Pallets Market

Global Pallets Market Size, Share & Trends Analysis Report by Types (Wood, Plastic, and Other Types), By End-User (Transportation & Warehousing, Food & Beverage, Pharmaceutical, Retail, and Others) Forecast Period 2022-2028 Update Available - Forecast 2025-2035

The global market for pallets market is projected to have a considerable CAGR of around 5.3% during the forecast period. Pallets are horizontal platforms that support products and aid in transporting them from one location to another using a forklift or front loader. Pallets are widely used in the shipping, transport, and storage of products. They are available in either standardized or customized specifications. They're one of the most frequent stacking bases, and they're usually attached with a stretch wrap, pallet collar, adhesive, or other forms of stabilization. The demand for logistics services is increasing significantly as a result of rising smartphone sales, increased internet penetration, and the developing e-commerce industry, which is boosting the growth of the pallet market globally. Moreover, the demand for packaging has surged throughout the past decade. There has also been a shift in the types of packing materials used. In most industries, shifting from rigid to flexible packaging has become the norm. In addition, the use of radio-frequency identification (RFID) tags for product tracking, especially in plastic pallets, is increasing rapidly in the recent past. These tags can contain more information and can easily be located within the warehouse.

Segmental Outlook

The global pallets market is segmented based on product type, and end-user. Based on the type, the market is further classified into the wood, plastic, and other types. Further, based on end-user, the market is segregated into transportation & warehousing, food & beverage, pharmaceutical, retail, and others.

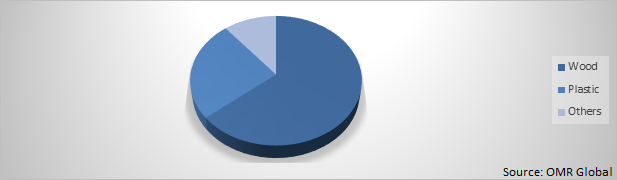

Global Pallets Market Share by Type, 2020 (%)

The Wood Hold Significant Share in the Global Pallets Market.

Among product type, the wood pallets segment is estimated to dominate by holding significant share during the forecast period as they play a significant role in the movement of safe, effective transport and storage platforms throughout the handling and distribution process globally. Pallet construction is becoming more standardized in many countries. For instance, in Europe, with a migration to the EUR pallet, the most prevalent size of wood pallet is 800mm x 1,200mm unit as specified by the European Pallet Association. Wooden pallet sizes and designs, on the other hand, are far less standardized in North America, where the majority of pallets are custom-designed to fit specific transport and shipping needs. Moreover, in North America, the food and beverage industries are the largest users of wooden pallets, followed by the chemical and pharma industries, and then agriculture. However, competition from substitute products such as plastic and steel pallets and the fragmented nature of the industry is restraining the growing market in the US.

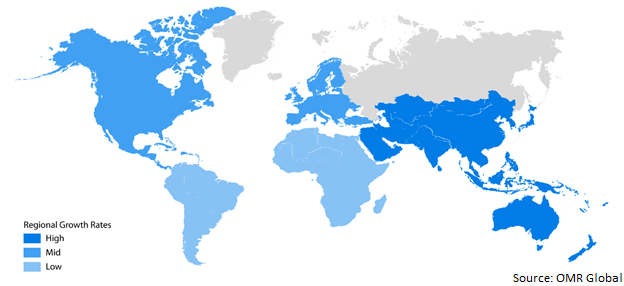

Regional Outlook

Geographically, the global Pallets market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is one of the fastest-growing pallet markets. The majority of the demand in the region comes from the US and Canada as a result of their well-established food and beverage as well as the construction industry. Pallets are utilized in the region's pharmaceutical sector on account of the assistance offered in reducing product contamination.

Global Pallets Market Growth, by region 2022-2028

The Asia-Pacific to Witness Significant Growth in the Global Pallets Market

Geographically, Asia-Pacific is projected to hold a significant growth in the global pallets market as the region has the highest adoption of plastic and wooden pallets. Further, the theme of sustainability has marked the functioning of the pallet industry in the Asia Pacific. Furthermore, the region has also witnessed the injection of funds which is augmenting the growth of the market. For instance, in January 2021, Morgan Stanley and LEAP (Leading Enterprise in Advanced Pooling) announced that Morgan Stanley India Infrastructure, an infrastructure-focused fund invested USD 25 million in LEAP India. Plastic pallets are common in the automotive, dairy, pharmaceutical, and beverage industries, and some Asian countries. The technological advancement by the various key players in the region is bolstering the market growth. For instance, in March 2021, Yelopack, a supply chain management company that provides industrial customers with smart logistic solutions based on a shared pallet and package service, adopted the AFFINITY polyolefin elastomer (POE) in its existing plastic pallets. The adoption of the technology offered by Dow allows Yelopack to increase the life span of its pallets by 150%, reducing its carbon footprint.

