Packaging Adhesives Market

Packaging Adhesives Market Size, Share & Trends Analysis Report By Technology (Water-based, Solvent-based, and Hot-melt), by Application (Flexible Packaging, Folding Boxes and Cartons, Sealing, Labels and Tapes, Corrugated Packaging, and Others) Forecast Period (2024-2031)

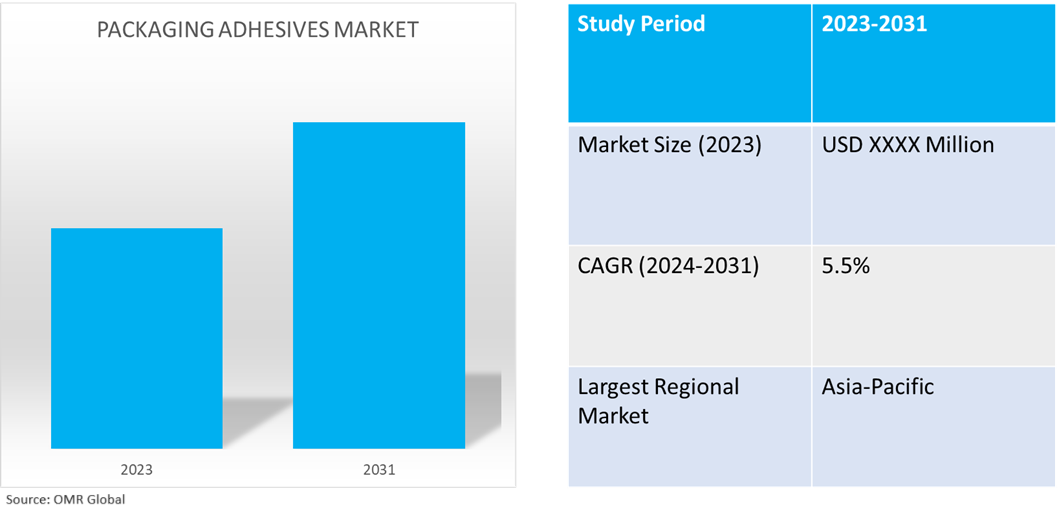

Packaging adhesives market is anticipated to grow at a CAGR of 5.5% during the forecast period (2024-2031). The rise of e-commerce has increased the demand for packaging adhesives, as consumers prefer secure, durable, and efficient solutions. Sustainability trends and technological advancements are major promoters of market growth, with water-based adhesives becoming more popular.

Market Dynamics

Innovations in Adhesive Technology

The performance and sustainability of packaging materials have been enhanced by technological advances in adhesive technology, which include solvent-free and water-based solutions. For instance, in April 2024, Flow Materials introduced a new range of solvent-free, water-based adhesive solutions for flexible packaging converters, focusing on sustainability. The company is working with customers in the UK, Germany, and Italy to improve supply performance. Additionally, it has added a new paper tape with natural rubber adhesive and backing from sustainable forestry.

Increased Sustainable Development and Regulatory Standards

The rise in regulatory standards and consumer demand for sustainable packaging solutions are driving manufacturers to adopt environmentally friendly adhesives. For instance, in November 2022, Bostik introduced two new tape and label adhesives in India, HM2060, and HM2070, to support the circular economy and high-speed label converting in FMCG, pharmaceutical, and logistics industries. HM2060 offers improved resistance and adhesion on low surface energy substrates.

Market Segmentation

- Based on technology, the market is segmented into water-based, solvent-based, and hot-melt.

- Based on application, the market is segmented into flexible packaging, folding boxes and cartons, sealing, labels and tapes, corrugated packaging, and others (case & carton, folding carton).

