Oxidative Stress Assay Market

Oxidative Stress Assay Market Size, Share & Trends Analysis Report by Product (Instruments, Consumables, and Services), by Test Type (Indirect Assays, Antioxidant Capacity Assays, Enzyme Assays, and Reactive Oxygen Species Assays) by Technology (Enzyme-Linked Immunosorbent Assay (ELISA), Flow Cytometry, Chromatography, Microscopy, and Others) by Disease Type (Cardiovascular Disease, Chronic Obstructive Pulmonary Disease (COPD), Cancer, Respiratory Diseases, Diabetes, and Other) and by End User (Pharmaceutical and Biotechnology Industries, Academic Research institutes, and Clinical Research Organizations) Forecast Period (2024-2031)

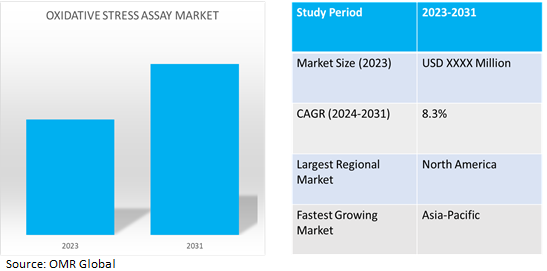

Oxidative stress assay market is anticipated to grow at a CAGR of 8.3% during the forecast period (2024-2031). The global oxidative stress assay market is influenced by various factors, including the increasing prevalence of chronic diseases, the aging population, environmental factors, and the shift towards personalized medicine. Chronic diseases, such as cancer, cardiovascular diseases, diabetes, and neurodegenerative disorders, are more susceptible to oxidative stress due to reduced antioxidant defense mechanisms. The aging population is additionally more susceptible to oxidative stress due to increased exposure to pollutants and toxins. The shift towards personalized medicine has fueled the demand for biomarker-based assays, enabling healthcare providers to tailor treatment strategies based on individual patient characteristics. Technological advancements have improved the sensitivity, specificity, and accuracy of oxidative stress measurements. Regulatory support from agencies like the FDA and EMA encourages adoption in healthcare settings. Awareness campaigns and collaborations between academic institutions, research organizations, and biotechnology companies further drive market growth. .

Market Dynamics

Increased Susceptibility to Oxidative Stress

The aging leads to decreased antioxidant defenses, increasing oxidative stress-related conditions. As the aging population grows, demand for oxidative stress assays increases for early detection and monitoring. According to the Centers for Disease Control and Prevention (.gov), in September 2022, the aging population in the US has reached unprecedented levels, with $54.1 million adults aged 65 or older in 2019, accounting for 16.0% of the population. By 2040, it is projected that this number will increase to $80.8 million, and by 2060, it will reach $94.7 million, comprising almost 25.0% of the total population. With age, the risk of chronic diseases such as dementia, heart disease, type 2 diabetes, arthritis, and cancer also increases, leading to significant healthcare costs and societal implications.

Rising Public Health Initiatives and Government Policies

Governments and international organizations are investing in public health initiatives to address chronic diseases and improve healthcare infrastructure. Integrating oxidative stress assays into national health programs supports evidence-based policymaking and stimulates market growth. According to the World Health Organization (WHO), in December 2023, global health spending reached a new high of $9.8 trillion, accounting for 10.3% of GDP. However, the distribution of spending remained unequal, with public spending increasing globally, except in low-income countries where government spending decreased. Low-income countries accounted for only 0.24% of global health expenditure.

Market Segmentation

Our in-depth analysis of the global oxidative stress assay market includes the following segments by product, test type, technology, disease type, and end-user:

- Based on product, the market is sub-segmented into instruments, consumables, and services.

- based on test type, the market is sub-segmented into indirect assays, antioxidant capacity assays, enzyme-based assays, and reactive oxygen species-based assays.

- Based on technology, the market is bifurcated into Enzyme-Linked Immunosorbent Assay (ELISA), flow cytometry, chromatography, microscopy, and others.

- Based on disease type, the market is bifurcated into cardiovascular disease, Chronic Obstructive Pulmonary Disease (COPD), cancer, respiratory diseases, diabetes, and other(neurodegenerative diseases).

- Based on end-users, the market is sub-segmented into pharmaceutical and biotechnology industries, academic research institutes, and clinical research organizations.

Pharmaceutical and Biotechnology Industries is Projected to Emerge as the Largest Segment

Based on the business model, the global oxidative stress assay market is sub-segmented into pharmaceutical and biotechnology industries, academic research institutes, and clinical research organizations. Among these, the advertising-supported model sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the pharmaceutical and biotechnology industries are experiencing growth owing to reduced taxes, lower drug prices, and economic growth in regions such as the US, China, and India, leading to increased investment in R&D. According to the National Center for Biotechnology Information, in March 2021, it reduced taxes and lowered drug prices in the US, a gross domestic product growth greater than 6.0% in China and India, widespread population aging and sedentary lifestyles leading to increased chronic diseases, industrialized data services in R&D enabling the use of clinical trial data in trial simulations, lowered regulatory barriers for new drugs in the US, and high urban pollution levels increasing the incidence of conditions such as asthma, have contributed to the growth of the healthcare market.

