Pharmaceutical Industries Ltd., and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, merger, and acquisition, collaborations with government, to stay competitive in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global over the counter (OTC drugs market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Bayer AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. GlaxoSmithKline Plc

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Novartis International AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Pfizer, Inc

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Sanofi SA

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Over the Counter (OTC) drug Market by Product Type

5.1.1. Analgesics and Pain Relievers

5.1.2. Cough, Cold and Flu Products

5.1.3. Vitamin & Mineral Supplements

5.1.4. Ophthalmic Products

5.1.5. Others

5.2. Over the Counter (OTC) drug Market by Distribution Channel

5.2.1. Retail & Supermarket

5.2.2. Online Platform

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Achelios therapeutics., Inc.

7.2. Alkem Laboratories Ltd.

7.3. Amgen Inc.

7.4. Amway Corp.

7.5. AstraZeneca PLC

7.6. Bayer AG

7.7. Boehringer Ingelheim International GmbH

7.8. Bristol-Myers Squibb Co.

7.9. Cipla Ltd.

7.10. Dr. Reddy’s Laboratories Ltd.

7.11. GlaxoSmithKline Plc

7.12. Glenmark Pharmaceuticals Ltd

7.13. Johnson & Johnson Services, Inc.

7.14. Merck KGaA

7.15. Novartis International AG

7.16. Perrigo Co. plc

7.17. Pfizer, Inc

7.18. Reckitt Benckiser Group plc

7.19. Sanofi SA

7.20. Sun Pharmaceutical Industries Ltd.

7.21. Teva Pharmaceutical Industries Ltd.

1. GLOBAL OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL ANALGESICS & PAIN RELIEVERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COUGH, COLD & FLU PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL VITAMIN & MINERAL SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OPHTHALMIC PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER OTC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

8. GLOBAL OVER THE COUNTER (OTC) DRUG AT RETAIL & SUPERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL OVER THE COUNTER (OTC) DRUG AT ONLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. NORTH AMERICAN OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

14. EUROPEAN OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

20. REST OF THE WORLD OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD OVER THE COUNTER (OTC) DRUG MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

1. GLOBAL OVER THE COUNTER (OTC) DRUG MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL OVER THE COUNTER (OTC) DRUG MARKET SHARE BY DISTRIBUTION CHANNEL, 2018 VS 2025 (%)

3. GLOBAL OVER THE COUNTER (OTC) DRUG MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

6. UK OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD OVER THE COUNTER (OTC) DRUG MARKET SIZE, 2018-2025 ($ MILLION)