Flexible Packaging is Projected to Emerge as the Largest Segment

The primary factor supporting the segment's growth includes the demand for lightweight and convenient packaging solutions. According to the Flexible Packaging Association (FPA), in 2022, the US flexible packaging industry is projected to experience growth, with estimated sales of $39.0 billion in 2021, up from $34.8 billion in 2020. This industry segment focuses on adding value to flexible materials through various processes such as printing, laminating, coating, extrusion, and bag/pouch manufacturing. The estimated value of this segment is $29.5 billion for 2021, excluding retail shopping bags, consumer storage bags, or trash bags. Flexible packaging accounts for approximately 20.0% of the total $184.6 billion US packaging industry, making it the second largest segment after corrugated paper.

Hot-melt Sub-segment to Hold a Considerable Market Share

The increasing awareness and preference for sustainable packaging solutions are driving a rise in the demand for eco-friendly adhesives. For instance, in April 2023, Dow and Avery Dennison developed a new hotmelt label adhesive solution that allows mechanical recycling of polyolefin filmic labels and polypropylene or polyethylene packaging. This innovative solution is the first of its kind in the label market and is approved by Recyclass for HDPE colored stream recycling in Class B. The adhesive is based on Dow's AFFINITY GA Polymers.

Regional Outlook

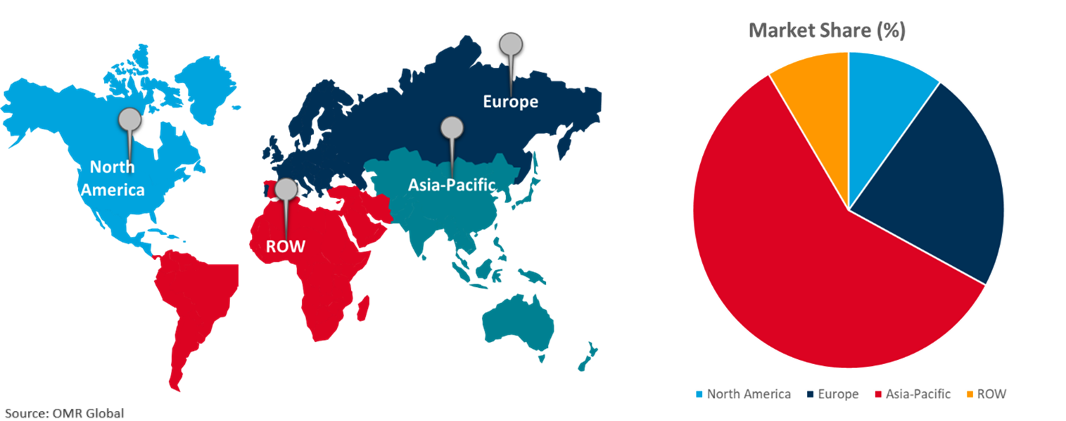

The global packaging adhesives market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Research and Development Investments In North America Region

Significant proposals to improve adhesive uses and formulations through innovative research and development are a major contributor to the regional market growth. For instance, in May 2023, Henkel opened an adhesive technologies center in Bridgewater, the US, featuring innovative innovations like printed electronics and engineered wood building. The 70,000ft² center serves strategic partners and customers.

Global Packaging Adhesives Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market