Cancer Sub-segment to Hold a Considerable Market Share

The oxidative stress assay market is experiencing growth owing to the rise in cancer incidence and demand for innovative diagnostic solutions. Advancements in assay platforms, screening methodologies, and data analytics enhance their sensitivity and specificity. According to the American Cancer Society, in 2022, it is projected approximately $1.9 million new cases of cancer diagnosed and an estimated 609,360 fatalities caused by cancer in the US.

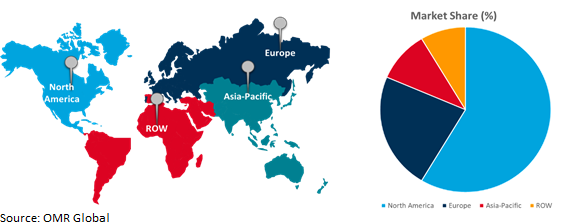

Regional Outlook

The global oxidative stress assay market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Investment in Healthcare Infrastructure In Asia-Pacific Region

A growing emphasis on improving healthcare infrastructure, especially in developing countries such as India for enhanced diagnostic services and market expansion, is highlighted by the rise in health expenditure and PMABHIM operations. According to the Healthcareradius.in, February 2024, the total expenditure on health has seen a significant increase, rising from $9.5 billion in 2023-24 to $10.9 billion in 2024-25. In addition, the allocation for the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PMABHIM) has also experienced a substantial boost, going up from $2.5 in 2023-24 to $49.7 in 2024-25.

Global Oxidative Stress Assay Market Growth by Region 2024-2031

North America Holds Major Market Shareidual

The US oxidative stress assay market is expanding owing to the R&D investment in the US, international collaborations, strategic partnerships, and technological innovation. This market is influencing global healthcare needs and growth. According to National Center for Science and Engineering Statistics (.gov), in April 2022, the US research and experimental development performance experienced significant growth in recent years, with the total reaching $667.0 billion in 2019 and an estimated $708.0 billion in 2020. This growth was observed across all sectors, particularly in the business sector. Additionally, the US national R&D intensity, a measure of R&D investment, has shown a steady increase, reaching an 3.39% in 2020.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global oxidative stress assay market include Abcam Ltd., Cell Biolabs, Inc. Merck KGaA, Promega Corp., and Thermo Fisher Scientific Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2022, Invitae launched the availability of FusionPlex Dx and LiquidPlex Dx in Europe, part of its industry-leading Anchored Multiplex PCR chemistry in-vitro diagnostic (IVD) products. Invitae is delivering essential high-quality innovation for precision oncology in the fight against cancer.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global oxidative stress assay market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abcam Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Merck KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Promega Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Oxidative Stress Assay Market by Product

4.1.1. Instruments

4.1.2. Consumables

4.1.3. Services

4.2. Global Oxidative Stress Assay Market by Test Type

4.2.1. Indirect assays

4.2.2. Antioxidant capacity assays

4.2.3. Enzyme based assays

4.2.4. Reactive Oxygen species based assays

4.3. Global Oxidative Stress Assay Market by Technology

4.3.1. Enzyme-linked Immunosorbent Assay (ELISA)

4.3.2. Flow Cytometry

4.3.3. Chromatography

4.3.4. Microscopy

4.3.5. Others(Nuclear Magnetic Resonance (NMR) Spectroscopy, and Spectrophotometry)

4.4. Global Oxidative Stress Assay Market by Disease Type

4.4.1. Cardiovascular disease

4.4.2. Chronic Obstructive pulmonary disease (COPD)

4.4.3. Cancer

4.4.4. Respiratory Diseases

4.4.5. Diabetes

4.4.6. Others (Inflammatory Diseases, Neurological Disorders)

4.5. Global Oxidative Stress Assay Market by End-user

4.5.1. Pharmaceutical and Biotechnology Industries

4.5.2. Academic Research institutes

4.5.3. Clinical Research Organizations

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AMSBIO

6.2. Arbor Assays, Inc.

6.3. Cayman Chemical Co.

6.4. Cell Biolabs, Inc.

6.5. Enzo Biochem, Inc.

6.6. Enzo Life Sciences, Inc.

6.7. F. Hoffmann-La Roche Ltd.

6.8. Antibodies Inc.

6.9. OXFORD BIOMEDICAL RESEARCH

6.10. QIAGEN

6.11. Sekisui Diagnostics, LLC.

6.12. StressMarq Biosciences Inc.

6.13. Thermo Fisher Scientific Inc.

6.14. KAMIYA BIOMEDICAL CO.

1. GLOBAL OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL INSTRUMENTS OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CONSUMABLES OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SERVICES OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

