Packaging Machinery Market

Packaging Machinery Market Size, Share & Trends Analysis Report by Type (Filling and Dosing, Form-Fill-Seal (FFS), Labeling and Coding, Closing and Sealing, Wrapping and Bundling, and Others), and by End-User (Food and Beverage, Personal care, Pharmaceutical, Chemical, and Others) Forecast Period (2024-2031)

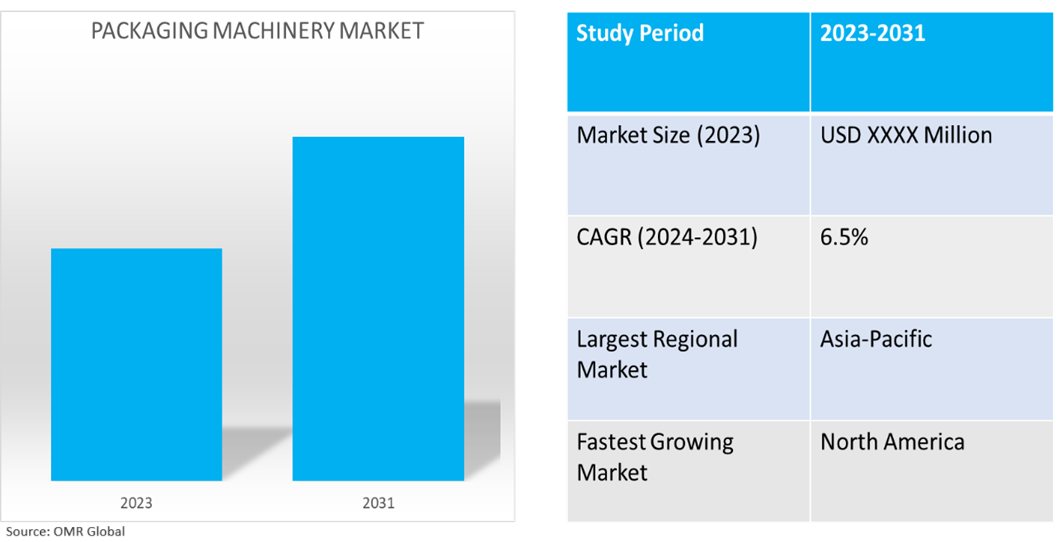

Packaging machinery market is anticipated to grow at a considerable CAGR of 6.5% during the forecast period (2024-2031). The demand for packaged goods is driven by consumer preferences, e-commerce growth, technological advancements, sustainability, regulatory compliance, and rising disposable incomes. Advanced packaging machinery improves production speed, reduces errors, and meets standards. Therefore, the growing demand for packaging machinery is driving the global packaging machinery market.

Market Dynamics

Increased Global Population and Consumer Demand

The demand for packaged goods, especially in the food and beverage industries, is rising significantly owing to the growing global population and changing customer preferences. According to the World Population Data Sheet, in December 2023 the global population is expected to reach its highest point at approximately 10.4 billion people by 2086. This year's update adjusts the peak to 2084, with the population reaching just under 10.3 billion.

Technological Advancements and Automation

Automation and smart packaging technologies are enhancing efficiency, productivity, and quality in packaging operations, reducing labor costs, and increasing production speeds. Thus, the ongoing technological advancements are creating a huge demand for packaging machinery globally. For instance, in July 2024, Cama Group launched a new top-loading packaging machine, aiming to increase productivity and reduce machinery footprint in the multipack market. The machine, designed by an Italian secondary-packaging machine company producer, is designed to meet the increasing demand for efficient multipack packaging. The machine is designed to fit seamlessly into production lines. Further, in February 2024, Ranpak launched the Cut'it! EVO automated in-line packaging machine for end-of-line packaging applications. The machine aims to pack materials using minimal volume and minimize void fill, supporting the EU Packaging Directive's maximum 40% void target. it additionally offers digital tools such as Precube'it! and DecisionTower.

Market Segmentation

- Based on the machine type, the market is segmented into filling and dosing, form-fill-seal (FFS), labeling and coding, closing and sealing, wrapping and bundling, and others (palletizing and de-palletizing machines and cartoning machines).

- Based on the end-user, the market is segmented into food and beverage, personal care, pharmaceutical, chemical, and others (electronics and industrial).

Food and Beverage is Projected to Hold the Largest Segment

The expansion of the beverage sector, especially in emerging markets, requires innovative packaging solutions to satisfy the rising consumer demand. For instance, in January 2024, Sidel launched EvoFILL PET, a new filler for beverage packaging, aimed at improving hygiene and efficiency in the growing water industry in China, India, and Turkey. Its reduced filler enclosure ensures flowmeter contactless filling and bottle integrity. Further, in October 2022, R.A Jones introduced the Orbi-Trak TC-6 speed-up kit for its Meridian XR machines, enabling beverage and food manufacturers to run canned product configurations at 345 cartons per minute. This innovative carton feed technology approaches the industry standard speed of 300 cartons per minute. The kit, featuring six spindle locations, boosts overall production rates.