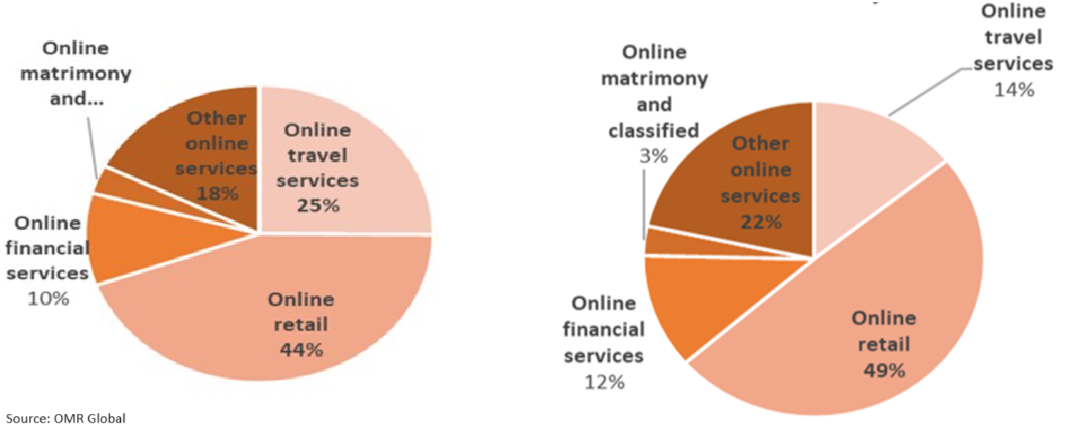

The increasing use of digital payment systems has led to more consumers shopping online, facilitating seamless transactions. According to the India Brand Equity Foundation (IBEF), in May 2024, the value of Indian e-commerce was $46.2 billion in 2020 and is expected to grow by 18.3% to $136.5 billion by 2026. E-commerce activity is increasing, as is the use of digital payment systems. Momentum in this sales channel has been steadily growing but was amplified during the COVID-19 pandemic. It is often beneficial to have a distributor with an online presence and dedicated website, positioned to market your product via the e-commerce channel. E-commerce is subject to the Competition Act issued by the Indian government to enforce pricing and distribution laws. To avoid competition law violations, US companies should be aware of such provisions and include relevant clauses in distribution partnership agreements.

Major Segments of India’s E-Commerce Market

Source: India Brand Equity Foundation (IBEF)

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the packaging adhesives market include 3M Co., Arkema SA, Avery Dennison Corp., Bostik Ltd., and Henkel AG & Co. KGaA among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in May 2024 Arkema acquired Dow's flexible packaging laminating adhesives business, a leading producer of adhesives for the flexible packaging market, generating annual sales of around $250.0 million, offering high-quality solutions in food, medical, and industrial applications.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global packaging adhesives market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Arkema SA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Avery Dennison Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Packaging Adhesives Market by Technology

4.1.1. Water-based

4.1.2. Hot Melt Adhesives (HMAs)

4.1.3. Solvent-based

4.2. Global Packaging Adhesives Market by Application

4.2.1. Flexible Packaging

4.2.2. Folding Boxes and Cartons

4.2.3. Sealing

4.2.4. Labels and Tapes

4.2.5. Corrugated Packaging

4.2.6. Others (Case & Carton, and Folding Carton)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Ashland Inc.

6.2. Beardow Adams

6.3. Bostik Ltd.

6.4. Chemence Inc.

6.5. DIC Corp.

6.6. Dow Chemical Co.

6.7. Dymax Corp.

6.8. Eastman Chemical Co.

6.9. Franklin International

6.10. H.B. Fuller Co.

6.11. Henkel AG & Co. KGaA

6.12. Huntsman International LLC

6.13. Jowat SE

6.14. Mactac

6.15. MAPEI S.p.A.

6.16. Novamelt GmbH

6.17. Paramelt RMC B.V.

6.18. Pidilite Industries Ltd.

6.19. Sika AG

6.20. Toyo Ink SC Holdings Co., Ltd.

6.21. Wacker Chemie AG

1. Global Packaging Adhesives Market Research And Analysis By Technology, 2023-2031 ($ Million)

2. Global Water-Based Packaging Adhesives Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Solvent-Based Packaging Adhesives Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Hot-Melt Packaging Adhesives Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Packaging Adhesives Market Research And Analysis By Application, 2023-2031 ($ Million)

6. Global Packaging Adhesives In Flexible Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Packaging Adhesives In Folding Boxes And Cartons Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Packaging Adhesives In Sealing Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Packaging Adhesives In Labels And Tapes Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Packaging Adhesives In Corrugated Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Packaging Adhesives In Other Application Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Packaging Adhesives Market Research And Analysis By Region, 2023-2031 ($ Million)