6. GLOBAL INDIRECT OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ANTIOXIDANT CAPACITY OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ENZYME BASED OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL REACTIVE OXYGEN SPECIES BASED OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

11. GLOBAL OXIDATIVE STRESS ASSAY BY ENZYME-LINKED IMMUNOSORBENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL OXIDATIVE STRESS ASSAY BY FLOW CYTOMETRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL OXIDATIVE STRESS ASSAY BY CHROMATOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL OXIDATIVE STRESS ASSAY BY MICROSCOPY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL OXIDATIVE STRESS ASSAY BY OTHER TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2023-2031 ($ MILLION)

17. GLOBAL CARDIOVASCULAR DISEASE OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL CHRONIC OBSTRUCTIVE PULMONARY DISEASE OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL CANCER OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL RESPIRATORY DISEASES OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL DIABETES OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL OTHER OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

24. GLOBAL OXIDATIVE STRESS ASSAY IN PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. GLOBAL OXIDATIVE STRESS ASSAY IN ACADEMIC RESEARCH INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. GLOBAL OXIDATIVE STRESS ASSAY IN CLINICAL RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. GLOBAL OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. NORTH AMERICAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. NORTH AMERICAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

30. NORTH AMERICAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

31. NORTH AMERICAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

32. NORTH AMERICAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2023-2031 ($ MILLION)

33. NORTH AMERICAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

34. EUROPEAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

35. EUROPEAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

36. EUROPEAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

37. EUROPEAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

38. EUROPEAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2023-2031 ($ MILLION)

39. EUROPEAN OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

40. ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

41. ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

42. ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

43. ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

44. ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2023-2031 ($ MILLION)

45. ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

46. REST OF THE WORLD OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

47. REST OF THE WORLD OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

48. REST OF THE WORLD OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

49. REST OF THE WORLD OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

50. REST OF THE WORLD OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2023-2031 ($ MILLION)

51. REST OF THE WORLD OXIDATIVE STRESS ASSAY MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL OXIDATIVE STRESS ASSAY MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL INSTRUMENTS OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CONSUMABLES OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SERVICES OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OXIDATIVE STRESS ASSAY MARKET SHARE BY TEST TYPE, 2023 VS 2031 (%)

6. GLOBAL INDIRECT ASSAYS OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ANTIOXIDANT CAPACITY OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ENZYME BASED OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL REACTIVE OXYGEN SPECIES BASED OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OXIDATIVE STRESS ASSAY MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

11. GLOBAL OXIDATIVE STRESS ASSAY BY ENZYME-LINKED IMMUNOSORBENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL OXIDATIVE STRESS ASSAY BY FLOW CYTOMETRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL OXIDATIVE STRESS ASSAY BY CHROMATOGRAPHY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL OXIDATIVE STRESS ASSAY BY MICROSCOPY MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL OXIDATIVE STRESS ASSAY OTHER TECHNOLOGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL OXIDATIVE STRESS ASSAY MARKET SHARE BY DISEASE TYPE, 2023 VS 2031 (%)

17. GLOBAL CARDIOVASCULAR DISEASE OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL CHRONIC OBSTRUCTIVE PULMONARY DISEASE OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL CANCER OXIDATIVE STRESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL RESPIRATORY DISEASES OXIDATIVE STRESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL DIABETES OXIDATIVE STRESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL OTHERS OXIDATIVE STRESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL OXIDATIVE STRESS ASSAY MARKET SHARE BY END USER, 2023 VS 2031 (%)

24. GLOBAL OXIDATIVE STRESS ASSAY IN PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL OXIDATIVE STRESS ASSAY IN ACADEMIC RESEARCH INSTITUTES MARKET SHARE BY REGION, 2023 VS 2031 (%)

26. GLOBAL OXIDATIVE STRESS ASSAY IN CLINICAL RESEARCH ORGANIZATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

27. GLOBAL OXIDATIVE STRESS ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

28. US OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

29. CANADA OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

30. UK OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

31. FRANCE OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

32. GERMANY OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

33. ITALY OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

34. SPAIN OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

35. REST OF EUROPE OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

36. INDIA OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

37. CHINA OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

38. JAPAN OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

39. SOUTH KOREA OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

40. REST OF ASIA-PACIFIC OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

41. LATIN AMERICA OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)

42. MIDDLE EAST AND AFRICA OXIDATIVE STRESS ASSAY MARKET SIZE, 2023-2031 ($ MILLION)