Market Players Outlook

The key players in the Pallets market contribute significantly by providing different types of products and increasing their geographical presence across the globe. CABKA Group GmbH, Palettes Gestion Services PalletOne, Inc., Falkenhahn AG among others. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In December 2021, CHEP, a supply chain solutions company that is offering various kinds of pallets, announced that the company rented out and reused 345-million wooden pallets used for transportation of goods, reducing cost and the overall environmental impact. The company has partnered with food and beverage company Clover which led to the reduction of carbon dioxide emissions by 56%, its wood usage by 71%, and its waste by 59%, which is equivalent to saving 2,666 trees a year.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pallets market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Pallets Industry

• Recovery Scenario of Global Pallets Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Pallets Market by Types

5.1.1. Wood

5.1.2. Plastic

5.1.3. Other Types (Metal)

5.2. Global Pallets Market by End-User

5.2.1. Transportation & Warehousing

5.2.2. Food & Beverage

5.2.3. Pharmaceutical

5.2.4. Retail

5.2.5. Others (Construction)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arrington Lumber & Pallet Co. Inc.

7.2. Bay wood Products Inc

7.3. Brambles Ltd.

7.4. CABKA Group GmbH

7.5. CHEP (Commonwealth Handling Equipment Pool)

7.6. Coxco Inc

7.7. Craemer Holding GmbH

7.8. Falkenhahn AG

7.9. LCN, Inc.

7.10. Loscam Australia Pty Ltd

7.11. ORBIS Corp

7.12. Palettes Gestion Services

7.13. Pallcon Inc

7.14. PalletOne, Inc.

7.15. PECO Pallet Inc

7.16. Rehrig Pacific Company, Inc.

7.17. Schoeller Allibert Group B.V.

7.18. The Corrugated Pallets Company

7.19. Universal Forest Products Inc

7.20. World Steel Pallet Co. Ltd

1. GLOBAL PALLETS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL WOOD PALLETS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL PLASTIC PALLETS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHER PALLET TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

6. GLOBAL PALLETS IN TRANSPORTATION & WAREHOUSING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PALLETS IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL PALLETS IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL PALLETS IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL PALLETS IN OTHERS END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL PALLETS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN PALLETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN PALLETS MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

14. NORTH AMERICAN PALLETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

15. EUROPEAN PALLETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN PALLETS MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

17. EUROPEAN FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC PALLETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC PALLETS MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC PALLETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. REST OF THE WORLD PALLETS MARKET RESEARCH AND ANALYSIS BY TYPES, 2021-2028 ($ MILLION)

22. REST OF THE WORLD PALLETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL PALLETS MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL PALLETS MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL PALLETS MARKET, 2021-2028 (%)

4. GLOBAL PALLETS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL PALLETS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

6. GLOBAL PALLETS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL WOOD PALLETS MARKET BY REGION, 2021 VS 2028 (%)

8. GLOBAL PLASTIC PALLETS MARKET BY REGION, 2021 VS 2028 (%)

9. GLOBAL OTHER PALLETS TYPES MARKET BY REGION, 2021 VS 2028 (%)

10. GLOBAL PALLETS IN TRANSPORTATION & WAREHOUSING MARKET BY REGION, 2021 VS 2028 (%)

11. GLOBAL PALLETS IN FOOD & BEVERAGE MARKET BY REGION, 2021 VS 2028 (%)

12. GLOBAL PALLETS IN PHARMACEUTICAL MARKET BY REGION, 2021 VS 2028 (%)

13. GLOBAL PALLETS IN RETAIL MARKET BY REGION, 2021 VS 2028 (%)

14. GLOBAL PALLETS IN OTHERS END-USER MARKET BY REGION, 2021 VS 2028 (%)

15. US PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

17. UK PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

22. ROE PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

26. ASEAN PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC PALLETS MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD PALLETS MARKET SIZE, 2021-2028 ($ MILLION)