13. North American Packaging Adhesives Market Research And Analysis By Country, 2023-2031 ($ Million)

14. North American Packaging Adhesives Market Research And Analysis By Technology, 2023-2031 ($ Million)

15. North American Packaging Adhesives Market Research And Analysis By Application, 2023-2031 ($ Million)

16. European Packaging Adhesives Market Research And Analysis By Country, 2023-2031 ($ Million)

17. European Packaging Adhesives Market Research And Analysis By Technology, 2023-2031 ($ Million)

18. European Packaging Adhesives Market Research And Analysis By Application, 2023-2031 ($ Million)

19. Asia-Pacific Packaging Adhesives Market Research And Analysis By Country, 2023-2031 ($ Million)

20. Asia-Pacific Packaging Adhesives Market Research And Analysis By Technology, 2023-2031 ($ Million)

21. Asia-Pacific Packaging Adhesives Market Research And Analysis By Application, 2023-2031 ($ Million)

22. Rest Of The World Packaging Adhesives Market Research And Analysis By Region, 2023-2031 ($ Million)

23. Rest Of The World Packaging Adhesives Market Research And Analysis By Technology, 2023-2031 ($ Million)

24. Rest Of The World Packaging Adhesives Market Research And Analysis By Application, 2023-2031 ($ Million)

1. Global Packaging Adhesives Market Share By Technology, 2023 Vs 2031 (%)

2. Global Water-Based Packaging Adhesives Market Share By Region, 2023 Vs 2031 (%)

3. Global Solvent-Based Packaging Adhesives Market Share By Region, 2023 Vs 2031 (%)

4. Global Hot-Melt Packaging Adhesives Market Share By Region, 2023 Vs 2031 (%)

5. Global Packaging Adhesives Market Share By Application, 2023 Vs 2031 (%)

6. Global Packaging Adhesives In Flexible Packaging Market Share By Region, 2023 Vs 2031 (%)

7. Global Packaging Adhesives In Folding Boxes And Cartons Market Share By Region, 2023 Vs 2031 (%)

8. Global Packaging Adhesives In Sealing Market Share By Region, 2023 Vs 2031 (%)

9. Global Packaging Adhesives In Labels And Tapes Market Share By Region, 2023 Vs 2031 (%)

10. Global Packaging Adhesives In Corrugated Packaging Market Share By Region, 2023 Vs 2031 (%)

11. Global Packaging Adhesives In Other Application Market Share By Region, 2023 Vs 2031 (%)

12. Global Packaging Adhesives Market Share By Region, 2023 Vs 2031 (%)

13. US Packaging Adhesives Market Size, 2023-2031 ($ Million)

14. Canada Packaging Adhesives Market Size, 2023-2031 ($ Million)

15. UK Packaging Adhesives Market Size, 2023-2031 ($ Million)

16. France Packaging Adhesives Market Size, 2023-2031 ($ Million)

17. Germany Packaging Adhesives Market Size, 2023-2031 ($ Million)

18. Italy Packaging Adhesives Market Size, 2023-2031 ($ Million)

19. Spain Packaging Adhesives Market Size, 2023-2031 ($ Million)

20. Rest Of Europe Packaging Adhesives Market Size, 2023-2031 ($ Million)

21. India Packaging Adhesives Market Size, 2023-2031 ($ Million)

22. China Packaging Adhesives Market Size, 2023-2031 ($ Million)

23. Japan Packaging Adhesives Market Size, 2023-2031 ($ Million)

24. South Korea Packaging Adhesives Market Size, 2023-2031 ($ Million)

25. Rest Of Asia-Pacific Packaging Adhesives Market Size, 2023-2031 ($ Million)

26. Latin America Packaging Adhesives Market Size, 2023-2031 ($ Million)

27. Middle East And Africa Packaging Adhesives Market Size, 2023-2031 ($ Million)