Filling and Dosing Segment to Hold a Considerable Market Share

Efficiently satisfying the growing production demands requires high-speed packing capabilities. For instance, in July 2024, Jochamp introduced the JCZ-250 series of shisha dosing packaging machines, designed to address issues like tobacco extrusion and weight inaccuracy owing to viscosity in shisha packaging. These machines offer flexible packaging, weight accuracy, and high packaging speeds, with integrated HMI systems.

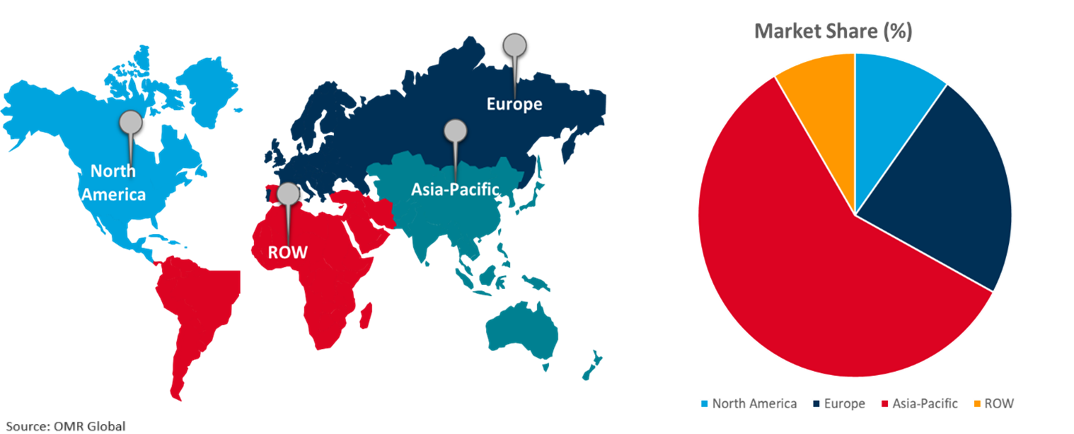

Regional Outlook

The global packaging machinery market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Consumer Demand For Fast And Efficient Packaging Processes In North America

- The rapid advancement in the development of advanced automated packaging machinery that can operate at high speeds is driving regional market growth. For instance, in July 2023, EndFlex introduced a new automated packaging system capable of filling 50 cartons per minute, featuring a Kartnr vertical cartoning machine and a PKR-Delta robotic pick and place cell, for picking, placing, and sealing bottles. Further, in January 2023, JASA launched its latest generation of vertical packaging machines, NXXT, at Fruit Logistica in Berlin. The machines, based on six unique selling points, are easy to clean, quick, flexible, improve operator safety, ensure energy efficiency, and deliver higher processing speeds.

Global Packaging Machinery Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

The packaging machinery market is expanding owing to the pharmaceutical sector growth in emerging markets, particularly in the Asia-Pacific region. According to the India Brand Equity Foundation (IBEF), in May 2024, it is anticipated that India's pharmaceutical sector is projected to produce $65.0 billion by 2024, $130.0 billion by 2030, and $450.0 billion by 2047. Over $25.0 billion of the industry's estimated $50.0 billion comes from exports. India is the third-largest country in the Asia-Pacific and a major biotechnology destination globally. India is the globe's third-largest manufacturer of services and accounts for 3-5% of the global biotechnology market. By 2030, the government intends to receive $50.0 billion invested in the medical equipment industry. The biotechnology sector in India is projected to grow from its 2020 valuation of $70.2 billion to $150 billion by 2025.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the packaging machinery market include Barry-Wehmiller Group, Inc., Coesia S.p.A., Illinois Tool Works Inc., Krones AG, MARCHESINI GROUP S.p.A., and Tetra Pak International S.A. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In March 2024, Ishida acquired South African packaging equipment manufacturer National Packaging Systems (NPS), offering entry-level weighing and packing systems for start-up operations. The partnership provided high levels of support, localized service, and spare parts supply, enabling customers to automate processes and benefit from a wide range of products.

