Packaging Contract Manufacturing Market

Global Packaging Contract Manufacturing Market Research By End-User (Food and Beverage, Consumer Goods, Personal Care, Pharmaceutical and Other) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global packaging contract manufacturing market is growing at a considerable CAGR of 12% during the forecast period. Development in machinery and growth of industrial automation are the prime factors affecting and driving the market. Increasing growth in industry related with food along with pharmaceutical is also estimated to be the prime factors that are contributing significantly towards the growth of the market. However, managing costs involved in the contract packaging is major factors constraints that are hindering the growth of the global packaging contract manufacturing market across the globe.

Further, increasing shift towards usage of eco-friendly raw material is one of the key factors that are creating opportunity for the market. New strategies along with acquiring process in the market are likely to drive the growth of the global packaging contract manufacturing market across the globe. For instance, in April 2020, GPA Global had done the acquisition of Hub Folding box which is one of the printing and packaging suppliers. This acquisition will support the GPA Global in order to elaborate the manufacturing process by offering its services in North America.

Impact of COVID-19 on the Global Packaging Contract Manufacturing Market

The global packaging contract manufacturing market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic in the major economies had disrupted the manufacturing and transportation activities. However, due to COVID-19 pandemic pharmaceutical had seen an increase in demand along with certain food products that are safe from contaminants across the globe. Moreover, online spending on various industry products has also increased affecting growth of the market.

Segmental Outlook

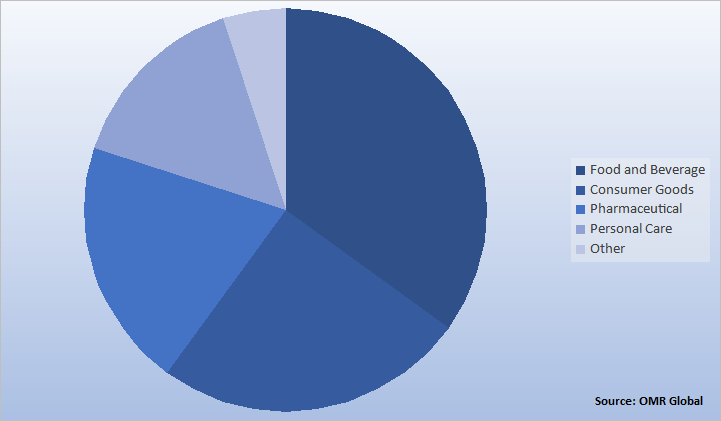

The market is segmented based on end user. By end user, market is segmented into Food and Beverage, Consumer Goods, Personal Care, Pharmaceutical and Other.

Global Packaging Contract Manufacturing Market Share by End User 2020 (%)

Based on the end-user, food and beverage holds significant share in the market. Packaging for food and beverageare mostly used and demanded for providing better quality ingredients to the consumer. Through proper packaging of food its durability is increased and can keep the food fresh for a longer period of time. Additionally, with help of packaging the food kept is safe and secured from contaminants and increases the shelf life of food. Moreover, through effective packaging it help in identifying the food easily along with consuming healthy products that are packedespecially for children. Further, across the globe increasing population along with rising urbanization has also increased the need and want related with packed and ready to eat food which is also a key factor expected to drive the growth of the market.

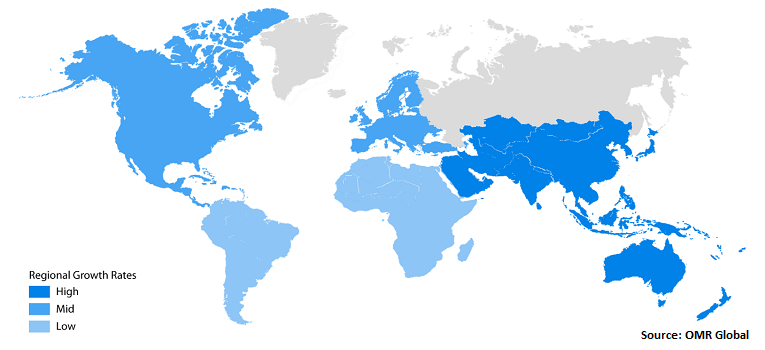

Regional Outlooks

The global packaging contract manufacturing market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America held a considerable share in 2020 in the global packaging contract manufacturing market. Some factors that are boosting the market growth in North America are high demand in food and beverages along with increased in the disposable income in the region. Additionally, presence of key market players in the region is other factors that are promoting the growth of the market.

Global Packaging Contract Manufacturing Market, by Region 2021-2027

Asia-Pacific will have Considerable Growth in the Global Packaging Contract Manufacturing Market

Asia-Pacific region is expected to witness significant growth opportunities for the market. Increasing need and want for contract packaging along with growth in annual exports in emerging economies of the region are likely to drive the growth of the regional market. Further, small scale packaging contract manufacturersin large number present in India along with China are also some of the factors that are affecting and impacting the growth in this market.

Market Player Outlook

Key players of the global packaging contract manufacturing market are Aaron Thomas Company, Inc., CCL Industries., Reed-Lane, SupplyOne, and Jones Healthcare Group among others.To survive in the market, these players adopt different marketing strategies such as new launches and acquisition. For instance, in September 2020, Jones Healthcare Group. had introduced its CpaX NFC Connected Packaging Solutions. Through this platform it supports the digital user experience and ultimately leading to improve decision making with its intelligent package component and cloud software.

In September 2020, PLZ Aeroscience had acquired one of the contract manufacturers of specialty personal care products named as Mansfield-King, LLC. Through this acquisition it can expand its entire service offering in North America for personal care network.

In September 2020, one of the contract packaging companies named as MaxPax LLC, had planned to locate its self to Hickory, North Carolina for the purpose of expanding its business with an invest of around $9.55 million.

In November 2019, one of the suppliers across the globe of end-to-end manufacturing solutions for pharma industry ACG group had introduced NXT series for its pharma production, inspection along with packaging equipment.

In June 2019, Assemblies Unlimited, Inc. had announced to diversify its packaging and assembly operations in several new US market. Through this company can expand its presence as the global packager by offering their primary and secondary packaging business, along with existing contract packaging plant locations.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global packaging contract manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Packaging Contract Manufacturing Industry

• Recovery Scenario of Global Packaging Contract Manufacturing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Packaging Contract Manufacturing Market by End User

5.1.1. Food and Beverage

5.1.2. Consumer Goods

5.1.3. Personal Care

5.1.4. Pharmaceutical

5.1.5. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB LABELS

7.2. Aaron Thomas Company, Inc.

7.3. ACG

7.4. Adept Group LLC

7.5. Advanced Concept Innovations

7.6. Advantage Line Global

7.7. Aldelano

7.8. Assemblies Unlimited, Inc.

7.9. Atlantic Packaging

7.10. AVC Corp.

7.11. Bernard Laboratories

7.12. Berry Global Inc.

7.13. Blendco Inc.

7.14. CCB Packaging

7.15. CCL Industries.

7.16. CMC Packaging Group

7.17. Co-Pak Packaging Corp.

7.18. Compact Industries, Inc.

7.19. Complemar Partners Inc.

7.20. Contract Pharmacal Corp.

7.21. Coregistics

7.22. Cosmetics & Perfume Filling & Packaging, Inc.

7.23. Dimensional Merchandising

7.24. Export Corp.

7.25. First Choice Packaging

7.26. GPA Global

7.27. Huizenga Group

7.28. LIQUIPAK CORP.

7.29. Manna Foods, LLC.

7.30. Marsden Packaging Ltd.

7.31. MaxPax LLC

7.32. Michelman, Inc.

7.33. MSL COPACK + ECOMM

7.34. Multi-Pack Solutions LLC

7.35. PaxHoldingsGroup.

7.36. Pharma Packaging Solutions

7.37. Pharmapacks

7.38. PLZ Aeroscience

7.39. Reed-Lane

7.40. Ruspak Corp.

7.41. Sonoco Products Co.

7.42. Stamar Packaging.

7.43. Subco Foods.

7.44. SupplyOne

7.45. Jay Group.

7.46. Jones Healthcare Group.

7.47. TRANS-PACKERS-SERVICES CORP.

7.48. Unicep

7.49. Unit Pack Co., Inc.

7.50. Verst Logistics, Inc.

7.51. Wedor Corp.

7.52. WestFall Technik

1. GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET BY END USER, 2020-2027 ($ MILLION)

3. GLOBAL FOOD AND BEVERAGE MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CONSUMER GOODS MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL PERSONAL CARE MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL PHARMACEUTICAL MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHER MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

9. NORTH AMERICAN PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. NORTH AMERICAN PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

11. EUROPEAN PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. EUROPEAN PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

13. ASIA-PACIFIC PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. ASIA-PACIFIC PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

15. REST OF THE WORLD PACKAGING CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY END USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET SHARE BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET, 2021-2027 (%)

4. GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET SHARE BY END USER, 2020 VS 2027 (%)

5. GLOBAL PACKAGING CONTRACT MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL FOOD AND BEVERAGE MARKET BY REGION, 2020 VS 2027 (%)

7. GLOBAL CONSUMER GOODS MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL PERSONAL CARE MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL PHARMACEUTICAL MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL OTHER MARKET BY REGION, 2020 VS 2027 (%)

11. US PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

12. CANADA PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

13. UK PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

14. FRANCE PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

15. GERMANY PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

16. ITALY PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

17. SPAIN PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

18. REST OF EUROPE PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

19. INDIA PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

20. CHINA PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

21. JAPAN PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

22. SOUTH KOREA PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF ASIA-PACIFIC PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD PACKAGING CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)