- In May 2023, Amcor acquired Moda Systems, a New Zealand-based company that designs and manufactures high-performance modular vacuum packaging solutions for the meat, poultry, and dairy industries.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the packaging machinery market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Coesia S.p.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Krones AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. MARCHESINI GROUP S.p.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Packaging Machinery Market by Machine Type

4.1.1. Filling and Dosing

4.1.2. Form-Fill-Seal (FFS)

4.1.3. Labeling and Coding

4.1.4. Closing and Sealing

4.1.5. Wrapping and Bundling

4.1.6. Others (Palletizing and De-palletizing Machines and Cartoning Machines)

4.2. Global Packaging Machinery Market by End-User

4.2.1. Food and Beverage

4.2.2. Personal care

4.2.3. Pharmaceutical

4.2.4. Chemical

4.2.5. Others (Electronics and Industrial)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Accutek Packaging Co.

6.2. Aetna Group S.P.A

6.3. ARPAC, LLC

6.4. Asian Packing Machinery Pvt. Ltd.

6.5. Barry-Wehmiller Group, Inc.

6.6. CKD Corp.

6.7. FUJI MACHINERY CO., LTD.

6.8. GEA Group Aktiengesellschaft

6.9. HERMA GmbH

6.10. Illinois Tool Works Inc.

6.11. John Bean Technologies

6.12. KHS Group

6.13. MULTIVAC Sepp Haggenmüller SE & Co. KG

6.14. Nordson Corp.

6.15. OPTIMA Packaging Group GmbH

6.16. ProMach Inc.

6.17. Serac Group

6.18. Serverplan srl

6.19. Syntegon Technology GmbH

6.20. Tetra Pak International S.A.

1. Global Packaging Machinery Market Research And Analysis By Machine Type, 2023-2031 ($ Million)

2. Global Filling and Dosing Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Form-Fill-Seal Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Labeling and Coding Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Closing and Sealing Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Wrapping and Bundling Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Other Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Packaging Machinery Market Research And Analysis By End-User, 2023-2031 ($ Million)

9. Global Packaging Machinery For Food and Beverage Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Packaging Machinery For Personal Care Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Packaging Machinery For Chemical Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Packaging Machinery In Gaming and Virtual Reality (VR) Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Packaging Machinery For Other End-User Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

15. North American Packaging Machinery Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Packaging Machinery Market Research And Analysis By Machine Type, 2023-2031 ($ Million)

17. North American Packaging Machinery Market Research And Analysis By End-User, 2023-2031 ($ Million)

18. European Packaging Machinery Market Research And Analysis By Country, 2023-2031 ($ Million)

19. European Packaging Machinery Market Research And Analysis By Machine Type, 2023-2031 ($ Million)

20. European Packaging Machinery Market Research And Analysis By End-User, 2023-2031 ($ Million)

21. Asia-Pacific Packaging Machinery Market Research And Analysis By Country, 2023-2031 ($ Million)

22. Asia-Pacific Packaging Machinery Market Research And Analysis By Machine Type, 2023-2031 ($ Million)

23. Asia-Pacific Packaging Machinery Market Research And Analysis By End-User, 2023-2031 ($ Million)

24. Rest Of The World Packaging Machinery Market Research And Analysis By Region, 2023-2031 ($ Million)

25. Rest Of The World Packaging Machinery Market Research And Analysis By Machine Type, 2023-2031 ($ Million)

26. Rest Of The World Packaging Machinery Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Packaging Machinery Market Share By Machine Type, 2023 Vs 2031 (%)

2. Global Filling and Dosing Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

3. Global Form-Fill-Seal Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

4. Global Labeling and Coding Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

5. Global Closing and Sealing Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

6. Global Wrapping and Bundling Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

7. Global Other Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

8. Global Packaging Machinery Market Share By End-User, 2023 Vs 2031 (%)

9. Global Packaging Machinery For Food And Beverage Market Share By Region, 2023 Vs 2031 (%)

10. Global Packaging Machinery For Personal Care Market Share By Region, 2023 Vs 2031 (%)

11. Global Packaging Machinery For Pharmaceutical Market Share By Region, 2023 Vs 2031 (%)

12. Global Packaging Machinery For Chemical Market Share By Region, 2023 Vs 2031 (%)

13. Global Packaging Machinery For Other End-User Market Share By Region, 2023 Vs 2031 (%)

14. Global Packaging Machinery Market Share By Region, 2023 Vs 2031 (%)

15. US Packaging Machinery Market Size, 2023-2031 ($ Million)

16. Canada Packaging Machinery Market Size, 2023-2031 ($ Million)

17. UK Packaging Machinery Market Size, 2023-2031 ($ Million)

18. France Packaging Machinery Market Size, 2023-2031 ($ Million)

19. Germany Packaging Machinery Market Size, 2023-2031 ($ Million)

20. Italy Packaging Machinery Market Size, 2023-2031 ($ Million)

21. Spain Packaging Machinery Market Size, 2023-2031 ($ Million)

22. Rest Of Europe Packaging Machinery Market Size, 2023-2031 ($ Million)

23. India Packaging Machinery Market Size, 2023-2031 ($ Million)

24. China Packaging Machinery Market Size, 2023-2031 ($ Million)

25. Japan Packaging Machinery Market Size, 2023-2031 ($ Million)

26. South Korea Packaging Machinery Market Size, 2023-2031 ($ Million)

27. Rest Of Asia-Pacific Packaging Machinery Market Size, 2023-2031 ($ Million)

28. Latin America Packaging Machinery Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Packaging Machinery Market Size, 2023-2031 ($ Million)